The Healthcare Breakdown No. 019 - Breaking down MedTech Part II: The mysteries of MedTech mechanics

Brought to you by my alluring alliteration abilities

What we’re breaking down: The MedTech company; from the inside

What you’ll learn: The underlying principles that drive MedTech companies

Why it matters: MedTech companies operate in a tough ecosystem, core principles are critical to understanding strategy and how it fits into the broader healthcare discussion

Read time: The amount of time it takes you to find the movie you want to watch on Netflix (12 minutes for real though)

But first! A word from our Sponsor, MedTech Militia

Just kidding, still me. But you should totally check out MedTech Militia if you wanna be a cool MedTech magician.

It’s the #1 networking channel for sales, marketing, and clinical professionals in MedTech.

Sign up to get:

Job board access

Vendor discounts

Open office hours

Weekly career workshops

Robust member directory

Curated networking events

Exclusive content and newsletters

1:1 virtual coffee chats every 2 weeks

Slack community access with moderated discussion channels

Plus, if you sign up this week, you’ll get an exclusive 30-min Zoom with the founders.

You can ask them anything. Like, “Hey Greg, if you were to sail across the Atlantic, what swim trunks would you recommend?”

Or, “Hey Beau, what’s your real first name?”

Just some thoughts.

Check it out here: medtechmilitia.com

See you out there!

Back to the show.

If you missed it, check out Part I of the Medtech breakdown. To understand the game, you need to know the players.

Plus, it’s hilarious.

For this episode we are looking under the hood of the MedTech company.

As a reminder and caveat the term MedTech covers all manner of sin. This is a general look, so it may not apply 32,000% to every company. But like 17,000%.

Also, in case you need to see my drivers license, I was a product manager at Global MedTech companies responsible for $100M in portfolios. I got you boo.

You may be thinking this is going to be super complicated. A lot of strategy talk, the nuances of product development, go-to-market musings, the critical nature of clinical champions, yada, yada, yada, but you’d be wrong.

Because as you know, I am a simple fellow.

