The Healthcare Breakdown No. 006 - Breaking down cash flow Part II, an Intermountain story

The Healthcare Breakdown

Breaking down topics in business, so you can take back the business of healthcare

What we’re breaking down: Cash Flowwwwwwwwww Part II: Revenue vs. Cash

What you’ll learn: The difference and how it impacts an organization

Why it matters: Revenue means little and growth can bankrupt a company without the right cash management

Read time: The last 72 seconds of a basketball game

Roll up your sleeves and get ready for the next episode of The Healthcare Breakdown!

Cash Flow Part II: Revenue vs. Cash

Last week we went over the Statement of Cash Flow. The sections. What it all means. How it’s used. Why it matters.

The point of today is to understand the fundamental difference between real money (cash) and revenue/income.

You’ve heard me (read me?) talk about it before…Just because an organization reports a loss on its income statement, doesn’t mean it necessarily lost any real money.

It’s not great to have P&L losses. You don’t want to be posting negative results, but blanket statements about income losses are only part of the story.

The same is true for positive income. Companies can and will mesmerize you with positive income and certainly positive EBITDA, while cash is being lit on fire on a mattress behind the building.

Revenue ain’t cash.

Income ain’t cash.

I mean, if you run a lemonade stand, yes, it basically is cash. When you earn revenue, someone is handing you a crumpled two-dollar bill they’ve been keeping in their wallet for 23 years. You recognize the revenue and get the cash at the same time.

But most companies don’t work like that. They work on credit.

Let’s take a gander at Intermountain Health.

Here’s its income statement:

Here’s its statement of cash flow:

Operating income: $121M

Cash from operations: $401M

More cash from operations than net income.

And you’ve seen this already. Because I keep throwing shade at Ascension and other hospitals claiming huge losses but making tons of cash.

The other main point I want to hit on today about the cash flow conundrum is TIMING.

When I go to the hospital to get my knee replaced from all the tobogganing I do on the weekends, the hospital recognizes the $38,000 for that procedure as revenue.

But I sure as heck fire don’t pay that right away.

It gets billed to insurance.

Insurance drags its feet.

I drag my feet.

The hospital doesn’t get paid until 87 days later.

Revenue is not cash.

Income is not cash.

And you can’t pay bills with revenue or income.

Detour: how do we keep track of this unpaid revenue?

