The Healthcare Breakdown No. 028 - Breaking down Ascension’s most recent year of shenanigans

Brought to you by old timey nostalgia when seasons change and the air turns crisp

What we’re breaking down: How Ascension could possibly lose $3B and make $1.4B in cash

Why it matters: Uhhhh, it matters, ok?

Read time: Jayne Eyre (6 minutes for real though)

“It was the best of times; it was the worst of times. It was the age of wisdom; it was the age of foolishness.”

I don’t know why I thought of that quote… probably unrelated.

Funny story though, the first breakdown I did, that which catapulted me into the most minor amount of infamy imaginable, was about this particular topic. In fact, it was the original inspiration for The Healthcare Breakdown.

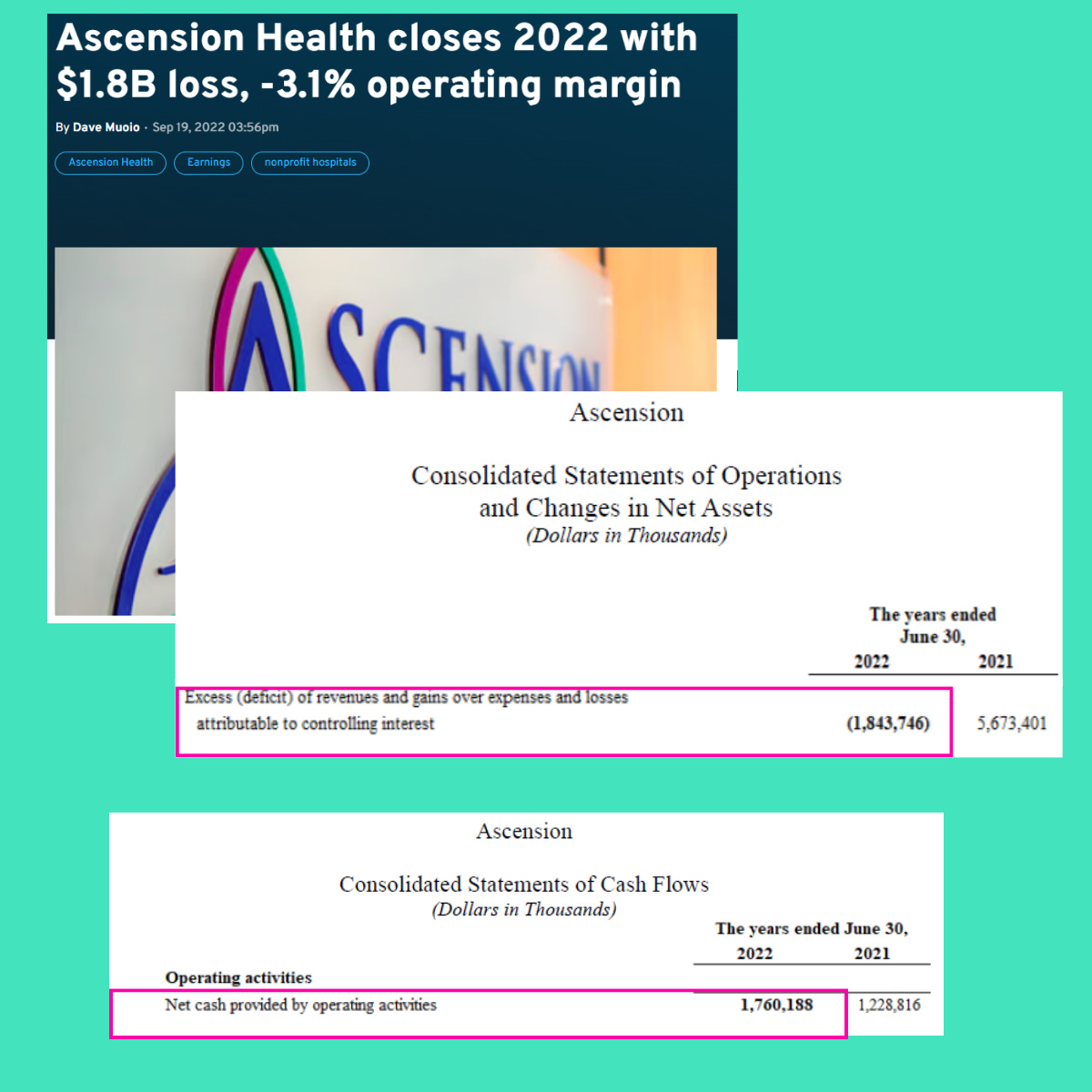

I was minding my own business last year, when BOOM! Ascension loses $1.8B!!! Ahhhh!! Shriek, scream, horror, terror, run around in circles and cry, for the love of god! Save our hospitals!!!

But then I thought to myself, is this really the end of days? And how do you even lose that much money?

I just had to see for myself. To my bemusement? Horror? Delight? Mix of wildly oscillating emotions, I also found that the same health system, in the same year, made $1.76B in cash from operations.

How in the Looney Toons double take!?

