The Healthcare Breakdown No. 041 - Breaking down Clover Health’s Adjusted EBITDA

Brought to you by dreidels

What we’re breaking down: Why EBITDA and especially Adjusted EBITDA aren’t great looks

Why it matters: These shenanigans can put peoples’ jobs and hard earn equity at risk

Read time: The time it took to fill out your bracket (8 minutes for real though)

Before we start the fun, since we are talking about public companies, this is not investment advice. If I had investment advice to give, I’d give it to myself. My portfolio is a hot mess.

All righty. Since you, like me, have lot’s of time on your hands and just wait for healthcare news to come across your doom scroll, you probably saw Clover Health’s recent earnings call. Or listened to it? Either way, you heard (read? ugh) that Q4 and FY 2023 were MUCH better than previous years.

As you also know, it exited the ACO REACH program to focus exclusively on Medicare Advantage.

Still, trouble abounds. Here’s how the stock has been doing:

Yeesh.

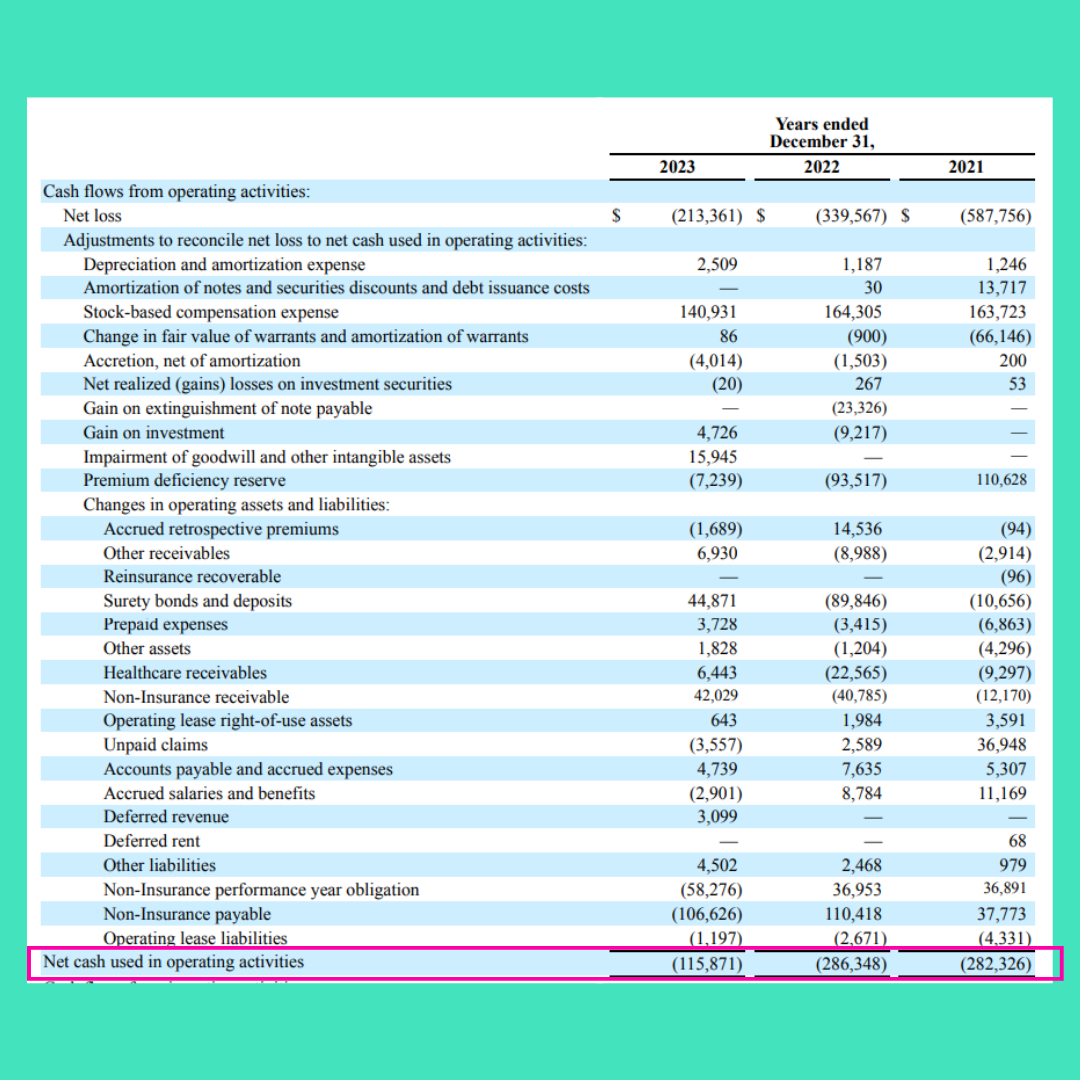

Meanwhile, here’s a glance at the books.

That’s a lot of scratch. And ok, there is a lot to talk about and unpack, but like I said, this isn’t investment advice. Just a quick look.

Clover Health loses a lot of money.

Interruption! Healthcare needs a revolution. It needs you.

But I get it, business can be intimidating. And when people say business they usually mean finance. I totally get it, numbers make it real.

Don’t worry! I made a course that explains all of it! So you don’t have to be intimidated anymore. Don’t let numbers and finance be the thing that stops you from creating the change you want to see and we all need.

Check out:

Healthcare Breakdown - The Finance Course!

Craft value props with numbers to sell more

Read and understand financials like a pro

Make better investment decisions

Manage your company’s finances

Build your own financial models

Go toe-to-toe with any CFO

In an afternoon.

There’s templates, jokes, and all kinds of good stuff in there.

You don’t have to avoid finance anymore. It’s cool.

And if you think about it and look at the other InsureTech missteps it makes sense. At least in my limited understanding of the world it does.

These are tech first companies that have waded into the messy world of healthcare. They saw the money to be made on new Medicare programs where they, with technology as the main mechanism, could control costs – translation: control people’s healthcare behaviors – and participate in that sweet shared savings, risk bearing pot.

The crux, which I am sure you caught, is that bolt on tech to manage behavior of one of the most complex psychological issues like getting healthcare coupled with the inane morass of the healthcare system is not easy.

