The Healthcare Breakdown No. 031 - Breaking down the charity care loophole (I know, you’re shocked there’s a loophole in healthcare)

Brought to you by Fruit Loops, part of a complete breakfast… in the 90’s

What we’re breaking down: How health systems overinflate charity care numbers

Why it matters: Health systems are tax-exempt predicated on providing charity care, which can be gamed (shocker)

Read time: How long it takes to enjoy a frosted lemonade (6 minutes for real though)

But first! A word from our sponsors…

Check out the awesome logo:

MedTech Militia is the #1 networking channel for sales, marketing, and clinical professionals in the MedTech industry.

Here’s some of that value you can expect:

1:1 virtual coffee with VPs of sales, founders, and all-around great folks.

Tons of events including live meetup with fried chicken sandwiches, indoor golf, cocktails, oversized fireplaces, and no sense of irony.

Onboarding meeting with the founding team of veteran MedTech gurus.

Learning from community members with probably like 793 years of combined experience.

Resources to help you grow and thrive in MedTech.

Career development like you’ve never seen it before.

Really nice sports coats.

And so, so, so, much more. Like, promise. It’s going to be awesome.

Check it out at: medtechmilitia.com

Charity care is a whole big heaping mess of things. Sounds great, but when we look beneath the surface, per usual, we find so much more.

Isn’t it a blast being in healthcare and reading this happy periodical.

Ya…. Sorry about that.

Anyways, if you have been reading the ticker there’s a whole lotta hubbub about charity care versus tax exemptions. I am not going to go into all that, but the gist is that a lot of folks are calling foul on health systems for not providing enough charity care to justify their tax exempt status.

You’ve probably seen the headlines:

On the other side of the aisle, fence, or other man-made symbolic barrier indicating opposition, we have the health system operators and pundits calling foul for under-reporting what health systems are actually paying in both charity care and beyond.

The beyond includes, bad debt, Medicare shortfalls, Medicaid shortfall, and community benefits.

Regardless of what side of the debate you are on, here’s the charity care rub. Well, there’s two and a half I want to point out.

1. The charity care calculation can over-inflate the amount of charity care provided.

Shocking right?

Here’s how it should work out….

Find your Cost-to-Charge ratio first. That’s just total expenses (costs I guess even though hospitals suck at costs) divided by total made-up unicorn charges

Here’s an example:

These are numbers from Emory Decatur, formally Dekalb Medical Center. Part of the grand consolidation of Atlanta hospitals.

The trick here is getting the Gross charges. Those aren’t in my favorite audited financials. Luckily the good people at CMS collect cost reports which are publicly available.

So, before you go and buy that subscription to Definitive or some other overpriced data repository, just download and crappy CMS zip folder. It’ll do 80% of the job.

Here’s a link. It’s a little elderly, but that’s what CMS does right?

Now we need to see how much charity we gave out to people who totally should have just had insurance… kidding.

That one is easy, the hospital knows how much money it didn’t collect but should have.

Still Gross charges by the way. You know the made up number.

Now we have two numbers, charity care gross charges (what we normally would have collected) and our CCR (Cost-to-charge ratio).

Cool beans.

Multiply them suckers.

That’s it.

According to Emory Decatur then, they provided $3.3M in charity care. Very thoughtful.

Here’s where it gets dicey….

Charity care isn’t always a 100% discount. Some hospitals in their infinite kindness will discount a portion of care depending on your situation.

So, while you may not owe 100% of the inflated, made-up nonsense amount, you owe like 32% of it.

Cool, I guess.

Well, we need to take that into account for charity care. We can’t (the government says we can’t) claim the entire amount as charity care, we can only claim the 68% as charity care.

Of note, which I mention later, hospitals can make up discounts and don’t always have a consistent policy.

Fun game, next time you get a hospital bill, call ‘em up, tell them you want to pay cash or not, whatever, they like to roll the dice too. See how much they will take off the bill. It’s crazy how much you can negotiate, seemingly out of thin air.

