The Healthcare Breakdown No. 007 - Breaking down cash flow Part III: Build a cash forecast brought to you by a made up company

That was the longest title ever

What we’re breaking down: Cash Flowwwwwwwwww Part III: Build a cash flow forecast

What you’ll learn: How to build a cash forecast

Why it matters: Income statements don’t pay bills, cash does

Read time: 12 days because you’ll want to read this over and over again

Special announcement!

We’re on Substack now!

That’s it. Back to business as usual.

We’ve been on quite the cash journey over the last 2 weeks.

First, we looked at what a statement of cash flow is, its parts, what they all mean, yada yada, yada.

Then we looked at Cash vs. Revenue and Income. Takeaway: Income ain’t cash.

If you missed these breakdowns, you can find all past issues here, in our new home on the stacks.

Let’s get into…. Drumrollll…… PART III! Building your own cash forecast.

Now, I thought about the best way to do this and writing probably isn’t the best way. But here we are.

So, if this becomes the greatest thing you have ever read or it sucks and you would like a different format, let me know. Maybe I will make a video or a course or something, charge a bunch of money and then sell another course teaching people how to build and sell courses and live on the beach sipping Mai Tais.

Because you know that your income statement is not reflective of the cash you have, you also know that if you are planning to start a company or want to manage your current cash well, you need a forecast.