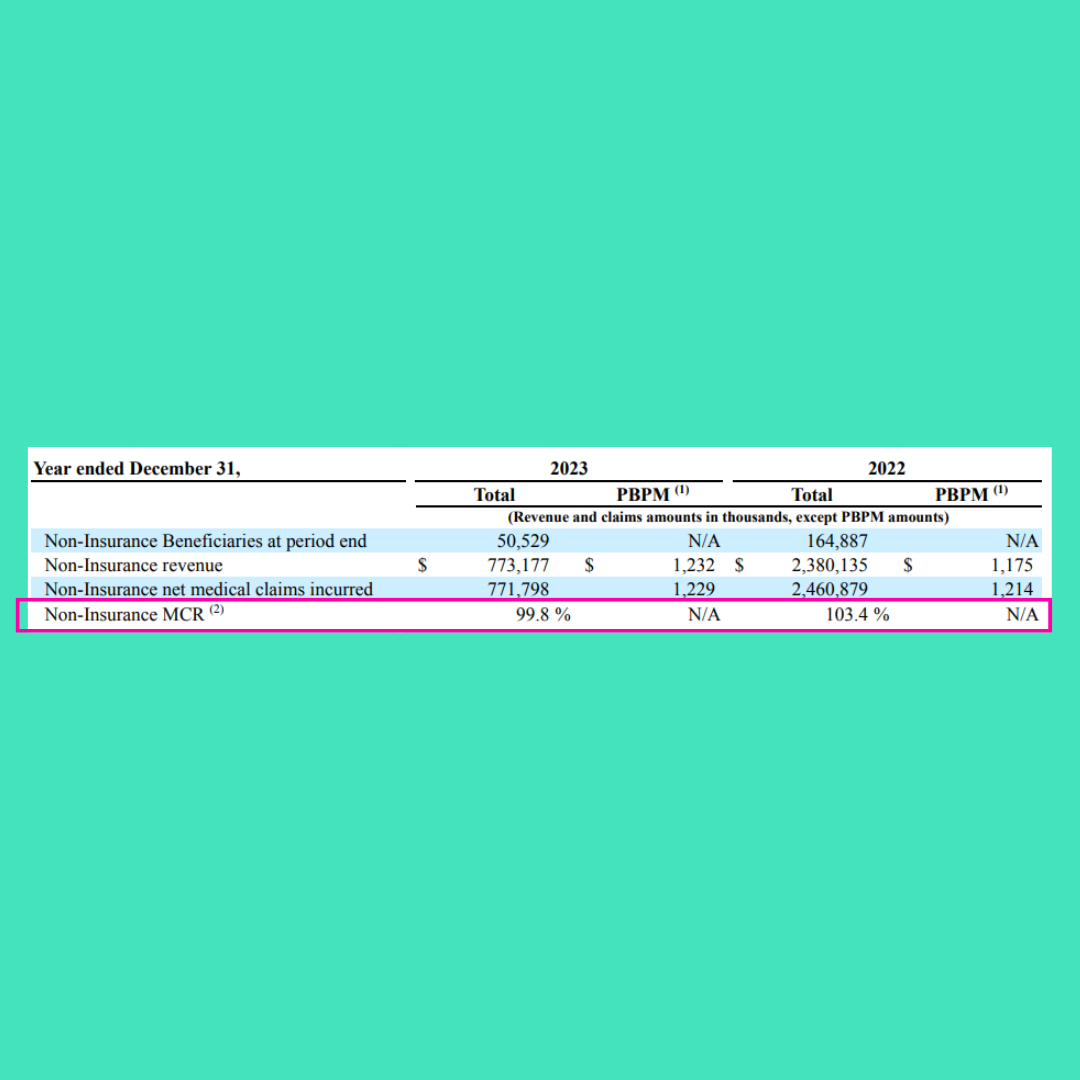

It’s why Clover Health’s Medical Loss Ratio (it calls it Medical Care Ratio) has been over 100% in recent years. It’s also why it exited the ACO market.

Here’s the last two years for the ACO operations:

But despite some obvious headwinds, burning tons of money, lack of infrastructure, and teetering on the edge of being delisted, things are looking up!

How do I know, well, look what the rags have to say about it:

That brings us to this adjusted EBITDA thing. And before we get there, let’s even just talk about EBITDA.

EBITDA stands for earnings before interest, tax, depreciation, and amortization. It’s supposed to be a quick back of the envelop method to get to cash or earnings from operations.

But, if you’re like Warren Buffet, and who wouldn’t want to be like him, you’re none too big a fan of it.

Here are his thoughts on the matter:

Trumpeting EBITDA (earnings before interest, taxes, depreciation and amortization) is a particularly pernicious practice. Doing so implies that depreciation is not truly an expense, given that it is a “non-cash” charge. That’s nonsense. In truth, depreciation is a particularly unattractive expense because the cash outlay it represents is paid up front, before the asset acquired has delivered any benefits to the business. Imagine, if you will, that at the beginning of this year a company paid all of its employees for the next ten years of their service (in the way they would lay out cash for a fixed asset to be useful for ten years). In the following nine years, compensation would be a “non-cash” expense – a reduction of a prepaid compensation asset established this year. Would anyone care to argue that the recording of the expense in years two through ten would be simply a bookkeeping formality?

Obviously he has a great point. But to be fair to us common folk, if you are looking at year-over-year cash flows and a company has made capital outlays in prior years, that’s not necessarily a bad thing and is often necessary. It doesn’t mean you’re in a bad business.

