The Healthcare Breakdown No. 003 - Breaking down Teladoc's EBITDA (you pronounced it wrong)

View this email in your browser

The Healthcare Breakdown

Breaking down topics in business, so you can take back the business of healthcare

What we’re breaking down: EBITDA, baby!

What you’ll learn: How to pronounce it, what it means, and why you should be skeptical.

Why it matters: EBIDTA is a measure of profitability. But it’s like the wild west; hot, but totally unregulated.

Read time: 4 -17 minutes

Let’s get one thing straight off the bat, it’s pronounced ee-bi-duh, short vowel sound on the “i.”

Don’t pronounce the “t.” Or try to at least.

And for the love of Pete, please don’t say ee-bi-d-ahhh. Weak game.

All right, now that that’s settled, let’s get into it.

First, what in the fire and brimstone land does it stand for?

Earnings

Before

Interest

Tax

Depreciation

Amortization

Boom, learning, awesome sauce.

Next, context.

We’re going to take a trip out of hospital/health system land for this one. Since most health systems are non-profit, EBITDA is less of a thing. HCA reports on it, but I’ve been giving health systems a lot of heat lately, so I’ll cool it.

EBITDA was invented by wall street bros as a “truer” measure of business operations profitability. Essentially it’s a rough proxy for cash flow from operations. And when I say “truer,” I really mean rosier.

Let’s look at Teladoc. Everyone’s favorite Telehealth app for when your kid probably doesn’t have an ear infection but you want to go ahead and get the antibiotic anyway just because, well, it’s so convenient.