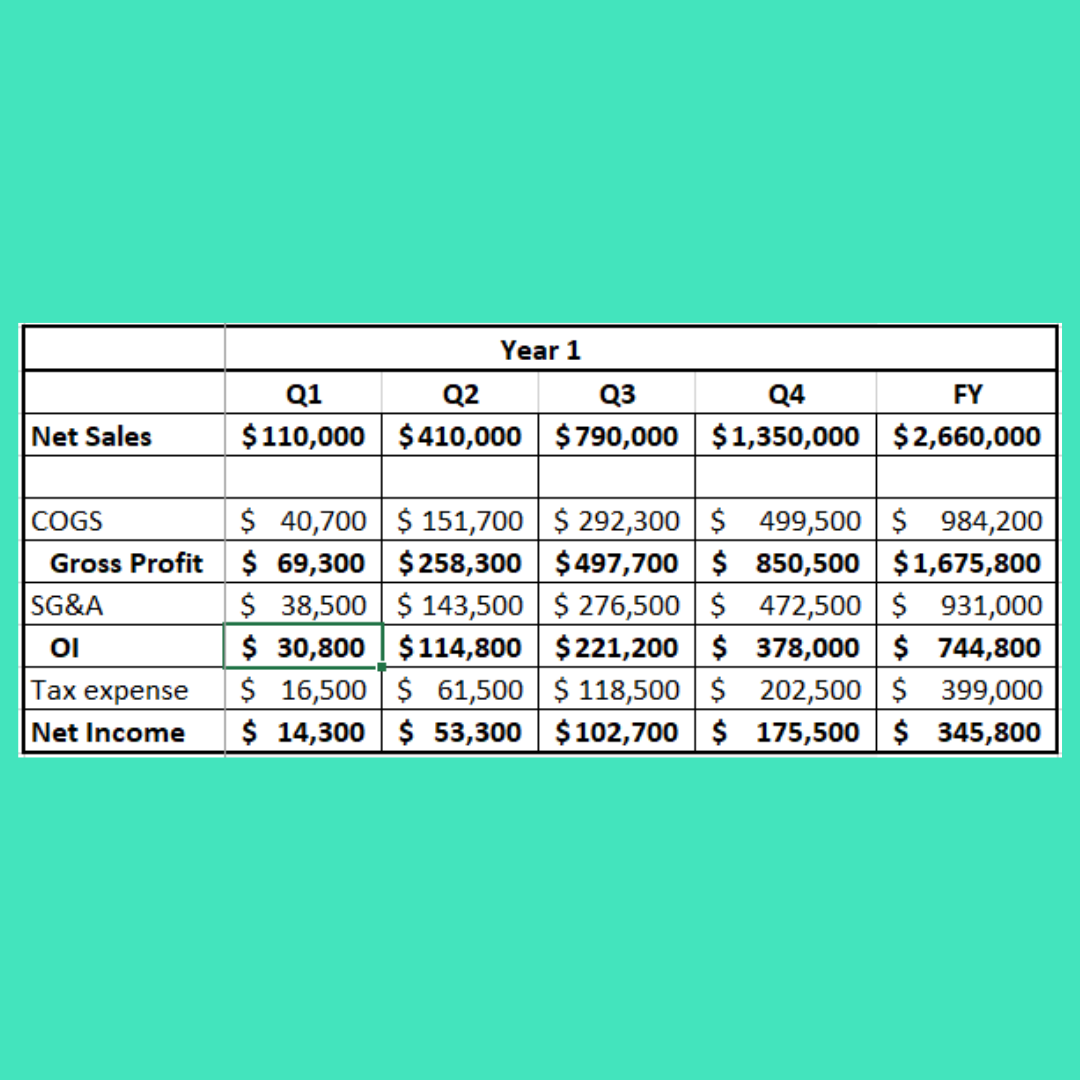

Per usual though we are going to start with an income statement. While I always like to use real healthcare companies, today I am just going to make everything up.

For this example, let’s go with something a little more capital intensive and inventory heavy. It’s easier to get a perspective versus say a SaaS model, though the principles still apply.

Today we are a medical device company that makes a middle finger lengthener so you can be a more effective driver. Medically necessary to be sure.

Here’s my totally awesome income statement:

Yay, we’re profitable! Because, well, obviously.

This is a SUPER simplified version, but I am a simple version of a person. It’s genetics. Hooked on Phonics did not work for me. The level of detail will also depend on your business and its particulars.

