The Healthcare Breakdown No. 037 - Breaking down Medicare disAdvantage

Brought to you by see what I did there?

What we’re breaking down: That thing everyone is talking about, Medicare Advantage

Why it matters: 52% of eligible Medicare beneficiaries are enrolled in Medicare Advantage, it’s destroyed billions in investor value, and it’s probs going to get worse

Read time: Way longer than the time it takes to hydrate a Pizza Hut pizza on level 4 in the year 2015 (5 minutes for real though)

First things first, I am writing this sick, so if it makes no sense and seems a bit rambly, then nothing is different than usual, so let’s carry on.

Medicare Advantage, he said in a booming, echoing, movie phone guy voice.

The news has been all in a tizzy about Medicare Advantage since Humana’s stock dropped 17% in one day. That’s gotta hurt the executive teams’ wallets.

The reason, the company cited, was increased healthcare utilization. GAAASSSSP. People using their healthcare benefits and seeing doctors. The audacity. Don’t these sick people know they’re messing with shareholder value that they have been paying for through their own tax money for like 40+ years.

It’s just insensitive.

Here’s what Humana said about the whole ordeal:

“…continuation of elevated Medicare Advantage utilization trends as previously discussed, which further increased in 4Q23, driven by higher than anticipated inpatient utilization, primarily for the months of November and December, as well as a further increase in non-inpatient trends, predominantly in the categories of physician, outpatient surgeries and supplemental benefits, which emerged with the November and December paid claims data (received throughout December and January, respectively)…”

