The Healthcare Breakdown No. 014- Breaking down ROI so you can buy that c-arm you’ve always wanted… or sell one

Brought to you by my love of being difficult

What we’re breaking down: Return on investment

What you’ll learn: A whole new way to think about investments

Why it matters: Your job is to work on the right things in invest in the right areas

Read time: 3 blocks in an NYC cab (6 minutes for real though)

“The ROI on that is going to be ridiculous.”

“What’s the ROI on that?”

“That’s a huge ROI!”

Ummmmmm, what?

So, like how much? How are you coming to that number? What method are you using? When you say ROI, what do you mean? Are you looking at this in a vacuum or are you comparing it to something else? Would we be better off just socking the money in some high-yield bonds?

Oh boy…

If I’ve said before, I’ll say it again… And if I haven’t said it before, write this down…

This is less about numbers and more about thinking.

Well, I guess I wrote it down. So just save that line to the random items folder on your desktop that you never look at even though there are a million things in there.

People are always talking about ROI, but what do they really mean?

Let’s jump into an example. I used to work in the medical device world and it’s a nice tangible thing, so let’s start there.

Super secret aside for all the device slingers out there: this is how you can win some bin-ness. Show their ROI. Hold their sunlight-deprived-from-working-in-procurement-which-is-always-in-the-basement-with-no-windows hand to make their job easier.

Say you want a new C-arm.

It costs $82,000.

You will be able to do an extra 4 procedures per month because it’s much more awesome. And you’re old one is on the fritz at least once a week, causing you to push back cases and schedule less.

Each new procedure brings in a margin of $311.

You’re going to go into your VAC meeting with hella amber colored energy.