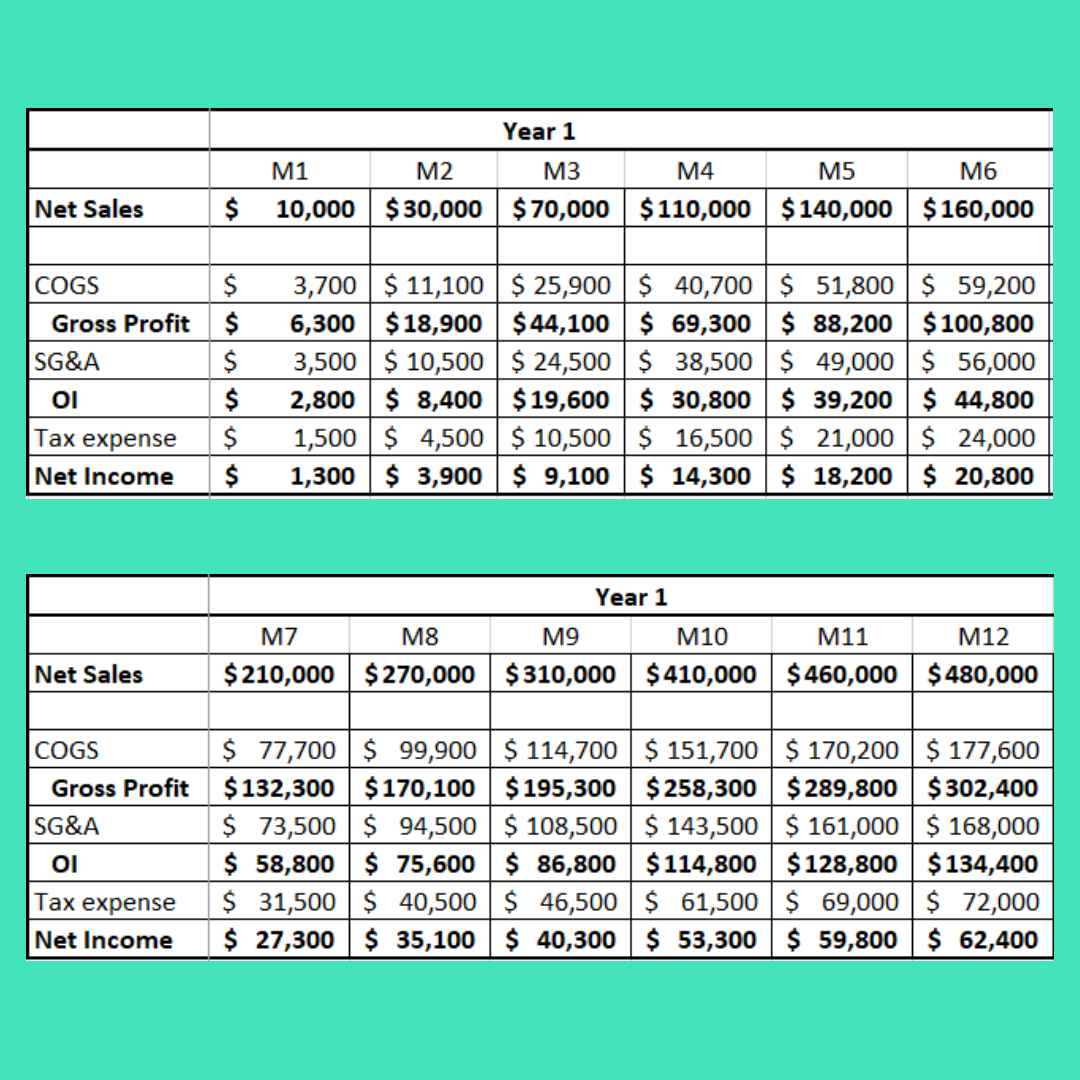

What we do next is get more detailed and breakout our income statement into months.

The reason you would do this is because it’s important to time cash flows in and out of the business. A quarterly view is not helpful when you owe money in February but don’t get paid until March.

