The Healthcare Breakdown No. 026 - Breaking down Healthcare Systems' move from hospital to financial firm

Brought to you by House of Cards

What we’re breaking down: Health systems’ investment focus

Why it matters: Investment losses need to be made up, that can mean cutting expenses, like nurses…

Read time: Your average beginner meditation session (4 minutes for real though)

I spent a day last week doing something pretty cool. And while I did spend one of my days cooking vegan side dishes and gluten free dessert, it wasn’t that.

I had the privilege to speak to a group of clinical leaders about finance and do a live-action breakdown. The thing that occurred to me as I was presenting is a key element of any multi-unit business.

That is, when one unit is lagging, the other units pick up the slack. That slack comes in a few forms, but ultimately the goal is to preserve or bolster the bottom line.

Like when your fantasy football quarterback is playing the Steelers and only needs to put up 12 points to win, but can’t get it done, so you rely on your tight end (good luck) to pick up the slack and make up for the deficit.

Sorry for the football analogy. When the Falcons start losing every game in the fourth quarter by 3 points and I lose interest, I promise I’ll think of better ones.

Business is basically a game of fantasy football, without the beer. Well, sometimes there’s beer.

Interruption! Healthcare needs a revolution. It needs you. Don’t let numbers and finance be the thing that stops you.

Healthcare Breakdown - The Finance Course! will show you how to read and understand financials like a pro, build financial models, and go toe-to-toe with any CFO.

In an afternoon.

There’s templates, jokes, and all kinds of good stuff in there.

Stop avoiding finance. It’s cool.

There’s a button too.

The reality of the modern, large, vertically integrated, multi-state health system, is that they spend as much, if not more, time, money, energy, and focus on investments and financial management as they do on patient care.

Holy run-on sentence Batman, that’s a lot of dedication.

The point is, health systems’ business is more than patient care.

