The Healthcare Breakdown No. 008 - Breaking down Balance Sheets Part I: The basics

Brought to you by Bankruptcy, I mean Envision Healthcare.

What we’re breaking down: The Balance Sheet Part I: The Basics

What you’ll learn: Another type of B.S.

Why it matters: Balance sheets tell you how a company is financed and owned

Read time: 5 minutes, give or take 13

What do you get when you take a private equity group, a physician services business reliant on maximizing efficiency and unscrupulous billing practices, new legislation, and wild amounts of debt?

Usually, the answer in healthcare is richer white dudes, but today the correct answer is: Bankruptcy.

So goes the story of Envision Healthcare.

Acquired by Private Equity in 2018 for nearly $10B, Envision has failed to pay interest on its $7B in outstanding debt and will declare bankruptcy (probably).

In honor of that (yikes, that’s insensitive), we are going to look at Envision’s last public Balance Sheet for the breakdown today!

Let’s get into it.

What in the good world is a Balance Sheet?

Other thank B.S. (that stands for Balance Sheet), simply, it’s a snapshot of a company’s financial position.

Three buckets:

Assets – How much you own.

Liabilities – How much you owe.

Equity – How much you’re worth.

For a non-profit health system Equity isn’t called equity since no one profits from the company (haha, that’s a hilarious joke). Instead, it’s called Net Assets (cleverly). But you can think about it in the same way.

To follow along with how clever accounting words are, the balance sheet, must balance.

Like so:

Assets = Liabilities + Equity

It balances because companies buy assets using debt (liabilities) or owners’ capital (equity).

Boom, simple, so long.

Ok, fine. For fun, let’s break it down. As you know this issue is a 2 part-er and knowing what’s on the balance sheet is essential to interpreting it.

Here is Envision Healthcare’s June 30, 2018 Balance Sheet:

Wonderful, what is all this madness??

Let’s take it from the top.

1. Assets - Things you own

Here is what Envisioned owned as of June 30, 2018.

Remember, the balance sheet is a moment in time, not money over time.

The big thing to keep in mind with assets is current vs. long term.

Current assets are assets that can be turned into cash in less than 1 year.

Long-term assets are anything that would take longer than 1 year to turn into cash.

The distinction is important when looking at liquidity and meeting obligations.

For example, a company may have $12B in total assets but mostly in Property, Plant, and Equipment (PPE). So, while its asset value is high it may still have trouble meeting debt obligations.

It’s like being an early 90’s one-hit-wonder super star, buying a mansion and then realizing you’re house poor and out of real money despite a high net worth.

Onto the next section!

2. Liabilities - Money you owe

This section is setup in the same way as the asset section. There are current liabilities (money owed in less than a year) and long-term liabilities (money owed more than a year away).

Again, helpful for liquidity estimations.

Here’s Envision’s liabilities in the good ole days before $7B in Private Equity debt.

Oh, wait… crap. It still has a lot of debt. But don’t worry, long-term debt. Basically the next generation’s problem. Everything is fine.