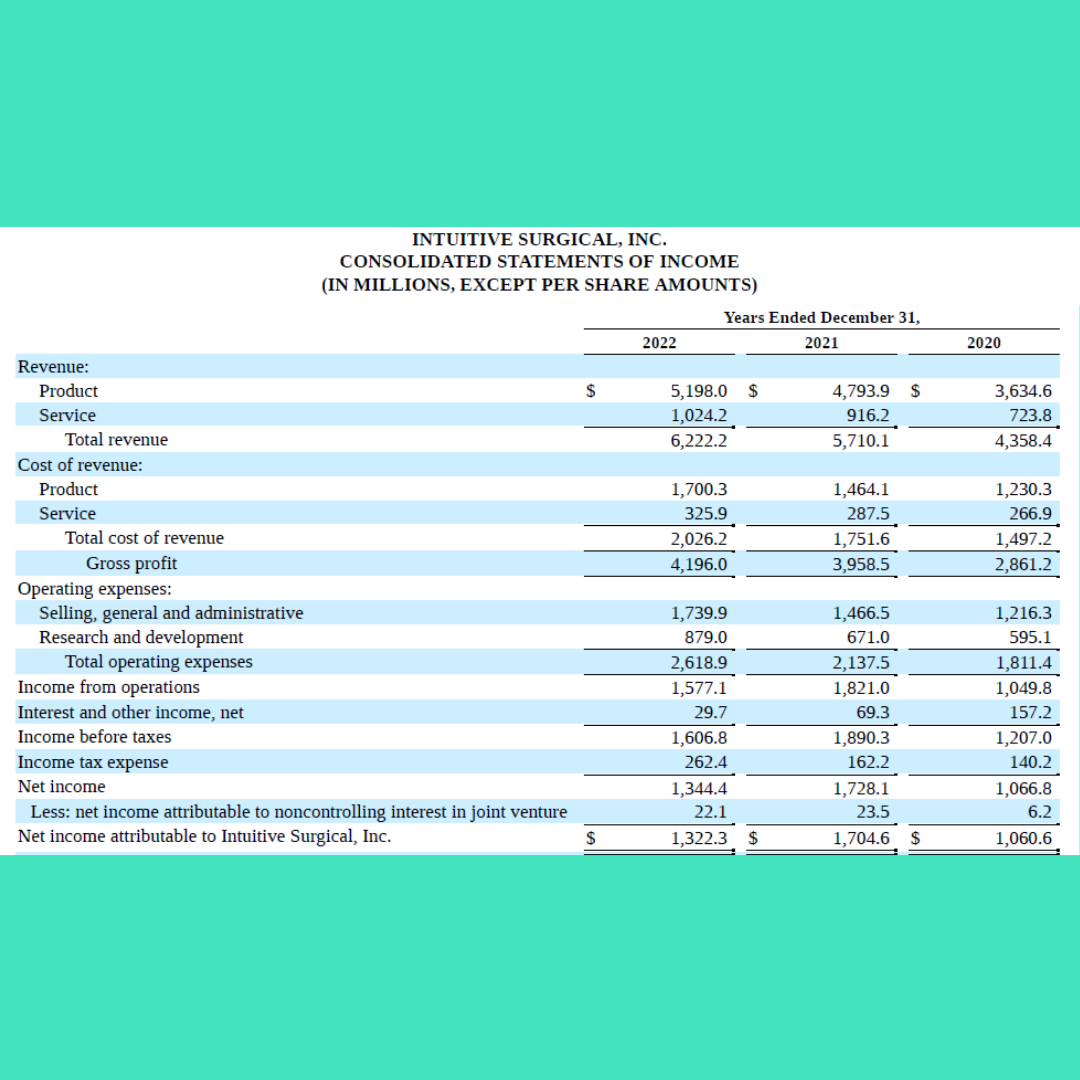

Simple like Intuitive Surgical’s P&L:

You would think that a Global, $6.2B company needs a lot of complication, but in essence it doesn’t.

It makes a product (costs).

Sells it (sales + marketing).

Profits (margin – expenses).

That’s why it really comes down to 3 numbers that are critical in MedTech.

Gross Margin

Sales costs

Fees

1. Gross Margin

Here’s Intuitive’s:

67.4%, solid. There are some devices out there with even higher margins.

Why is margin so important? Why am I about to spend way too long talking about it?

3 reasons.

First, it’s the money from which all other things are paid. You can have a balance between margin and volume (think syringes), but margin will always be a critical piece of that equation.

Second, the point of MedTech companies is to profit. Yes, we have departed from the world of purported altruism in non-profit land. MedTech companies help people, but are in business to be in business. That means profit. Controlling costs is hard. Being super efficient is hard. With higher margins, profit comes more easily.

Third, in the scope of healthcare in the United States, things aren’t getting any cheaper. When the goal is margin improvement, as it will always be, what happens to the overall costs? Yup, up.

Now that we know it’s important, how do we maximize it?

There are 2 levers in margin.

Price and cost.

That’s it. I wish it were more complicated than that because then I might be able to be a consultant and charge like $800 a second, but I won’t, because it isn’t.

To that end, to improve margin you can raise prices or lower costs. Duh.

Here’s how you lower costs:

Order higher volumes from suppliers

Get a new supplier that can provide the same quality for less

Move manufacturing locations to save on shipping costs and overhead

Re-engineer products for cost savings by reducing manufacturing complexity or introducing lower cost materials

Improve manufacturing processes and efficiency

Find alternate suppliers for raw materials because your manufacturer is using materials that cost too much and sucks at sourcing (no, this has never happened to me)

This list goes on.

The point? It’s friggin hard to lower costs. And each one of these things costs money to do. And time. And has risk.

For example, you want to improve margin 5%. It just so happens that your manufacturer has a 5% price break with 10K more units ordered.