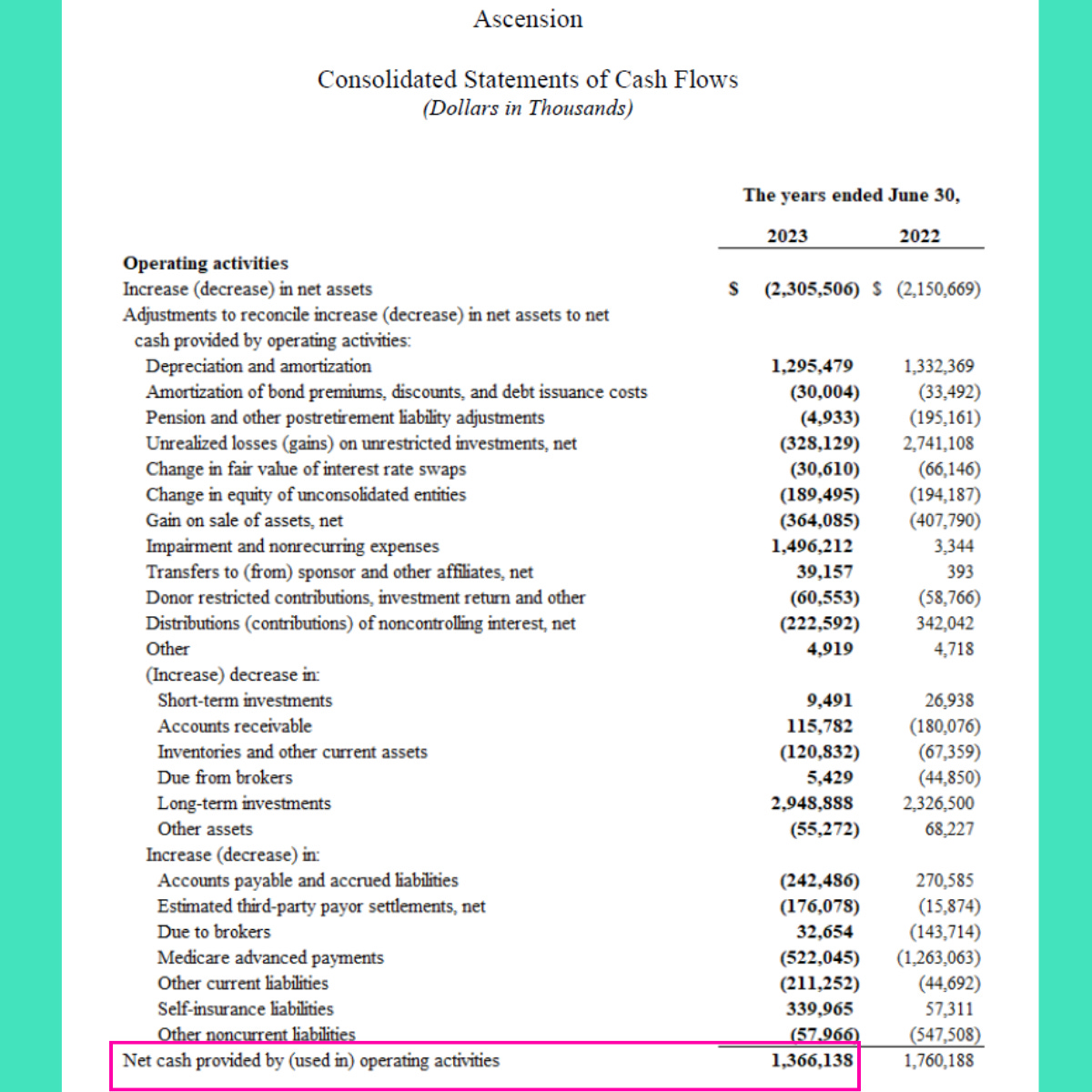

Look, for realsies, it happened:

See. Told ya.

So, naturally when I saw the terrifying headline that now Ascension has lost $3B (faint), I just had to see what all the fuss was about.

So let’s kick this old school and break it the downtown.