It’s not like See’s Candies never made capital purchases to make its delightful treats. Warren still likes that business.

But taken with all other wisdom of the Oracle, it’s never one thing. And when we only look at EBITDA, which glosses right over changes in working capital (the difference between current assets and current liabilities; i.e. the money you have available to invest in the business) and capital expenditure which include maintenance capex, you aren’t considering the real nature of the business.

Ok, boring finance jargon complete.

Now, for the even more malodorous cousin of EBITDA. If Warren is none too fond of EBITDA, he hates adjusted EBITDA.

And this metric is exactly why Clover Health feels its on the right path. Or at least is making you belive that it is.

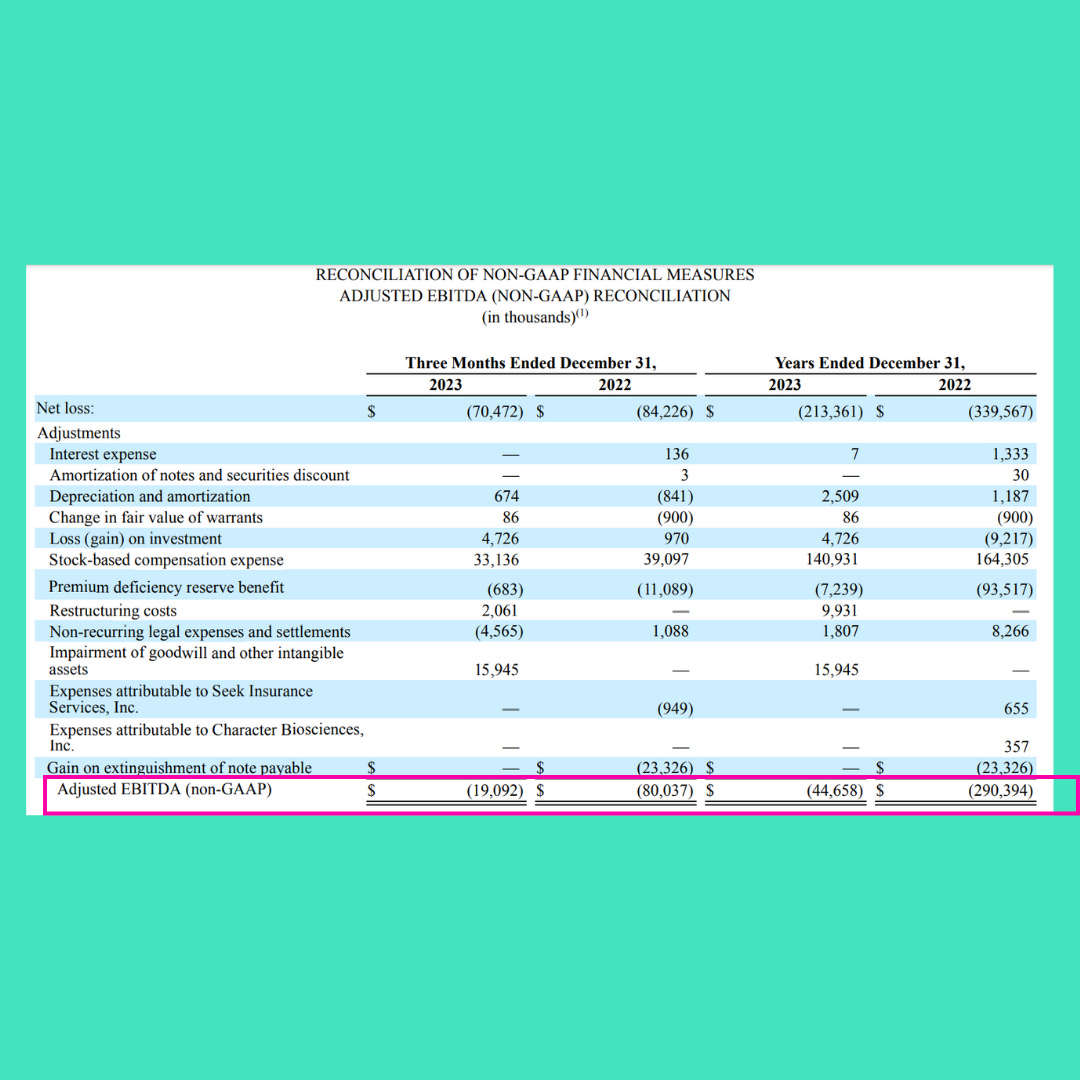

Here’s the jam:

So…

Q4 2023: Adjusted EBITDA vs. Net Loss is +269%

FY 2023: Adjusted EBITDA vs. Net Loss is +378%

I meannnnn…

Fine, let’s look at all the adjustments and why this is poppycock.

Disclaimer: lot’s of words coming your way…

Interest Expense – part of EBITDA. Ok fine, but you have to pay interest on debt, you took on to run your business. Why do we get to magically snap that away? It’s part of the business now.

Amortization of notes and securities – A small number, but still part of it. This is depreciation’s step brother and is the same deal but for intangible assets. See Warren’s wisdom on depreciation.

Depreciation and Amortization – Warren’s words.

Change in fair value of warrants – Warrants are rights to buy a financial security, but not an obligation. This looks at the change in value of the warrant which would be recognized as an unrealized gain or loss. I kinda get this one, but if we are looking at the total business, just like everything else we would take this into consideration upon valuation. Smudging these things out doesn’t always make total sense. But it will always depend on what you are looking for.

Loss (gain) on investment – same as above basically.

Stock based compensation expense – Ok, this one may get some heat. When you compensate someone with stock, technically (I guess) you aren’t using any money. The company owns that stock and can give it to employees. But, that means less stock to sell to raise capital. And, in finance land, everything costs something. So, just because you are using a lot of stock based compensation doesn’t mean it’s free. Again, all part of the business, operations, and financial value.