Cool! Well, first of all you are going to spend more net. Does the demand justify the increase? Can you generate demand to meet the increase? Can you hold inventory for longer during a ramp phase?

Not so simple.

On the other hand, here’s how you raise prices:

Raise the price

I mean, you’ll probably need to send a letter or something, but generally that’s it.

And you know what’s really great, everyone is used to having prices go up, so passing on price increases isn’t so hard to do.

Now, there is another side of that. My revenue is someone else’s cost. When you are in the midst of new contract negotiations with an IDN (Integrated Delivery Network) or a GPO (Group Purchasing Organization), it’s a different game. You have to have something of value to increase the price.

Remember, the overarching goal is margin improvement on each product. That means commanding price premiums. You do that a couple of ways.

Here’s the most popular two:

New or “better” product.

Clinical support or “value-add” services.

Here’s what each looks like:

Better product: This is your old product, but it’s quieter, has new colors, looks more modern, has easier to press buttons, addresses some ancillary customer requests for new features, and costs 10% more. 30% if you are a small account.

Value-add: Our reps do a lot of work for you. They are in cases, they help with your efficiency, utilization, and do consultative selling. We also have ex-clinicians that help your clinicians use more of our products. So it’s totally fine that we charge 20% more.

Higher price. Higher margin.

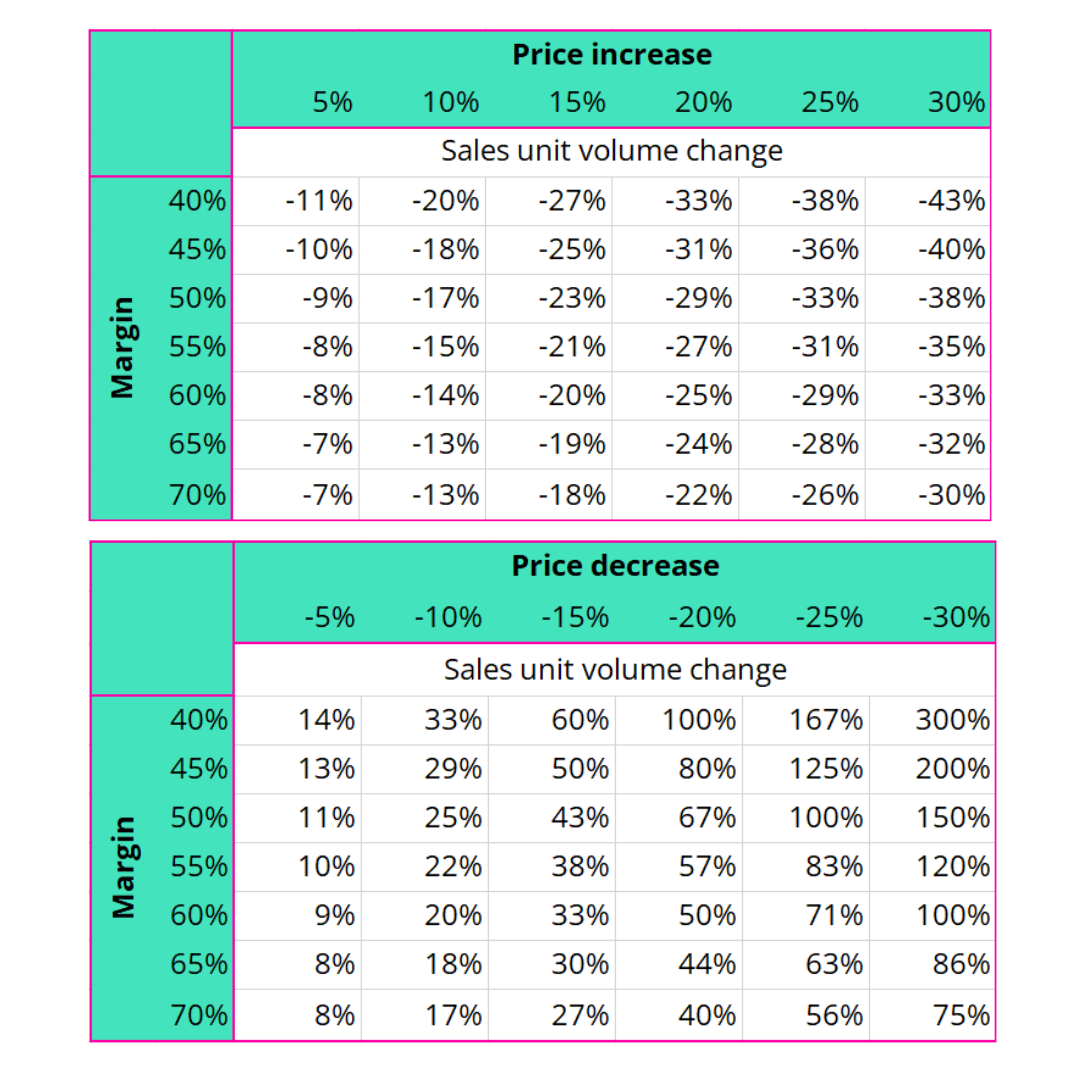

In fact, check out this really simple illustration on the power of pricing:

If I increase my price by 10% at a 40% margin, then I can sell 20% LESS units and still make the same amount of net dollars from total sales.

Conversely, if my price DECREASES by 10% at a 40% margin, I have to INCREASE sales by 33%!

The point is that price changes have a disproportionate impact on volume.

If you want to get really crazy, a 30% decrease in price requires a 300% increase in volume to make up the net sales. Tell that to your sales team after a poor contract negotiation.

Here, I made a chart:

To beat a dead horse, lowering cost is hard and making up volume on price erosion is super hard!

Now, if you can increase price, keep costs constant, and not lose sales, well then, welcome to your new position as COO.

Since you understand from Part I: The Playas, you also know that MedTech is always getting downward pricing pressure from the big dawgs. GPOs, IDNs, Distributors too.

