The Healthcare Breakdown No. 021 - Breaking down the Private Equity party in healthcare

Brought to you by Patagonia: fleece sweater vesting finance bros since the 90s

What we’re breaking down: Private equity

What you’ll learn: What it is, why it is, and how it works

Why it matters: Private equity has charged into healthcare and isn’t slowing down, impacting patients and clinician alike

Read time: As many times as you fall asleep trying to look smart reading Financial Times (7 minutes for real though)

Private equity!! He said in a loud and booming voice.

Sorry, I’m weird.

Today we are going to talk all about private equity, the new player on the scene in healthcare. After today you’ll have a better understanding of what it is, how it works, and draw your own conclusions as to whether or not it’s a good thing.

A word from our sponosor!

It’s me, I’m the sponsor…

This week’s Breakdown is brought to you (for real) by Healthcare Breakdown – The Finance Course! (booming voice again).

I would say it’s at least as much fun as a flame thrower.

If you are a clinician looking to sharpen your finance skills, want to head over to the leaders’ table, or build something of your own, this has got your name all over it.

Learn all about healthcare financials so you can read and understand what the numbers are really trying to tell you. Look at real examples and cases from healthcare companies. Build pro-formas to dazzle investors. Become a wizard at financial management and operations.

It’s a party. For. Real.

Just like the private equity party in healthcare, only you can use your new powers for good.

You can get all the fun here: Healthcare Breakdown - The Finance Course!

Back to the show!

Here’s how this is gonna go:

What is private equity

How does it work

Why does it love it some healthcare

1. What is private equity

I’ll keep this one short. Private equity is a group of people who raise a bunch of money and buy private businesses. It’s a way for investors to invest in private companies, expecting returns they otherwise couldn’t get in the stock market.

Imagine you have like $40M and you want to invest some of it but the old S&P workhorse just doesn’t do it for you anymore. So you meet a slick 30 something who’s dad set him up with his own private equity fund and all the fleece vests he could ever want.

He tells you that he can get 12%+ returns through his new $500M fund that he’s raising. He focuses on healthcare, buying practices and selling them in 3-5 years. And brother, business is a boomin.

So you and 27 of your closest friends plus a number of pension funds throw in and he raises $500M. He starts buying companies, increasing their value, and then selling them in the time frame promised.

Boom. A bunch of besties, pooling money and buying companies. That’s really what it boils down to.

Fine, maybe there’s a little more to it or they wouldn’t be able to afford all the sweater vests. Here’s some more of it.

2. How the game works

Sub-part: the structure of a private equity fund. This part has pictures, yessssssssssss.

Funds are setup like this: A General Partner (GP) goes out in his awesome vest and raises money from Limited Partners (LPs). The GP is the front man, makes the decisions, buys the businesses, and does all the fancy stuff to make lots of money for himself and his investors.

It looks like this:

All the lines are money lines. Not unlike the 80’s in your favorite stock broker’s private room at da club. The main difference is the lines were white then, not hot pink.

When this stately fellow is done raising his fund, he goes out and buys businesses using all that scratch.

Sub-part: how the money flows. More pictures!

The GP makes money on fees and performance. The most common structure is called 2 and 20.

This kindly lad charges 2% on all the money that gets deployed by the fund. So if he has a $500M fund and has bought $372M worth of companies for the portfolio, he’s making a meager $7.4M. Poor guy.

When he sells one of the fund’s businesses or exits it by going public, the LPs get their principle back plus 80% of the returns (the extra money the business was sold for). Young Beckham gets 20%. He’ll also get his principle back if he invested.

Arrows!

That’s the fund structure. Now, how are these gracious gallants buying these businesses?

Debt, baby!!

Sub-part: how businesses are bought, the debt jams. Also, pictures.

I shared recently that HCA was bought by private equity in 2006 and then taken back public in 2011. It demonstrates on a large scale how this works.

Here are the high level deets:

HCA was bought for $21B.

The private equity gentleman borrowed $16.8B (debt).

They invested $4.2B of their own money from the fund.

They owned it for 5 years.

During that time they distributed $4.3B in dividends.

They decided to exit by going public again in 2011 and raised $3.8B in the IPO.

Investors made $1B through the IPO.

They kept equity stake in the company worth $11B.

So basically they invested $4.2B and earned cumulative returns of $16.3B (dividends + sale profit + current equity).

Not a bad slice of pie.

I made another picture:

Now look at HCA’s debt today:

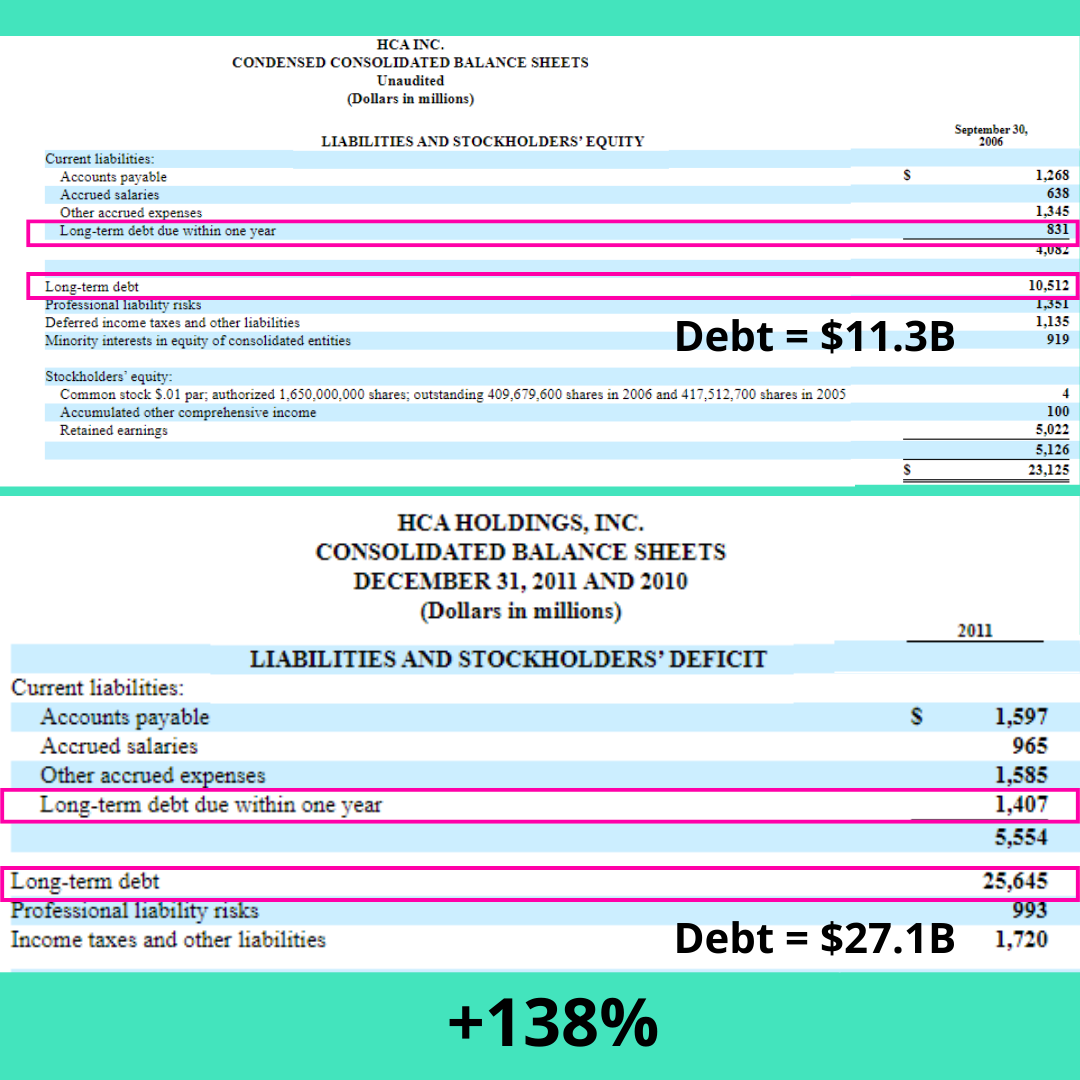

And here’s what that debt was in 2006 before the private equity saddle and after it went back public in 2011.

That’s quite the debt increase.

And in the Private Equity world, the company holds the debt. That’s the best part.

Another way to think about it is sort of like buying a house and flipping it. Basically you can learn everything about private equity by following those guys on Instagram who boast about how much debt they have in their rental portfolios and using OPM (Other People’s Money).

You put down 20% of your cash and then get a loan for the other 80%. The house is collateral.

For a company, you put down 20% of your cash and get a loan for the other 80%. The magic here is that the 80% goes on the company’s books. The business is on the hook for the debt, not you. And in theory, operations covers the debt. Just like your renters cover your mortgage.

Then you increase the value of the company and sell it in a couple of years. While in the house example you would need to pay off the debt from the sales money, in Private Equity world, you don’t. You leave the debt behind for the business to take care of over the next 30 years or so.

Winner, winner, chicken dinner.

See the game? No wonder Beckett just bought that chalet in Big Sky.

3. Why does Private Equity love it some healthcare?

I think you know. We all know. It’s a $4.3T opportunity for cryin out loud.

In the business world, in the investment world, that number is not something to be lowered. That’s market size. That’s opportunity to make a ton of money.

It also has incredibly inelastic demand. Meaning, you will do and pay anything when it comes to your health. Sure, you can skip that new Tesla that just came out, but there is no way you’re skipping that ambulance ride and bypass after you just had a massive heart attack.

We’re stuck.

The goal of private equity is simple, deliver outsized returns that investors otherwise would not have access to in public markets.

Healthcare is a great vehicle to deliver those returns, because there is so much money in it. There are a few other reasons, which we will get into another time. I guess you’ll just have to come back!

That’s private equity in a nutshell and why healthcare is so dang attractive.

It’s a way for investors to invest in private companies and theoretically, get returns they otherwise could not in public markets like that dreary old S&P 500. What does Warren Buffett know anyways?

Until next time, stay golden. Like Barron’s yacht toilet.

Great breakdown, Preston — would love to hear your thoughts on what flags a GP for viable companies to add to their portfolio. Stage, $$, size, market potential, etc.