The Healthcare Breakdown No. 017 - Breaking down the wild west of Adjusted EBITDA

Brought to you by Tenet Healthcare singing the Muppet Babies’, “close your eyes and make believe and you can be anywhere.”

What we’re breaking down: Adjusted EBITDA

What you’ll learn: The valueless nature of this metric (crap, did I spoil the surprise?)

Why it matters: Numbers don’t lie, unless they do. Don’t fall for the hoopla.

Read time: One and a half mimosas (4 minutes for real though)

This episode is brought to you by:

The kids will love this one.

If you are an aspiring healthcare operator, looking to transition from a clinical to a business role, or embarking down the healthcare entrepreneurial path, this course if for you!

Learn all about healthcare financials so you can read and understand what the numbers are really trying to tell you. Look at real examples and cases from healthcare companies. Build pro-formas to dazzle investors.

You won’t want to miss this cinematic event.

Check it out here: Healthcare Breakdown - The Finance Course!

I have to get something out of the way. This message is brought to you by my future legal team who would have told me to say: The following is not investment advice. I only vaguely know what I am talking about, so don’t go buying stocks based on anything you read here. Pay someone way too much money for that kind of advice so they can make lots of commissions and not beat the S&P 500 over time.

Ugh, legalese. Ok, back to our regularly scheduled programing.

If I have said it once, I’ll say it again, man I love being a turtle. Also, don’t believe everything you read.

Except this. Totally believe this.

It’s the end of the second quarter so you’ve probably come across splashy quarterly earnings headlines.

Here’s one:

Actually, you know what. You’re right. That’s super boring and not splashy at all.

Finance articles really need to step their game up.

Headlines aside, the main point of quarterly financial updates is to let investors know how things are going. Not to mention it’s required by the SEC if you are a public company.

One thing that you will almost always come across is this:

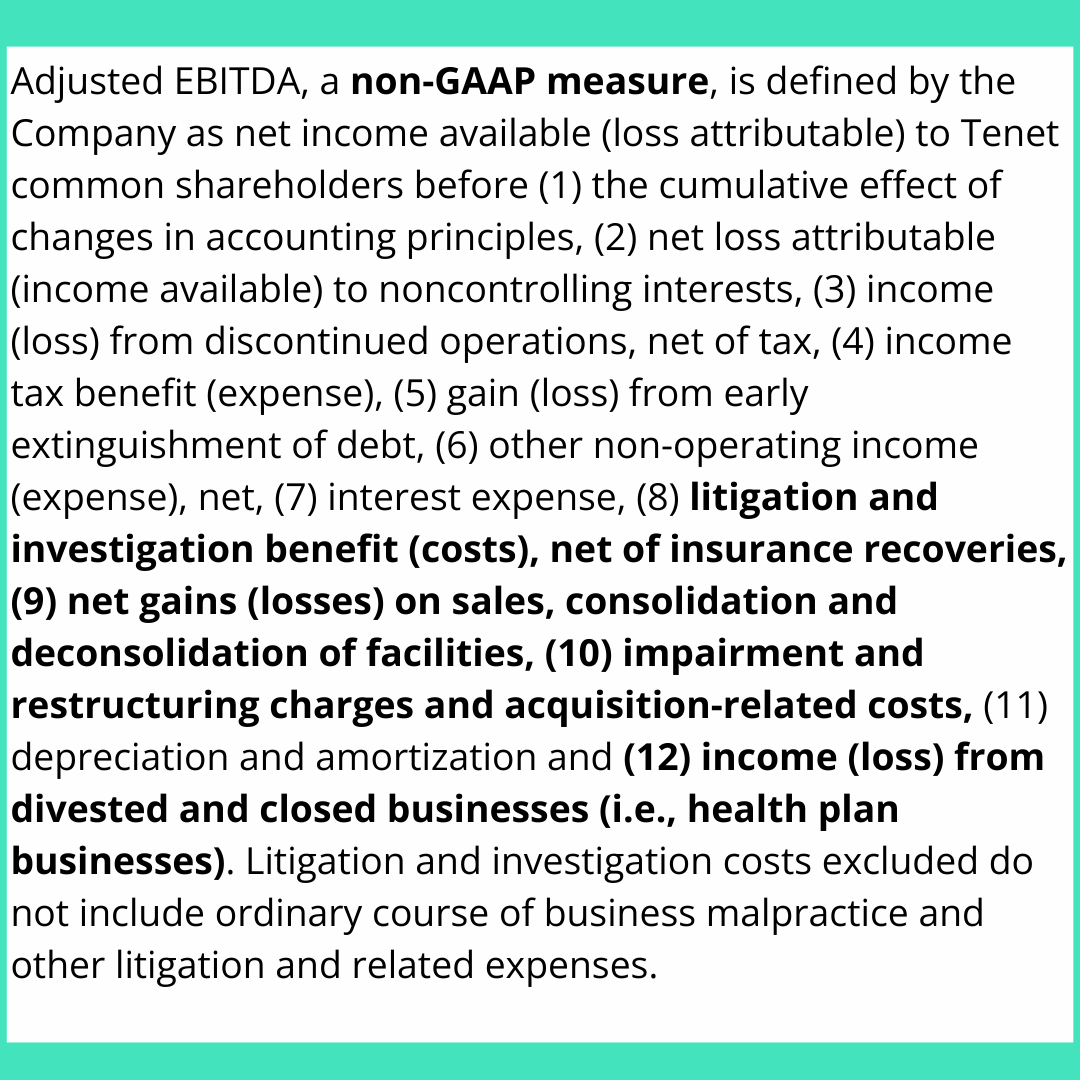

Yes, Adjusted EBITDA. The darling metric of the analyst world.

So, what is Adjusted EBITDA?

You may remember from Issue No. 003, all those eons ago, just what EBITDA is. For a refresher it’s Earnings before interest, tax, depreciation, and amortization. A quick, back of the envelope metric that can sometimes approximate cash flow.

Now, Adjusted EBITDA… that’s a whole different banana.

First, it’s a completely made up number based on what management deems to be relevant. For Tenet, here is what they consider to be Adjusted EBITDA.

Sorry for all the words. Theirs, not mine. Numbers are coming, don’t worry.

Basically, Tenet takes operating income then adds depreciation and amortization. Fair.

Then, as I have highlighted in bold, adds “non-operating” costs back in. I call these “non-operating” because apparently they are immaterial in the ongoing operations and performance of the organization.

So much so that they should be ignored when measuring performance. Kind of like when you ignore the fact that your 5-year-old magically moved 18 places ahead in Candyland to win the game, though her cards only told her to move ahead 4 spaces. No, that’s never happened to me.

Tenet has decided that litigation, losses on sales of facilities, impairment, restructuring and acquisition related costs, and losses from divested and closed businesses, don’t indicate financial performance.

My question then is, why do these things, which happen year after year, quarter after quarter, and are seemingly integral parts of the business, not count towards performance?

Like if Michael Jordan had been injured for most of his career, he wouldn’t still be the greatest basketball player of all time. Ok, ok sit down everyone over there shouting about LeBron. He’s cool too. Fine.

As I was saying. You couldn’t say, “well, he would have had the best season ever but he got hurt. Ya, I know we’ve been saying it for 19 seasons, but it really has nothing to do with underlying performance.”

Mkay.

Also, they kind of add a weird argument:

Sort of like saying, well people use and have been using it, so, I don’t know. Must be okay.

Weird flex, bro.

Sports analogies and bitter rivalries aside, here is Tenets EBITDA vs. Adjusted EBITDA in cold, hard, numeros.

As if by yacht-chartering-day-trader intervention, Tenet has surprised us all by adding $111M to its EBITDA.

Not to mention the $530M added to its operating income.

The thing is, Adjusted anything is the wild west.

There is a reason that companies are required to tell you that these are Non-GAAP, non-compliant, non-reality, non-dairy numbers.

As another example of this David Blainery, Boston Scientific has it’s own version of Adjusted EBITDA. It excludes acquisitions and divestitures, goodwill and intangible asset impairments, restructuring, and certain regulatory implementations.

Now, don’t you think that a global medical device company that is constantly restructuring, acquiring, divesting, impairing, and implementing new regulatory guidelines should look at these costs as reflections of normal business operations and performance?

Just saying.

Well, anyways, for fun here’s Boston Scientific’s swing on Adjusted EBITDA:

Oh would you look at that. A nice $758M chunk of change. +27% for the analysts out there.

Could you imagine growing real earnings by 27%?

That ain’t a thing unless you’re slingin pickle ball nets.

To conclude this romp down fantasy lane, be weary of Adjusted EBITDA. Or Adjusted Earnings. Or adjustments to your side view mirrors after your sister borrows your car. They all make you see a little less clearly.

Stay golden.

Good read on adjusted EBITDA, Preston. Always be skeptical of a metric that works in one’s favor all of the time. Do you truly believe that these companies would communicate their adjusted EBITDA if it reduced their EBITDA? Have you seen a case where one’s adjusted EBITDA is less than their non-adjusted EBITDA?