The Healthcare Breakdown No. 012 - Breaking down HCA's ($73) shareholder equity

Kevin Bacon edition

What we’re breaking down: How financial statements are connected

What you’ll learn: How the … financial statements… are… ummm… connected?

Why it matters: Knowing how its connected gives you the full perspective on a company

Read time: One episode of Bluey (6 minutes for real though)

You may not know this, but everyone in Hollywood is connected to Kevin Bacon. Kevin Bacon, one of the most underrated actors of our time (just look at his expert work in Tremors I & II) is no more than six degrees away from anyone who has worked in Hollywood.

What does this have to do with healthcare business? Well, nothing at all. Just needed a vaguely related opener.

Not wildly dissimilar to Kevin Bacon, though nothing alike, all the financial statements you now know and love are also connected.

Today, we are going to look at the connection.

Our helper today is HCA Healthcare. Undisputed champion of debt.

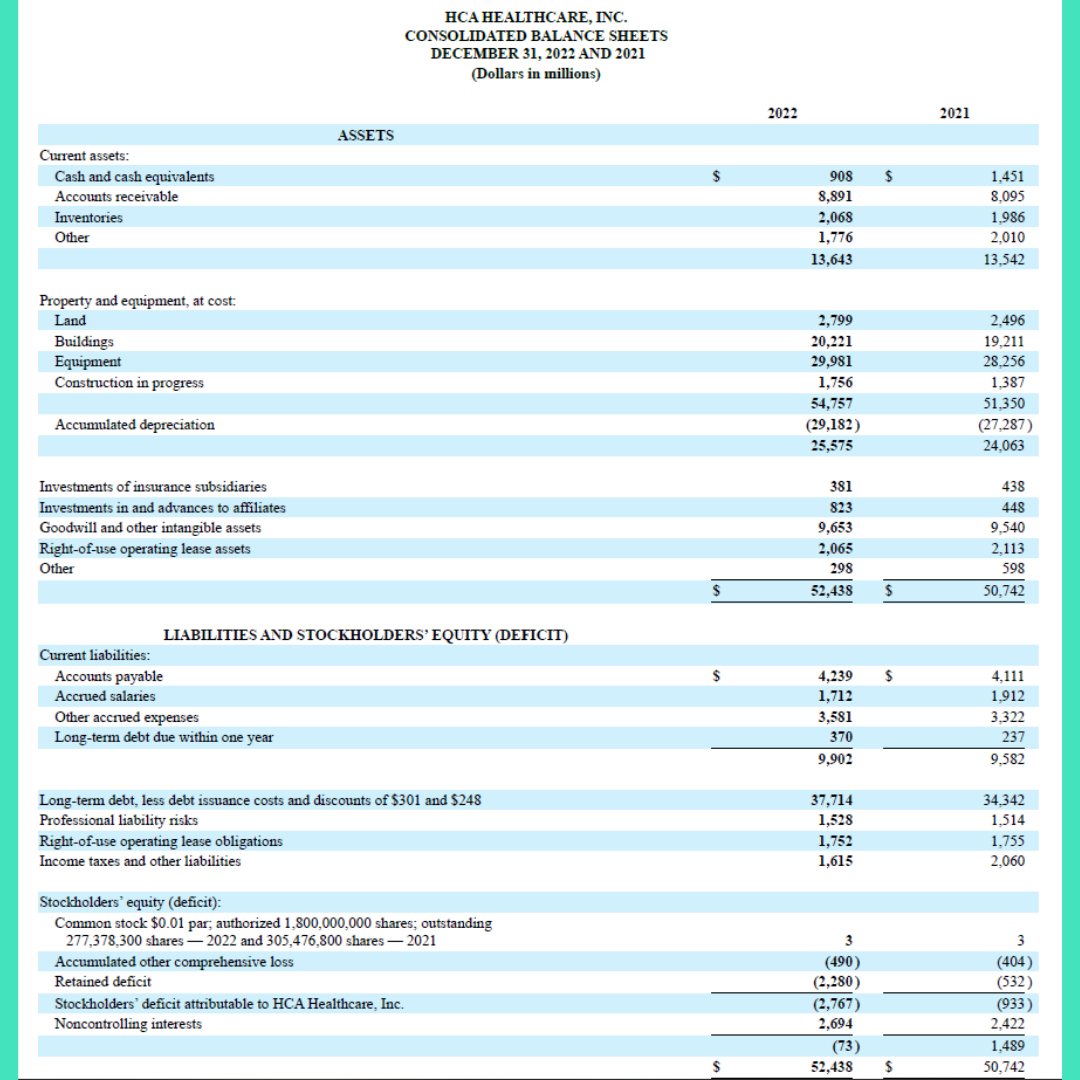

Let’s go ahead and put it all out there:

Here’s how it works in the simplest sense. The balance sheet changes one year to the next and the income statement and statement of cash flow show how everything changed.

And away we go.

Start on the balance sheet in the previous year. That’s the overview of a company’s finances. What it owns. What it owes. What shareholders have in equity.

Highlights:

Assets: $50.7B

Liabilities: $49.3B

Shareholder equity: $1.5B

HCA is a debt machine.

Ok, that is our starting point. But we want to know what all happened during the year to come to this new year end overview:

Assets: $52.4B

Liabilities: $52.5B

Shareholder equity: ($73M)

So, what happened? Well, good thing we have the income statement, statement of cash flow, and statement of stockholder’s equity (deficit) to help us out.

WOOOOOOAAAHHHHHH. Screeeeeech. Stop. No, no, no, no, no, no. Statement of stockholder’s what?? Is that another financial statement?

Well, yes. But don’t worry, we aren’t going off the rails, it’s just a little extra info to help on out Bacon exploration.