Next up…

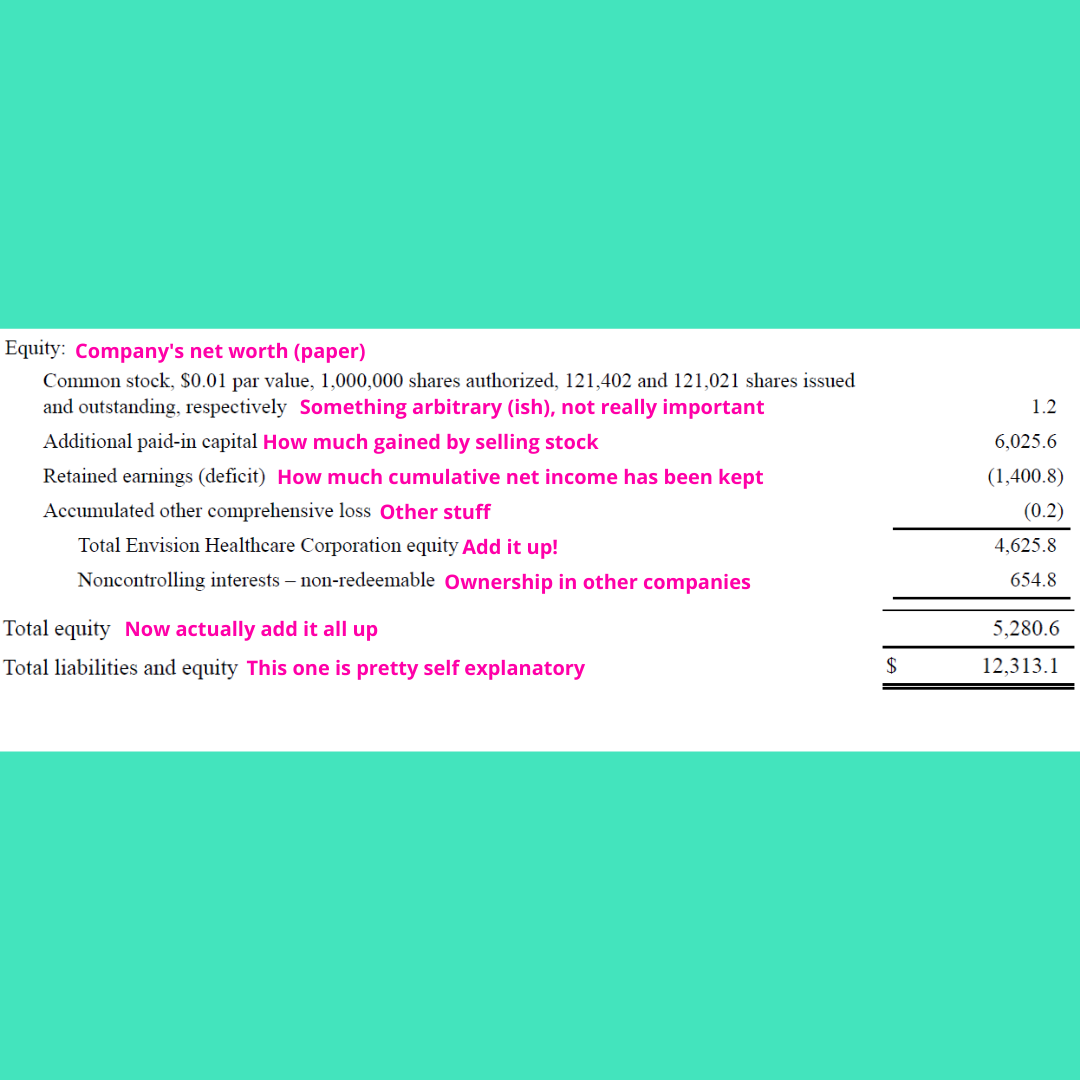

3. Equity - Your net worth on paper

Why on paper?

Because this does not represent the enterprise value of a company. At this time Envision was acquired for $9.9B, far more than the $5.3B in equity represented here.

I won’t go into the difference now, but it has to do with multiples, sweater vests, Bloomberg, and Yacht Rock.

For now, here’s what all the equity jargon means:

Of note in the equity section is a distinction between Contributed Capital and Earned Capital.

Check these pink boxes I made out:

Contributed capital is capital raised by selling stock.

Earned capital is capital made by business operations.

Capital is money.

Envision is bad at making it.

Wait, did I say that….

Thus concludes our 3 sections of the balance sheet.

And now, a moment of balanced Zen:

This is a balance sheet after all.

As I mentioned up top, Assets = Liabilities + Equity.

Assets are bought with debt (liabilities) or owners’ money (Equity), which is why they balance.

Woohooo!

We did it.

Don’t forget to come back next week if you want to interpret this mess and be able to tell when a company is in trouble…. Or I guess doing really well.

But you know, drama sells.

We’ll do some ratios. Look at some other statements in conjunction with this one. And probs make some jokes.

It’ll be terribly boring or incredibly fun I promise.