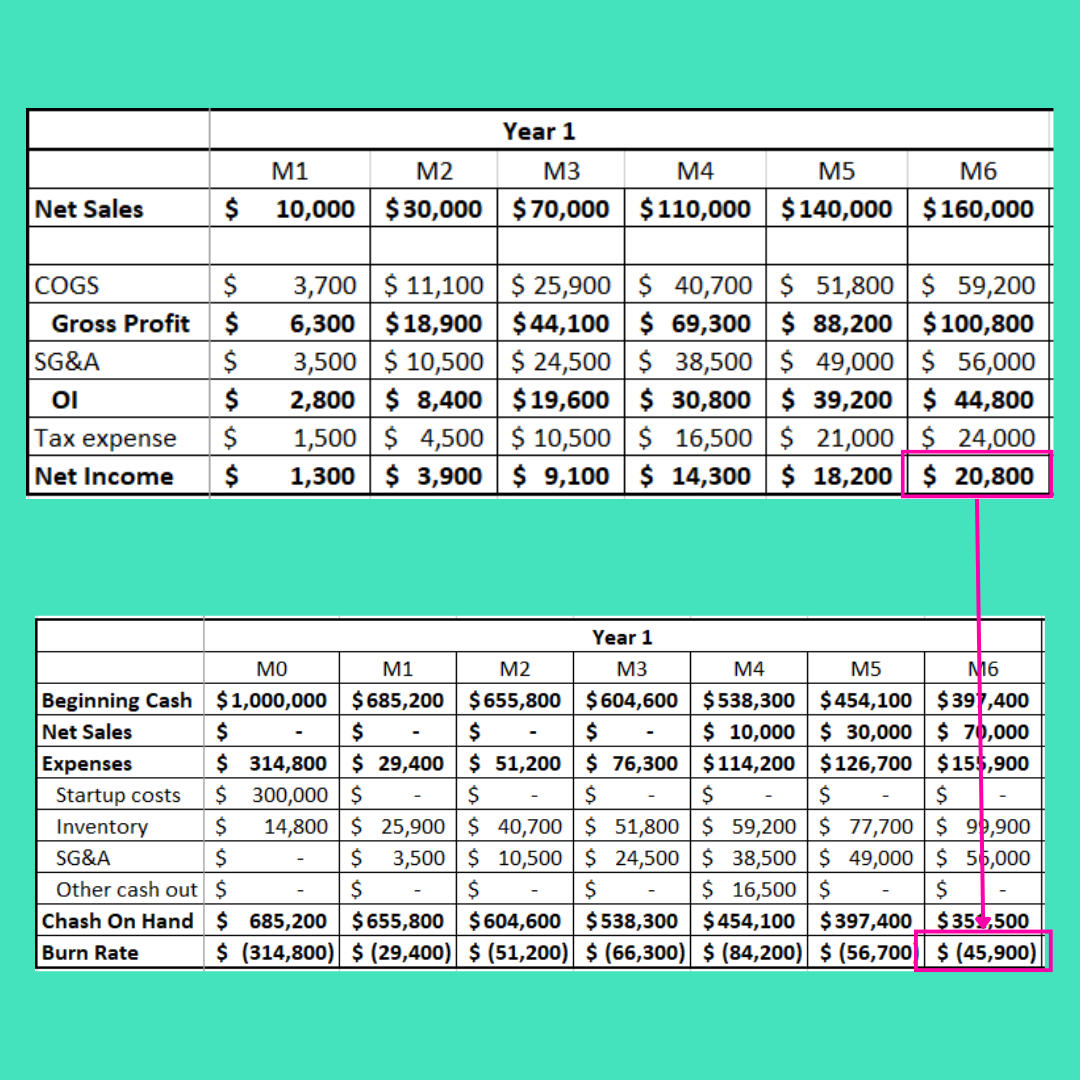

Here’s what the detail looks like:

Now the stage is set and it’s time to make some cash flow assumptions. These will be based on your unique business and circumstances.

Here are my assumptions:

We need 2 months of inventory on hand

There are going to be research, development, and engineering costs up front

It’s a 2-month sales cycle

Implementations take 1 month

Payment terms are net-30 but people will pay late

That’s a pretty good starting point that covers most of the timing issues. Obviously real life will be more detailed and will depend on a lot of things including operational and capital structures. For now, will leave that detail to your local Private Equity firm.