Here’s your business case…

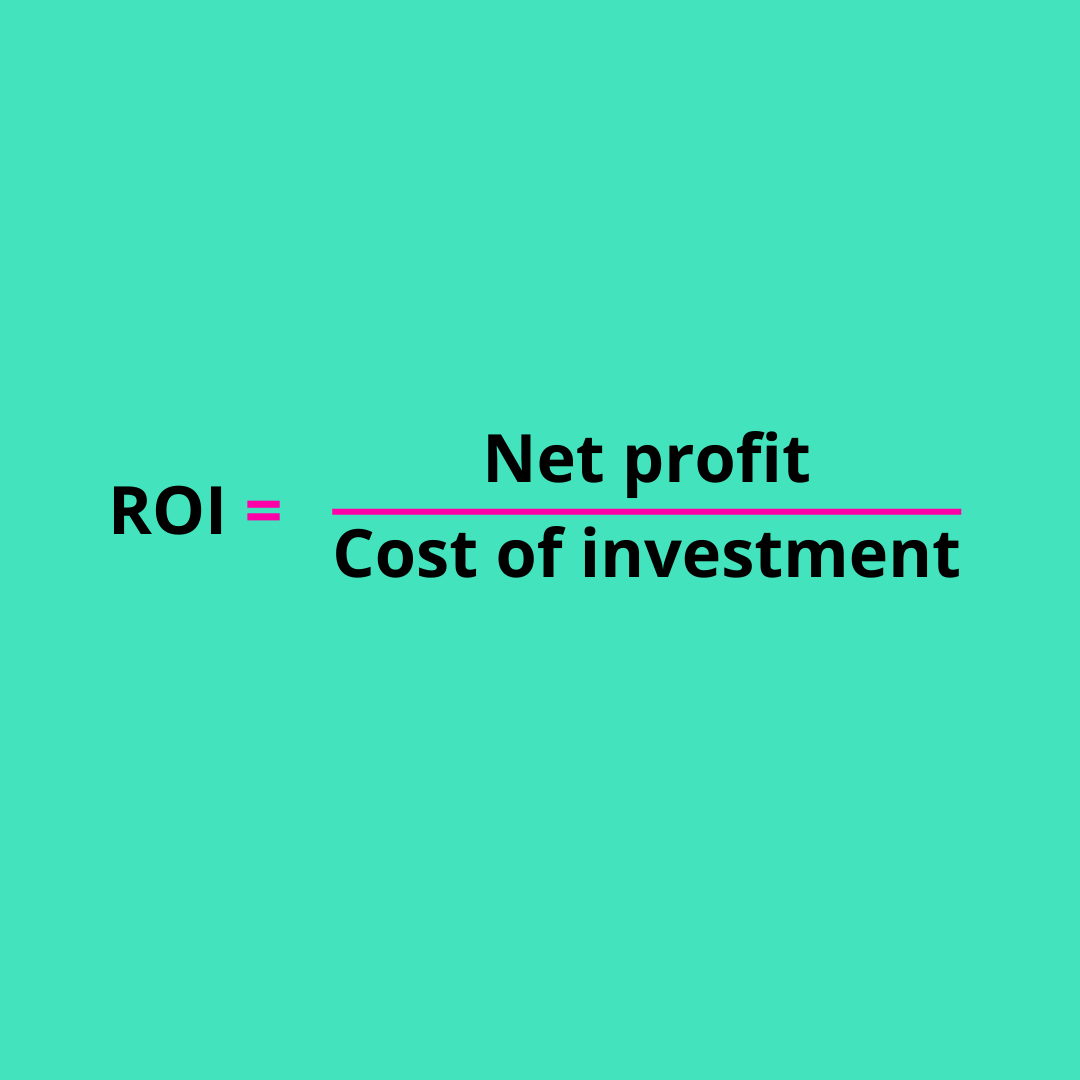

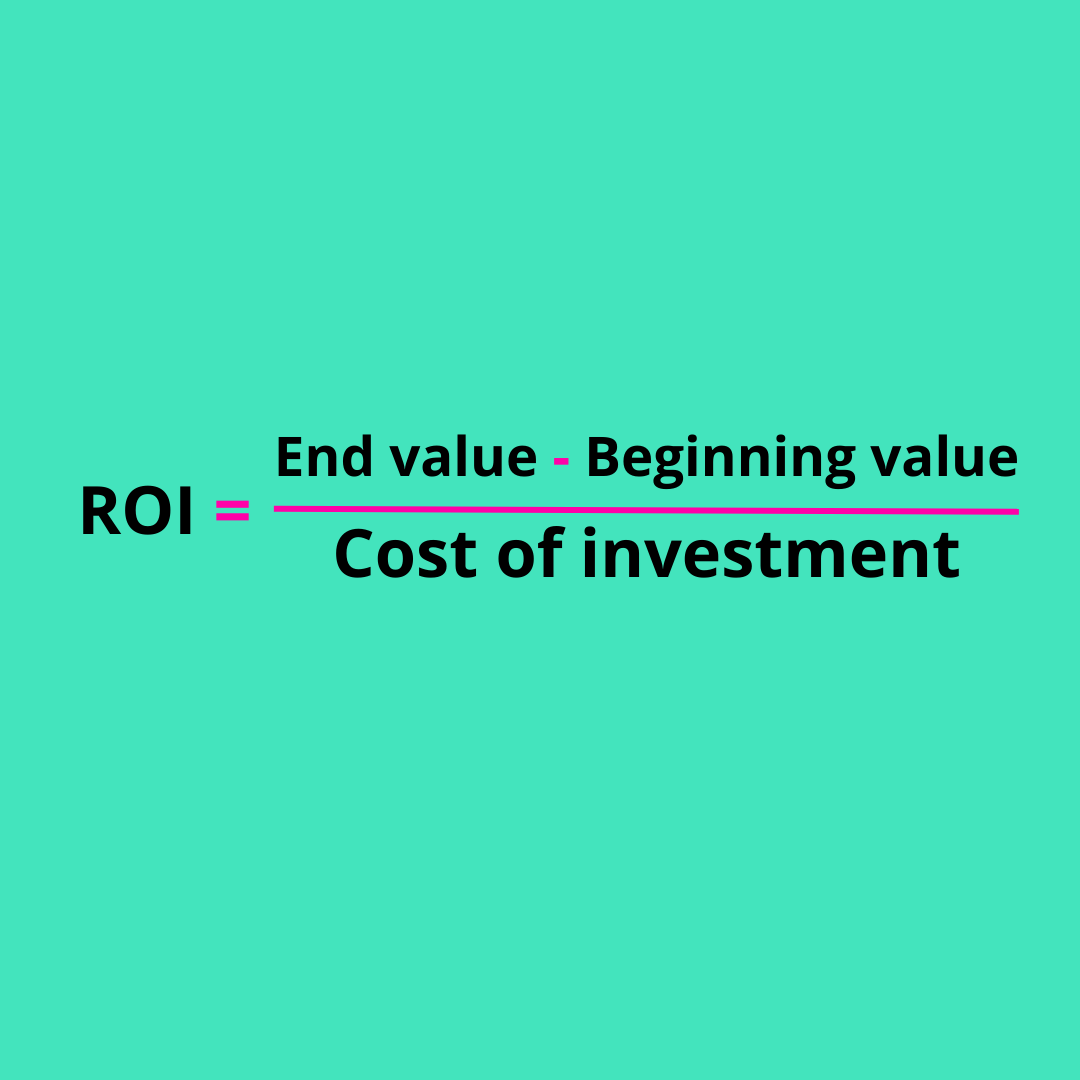

Well, first you google ROI and you get this:

Then you do this:

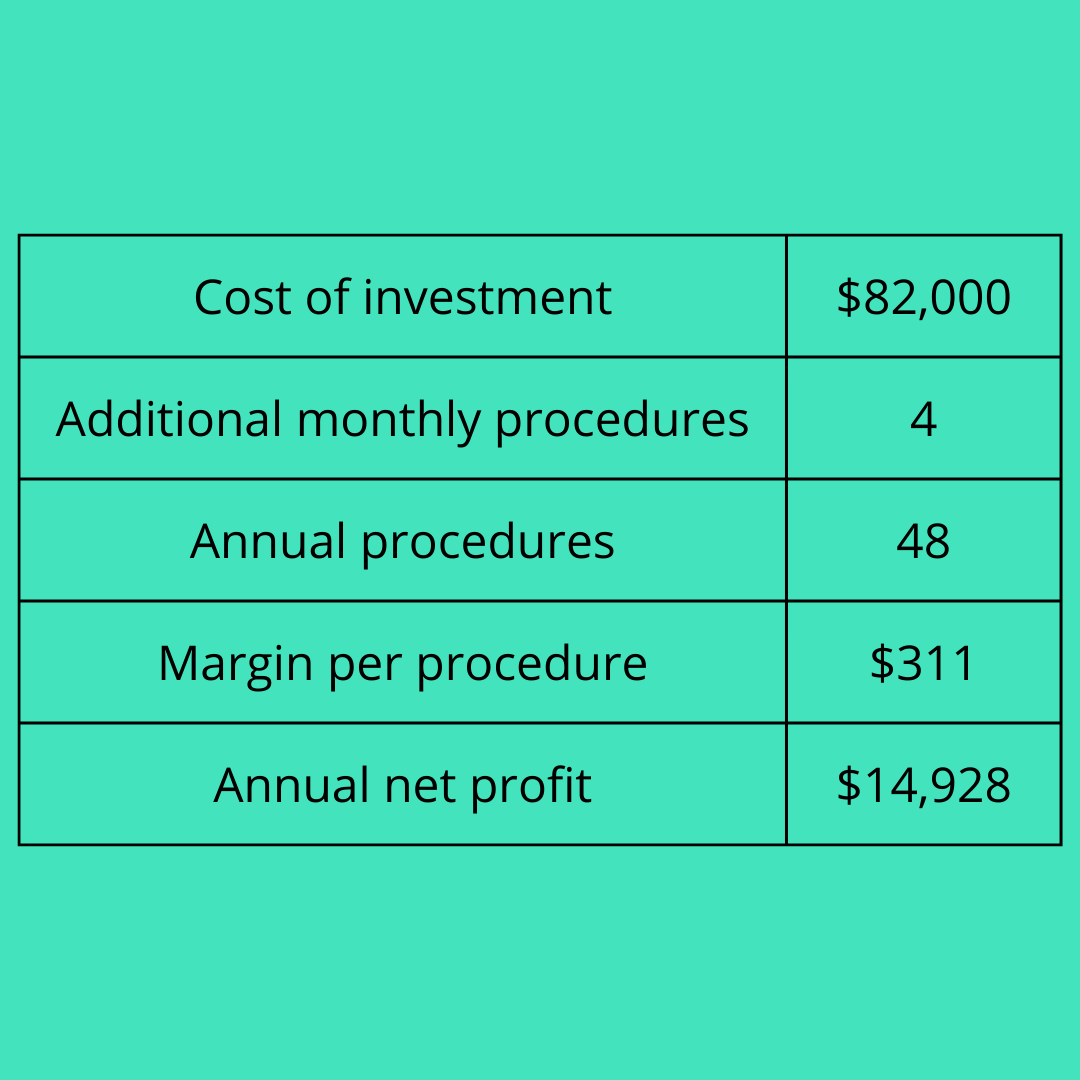

4 procedure a month is 48 per year.

48 procedures at $311 margin is $14,928 per year.

You even put it in a table:

Then, you plug and chug babay.

Yesssssssssssssssssssssss.

Score! Let’s do it right???

Right?

Well…

$15K sounds nice, but we are still out $67K.

Ok, ok, should we add depreciation to our margin then?

Sure, let’s.