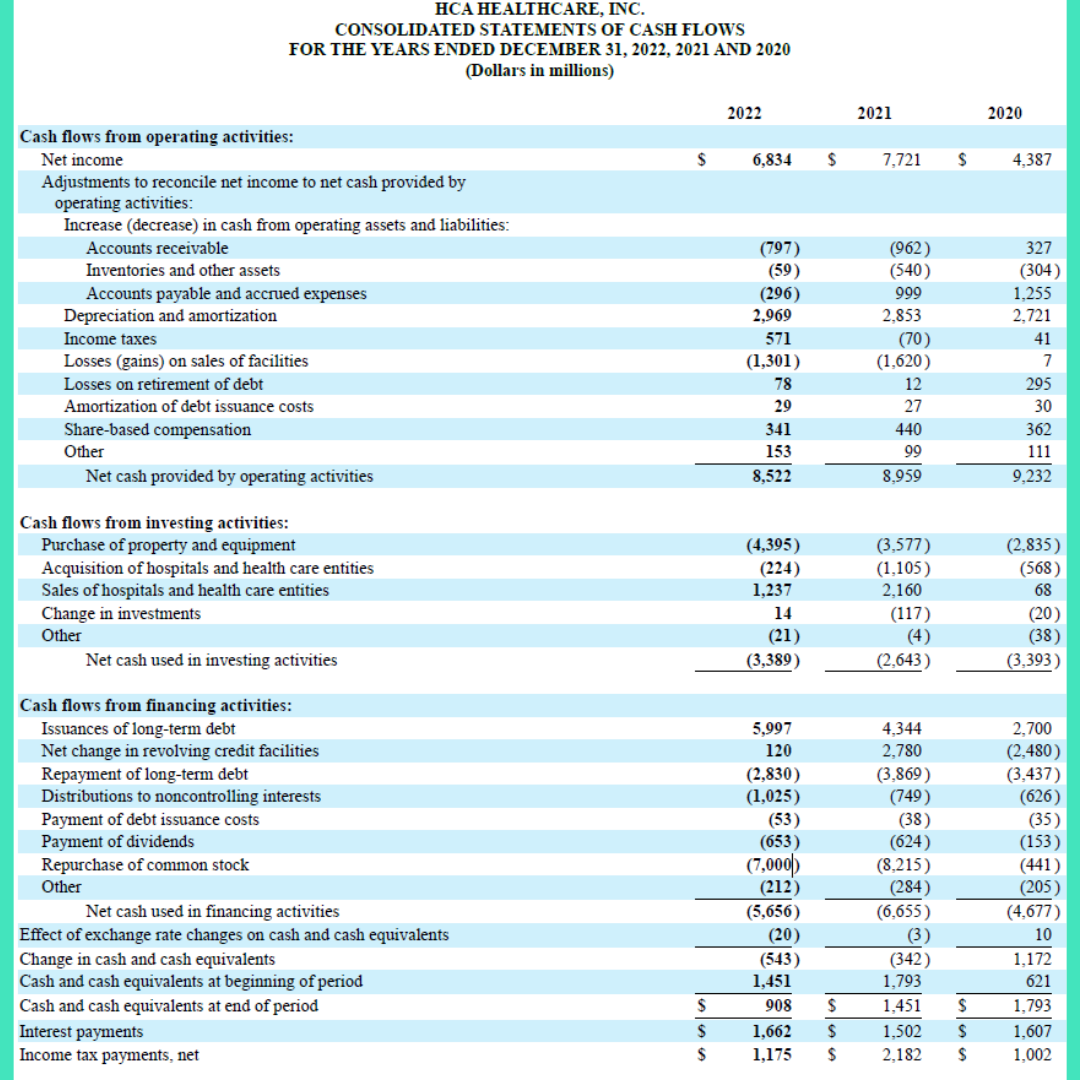

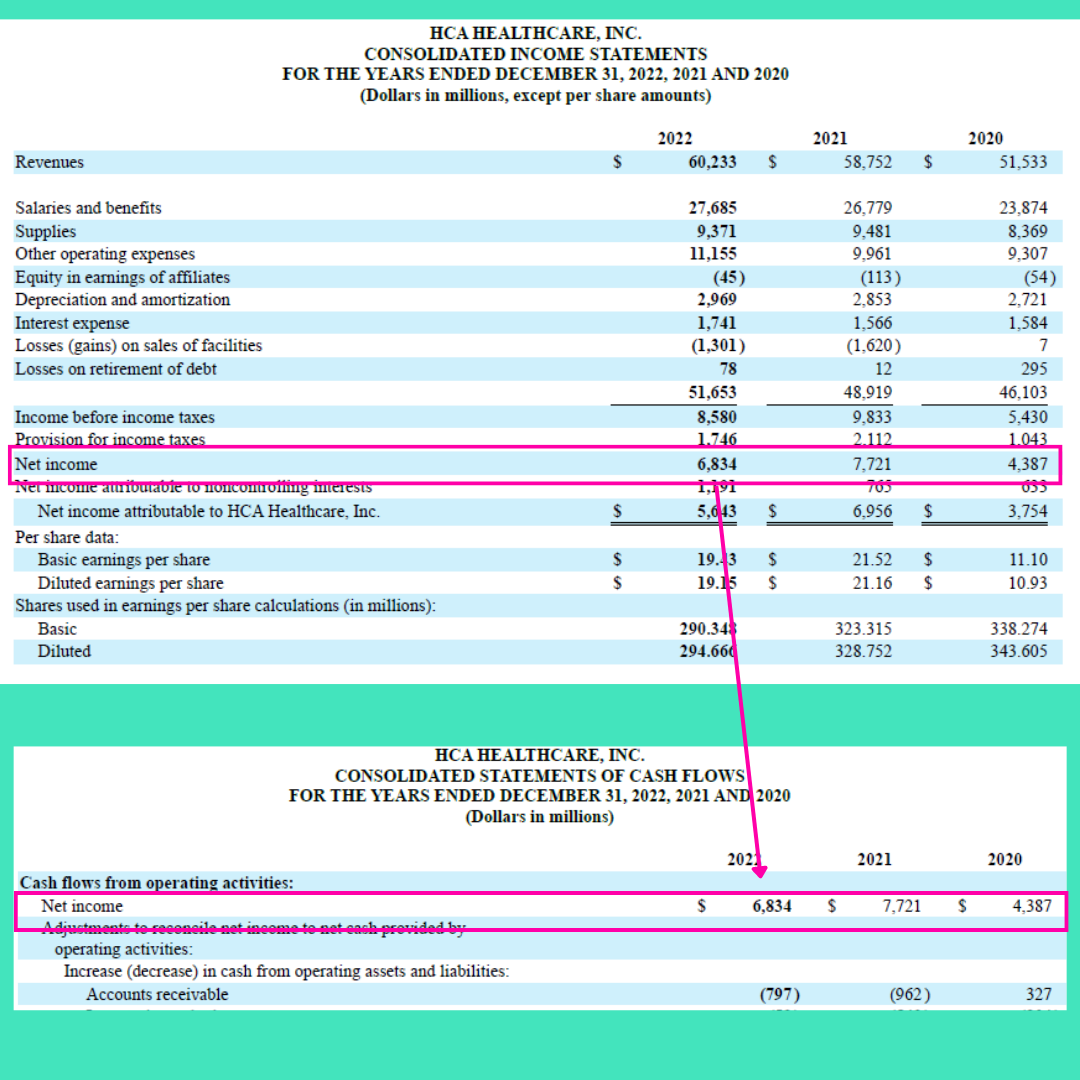

To see how we got from the first pink box above, to the second, start with the income statement.

Go ahead and skip down to net income. Net income is great, but as you know it’s a paper game. Changes in the balance sheet include some paper gaming, but are more reflective of what goes on from the statement of cash flow.

Luckily, the income statement is like the cash flow’s big sister and get’s things kicked off.

Like-a so:

And as you know, the statement of cash flow shows the overall change in cash from the beginning of the period to the end from operations, investing, and financing.

Quick refresher:

If we want, we can just scoot to the bottom and immediately see another connection point.

Listed plainly is the cash at the beginning period and cash at the end of the period. This is the change from all the cash generated in and used in operations, financing, and investing.

And it goes, dun dah dah dahhhhh!!! To the balance sheet.

Here:

We started with $1.45B at the end of 2021, all this stuff happened during 2022 and then we have $908M the end.