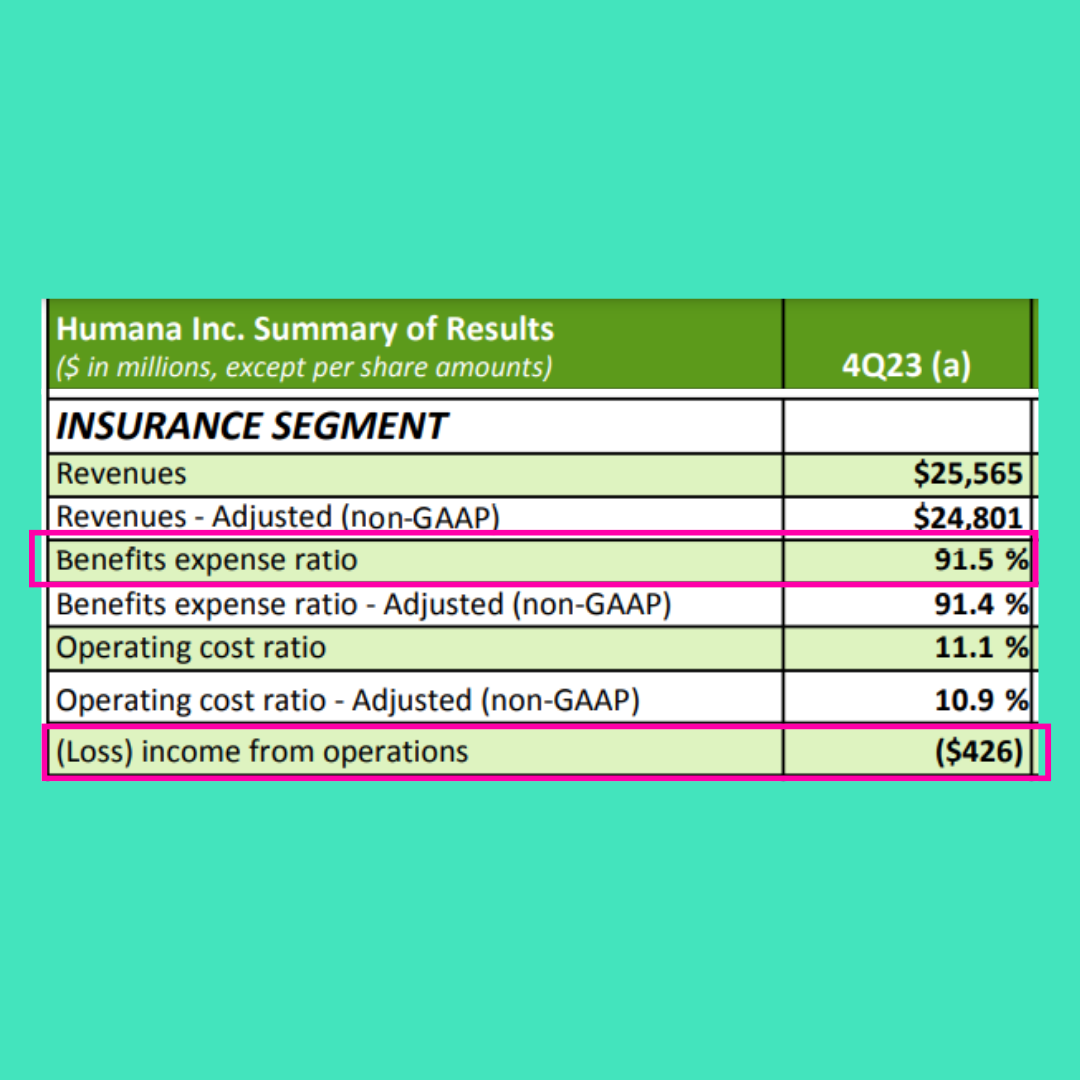

I know, a little dramatic. And here’s what happened to Q4 results:

Much to its chagrin, Humana had to shell out 91.5% of it’s sort of hard earned premium and capitated payment dollars to, I know… I know. It’s hard to say… To pay for healthcare.

That terrible act, led to an operating income for the quarter of ($426M)!

Negative!

I mean sure, it’ll finish the year with over $3B in net income, $3.9B in cash from operations, having completed $1.8B in stock buybacks, but still!!

Woe, is, them.

But let’s go back a bit, what even IS Medicare Advantage? What’s the big ole deal? Why did agilon insiders dump $2B in stock?

Oh, sorry. Was that a spoiler?

Here is the most important thing one should know about Medicare Advantage.

It’s like an HMO, narrow network PPO, capitated payments, old skool Medicare, and unfettered capitalism had a baby.

In simplest terms….

Yeesh, how do I put this in simple terms…

Medicare Advantage bundles everything together like, Medicare Part A (hospital stuff), Medicare Part B (physician and outpatient stuff), the supplements like dental, and Part D (drug stuff).

So, immediately you can see that it seems very convenient. Instead of your mom, who still believes in every conspiracy she sees on Facebook, trying to muddle her way through all the different parts and supplements, it’s one shebang.

Here’s another thing. Super low or even $0 premiums. Crazy right?

Also, one last item of note, there is no max out of pocket for Traditional Medicare. So without the right supplements, you may be in a whole heap of mess. Medicare Advantage on the other hand, operates more like commercial insurance and does have max OOP.

Oh, did I forget to mention that commercial insurers are the administrators of Medicare Advantage plans.

Basically the government forks of a lump sum or capitated payment if you’re fancy, for each beneficiary on a Medicare Advantage plan, to the commercial carrier.

You can probably guess the rest, but the carrier then does everything it can to keep as much of that lump sum as possible. Enter prior authorization bonanza, HMO life like the glory days, and narrow networks.

Also enter risk bearing entities. Like the intentionally lower cased, agilon.

First, here’s a grid all about Medicare vs. Medicare Advantage, to make it nice and easy to see.

Now, agilon. So, agilon is like an enabler. Ya, you can read that two ways. It enables physician practices to take on risk baring contracts. Or more lovingly called, value based care.

Since most people know it, it’s sort of like Oak Street Health, the main difference being, these aren’t agilon docs. Agilon runs in the background.

The kicker is it is still all coming from the Medicare Advantage pot.

Here, graphic party.

CMS gives Humana money, Humana tries to spend as little as possible and gives some big primary care practice some money to take care of a patient population, and agilon is sort of at the bottom getting what’s left over from the left overs.

What gets my attention is one, why do we still think SPACs are a good idea? Two, where are the alarm bells on the $2B insider sell-off? And three, when is it going to be clear that financial incentives of corporate enterprises will never align with providing healthcare.