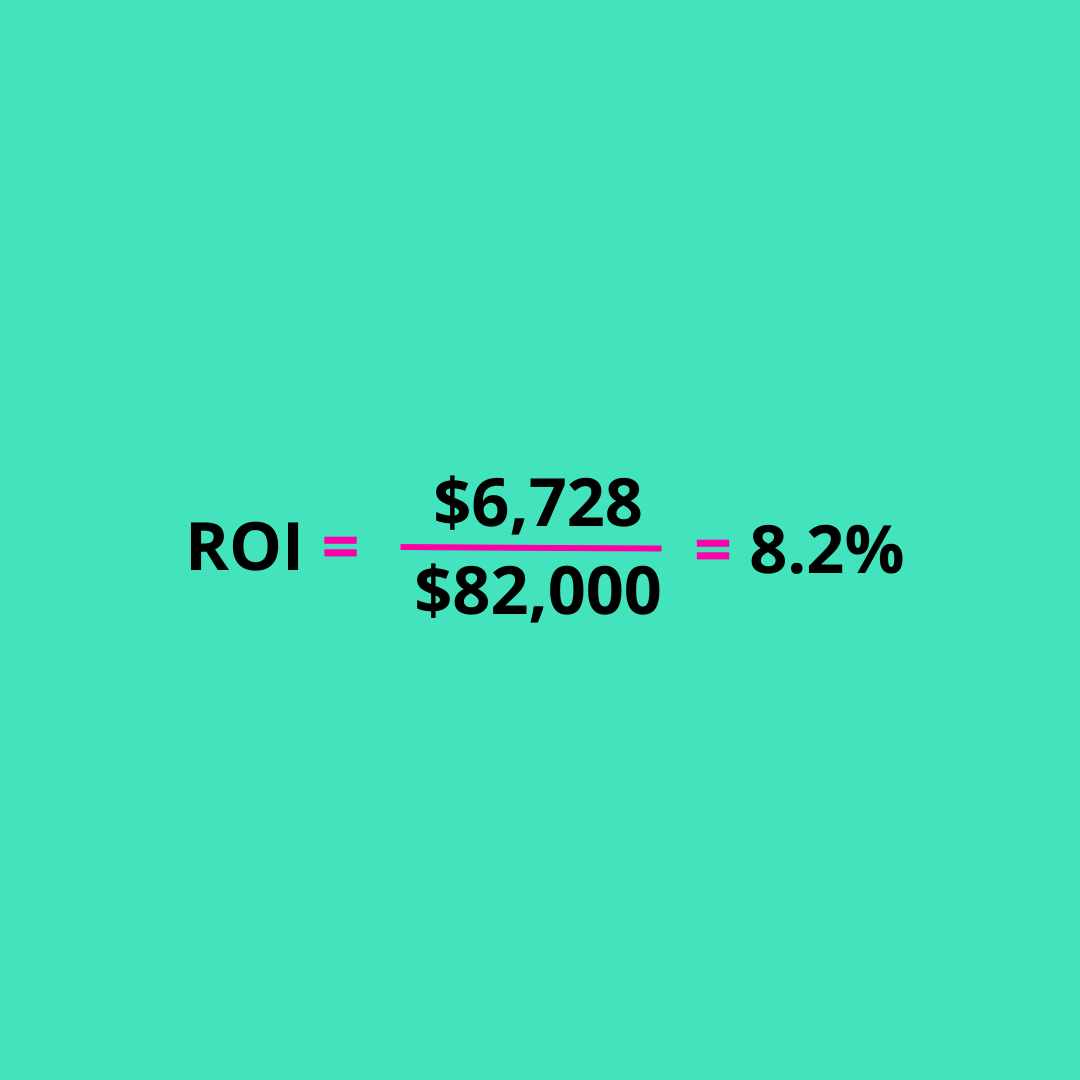

Straight line over 10 years that’s $8,200 per year, that’s a profit reduction to $6,728.

Eeek.

ROI still positive though, right?

8.2%!