Connected like a date on Bumble.

I hope it’s starting to be clear how this is all connected. Nothing happens in a vacuum on financial statements. Just like no movie gets made without Kevin Bacon.

Now for the piece de resistance (said in snooty French accent).

Retained earnings.

Let’s go back to the overall balance sheet…

Assets are $52.44B

Liabilities are $52.81B

That leaves Equity at ($73M)

It’s weird though right, since HCA made a bunch of cash to have negative shareholder equity?

The answer is yes.

And here’s why.

Where the income statement meets the balance sheet is in retained earnings. That’s the amount the company make and KEEPS.

It’s all the money the company has kept over all the years. So, each year the retained earnings go up and down based on net income and payouts to investors.

In the case of HCA, that would mean pay dividends, repurchase stock, pay distributions, and some other stuff. You know, the rich get richer part.

To mess up your whole world here is a FOURTH financial statement you never wanted to know about. The Statement of Stockholder’s equity.

Tada!!

And here is how it’s all connected:

Here’s how this played out.

HCA started with retained earnings of $1.49B. It made $6.75B. Then is bought back $7B worth of its own stock, paid out $655M in dividends, and $1B in distributions. Taking that $1.49B in equity to ($73M).

I went ahead and underlined the $7B buy-back.

This necessarily decreased shareholder equity as it buys equity back from shareholders.

By the way, these payments are on the statement of cash flows too.

Crazy right?

And that change changes the asset side of the balance sheet as we saw above. Because as you know, if the assets decrease, then liabilities or equity will also need to decrease.

The Zen nature of a balance sheet.

In a Bacony conclusion. The balance sheet is the financial snapshot of the company one period to the next. The business runs and that balance sheet changes throughout the period resulting in the ending numbers.

The business running is all on the income statement and cash flow statement explaining the changes on the balance sheet.

I’m glad we did this. This was fun.

Would love to do it again some time. I will check my schedule and reach out.