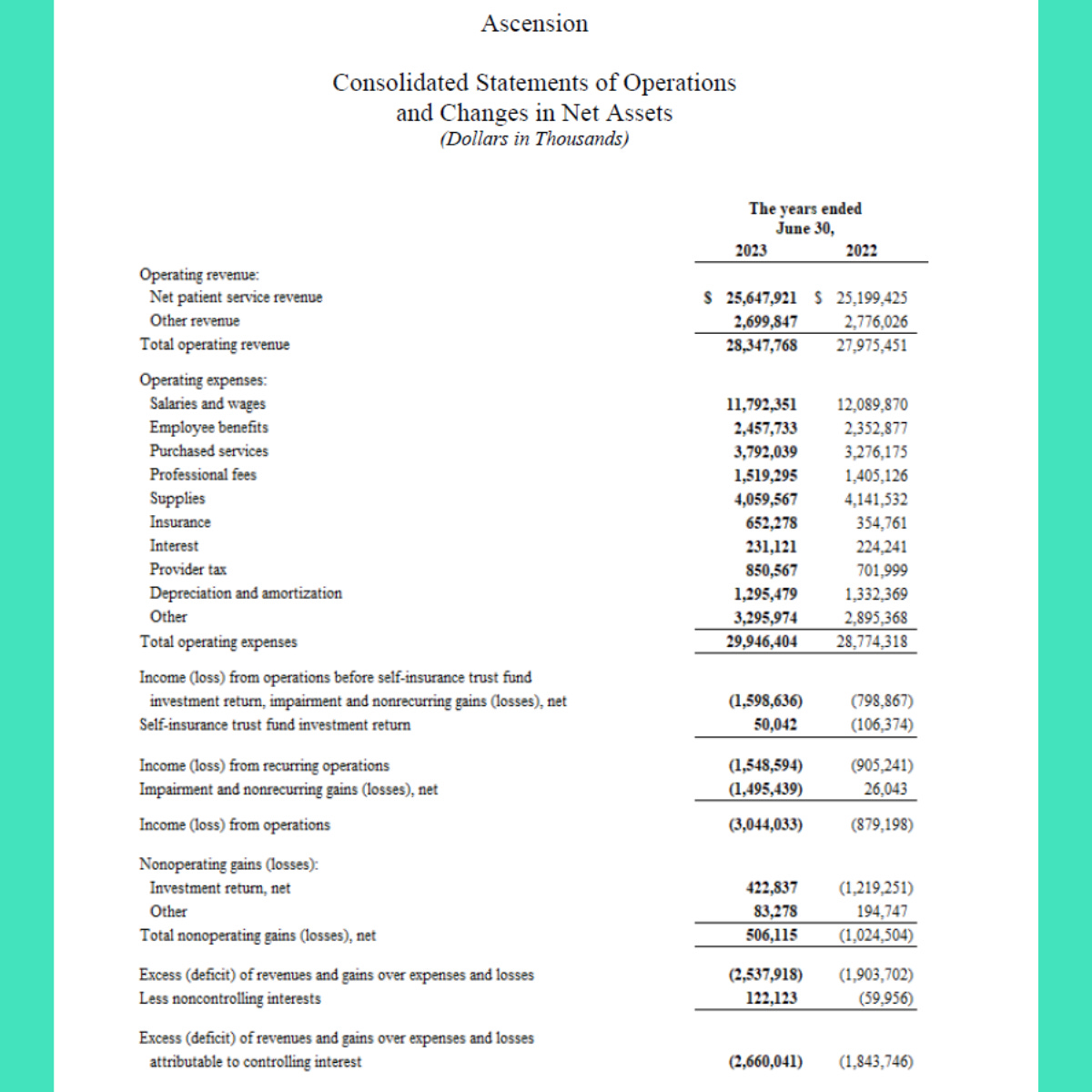

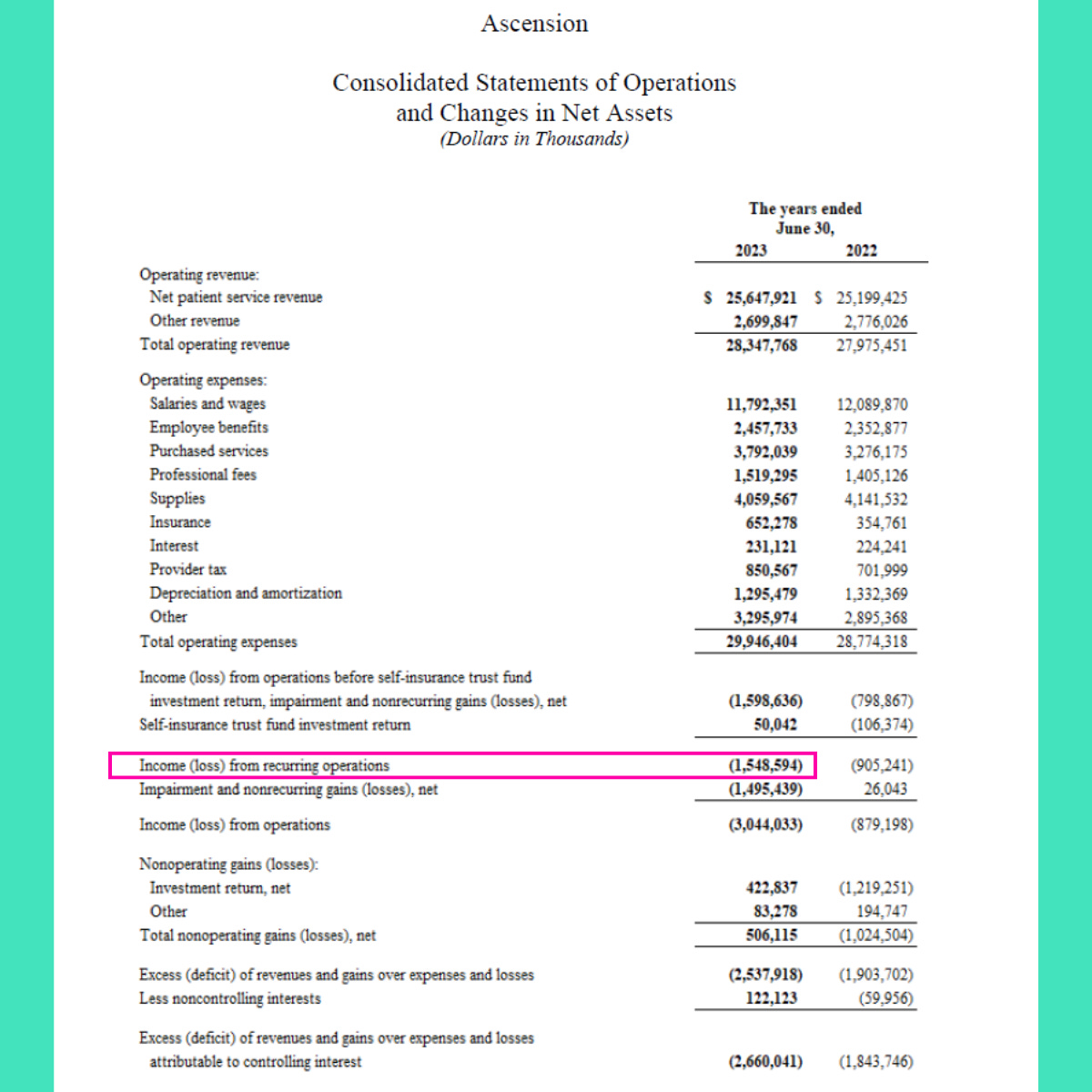

First, you have this handy income statement:

Yikes… that’s a lot of lost quiche.

By the way, how did quiche become a colloquialism meaning money? Like who was the first person to say quiche in reference to money and then why did their friend, think to themselves, “oh ya that makes sense,” instead of saying, “dude, what?”

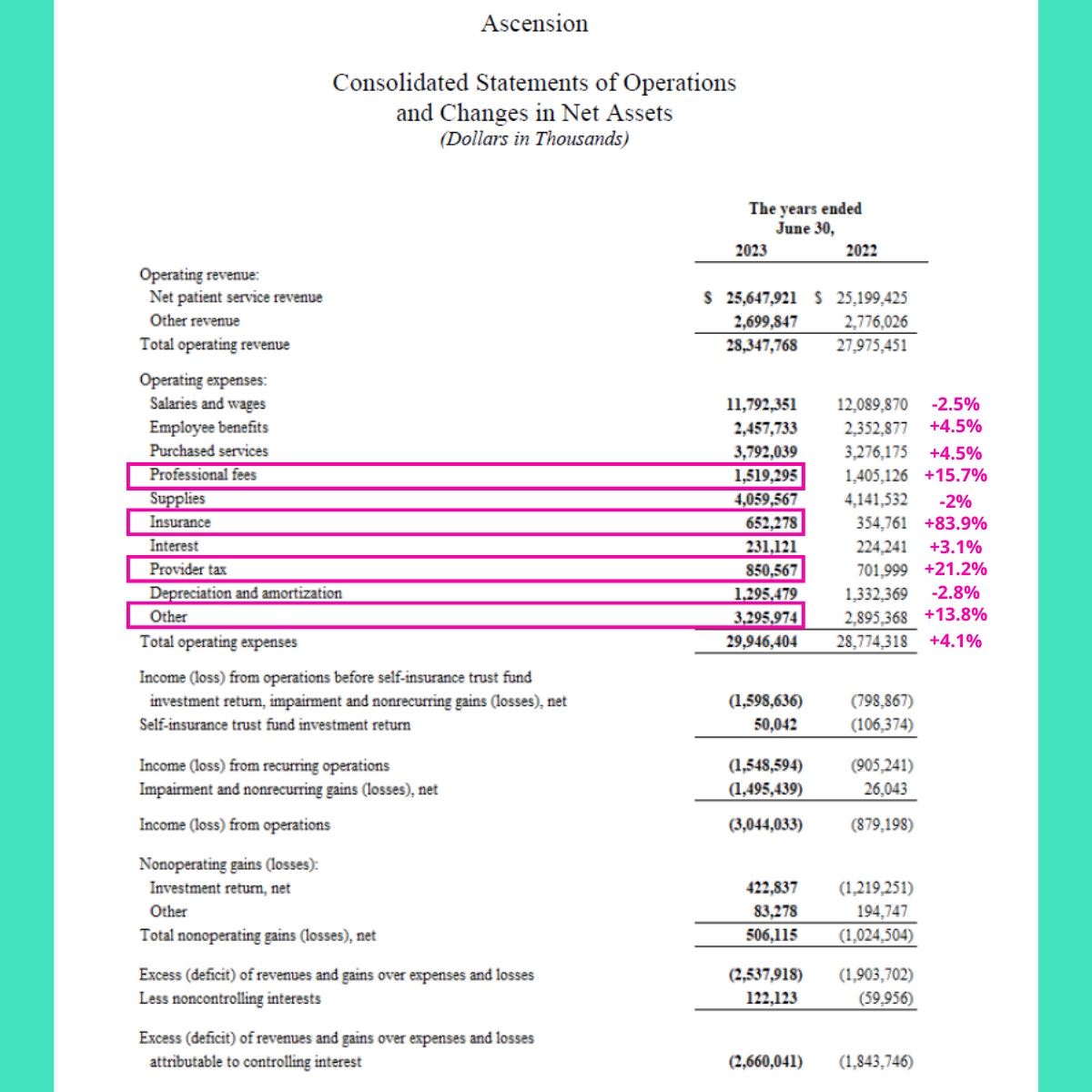

Where has all the quiche gone you ask? Looks like it went here:

Interesting… My big questions are why has insurance skyrocketed and what’s up with “Other?” That’s quite a catchall.