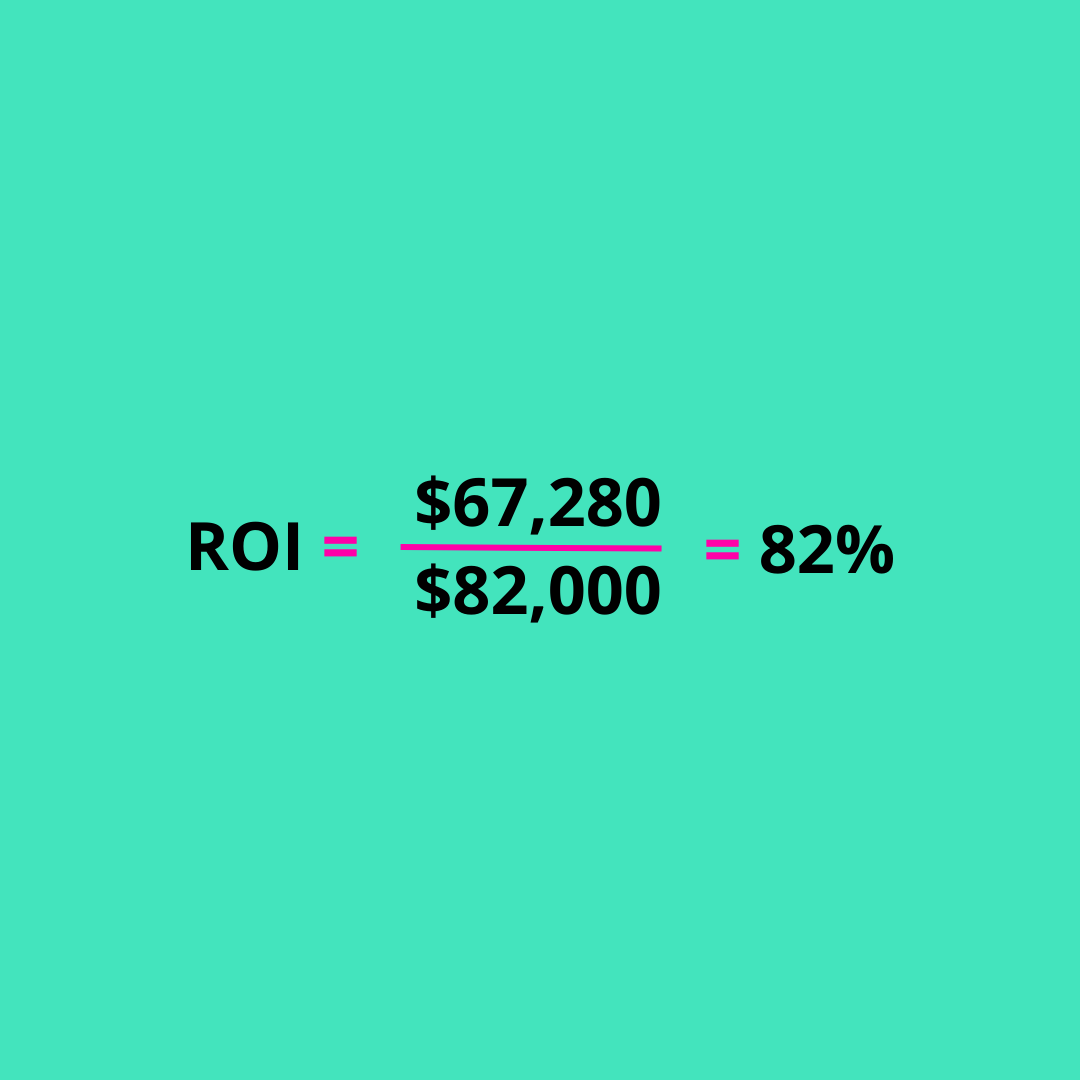

Well, I mean, we depreciated over 10 years, should we look at the 10-year ROI?

Oh, why not.

Profit added up over 10 years is $67,280.

Score.

ROI = 82%!!

Jamin!

Oh… wait, hang on.

If we had just put that $82,000 into an investment vehicle that returned 5% annually we would have $133,569.

And an ROI of 63%.

Woah, woah, woah.

More money, lower ROI???

How in the world!?!?

I think you’re probably seeing the point here.

There are a bunch of ways to calculate ROI and we used 2 and a half of them.

ROI on an investment into equipment for example is calculated by taking the net profit and dividing it by the cost of the investment. But it doesn’t take the cost of the investment into account.

We did version 1 ½ by adding depreciation expense which in theory takes the investment amount into account.

Then we looked at that same investment in a vehicle that returns 5% annually and get more money, but a lower return.

That’s because when you look at ROI on financial instruments, you only look at the gain, so the cost of the investment is take into account from the beginning.

Here’s that equation:

Since your cost is the beginning value, you’re essentially looking at a percent change.

Head spinning yet?

Good, here’s some more to consider.

We looked at the investment over 10 years. Did you account for the time value of money? Should we?

What the heck fire is time value of money???

Stop messing with me!

I know, I’m sorry. But this is what separates the yacht rockers with Patagonia vests from the rest of us.

Time value of money basically means that $100 now is worth more than $100 in the future.

Here’s a pretty salient example of time value of money:

How’s inflation been working out for you?

Another way to think about it is how else your money could be growing over that time. Like my $100 today could be invested well and make me 8% returns and then be worth $233 in 10 years.

That’s why $100 now does not equal $100 in the future.