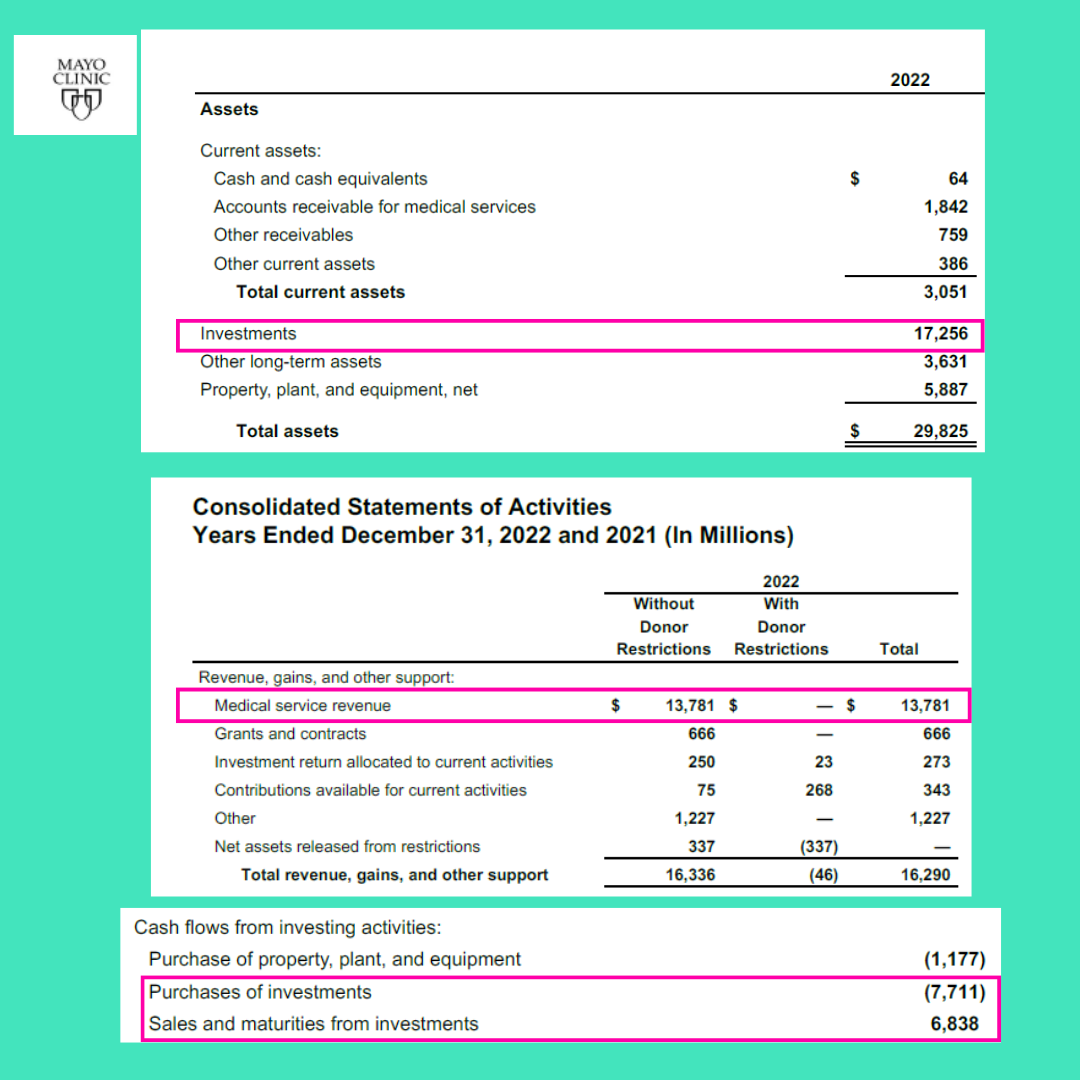

And since a picture is worth a thousands words… or in this case 1,012 words since there are also words in this picture…

Also just words to summarize:

$17.3B investments

$13.7B patient revenue

$14.5B investment transactions

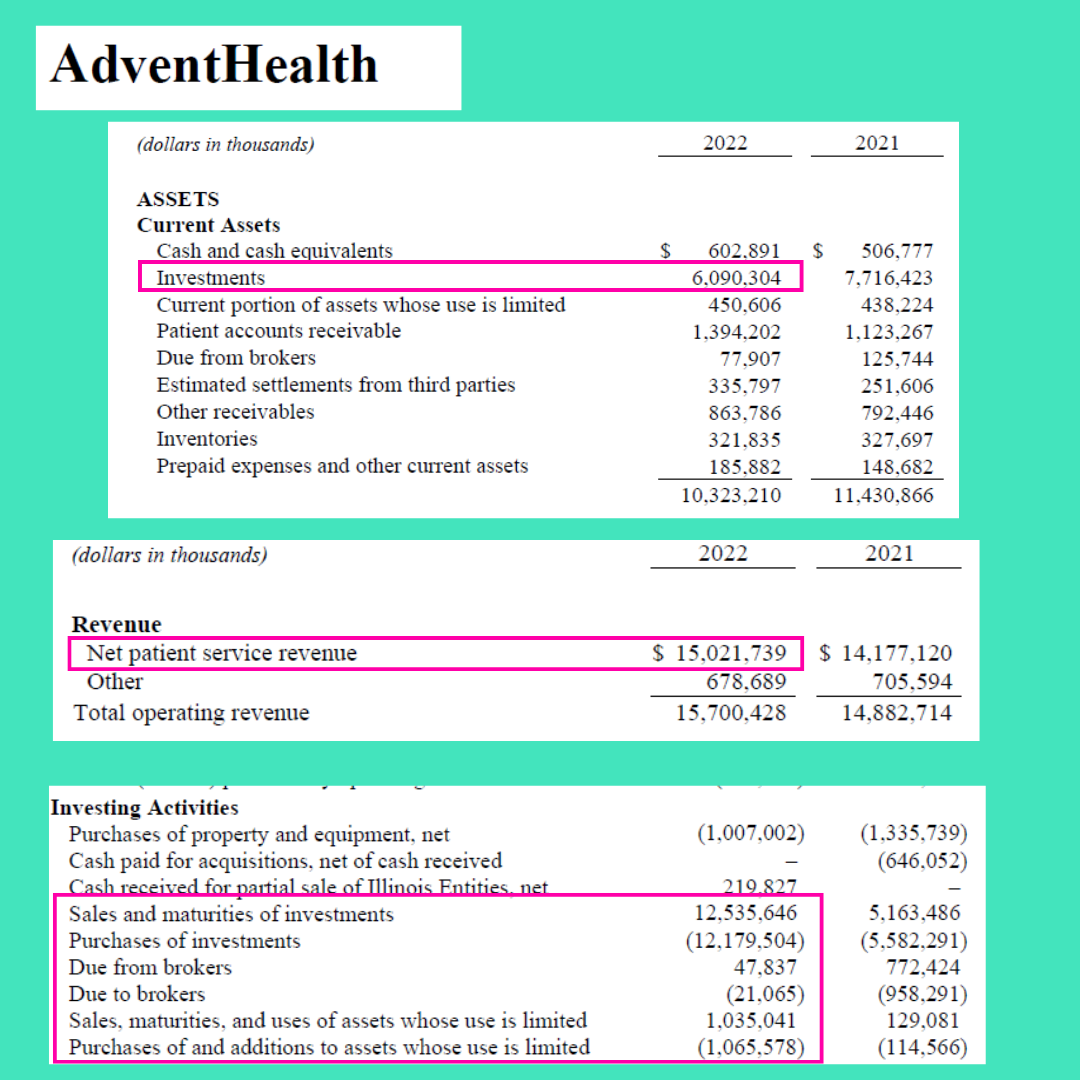

Mayonnaise isn’t the only one…

I did the math:

$6B investments

$15B patient revenue

$26.8B investment transactions

I could go on, but there’s a challah that needs baking today.

Looking at the revenue they generate, versus the investments they make, it’s clear where a lot of the focus is going.