That’s why in addition to “new” product introduction, portfolio diversification is also important. No, not like what your financial planner tries to confuse you with in order to sell you some junk bonds so he can turn a nickel.

The MedTech portfolio is going to be comprised of products with different margins. Customers will always vary in size, needs, and price sensitivity. While you want to always move to higher margin, you can have some less expensive stuff for the more price sensitive.

Just remember, you will have to make up for it in volume.

This also leads to different pricing strategies within the portfolio and among customers/contracts.

Here’s one example.

Say you have a large IDN putting a lot of pressure on you because Janice wants her year end bonus but needs to cut 7% of her spend in some category. Well good on you for being a big, diversified Medtronic. You happily agree to drop the price on the category she needs. You also (randomly) let her know, there is going to be an increase in price in another category. Don’t worry though, it’s not 7%, Janice still gets her net savings and hits the category target.

She’s delighted. And in 2 months you’ll send her a notice that the product she just got a 7% reduction on is being discontinued and the new product will be available at a 20% increase.

But it’s totally worth it because all the value add services plus doctors really like the digital readout on this one. Also, they just renewed their system wide contract with you as the sole supplier in this category.

Woohoo, good times.

I will go deeper into how the ecosystem works together in Part III. You won’t want to miss it!

Alright, I will stop rambling about margin.

The take away here is that gross margin is the mac daddy in this industry. The progenitor. The reason d’etre. The piece de resistance. The holy grail. The thing that funds your paycheck.

Let’s move on, finally!

2. Sales

I love my sales homies. As a product manager we might have made things we thought customers wanted, but the sales peeps drove the margin we so diligently protected to keep the gravy train going.

And management knows this. That’s why if you look at the breakdown on a P&L, sales is going to be the highest cost to the business.

At a large company, the sales team gets a car, phone, computer, iPad, gas, a base salary, plus (often) uncapped commission.

Why? Because they make it rain.

Why else? Because the margins are sweet. Just another reason to protect those margins.