Luckily, me and my buddy CTRL+F hang out on the regs.

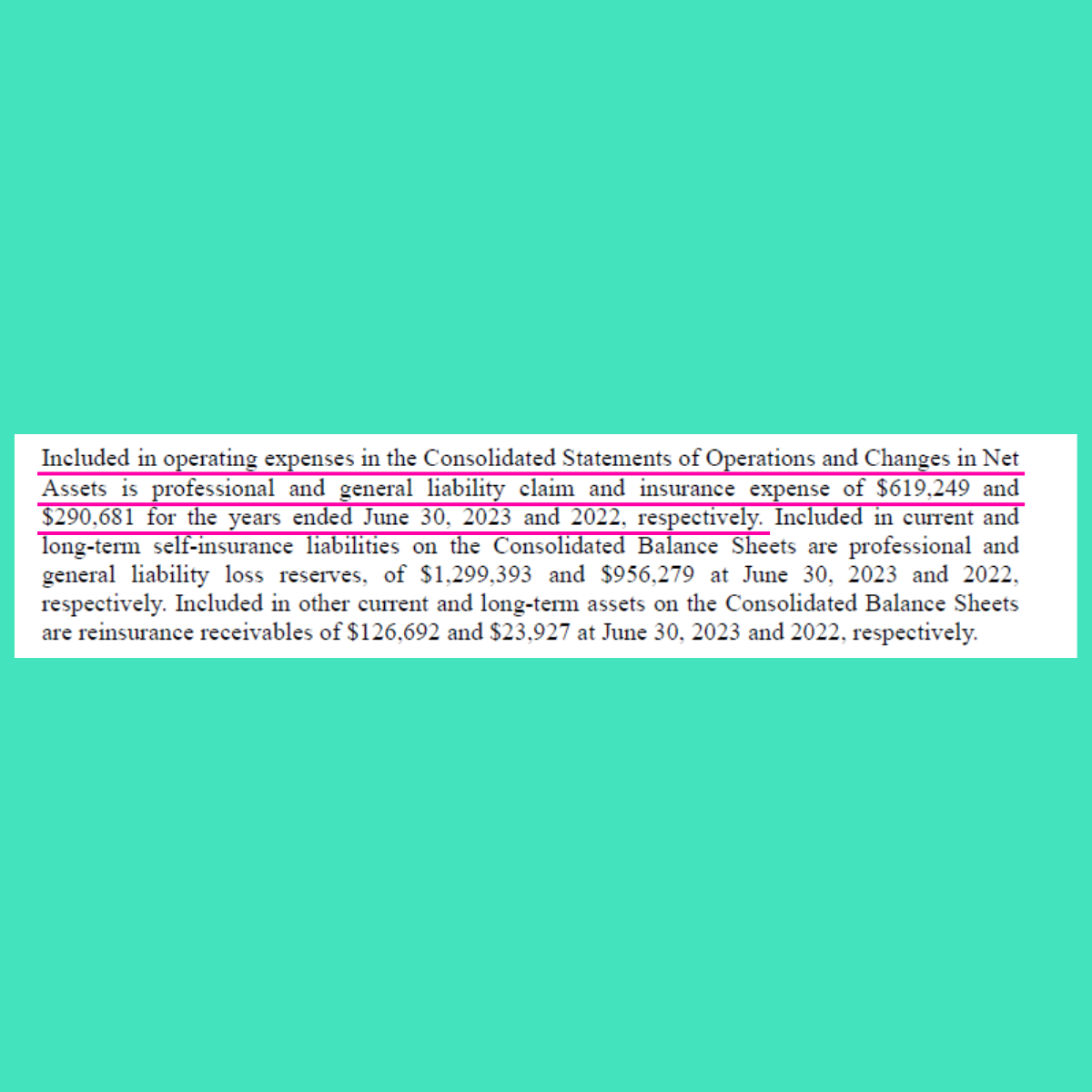

Here’s insurance:

Ok, general and liability insurance went up. A lot. Who am I to say why. I am sure there are lots of reasons. But it’s a funny thing about insurance premiums and claims going up and eating into your bottom line and you can’t seem to do anything about it. They wouldn’t know anything about that though.

Next, what in the world is “Other”?? I mean $401M increase and 14%. They gotta mention it somewhere.

They do, but barely. Lease expenses are in there. So, we’ll leave it to our imagination what that extra four hundred milli was spent on. Ascension doesn’t do any marketing do they? I am assuming all executives travel coach. They wouldn’t have any strike related costs…. Oh well, who knows, but I am sure it was worth it, totally necessary, and well spent.