For your reference, here’s the sell-off:

Also, here is the stock performance:

Annnnnnd in case you were wondering, here’s why:

$90M in unexpected utilization. That took 9 months to see????

Like, the whole point of the company is to track, manage, and help with utilization. So how do you miss that??

Or don’t you and you go on a selling spree?

I’m not pointing fingers, but it is all a little odd.

Ok fine. The Medicare Advantage markets are all in a tizzy. And it looks like we haven’t learned any lessons since Bright Health or Oscar. Or maybe it hasn’t been long enough.

But fundamentally, people, especially older adults are going to need healthcare. And that ish is expensive. And when we give private enterprise lumps of cash to manage those patients, they are going to do everything in their power to keep as much of the pot as possible.

It’s literally why they exist. Shareholder value.

And your mom’s MRI doesn’t create shareholder value.

To that end, it seems the tide has gone out. Poor management over years with the majority of beneficiaries on Medicare Advantage plans has led to people getting sick.

Shocker, I know.

Health is a funny thing. If you don’t take care of yourself, then you seem to get sick all at once.

So the gatekeeping, delays, and denials, may have just made people accidentally “over” utilize the healthcare they paid for.

Weird.

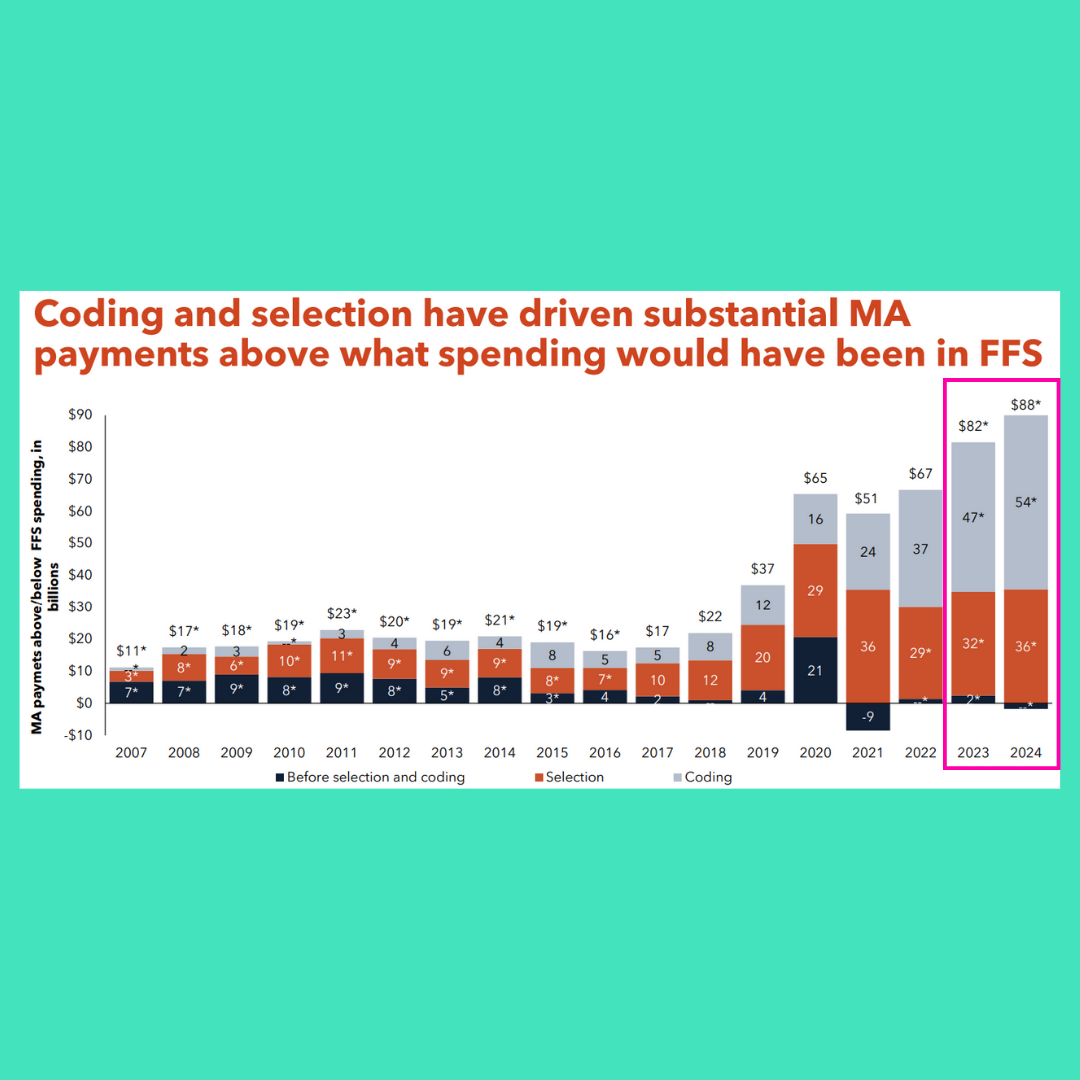

Oh, also, just for fun, here’s a MedPac report on Medicare Advantage:

Yup, that thing that is supposed to be so much better than Fee For Service and save the US healthcare system cost $82B more last year than FFS would have.

K, love you bye!

While it’s akin to picking a favorite child, this Breakdown may be the bestest of the bunch. Nicely done, Preston. Your wit and wisdom are appreciated. Cheers from Chapel Hill

While there are always opportunity to fine tune health spending, there are some meaningful failures of Medicare fee-for-service (FFS) that need to be acknowledged, for which Medicare Advantage (MA) has outperformed.

First, disease prevention. As summarized in a Sep 16, 2022 KFF report[1], MA patients were more likely than traditional Medicare patients to receive annual wellness exams, screenings, and vaccinations. Similar results we cited in that article for more consistent guideline-based control of heart disease and diabetes among MA members than Medicare FFS for patients. Per this report, MA was not a panacea on all metrics, but rarely did it underperform FFS.