Back to our example, $67,280 today should worth much more in the future.

In fact, we only need $31K today to be worth $67,280 in the future.

So, how in the world do we take that into account and see if this is all worth it!!??

I’m dyin over here.

There’s a little calculation you may know called internal rate of return. It takes a lot of things into account, including time value of money, and shows you an annualized return. It also takes into account the cost of the investment, which is important.

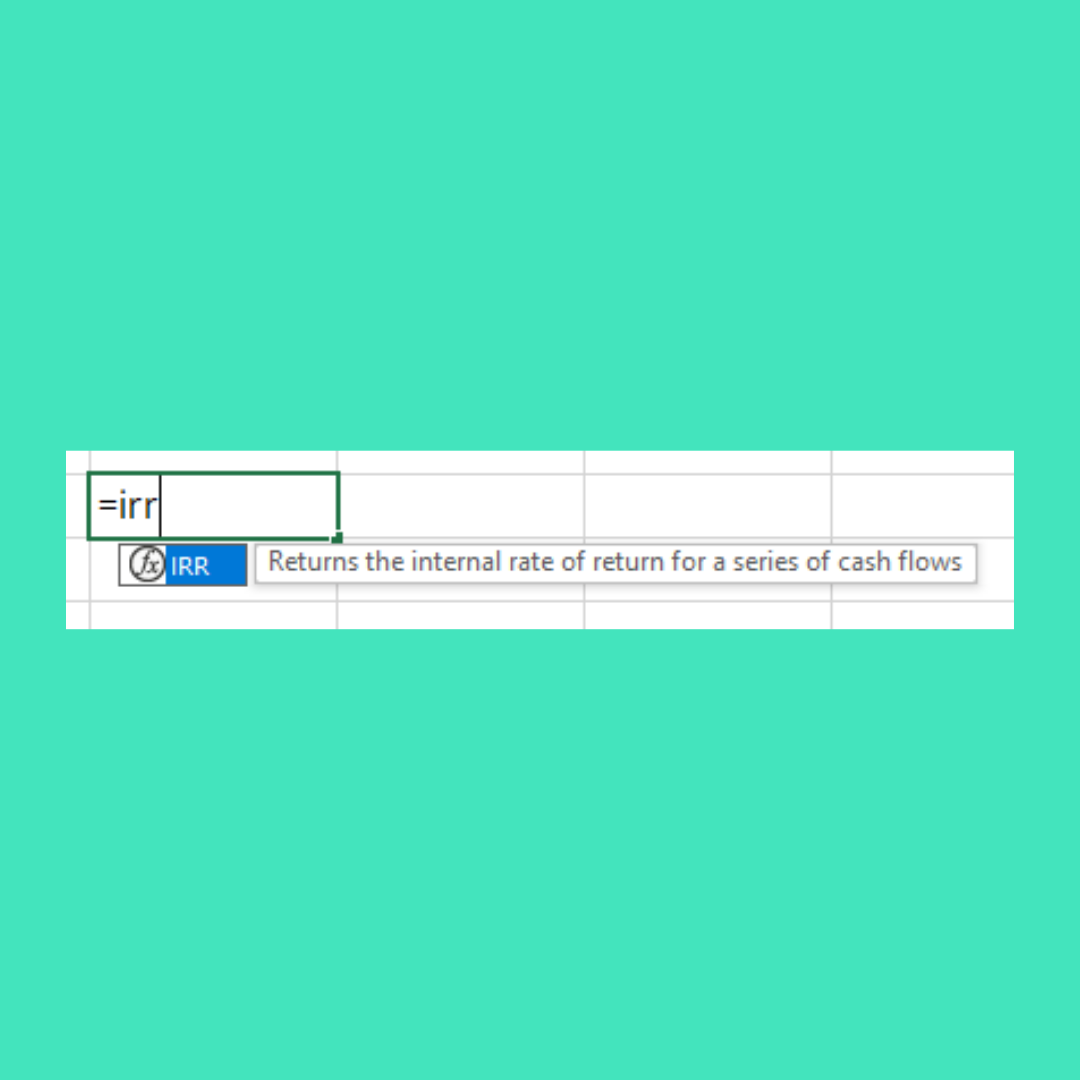

The best part is you can fire it up in excel.

Here’s the formula….

Super easy. You just need to estimate your cash flows (or margin) for each year.

Another great thing about it is they don’t have to be the same every year.