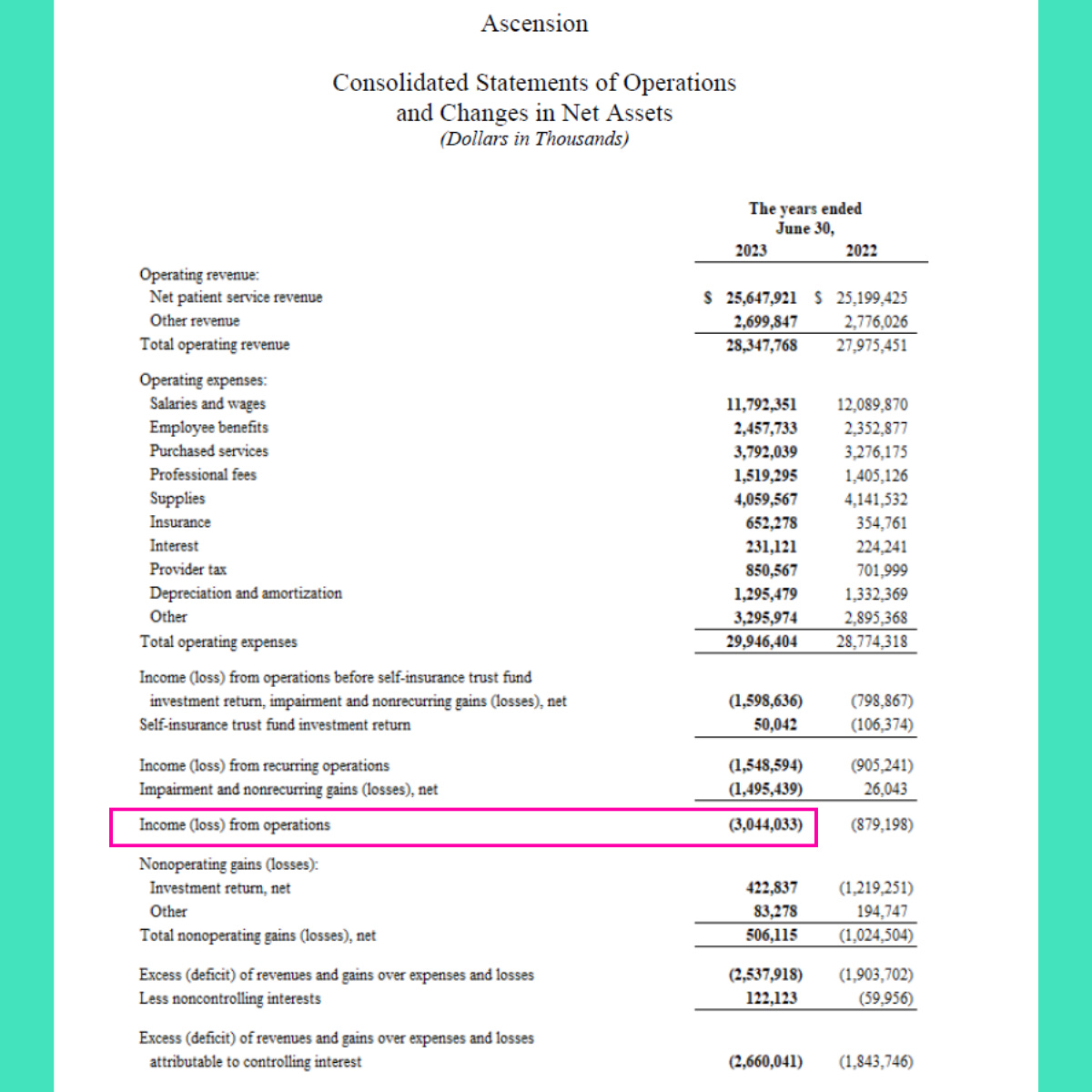

Nonetheless, that brings our total loss to… drumroll….

Wait, ($1.5B)??

I thought it was 3? Oh, my bad, next line… Heh.

Holy Majoly. There’s the non-money shot.

What in the heck fire happened?!

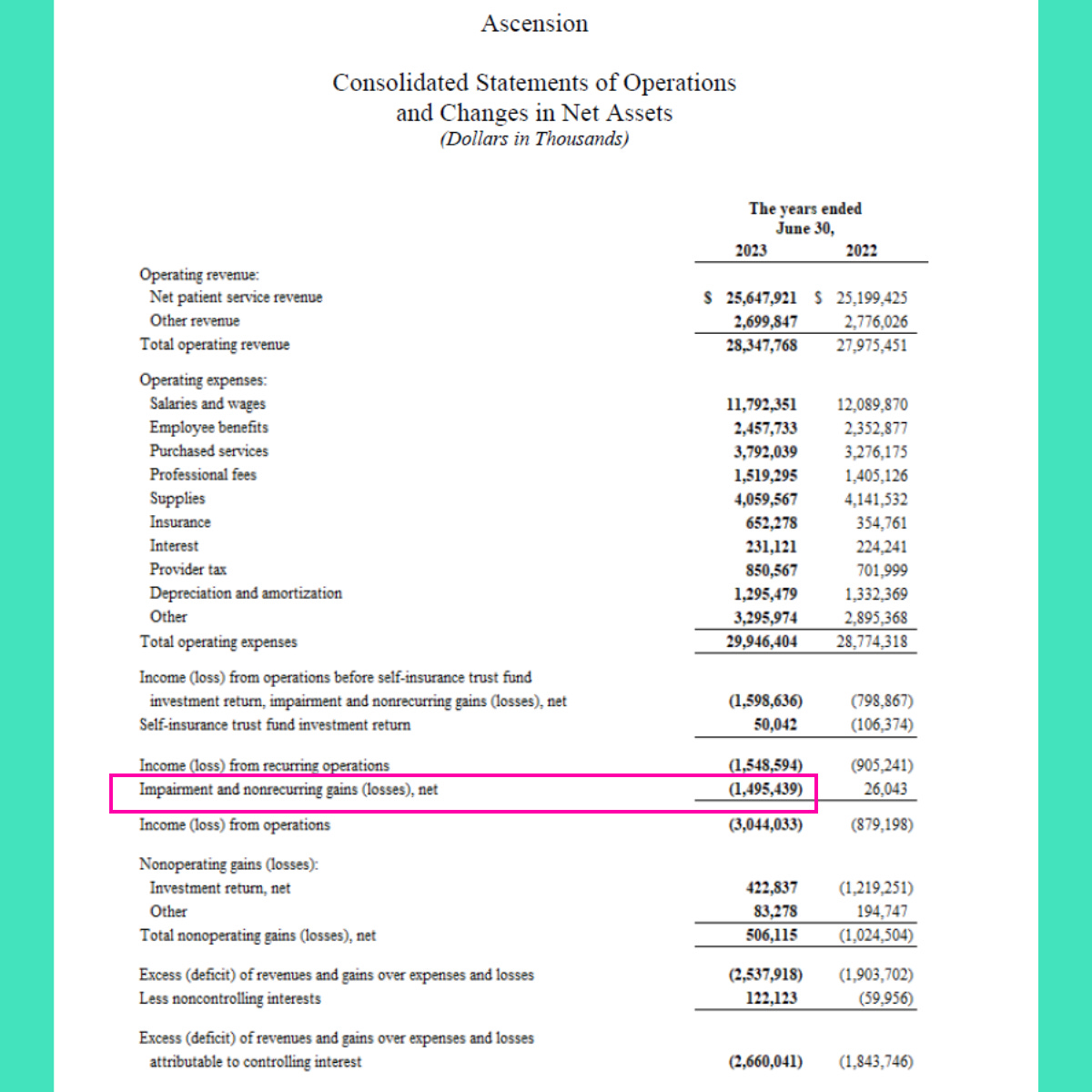

Well in addition to the mystery category of “Other,” this did:

An impairment loss of ($1.5B).

Again, a whole lotta quiche.

Let’s consult our handy dandy CTRL+F and see what this is all about!