The "coding intensity" issue, which contributes to the higher per-capita spend, is not necessarily bad. Medicare fee-for-service providers, paid by CPT code, disproportionally fail to code a full patient's disease burden. This creates unfortunate long-term issues, and associated cost. For example, a large percent of patients that "crash" into dialysis without ever having a diagnosis of kidney disease. Risk-based coding like that used with MA helps catch these patients earlier. The patients with serious depression that is both uncoded and untreated is similarly scary. Here again, risk-coding helps. Similarly, providers simply failing to recode an active diabetic who they are treating may not directly affect outcomes, they are being treated after all, but the lack of data means it is harder to monitor these patients with secondary disease prevention measures (e.g., foot exams, eye exams) that their conditions warrant.

While the author of the above post has certainly cast light on an important issue, and I applaud him for doing so, alas, no system is perfect, I think MedPAC Chair Michael Chernew summed up the issue nicely in his Jan 25, 2024 interview with MedPage Today, “I believe the Medicare Advantage program has successfully changed patterns of care in ways that have reduced overall utilization. They have enabled plans to offer better benefits to beneficiaries, financed by the plans' efficiencies as well as the payments they've received. And there's a range of technical things -- changing the risk adjustment models, which we have already done -- and making changes to the quality bonus program. There's a lot of strategies one could take if one wanted to improve the balance of payments between Medicare Advantage and fee-for-service.” [2]

[1] Beneficiary Experience, Affordability, Utilization, and Quality in Medicare Advantage and Traditional Medicare: A Review of the Literature. KFF

https://www.kff.org/medicare/report/beneficiary-experience-affordability-utilization-and-quality-in-medicare-advantage-and-traditional-medicare-a-review-of-the-literature/

[2] Will All Seniors Eventually Have No Choice but Medicare Advantage?. MedPage Today

https://www.medpagetoday.com/special-reports/exclusives/108423?xid=nl_mostcommented_2024-02-02&mh=9ff565ecc8ff83ac5cbca5d23c29dc5d