The Healthcare Breakdown No. 011 - Breaking down the financial gut check

Brought to you by Tift Regional Health System, a Georgia peach

What we’re breaking down: How to gut check a company’s financial health

What you’ll learn: How to do a 5 minute assessment of the numbers

Why it matters: Ain’t nobody got time for all that

Read time: Geez, better be 5 minutes or less…

Wait! I have a minor announcement!

I will make this quick.

I launched, well launching if enough people are interested, a course on healthcare finance!

It’s called Healthcare Breakdown - The Finance Course!

I won’t take up more of your 5 minutes with the details. Enrollment ends tomorrow and the next time it’s open, the price will go up.

Check it out.

It may just change your life. Probably. I mean I can’t guarantee that, but I can’t say it won’t change your life either.

Ok, cool. Back to the show

All right beautiful people, since we have started this crazy journey, we’ve look at a lot of stuff. From balance sheets, to incomes statements, pesky notes, and even done some more than tedious calculations.

Let’s get into a little rubber meeting the road situation.

Today we are going to bring a lot together and gut check the financial well being of a company. Since we all love it so much, we’re going to look at a health system.

Shocking, I know.

Anyways, when trying to perform a quick litmus test of financial health, there are 3 questions you want to answer:

Can the company pay its debt?

Is the company profitable?

Is it cash flow positive?

Oh, that’s a nice cascade. Wish I had figured that out for my LinkedIn post! We all know the magic is in the formatting.

We are going to look at a little health system here in Georgia for this one. No reason, just came up by accident. Much like most of my life choices.

It’s called Tift Regional Health System. Southwell, the name you’ll see at the top of the following financial statements, is the operating organization for the county owned system.

From the top!

Debt coverage

What we want to look for:

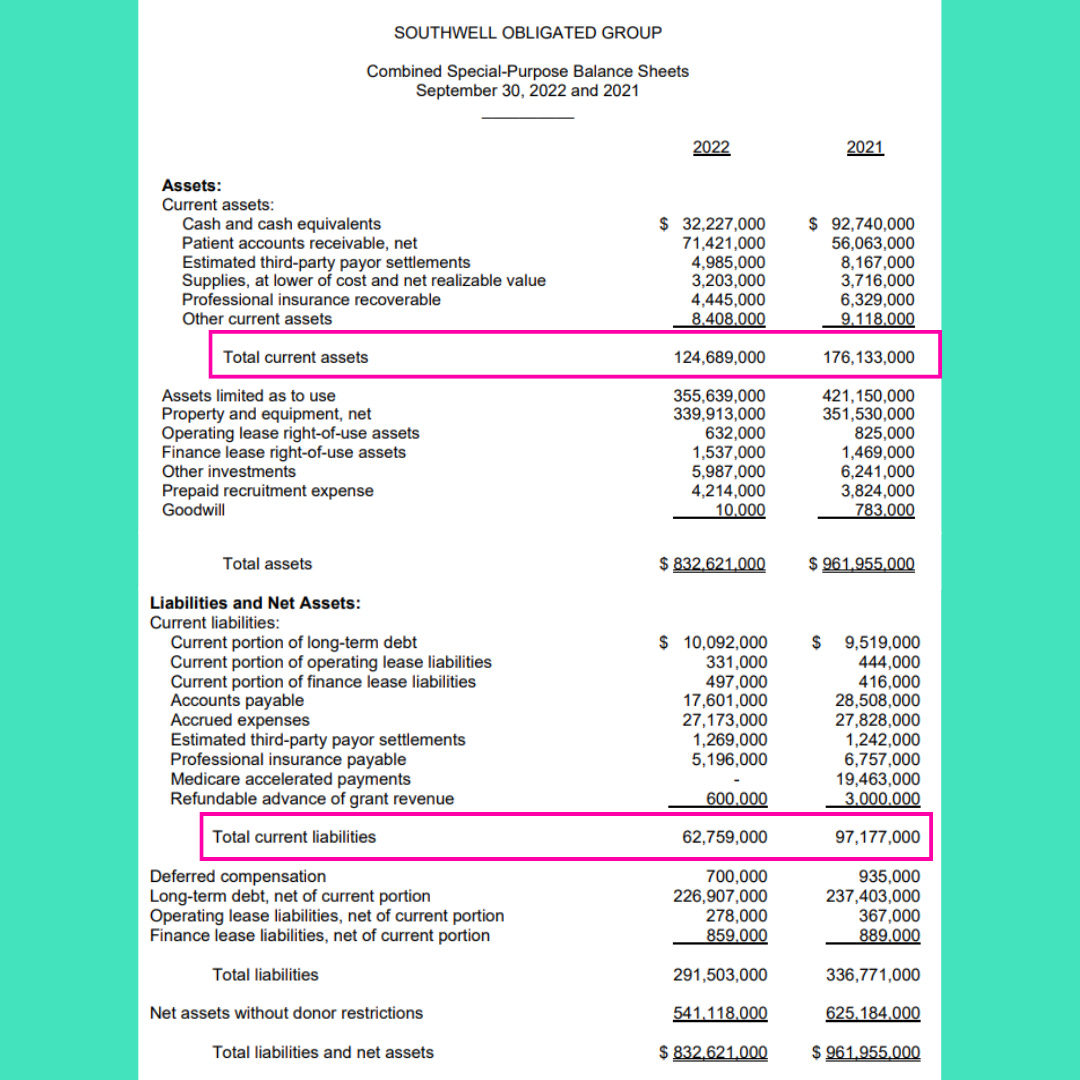

Current assets > current liabilities

Cash > current liabilities

Assets increasing vs. liabilities

Current assets > current liabilities

Does the company own more things than it owes?

Why does it matter?

Simply because if a company can’t pay its debts, it will go bankrupt. All hospitals carry debt in the form of bonds (most of the time) and many companies carry the same debts.

It’s the same as a mortgage. You get a loan to buy a house and then owe payments on that home. They take out a loan (bond) to buy a new hospital and then have to pay interest on the bond.

Too bad they can’t raise the debt ceiling… oh, wait.

This is a more macro look.

Here you go:

Boom! Check.

$125M > $62.8M

Off to a nice little start.

Let’s get a little more granular and look at…

Cash > current liabilities

This is a slightly more conservative look. Since cash is that stuff you can use to buy Yeezy’s, it’s immediately available. Current assets include accounts receivable, which are like IOUs from people. You can’t pay someone with someone else’s IOU.

I’ve tried. They said no. Claire’s has such strict policies on belly button piercings, I swear.

We want to see if the company has enough immediately available to cover its current debt. If not, that spells trouble.

Look for it here:

Woohoo!

$388M >> $62.8M

Note: most of “assets limited as to use” will be cash convertible and is treated as cash. See the last Breakdown No. 010 for more detail on this.

Assets increasing vs. liabilities

Finally, we take a look at the asset increase vs. the liabilities.

Sometimes assets go down, which is ok. I would be worried if they went down while liabilities increased. That would mean the company is taking on debt to fund declining business and using assets to pay for stuff.

Kind of like continuing to invest in your brother’s house flipping business. I know he’s got a heart of gold, but it ain’t gonna happen.

For this we just peek here:

Both down 13%. That means it used assets to pay liabilities.

I’d call this neutral.

It would be best if we looked over time, but this is a gut check. We’re only looking at the most recent two years here.

Onto the next!

Profitability

Here’s what to look for:

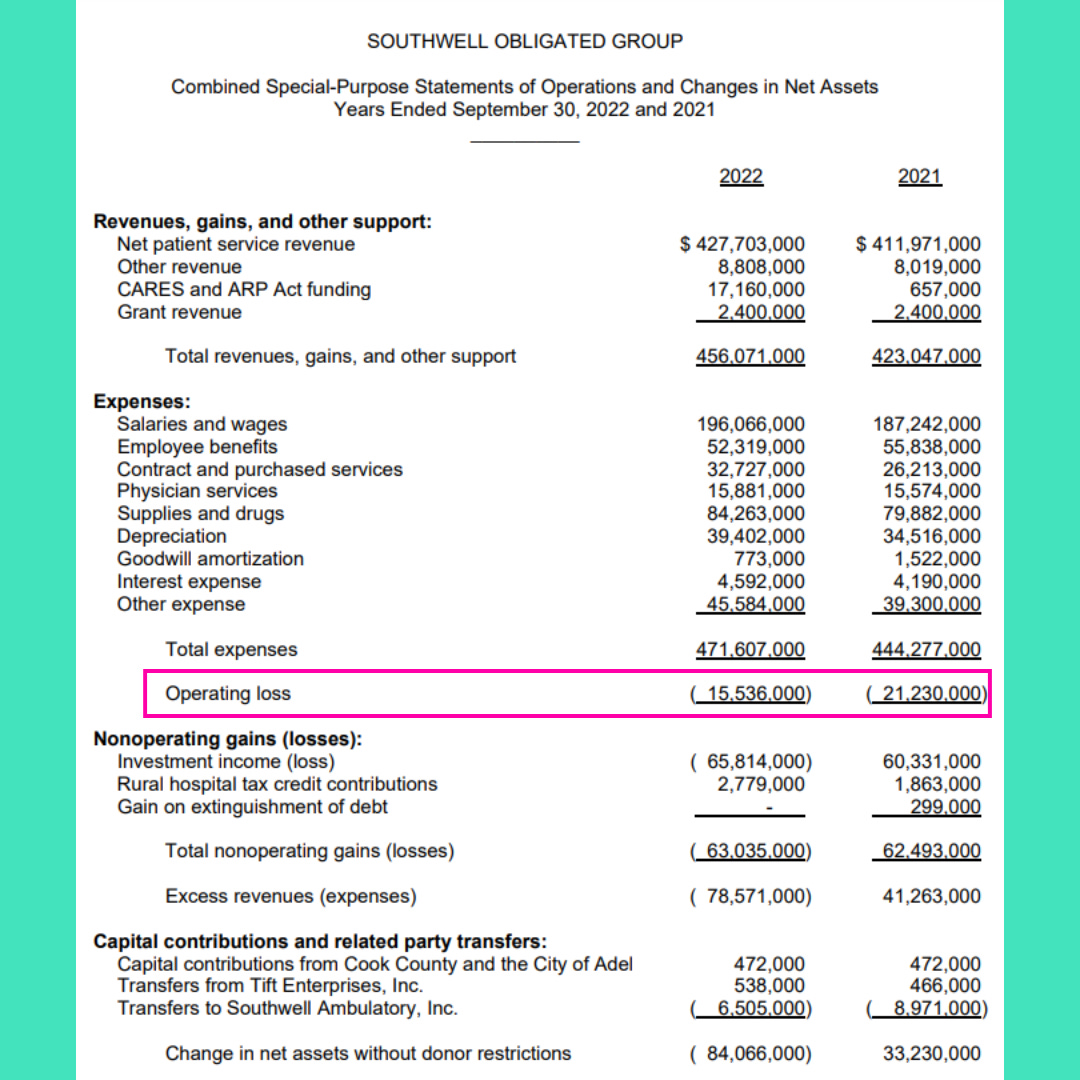

Revenue vs. expense growth

Operating income

Net income

First up!

Revenue vs. Expense growth

Is revenue increasing? Good.

Are expenses increasing? Probably.

Are they increasing less than revenue? Sweeeeet.

How is Tift doing?

Revenue is growing faster than expenses! Yesssssssss. Score.

8% growth vs. 6%.

Revenue growth always comes with expense growth. Just make sure expenses aren’t outpacing revenue. This isn’t an internet startup in 1998. We saw how that ended.

On to….

Operating income

No calculations for this one!

Boom, simple. Making paper.

Oh, wait. Losing paper in this case.

Not going into the subtly here. Typically, not great. Strike one.

Next!

Net income

A little lower… ahhhhhhhh

For a non-profit health system this number is going to be heavily influenced by investment gains and losses. What’s more is these are unrealized, which means no actual money is gained or lost. Just the value of the investments.

Still need to look at it, as a macro view of the system. It’s even more critical when looking at for-profit companies. That’s the main reason it’s included here.

Get the reps in to be able to look at any company like a champ!

Well, strike 2 for Tift. Looks like the income game is a little problematic but not astronomical. Still feelin’ all right.

Now for our third and final section:

Is the company flowing that cash.

Here’s what you want to look for:

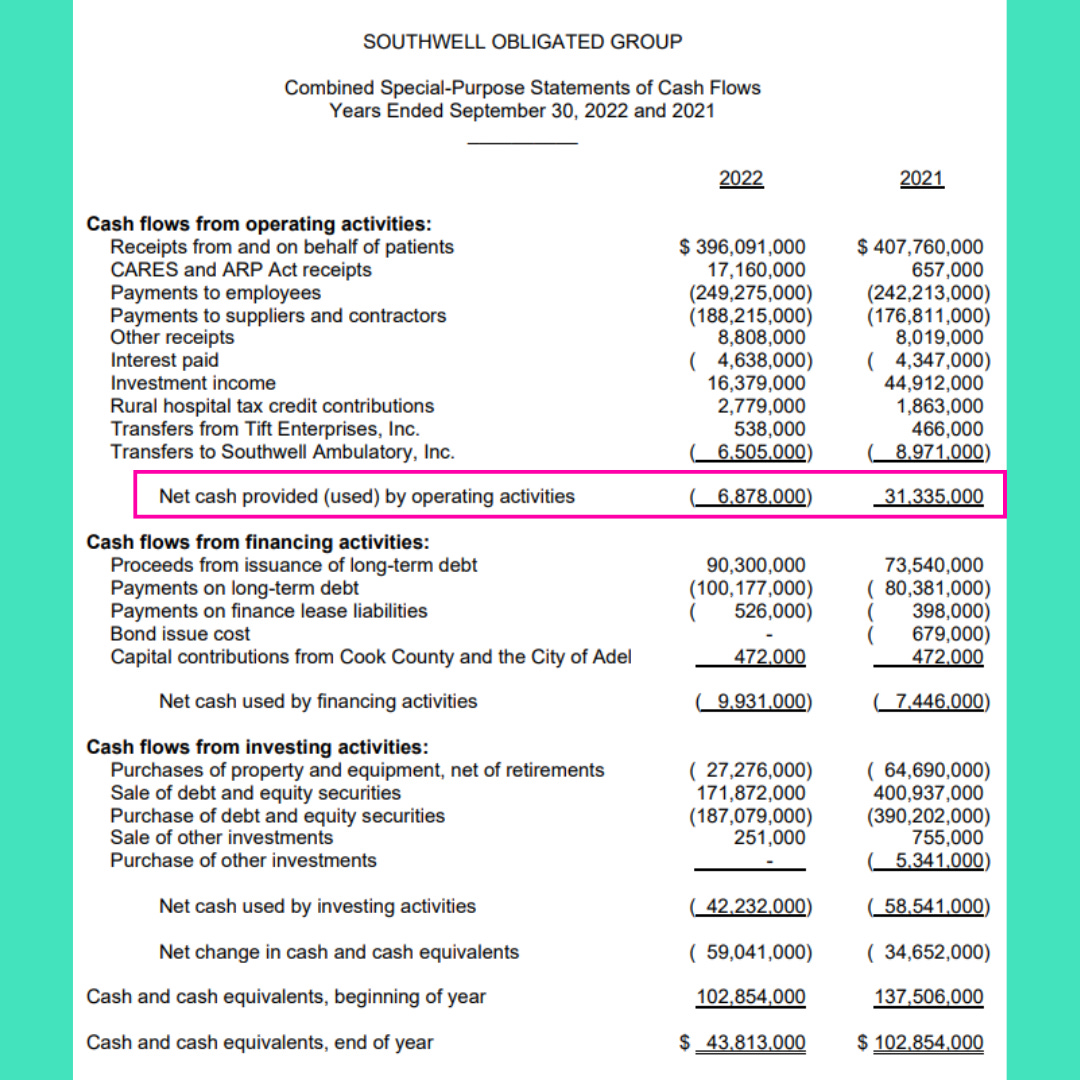

Cash from operations

New and paid debt

Investments made

Cash from operations

You guys know I love this one. How much cash the business is actually bringing in from its operations. Real money, not those silly book losses or recognized but unpaid foolishness. The cold hard good stuff. The Coors of income.

Here we are:

All right. All right.

I am not striking Tift out on this one. Pretty narrow loss and 2021 was pretty sweet.

Moving on.

New and paid debt

I want to know if the company is paying off its debt and/or taking on more.

Paying off debt is fine and can be a signal of a strong financial position. It can also be neutral. I wouldn’t say it’s bad unless there’s something crazy in the notes about debt restructures.

Wait! This is a gut check. Ignore that malarkey.

Go right on down the road to here:

There you are. Paid off some debt. Took on some debt. Nothing crazy.

Also explains the asset and liabilities changes more.

Finally….

Investments made

How is the company spending it cashy cash? Does it have stacks to invest?

If a health system cries about losing $4B but also sells $12B in investments while buying $13B, I will be keeping the tissues to myself thank you.

This will give you an indication of excess cash, if the business is taking on a lot more real cash from operations or otherwise, and if it has the capacity to turn investments into cash.

Because if operations start to go south, a company holding billions in investments should sell them. Not ask tax payer Sally for a bail out.

Good thing that never happe… Crap.

Anyways, let’s check back with Tift:

Same as the debt sitch. Sold some stuff. Felt good about buying some extra stuff. I am ok with it.

And for the big finale!

I’d say Tift passes the gut check.

Now, I would never make any kind of investment move based on a gut check. In fact I never make any investment moves. Index funds baby!

But it would let me know if there is anything I would want to dig deeper into. Or any crazy red flags.

Or crazy green flags for that matter. Are green flags a thing? Checkered flag? No idea.

Overall, Tift has decent cash flow when looking at the previous year. Income could be better, but there is some nuance to look into. Probably fine. And the balance sheet seems strong.

Not going to default. Generates cash. Seems like it can turn a profit.

Gut.. .checked!

And how about that, it only took you 4 minutes to read this.

Boom!

And now you can gut check the financial strength of any company.

You can also quickly call hootenanny on health systems claiming to have good reason for not providing more charity care, turning away poor people, and suing patients.

Man, this is fun!