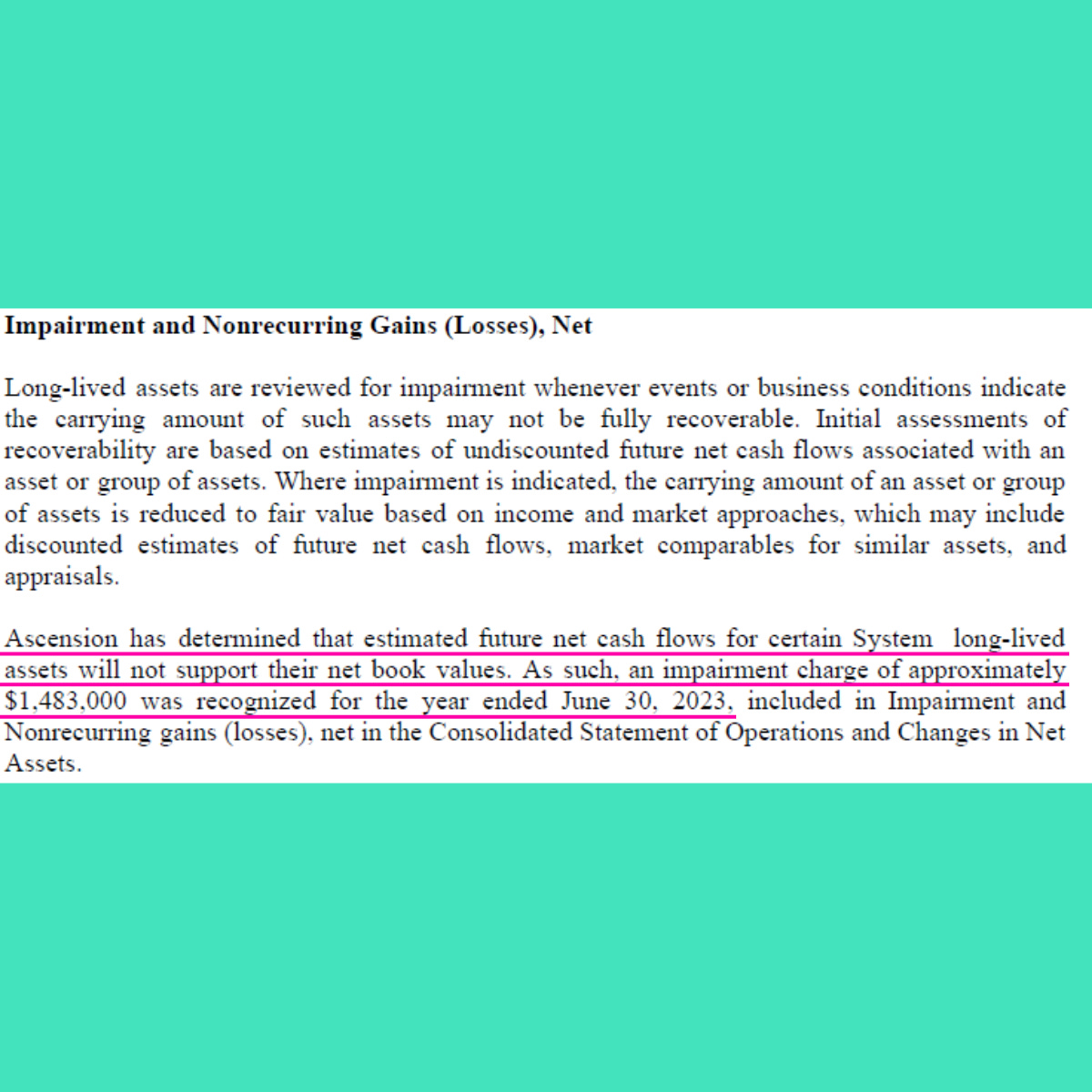

Don’t read that. Oh, you did already. Fun, right?

Allow me to translate. Sometimes Ascension reviews the things that it owns and thinks to itself, via many smart analysts, “is this thing still worth what I think it’s worth?”

If the answer is no, they impair the asset, or take an impairment charge, or take a non-cash loss, or just write a really big negative number on a piece of paper.

The easiest way to think about it is like your car, which goes down in value over time. If you bought it for $32K and then after a few years using depreciation rules (basically just dividing the cost of the car minus the resale value by the number of years you think you will be able to use the sucker). Easy sauce.

So, if after 5 years you think you can sell it for $18K, the book value (the value on paper that you report as an asset) is also $18K. You just subtract $2.8K from $32K, 5 times.

But, what if on January 1st Kia announces it’s giving away a free car to everyone ever. Well, then, ain’t no way you’re getting $18K for old dusty boots.

What do you do? You take the hit. You write-off the value of your asset. It’s now worth $0. Because accounting is a bunch of monkey business, and a big game of matching, you have to expense the asset’s loss in value. You know, balance and such.

Thing is, you didn’t really lose any money. No one came and took $18K away from you. And you can totally still drive the car. Heck, you can even start driving Uber. Or a delivery service. Or a site-seeing tour service.

The car can still generate revenue for you. You just aren’t going to be able to sell it for what you once thought you may be able to.

That, is the impairment.

It’s a little different in this case because Ascension is looking at more than just the value of the sales price of a building or something, but it also looks at how much money the thing will make in the future. I guess times are tough? Or different? Or they are in some markets that didn’t pan out like they thought they would. Or healthcare is just a messy mess mess and it turns out you can’t just charge whatever you want and eventually the market will correct.

I don’t know. Just spit balling.