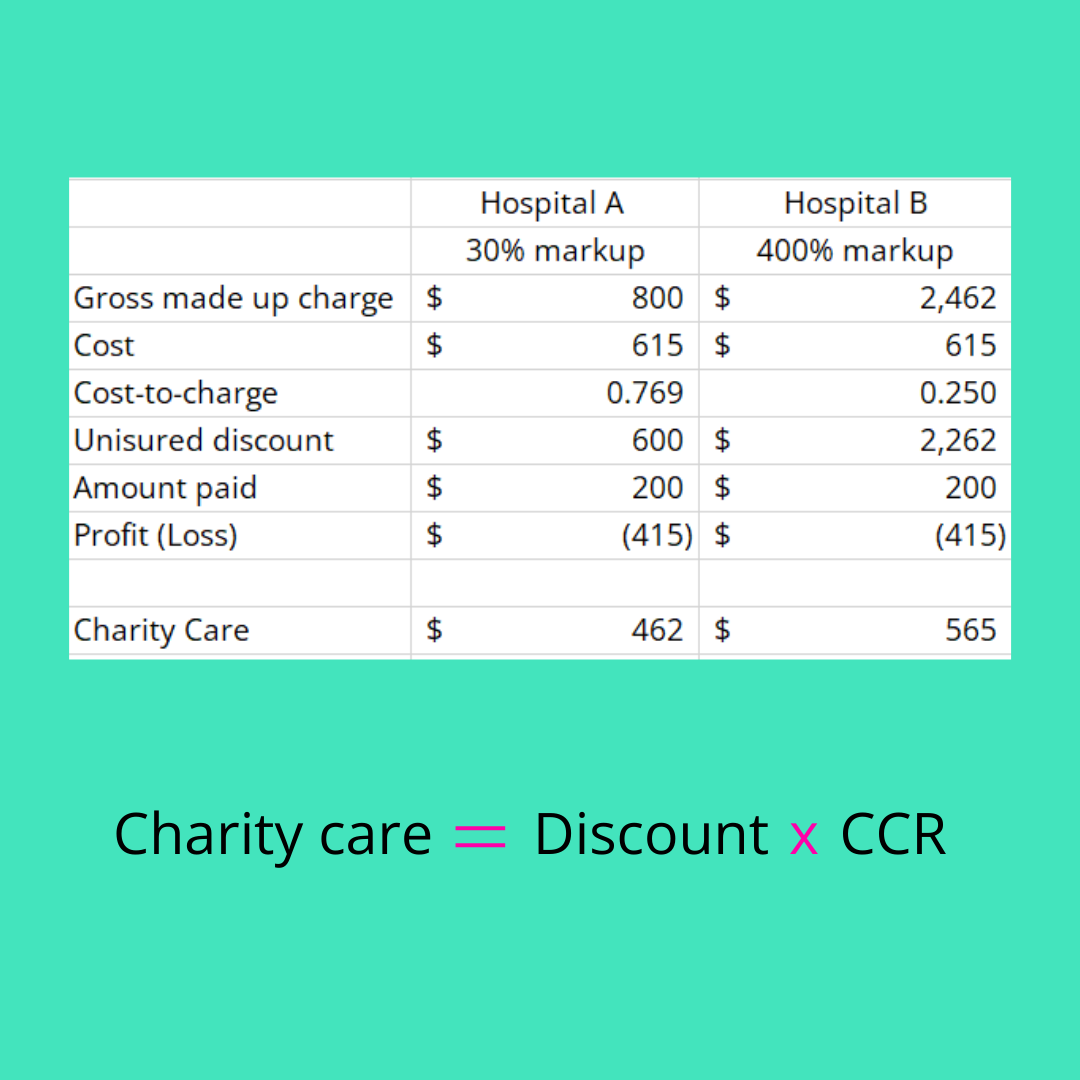

Let’s just do some math and see how this effs everything right up.

Both hospitals had the same cost and lost the same amount of money. But the hospital with the bananas over-inflated charges is now claiming way more charity care.

Part of the problem is unraveling that mess to determine just how, when, and where these charity care calculations are happening. While there is a 446 page document (I know, I looked for it) on how to calculate all this ish for Medicare, it’s still leaves some things up for interpretation.

There are swarms of accountants working on this stuff and the goal of the AHA is to show just how charitable every tax-exempt health system is. In fact, they publish it.

Here you go:

A cool $42.67B just handed out to folks in 2020.

So Charitable. Definitely not overinflated.

This brings us to point number 2.

2. Tax-exempt health systems are required to provide charity care in order to keep tax exempt status… but how much?

There is no specific number as to how much charity care, community benefit, or uncompensated care health systems have to provide. So, while we do like the old fist wag at these organizations, they don’t have any oversight.

Can we blame the fox who guards the henhouse?

Every health system then, comes up with it’s own policy.

Here’s one from my backyard:

You can see that if your income is less than 300% FPL, you qualify for charity care.

There’s also totally a typo in there by the way, no way Northside lets you off the hook if your income is 30,000% of the federal poverty level.

Free healthcare!! Whoops, don’t tell anybody I said that.

Some health systems have lower thresholds, meaning you need to make more to qualify. Or higher thresholds.. Or, wait.. Anyways, you need to be poorer to qualify.

This though ties to point 2.5…

2 1/2. Health systems don’t always tell you that your qualify for charity care, why would they?

That’s sort of the long and the short of that one. Health systems are not readily going out of their way to tell people that they qualify for free healthcare per their own policies.

They don’t go out of their way to publish that information in an easily accessible location.

And they don’t make it easy to apply either.

Because after all, if a person is uninsured you can bill them the full gross charges. Then sue them later. And make like 0.01% of your total revenue from suing poor people.

Who wouldn’t want to do that?

Oh, and here are some more links to stories like this. Just in case you want to be more depressed than you’re going to be when Taylor breaks up with Travis Kelcee. But they seemed so good together!!

Cool, so I ruined your day, I am sorry. What should we do about it??

Tell people. There are countless folks out there who qualify for charity care. They need to know about it.

Yell at your elected officials. They should be auditing and holding these health systems accountable. Counties and states forego billions in tax revenue based on murky accounting while Atrium make tax free money on rent from a PDQ Tenders chicken QSR and throws $52M of that tax free money into the Caymans.

True story…

By the way, if you have never heard of PDQ, like me, here’s a link to that fine establishment. https://www.eatpdq.com/locations/cornelius-tenders

But what can I say, I’m a Chick-Fil-A guy. It’s an Atlanta thing. Get the frosted lemonade. It’s wild.

See you out there… at Chick-Fil-A I mean. Frosted Lemonade on me.

Love you.

Can the hospital deny charity care to someone who has group insurance even if the plan document says it will pay benefits after charity care?