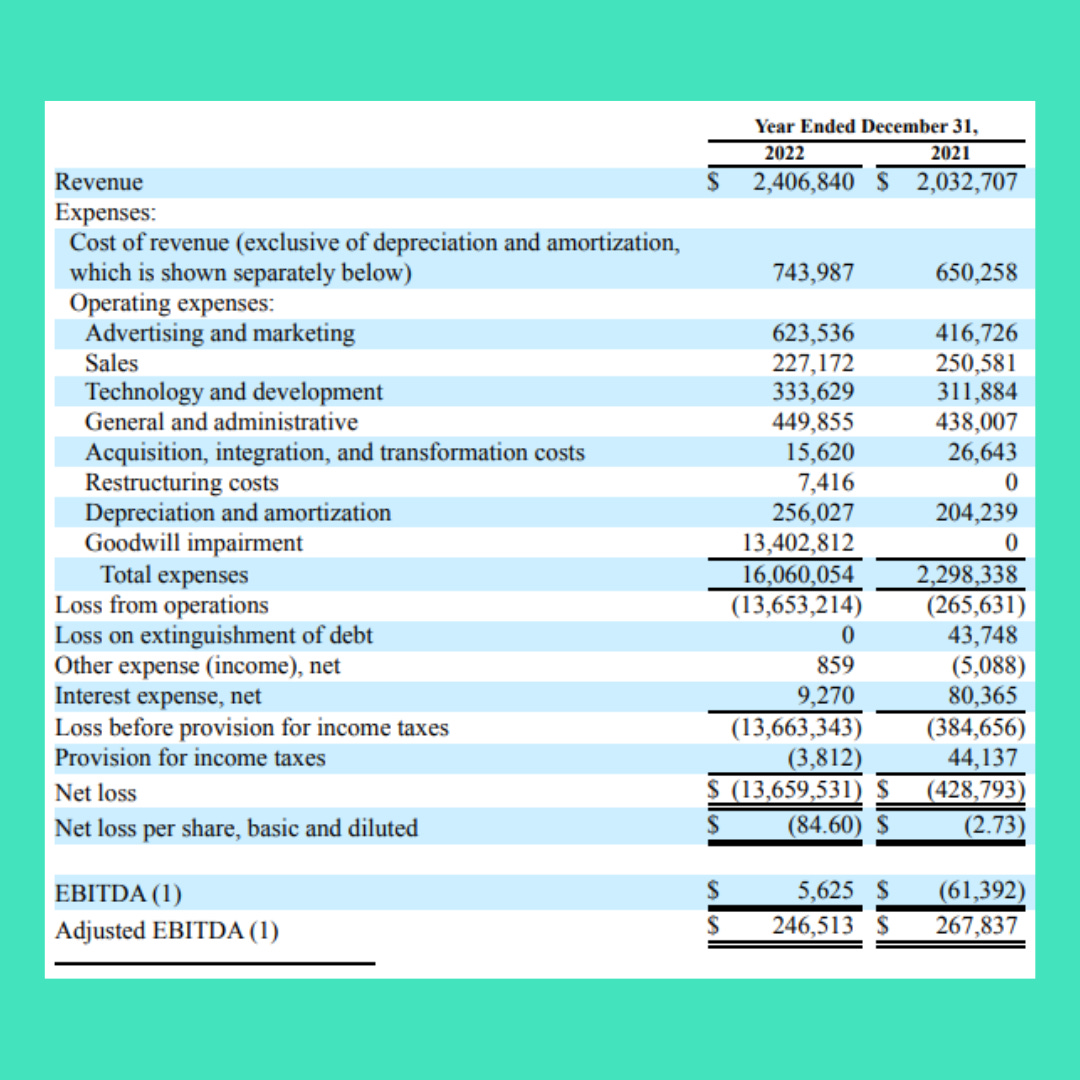

Here’s its income statement:

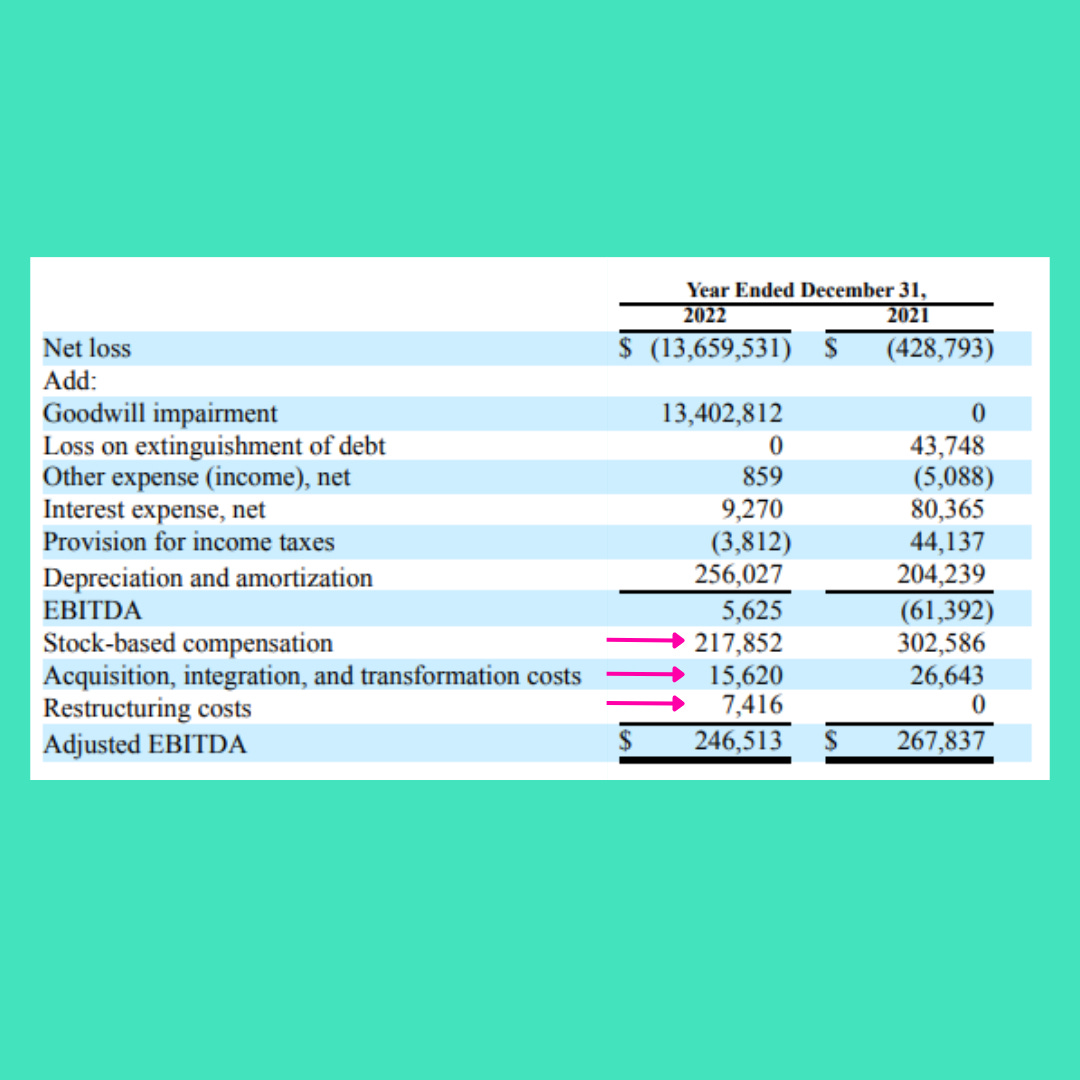

And here is the table where EBITDA and Adjusted EBITDA are derived:

(Very nice of them to provide this by the way…)

You’ll immediately notice this thing called “Adjusted EBITDA” at the very bottom. I know I didn’t even mention that before. It’s been a long day, ok? Sorry.

It’s just an even rosier metric whereby a company takes out even more expenses to make the “underlying business” look stronger.

What’s fun and interesting about EBITDA and why everyone should look at it with skepticism is because of statements like this:

That is a note in Teladoc’s financial report discussing EBITDA and Adjusted EBITDA. There’s more too, but this one speaks volumes.

In essence, Teladoc is stating that it decides and makes up what goes into EBITDA. It’s not comparable to other companies, and is about as reliable as you HP printer from 2003.

Let’s get into the details…

Teladoc starts with net income, otherwise called earnings and then backs out all the costs mentioned above to derive EBITDA.

You’ll also notice this wildly shocking “Goodwill Impairment” expense. That is from an acquisition gone bad. Teladoc bought Livongo in 2020 and let’s just say it has not gone swimmingly.

Because Teladoc bough Livongo for a paltry $18.5B (kidding, that’s a lot of quiche), the acquisition contributed to an increase in Goodwill for the company, which is reflected on the balance sheet. Goodwill is like brand value.

Think Nike. The value of that brand, an intangible, is Goodwill.

When Teladoc realized that Livongo was bupkis, it took a huge hit on Goodwill. When that happens you expense the impairment.

Since management thinks this sort of thing will never happen again, it removes the expense to, once again, show a number it believes is closer to underlying operations profitability.

After the goodwill impairment, it’s business as usual, adding back the usual suspects: interest, depreciation, amortization, and taxes. Just like you used to add water to your parents’ vodka stash in high school hoping they wouldn’t notice.

Going a little further down, you will see these three costs:

The whole point of EBITDA and it’s sly friend Adjusted EBITDA is to show profitability that is closer to cash flow and not what those pesky regulators think is a fair, accurate, standardized, uniform way to show profitability. Because who wants the consistency of a Volvo when you can have a wild ride on a motorcycle that your buddy just coming out of a midlife crisis, built in his garage for the first time. One will get you there, but the other one is like, a motorcycle.

Anyways, these are more “non-cash,” “non-operating,” “non-usual,” “non-cool,” expenses the company believes to be immaterial to the underlying business. Funnily enough they often show up year after year.

Seems like business as usual to me.

There you have it folks. In the simplest terms EBITDA adds interest, taxes, depreciation, and amortization back into net income.

Adjusted EBITDA goes one step further and takes out more expenses required to run the business, but not required to run up multiples.

Pretty impressive how a company can go from a $13.7B LOSS to a $247M GAIN.

That’s a wilder swing than Barry Bonds post-steroids when he could barely move his arms and neck. Or maybe he just didn’t have to because of the roid strength. And he had to inject things. Teladoc only needed a couple of quick lines of addition and a few footnotes.

Wonder what Barry Bonds is up to these days…

That’s the breakdown for today.

I hope you found this useful.

Not getting value from this newsletter? Please let me know, so I can improve it!

Loving this sh… stuff? Forward to a friend or colleague!

Want to see a topic broken down? Lemme know!

See you out there!

Love,

Preston

Our mailing address is:

*|IFNOT:ARCHIVE_PAGE|**|HTML:LIST_ADDRESS_HTML|**|END:IF|*

Want to change how you receive these emails?

You can update your preferences or unsubscribe