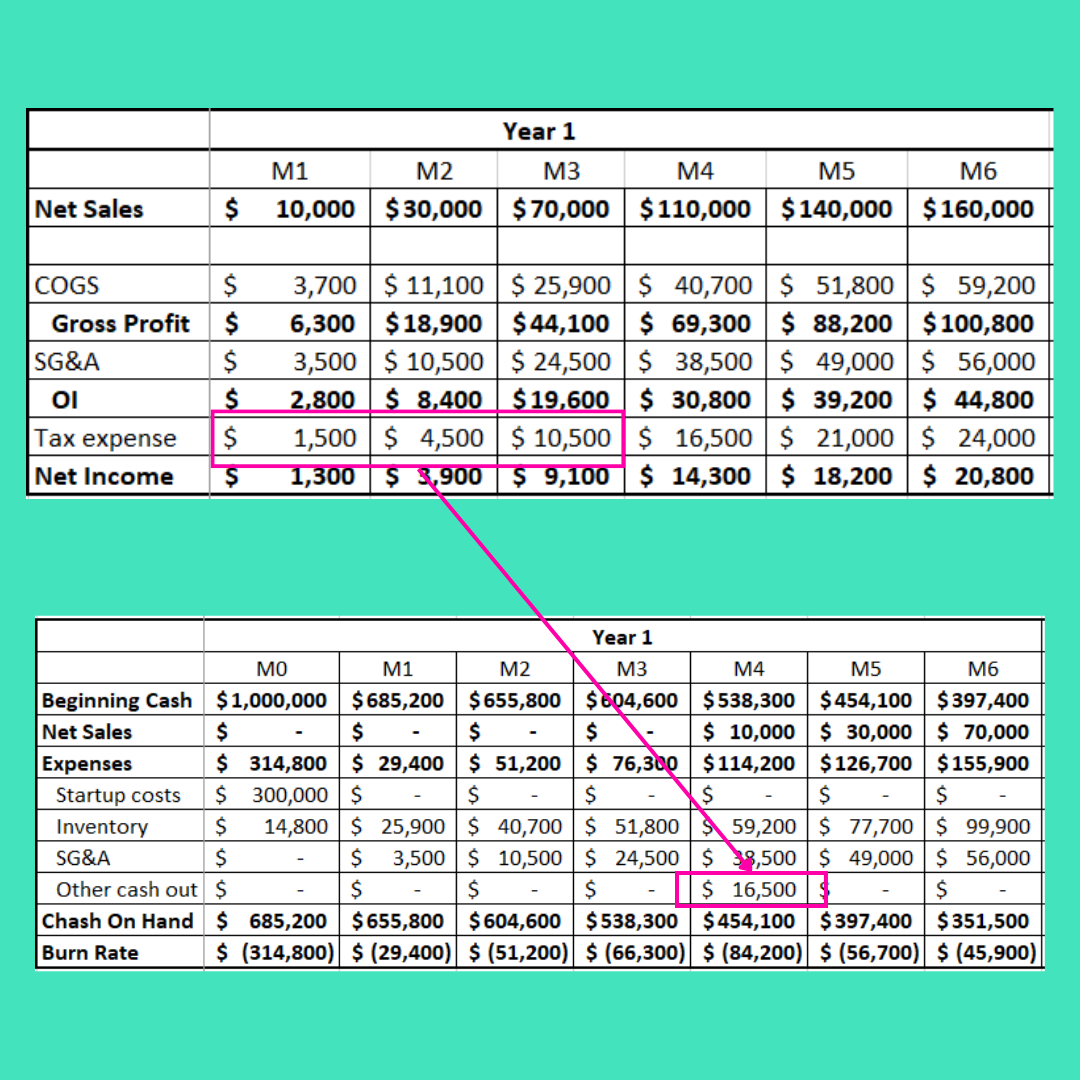

Now that we have the income statement broken out into months, we can time our revenue and expenses and put them into a cash flow statement.

This is what it will look like (don’t worry, I’ll go through it step by step, cause well, that’s the whole point of this episode):

Here’s the most important thing to keep in mind when going through this spreadsheet hell, and I am going to put this in bold, because it’s so important….

Match your projected revenue and expenses to the proper month based on you assumptions.

What that usually translates to is your expenses will be paid first and your revenue will be collected later.

For example, you pay for inventory in February to capture sales in March and get paid on March sales in April for what you paid for in February.

It should be pretty obvious now, why revenue isn’t cash, why income isn’t cash, and the importance of going beyond an income statement to build a cash flow model.

Here are the steps to making this madness happen:

Step 1: Upfront costs

You will notice I added a Month 0 (M0). That’s because it will take money to start the company and get initial inventory.

Most people don’t put that on the income statement or incorrectly match it to revenue.

Here it is:

Step 2: Match expenses to the right months

We made some assumptions on inventory. You may also have some assumptions on salary, hiring, buying office supplies etc.

You will likely pay upfront before getting cash back from the investment.

Match it appropriately.

Like-a-dis:

I pulled the inventory needs for the first 2 months selling back to M0, my catch-all startup month.

There are more expenses like SG&A and Other. Just like inventory, match them accordingly.

Peepers:

That’s me putting tax expenses in the right place for when I would need to pay out cash.