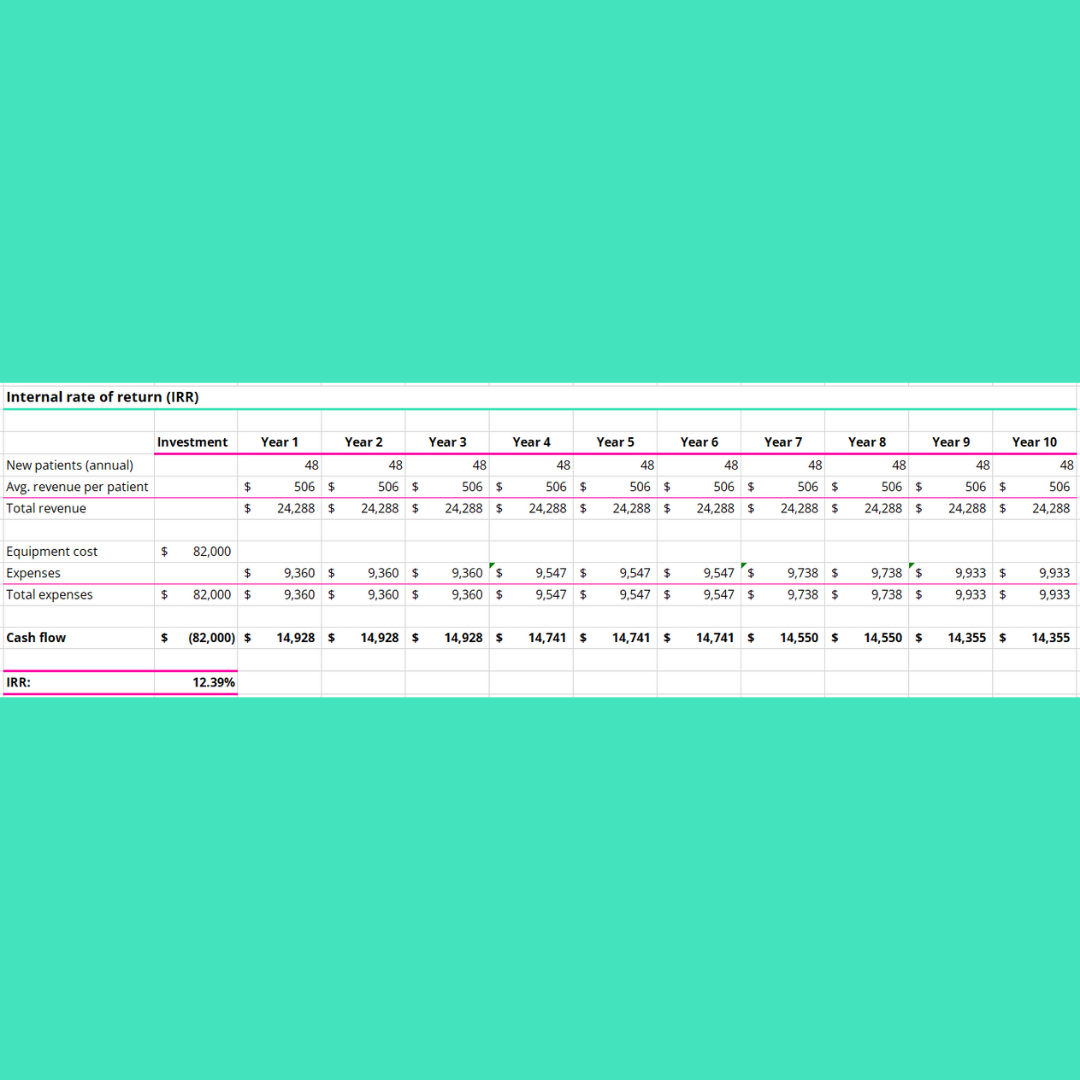

So here’s what it could look like for our above example:

P.S. I took depreciation expense out because we are accounting for the investment up front and talking about cash flow. And paper expenses don’t impact our cash flow.

Boom shacka!

12.4% IRR.