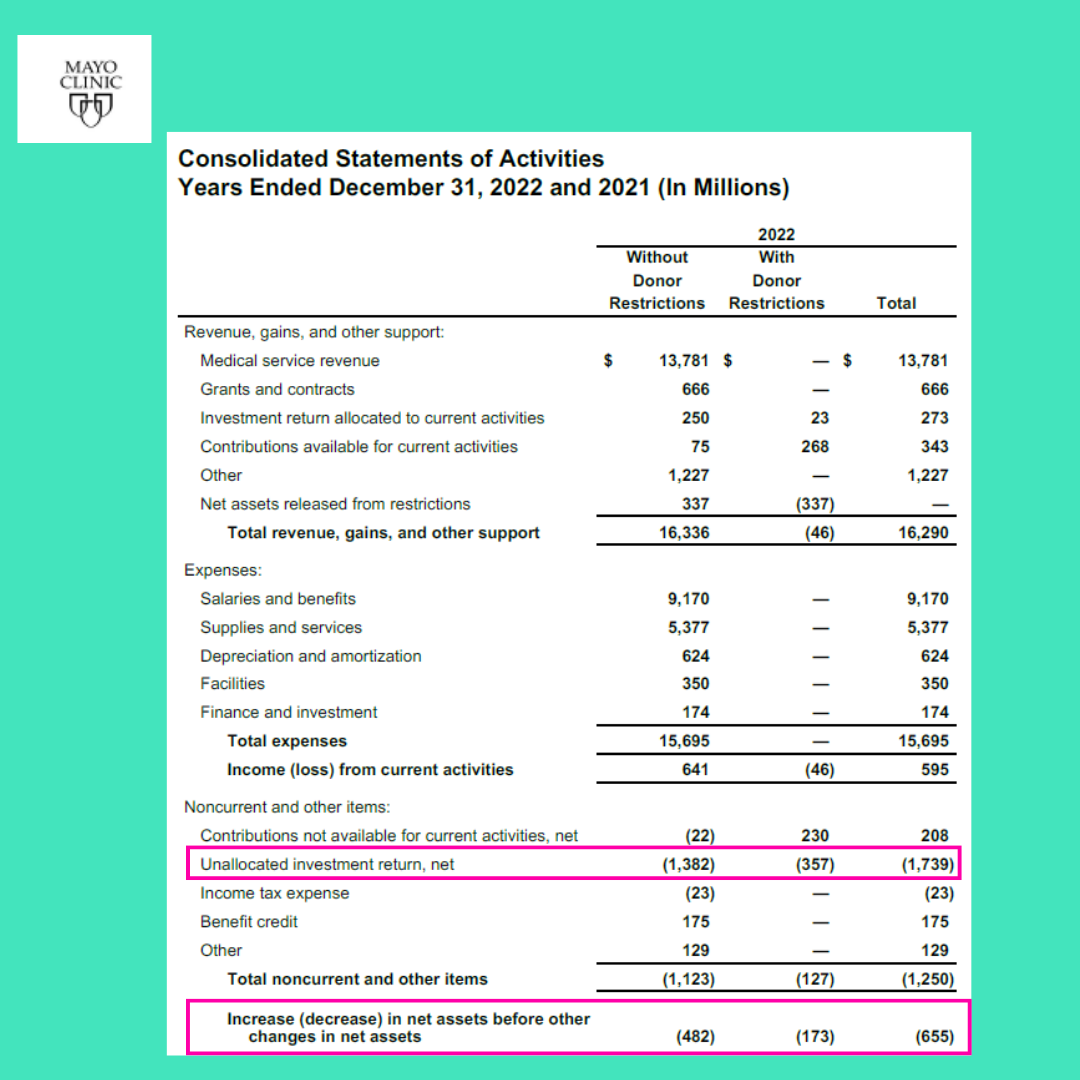

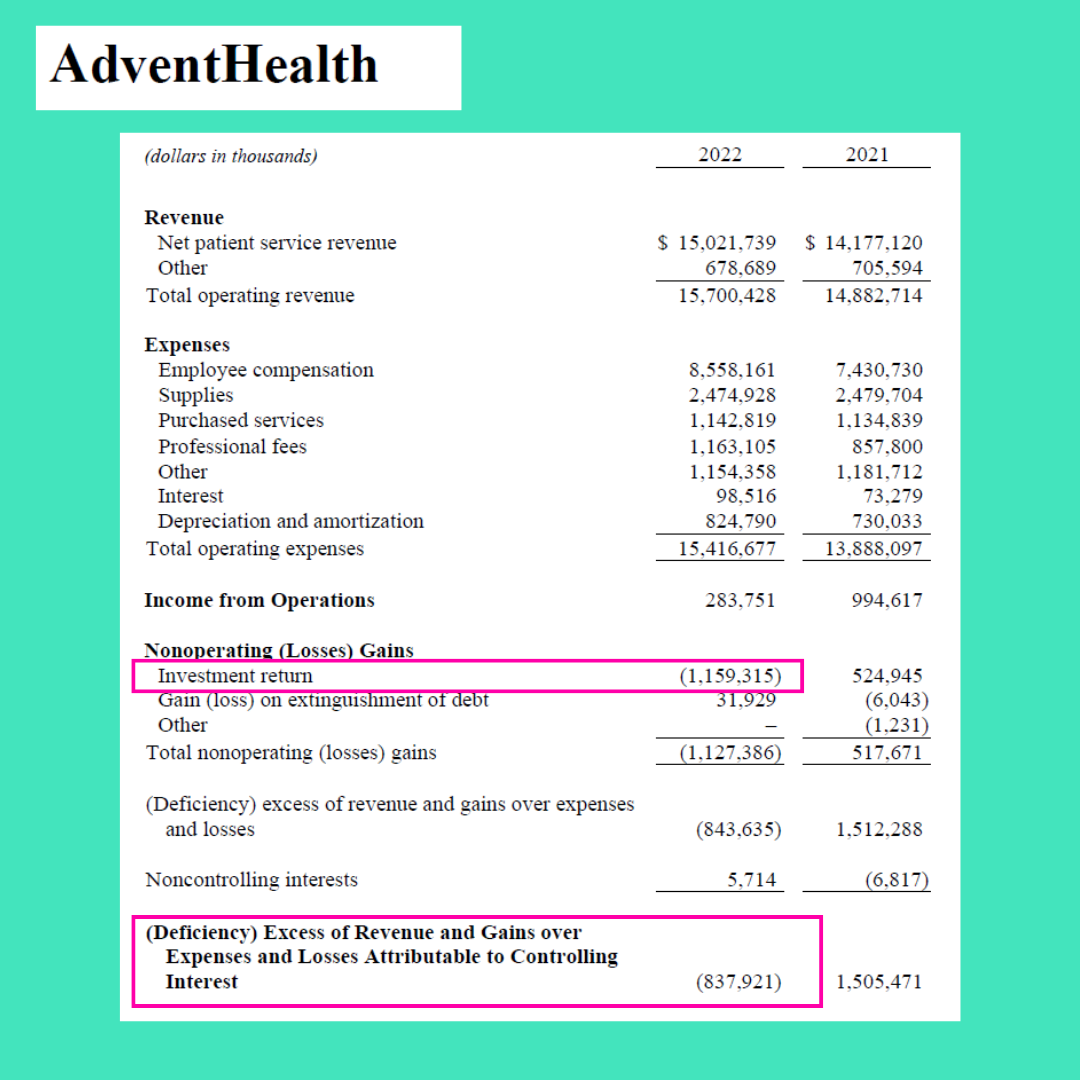

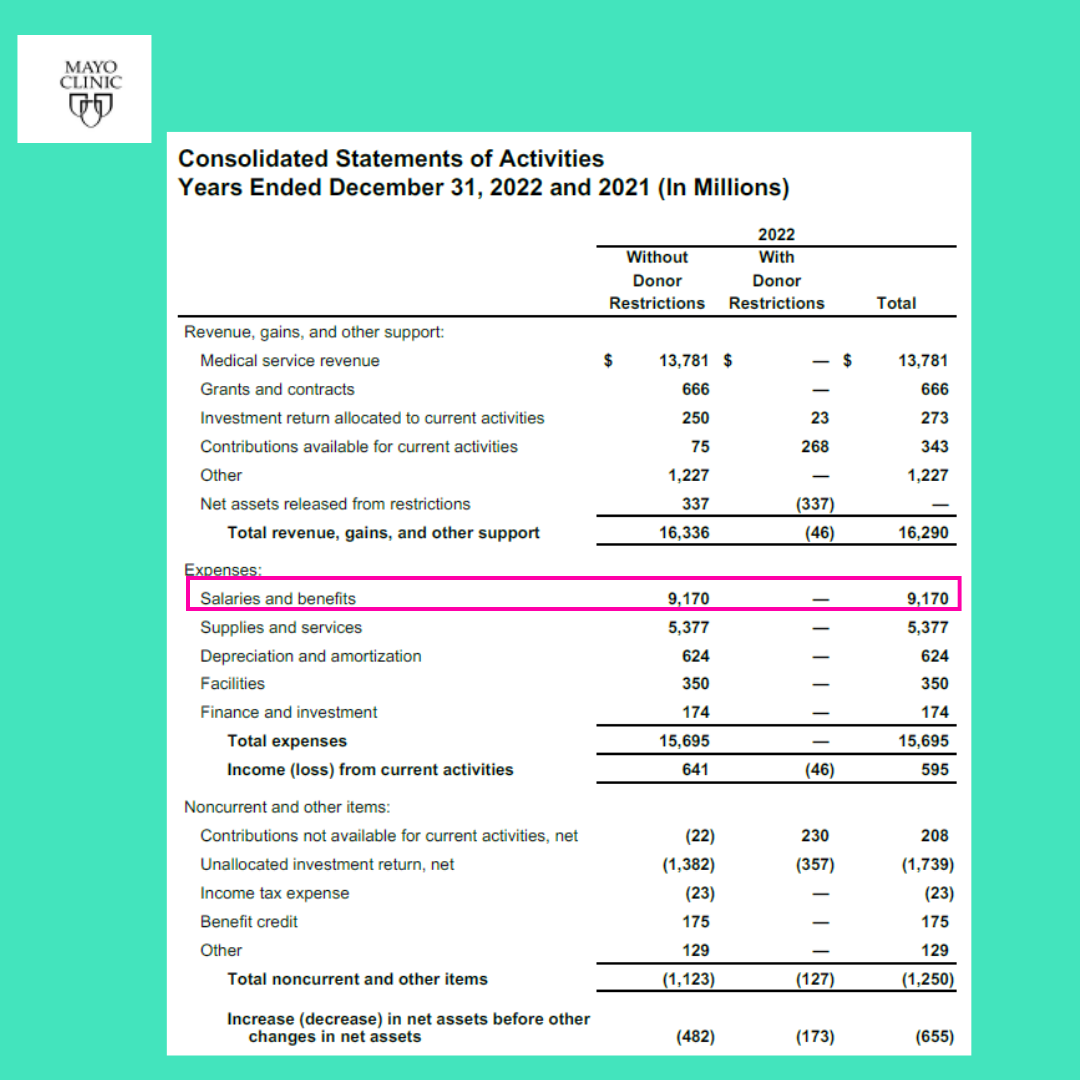

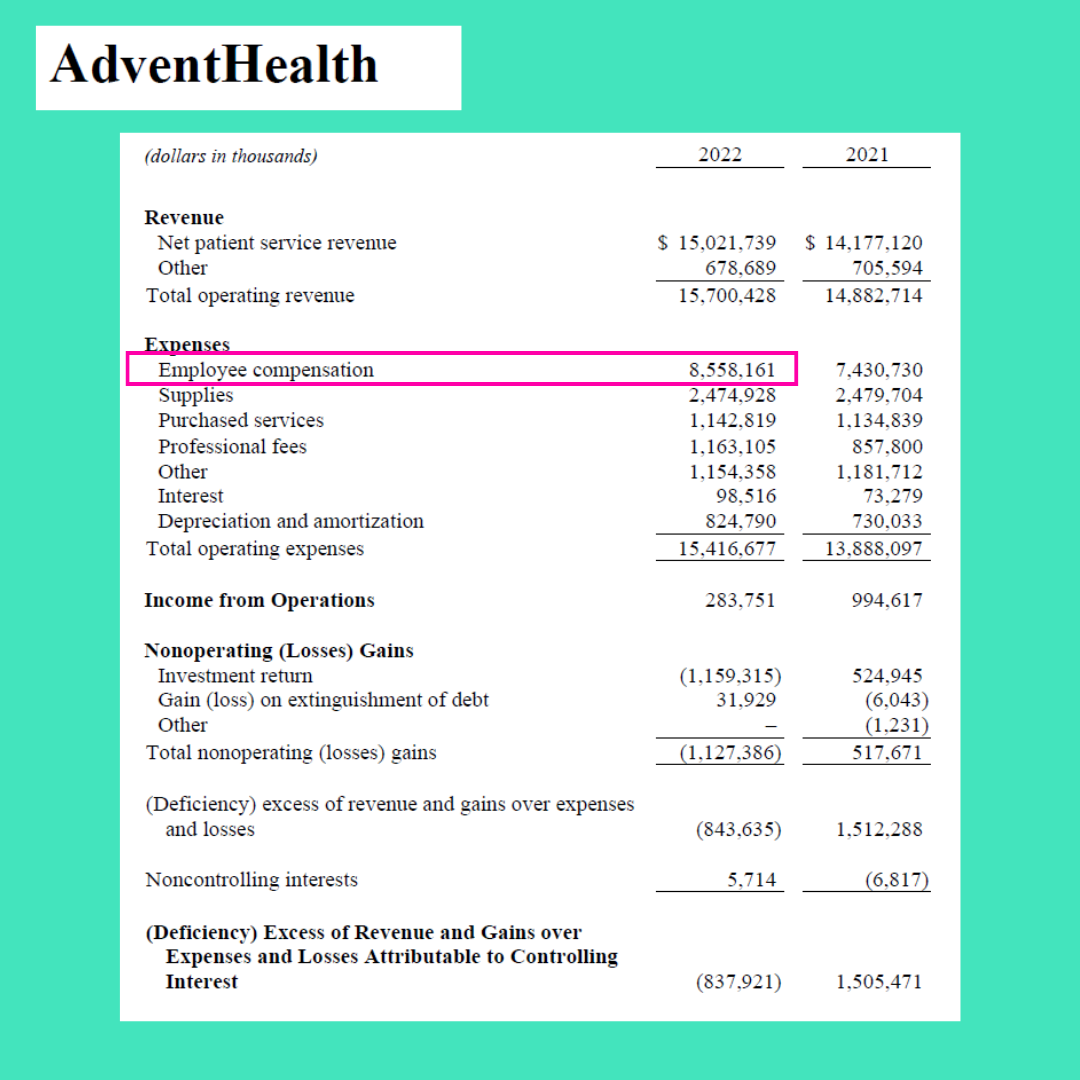

And more importantly, look at this:

Total losses are significantly driven by investment losses.

The total business, providing patient care and managing investments, plus all the over financial non-operating stuff has been producing a whole lotta negative net income.

When net income is negative, where does the business look to make up the short fall?

Well, the biggest line item of course.

This…

Wages and benefits are the single largest expense in health systems. We aren’t going to unpack where these wages are going, but needless to say, leadership will look to cut someone else’s job, salary, or benefits first.

And they do. Layoffs, short staffing, reduced hours, the whole nine yards.

The rub is investments are performing poorly and saving on expenses drops straight to the bottom line. Meaning if you spend $20M less on expenses with the same revenue coming in, that’s an immediate $20M lift in profit.

The problem is obvious here. You can’t save your way to prosperity and you certainly can’t understaff expecting to save on costs while simultaneously providing high quality care and not destroying the morale, morals, and souls of the folks working for you, trying to save lives on a shoestring.

When we hear about these wild losses, don’t wait for the axe to come down. Get proactive.

Do this:

Look at your health system’s financials.

Understand the pressures the total business is under.

Look at your unit financials.

Demonstrate through financial story telling how well performing your unit is and how it contributes to outcomes, quality, and profitability.

Start signaling to the organization that your unit is not to be messed with.

Buy a don’t tread on me flag and put it on your office door.

That last step is totally optional. Pirate flags are acceptable alternatives.

We shouldn’t let financial markets dictate how patient care is delivered.

So, don’t.