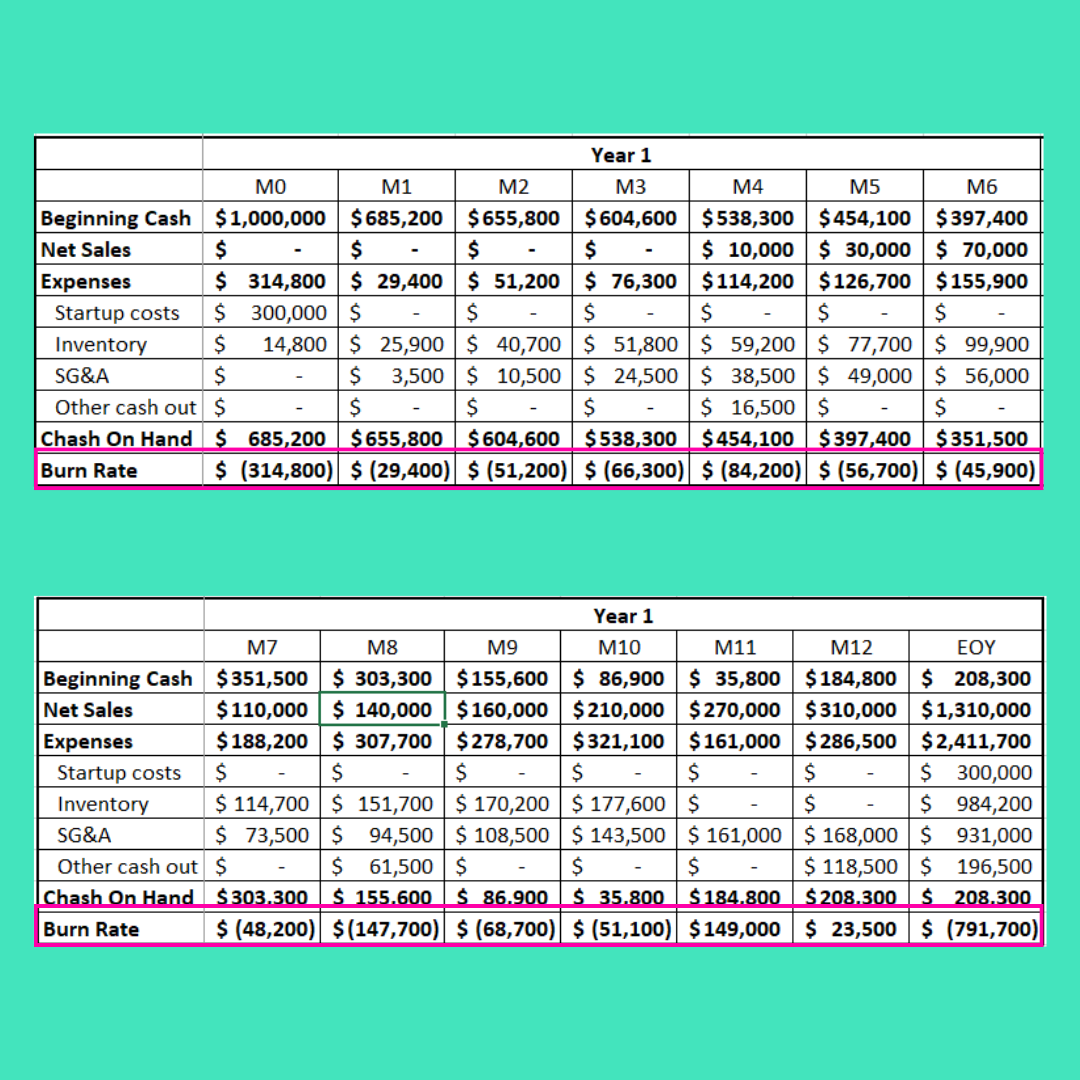

Step 4: Match revenue to when you expect to be paid

This part sucks.

You have terms and people will pay you late. Be conservative and bump revenue out even farther than your terms.

Here you go:

Woof.

Sales in month 1 (wishful thinking, I know) but no cash until month 4.

The magic of cash flow…

Step 5: Calculate your burn baby

At the bottom there is this thing called Burn Rate.

That’s how much cash you spent in the month.

Formulas anyone?

Burn Rate = (Beginning cash + Revenue - Expenses) - Beginning cash

Or more simply:

Burn Rate = Cash on Hand - Beginning cash

Here you go:

This also helps really crystalize the point that income is not cash.

Lookie here:

The income statement shows $21K in profit in Month 6.

In cash land, we spent $46K that month.

Step 6: Make sure you have enough cash

At the top of the flow is the beginning cash amount at each month. We don’t want that number negative or it means we are out of money.

For this business, $1,000,000 was required to get to a point where Burn Rate turned positive with a little extra juice.

When the Burn Rate is positive, the businesses is bringing in cash, not just spending it.

I put a box around it so you could see it easier:

We dipped to a low of $39K in Month 11, but started generating cash. So, at the end of the year we had $208K on hand.

Not bad for this entirely made up banana stand.

Step 7: Grab a juice box and hit the couch

To round this out, it’s all about the cash.

Building a pro forma cash flow will let you manage cash, know how much money you need to raise, and give you better control on operations.

Manage the cash.

Because you can be profitable and run out of cash.

Paper vs. bank account.

Thus concludes our series on cash flowwwwwwww.

Dang, what am I going to talk about next week….

I suppose it’s time to take on the big bad Balance Sheet. Another often overlooked critical look into a business. And boy are there some fun ones out there!

Don’t miss out!