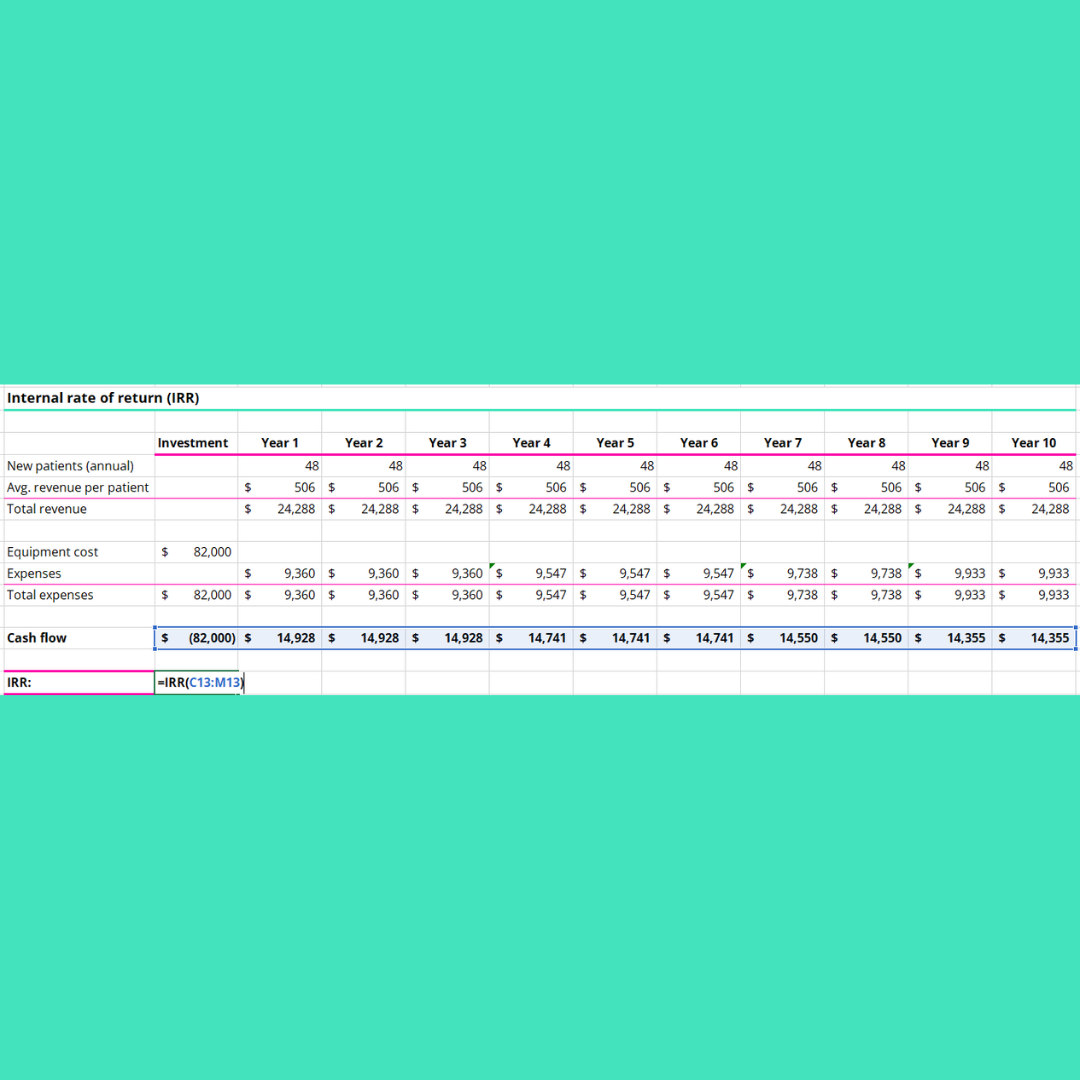

Oh, here’s what you would include in the formula:

Mmmmkayyy. So like, not even close to 82%, but we are also talking about an annualized return.

And we are taking into account time value of money. And we are taking into account change in cash flow. And we are now able to look at this as apples to apples against other investments.

Is IRR perfect? Well, no. But what is other than April 15th, when it’s not too hot and not too cold and only a light jacket is necessary?

Here’s the point for today: this is a thinking game, not a numbers game.

Here’s where you go from here and what I do when pitching returns and opportunities:

Get your expenses down pat. Nothing is worse than signing up for a number and falling short because you forgot to include training costs, down time, additional service, the new medicine man FTE to bless the equipment every day. Your profit calculations need to be tight.

Be very conservative. Underestimate the profit and overestimate the costs.

Use a more sophisticated return method. I like IRR and it’s in excel. What could go wrong?

Get more info from the finance nerds. They have secrets.

Make a nice little model and slap that sucker into your deck on why this is the best idea since sliced bread.

That’s it.

It’s not as complicated as the gurus would have you believe. Otherwise how would Harvard stay in business?

It just takes a few extra minutes of thought, some pointed questions, and a few keystrokes in excel.

Don’t fear the finance.

Well done, Preston. As you state, one’s assumptions are critical to this analysis. I can make a project look good by changing the assumptions. I can also make it look bad.

Hey man all of your articles are great but the spelling and grammar needs to be checked by somebody else. There are pesky little mistakes in almost every post. Nothing earthshattering but can get annoying to read. The content is excellent and your writing style is awesome! Thanks for writing!