Because the sales team drives the revenue and thusly the margin, all focus goes there. We have national sales meetings. They go to trade shows. There’s sales training, quarterly sales calls, check-ins, sales enablement tools, really awesome polo shirts and starter jackets. Sometimes a fancy Tumi wallet.

There’s diamond clubs and presidents clubs and super double secret clubs where the top sales dogs head to the Bahamas with their significant others for several days to see how many orders of pool side French fries they can take down while sipping Mai Tais.

And all of this is by design.

One, sales in MedTech is hard. It really is. Rockstar sales folks earn every cent, every trip, every lime green polo.

Two, they, like I’ve said too many times, are the primary revenue driver in MedTech.

To that end, the company focuses much of its time and investments to ensure the sales team is firing on all cylinders. Strategies are developed, regions realigned, people promoted, invested in, groomed, etc.

Ok, marketing, calm down. You know I love you. Just looking at this from a spend perspective, the budgets aren’t close. It’s a 7 person marketing team versus a 192 person sales team.

Sales is where it’s at.

P.S. there is a huge opportunity for MedTech marketing to get much better. By and large it sucks. The little money they do spend is mostly wasted. Just because that one old surgeon bought new retractors from the magazine ad he read, does not mean you should spend $78,000 in magazine ad spend next year. Please, like, stop the madness.

I digress.

3. Fees!

Welcome to the please god wrap this up section.

This one is relatively quick and, as you guessed has a lot to do with… drumroll….pricing and margin!

As you know from Part I, fees come into play a lot. From GPOs, from distributors, and yes from IDNs. I am including rebates here.

A perennial favorite, a rebate is a way for you to look good to your boss because price at the pump is high, you just send a “compliance” check at the end of the quarter. Helps cash flows too.

Nonetheless, fees are all over the place. What do we dutifully do as the keepers of sacred margin in marketing and finance? We fold those suckers right back into the price.

When contracts are coming up, the fun really starts. Even better if it coincides with strategic planning. You know that we’re always thinking of bundles and line extensions/new products to raise prices. You don’t know that we already do and will account for fees in our planning.

For example, if I am planning to introduce a new product, I know it will be on a GPO. They want 2% of your sales through them. Pay to play baby. Great, guess where my starting price is? Yes ma’am, 2% higher than it would have been.

All day, everyday.

Sure, we look at fees relative to profit margin of the overall business, but remember, the biggest lever is the price. The easiest one too. And it’s all accounted for.

Just like cost reduction, lowering fees is hard. It takes buying power, great negotiation, a little bit of gentle threats (the business kind of course), and usually some good fortune.

The hardest part is when contract negotiation comes around. Just like we want all our suppliers to lower costs, our customers also want lower costs. But their cost is our revenue. And we want that to go up. So, you have to start ahead, knowing price pressures will continue. Naturally you account for the fees ahead of time.

Call it cost of doing business.

Fees are also going to shift and drive who MedTech companies work with and how they work with the fee mongers. Can’t come to terms with a GPO over fees and kick-backs, excuse me rebates? Well, drop the contract, go to the big IDNs for direct contracts, raise prices for all the small members, leave the fee mark-ups in, invest in the sales team to mobilize around contract protection.

So while it may seem ancillary, it can dictate a lot of strategy.

WaaaaaaaayTL;DR

(1) Gross margin is king, or queen, or non-binary overlord

(2) Sales drives revenue and the company is designed around enabling that engine

(3) Fees are lame, but they’re already planned for, the customer pays them

Ok, I hope that was a helpful look into the inner ear of the MedTech machine.

Don’t forget to tune in next week for the conclusion and Part III: Can’t we all just get along? I’ll show you the big picture and how it’s all connected.

Peace out girl scout.

I'd be interested in a breakdown of the major job boards in this space like indeed, wanderly, vivian, vetted, fusion, etc.

Please breakdown how a COO of a (lets start small) rural hospital thinks about the COST of the nurses in two wards: ER and 1 med surg. Since we know they are rolled into the room cost.