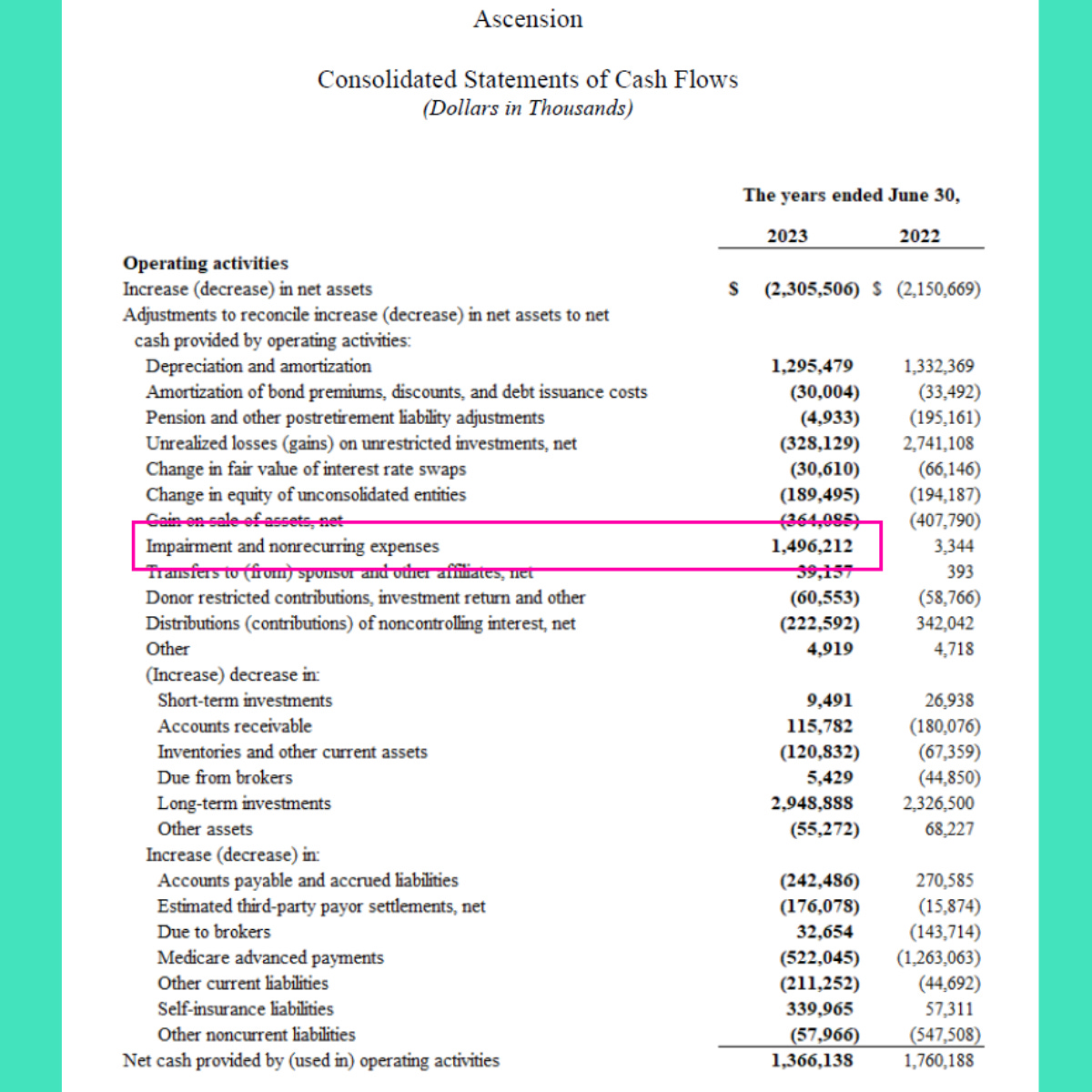

So, how does this all work out in the cash flow?!

We have established that Ascension spends a lot of money and that it took a big impairment, but like, how did they make all that cash then??

Well, like this….

First, here’s the whole shebang and the end result:

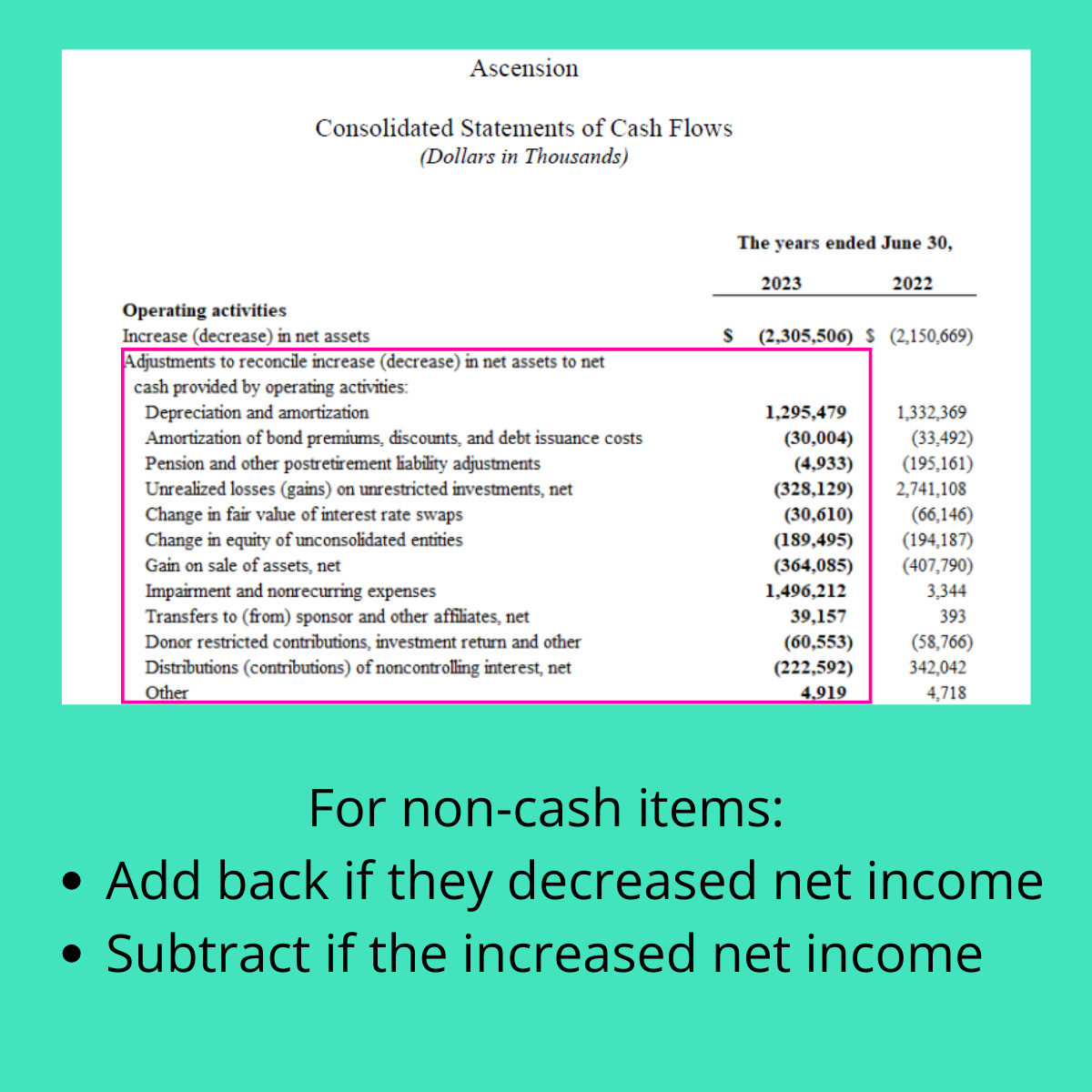

First, you add or subtract some non-cash items:

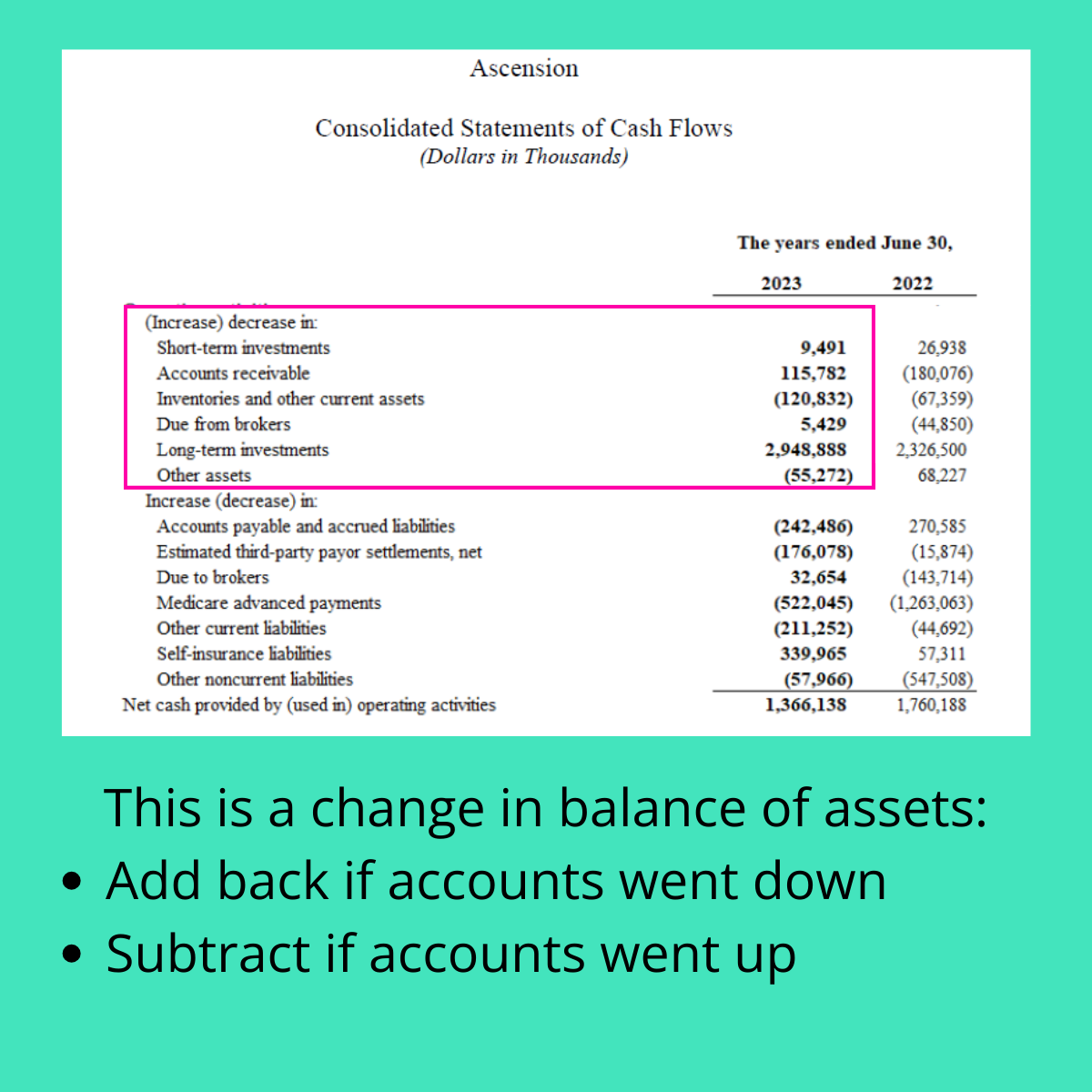

Then we add or subtract some changes in assets:

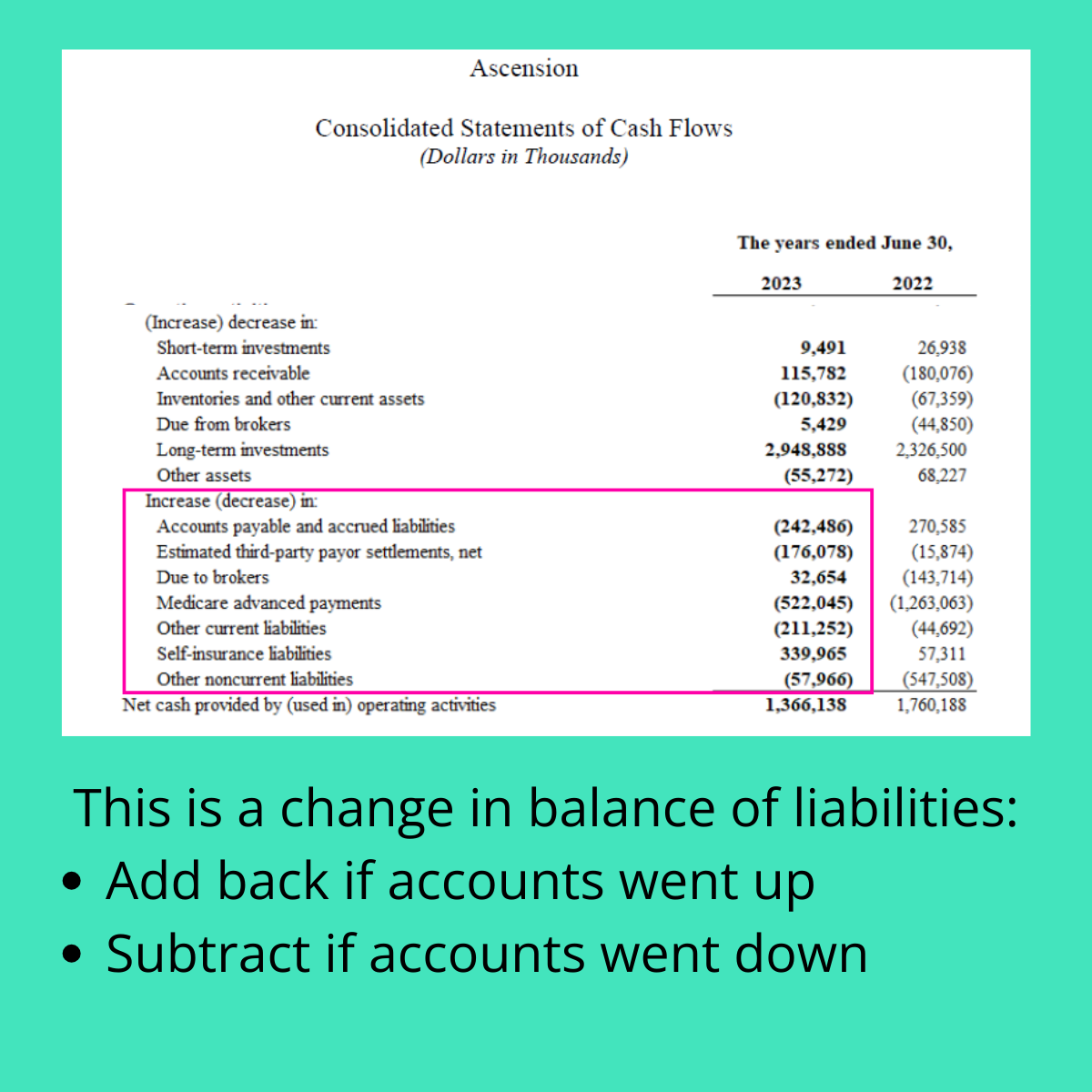

Finally we add or subtract some changes in liabilities:

Sorry that the last two things are confusing. The easiest way to think about it is with an example.

If patient accounts receivables goes down on the balance sheet, that means you got paid. Cash in hand. It’s no longer a receivable, it’s turned into cash. Increase the cash darn you!

On the flip side, if your accounts payable, goes up (a liability) that means you have not paid a bunch of stuff, so you are holding onto cash. So, cash goes up.

Oh ya, and where is that beautiful impairment? Ahhh, yes…

It was a non-cash item after-all. Add. It. Back!

That’s the long and the short of it. Did Ascension have a tough operating year, sure, whatever.

I mean it is hard when revenue increases $372M and expenses increase $1.2B.

Never mind that wages and benefits for healthcare services decreased by 2% and admin wages and benefits increased 10.7%.

And never mind that retail pharmacy grew $198M, +33%.

For sure don’t mind EBITDA of $829M.

Don’t mind at all.

Love you.