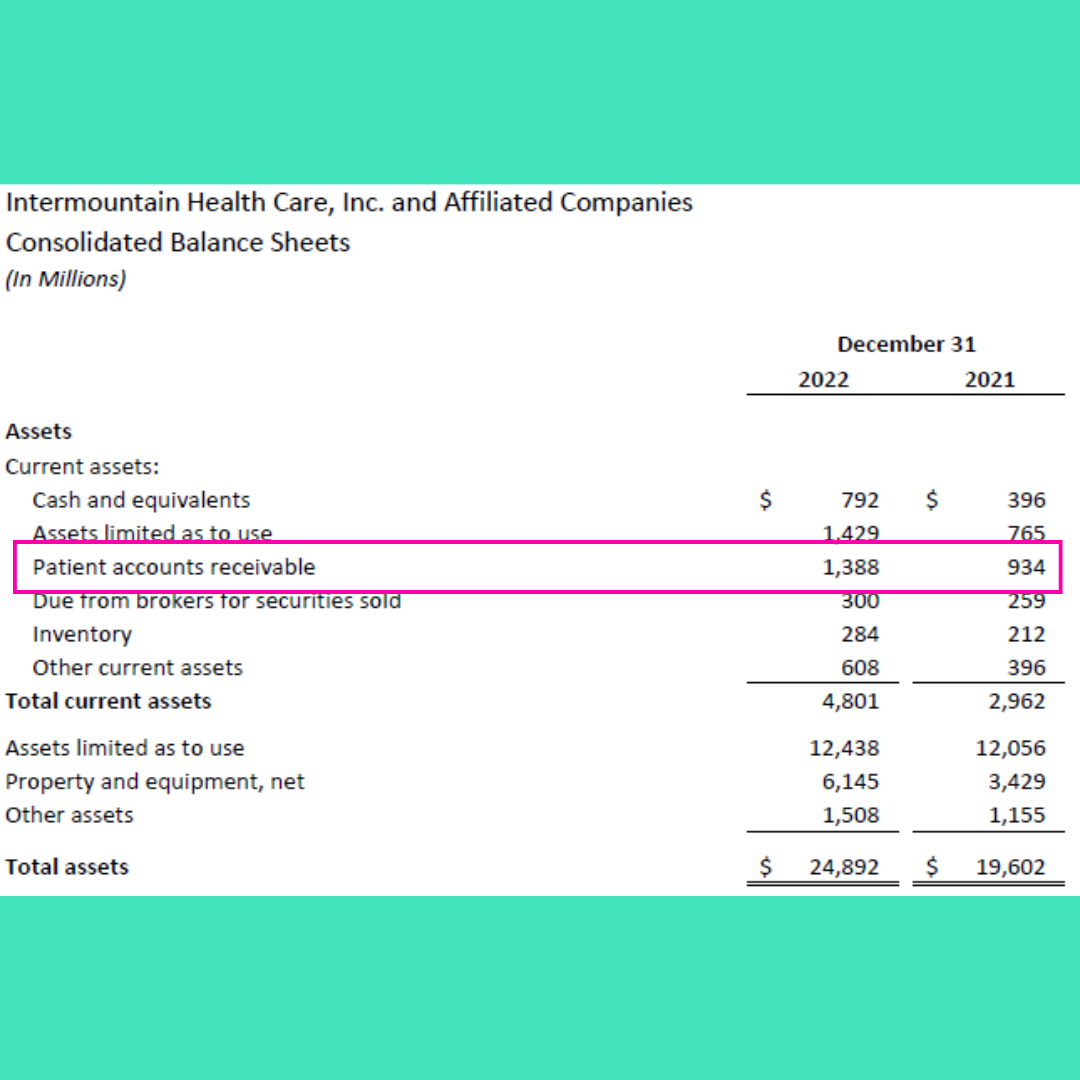

Thank you for asking. We keep it here:

Good ol’ Accounts Receivable

It’s about time we brought Balance Sheets into the discussion. More on that later, but now you can start to see how it’s all connected.

Revenue on the income statement leads to net income. Adjustments are made to derive cash into/out of the business. Cash goes onto the balance sheet as an asset. So does uncollected revenue as an account receivable.

Phew.

Why does this matter so much and why won’t I shut up about it?

Well, it almost sank me and I’ve seen it almost sink others.

Here’s an example:

You have a business selling bobble head hula dancers. You get an order for $100K.

Awesome! $100K in revenue! Weeee, let’s pop bottles!

Not so fast…

It will cost $52K to fulfill the order. You only have $15K in cash. And the order is net 30, meaning they don’t have to pay you for 30 days.

Good thing you have previous orders worth $60K that have been fulfilled already.

Oh crap. That’s right, they haven’t paid yet either.

30-day terms.

You are cash poor.

Just because you have revenue doesn’t mean you can pay for things. Because revenue has to be recognized at the time of sale, not when you get your money.

Tune in next week for Part III of this series on cash.

If you have or are interested in starting a business, you definitely don’t want to miss it. We are going to build a cash forecast brick by brick.

May even be a video….

Now where did I put my eye liner….

That’s the breakdown for today.

If you’re interested here’s two other things I’m up to:

Book a 1:1 consultation here. Have questions? Need help with your business? Looking for pizza recommendations? Let’s connect!

Pre-register for an Intro to finance course here. This ain’t your grandma’s finance course. You’ll be mighty dangerous at the end of it.

I hope you found this breakdown useful.

Please let me know if you have thoughts on how to improve it! I read every email.

Loving this sh… stuff? Forward to a friend or colleague!

Want to see a topic broken down? Lemme know!

See you out there!

Love,

Preston