Premium deficiency reserve benefit – Insurance companies need reserves to pay for claims. Makes sense. They estimate and reserve money for this. When things are looking good, they release the money, which is an earning on the income statement. So, in this case they reduce the amount. But again, even though this is a reduction, I am not sure it fully tracks. The reserves are there as a CYA. When things are favorable you need less. And it is an integral and required part of the business. Why, then is it just whisked away?

Restructuring costs – This is like saying, “listen y’all, I know we have been sucking but we spent a lot of money to do what the consultants told us to do to suck less, so now we will suck less. You totally should not count that against us.” Um, yeah, I totally should.

Non-recurring legal expenses – Brah. You’re an insurance company, you will always have legal expenses. It. Is. Part. Of. Your. Business.

Impairment of goodwill and other intangible assets – Goodwill comes from buying other companies and sort of taking the brand value or the projected value of the company. We saw this example play out with a $13B goodwill impairment from Teladoc recently over the Livongo debacle. Clover didn’t have that big of one, but has had some acquisitions and determined that the value of them is essentially zero based on discounted cash flow analysis. So… you bought a business that turned out to be useless and had to take an expense because it came off you balance sheet assets and we’re supposed to look the other way… How do I reach these keeeeeeeddddssss???

Expenses attributable to… – The next two are earnings or losses from businesses Clover has interest in and would otherwise take distributions from or participate in the earnings. You don’t have control over that business, but you chose to get in bed with them and it still impacts your business. So, like deal with it homie.

Gain on extinguishment of note payable – Clover paid off some debt at less than the debt cost, so it “made” some money on the deal. Sort of like going to Target and buying a new sweater that’s $20 off, going home and telling your spouse that you made $20. That’s never happened to me by the way.

Well, in a nutshell, that’s why I think adjusted EBITDA is a bunch of bumpkis. This stuff is all part of the business. It just is and I feel like I’m taking crazy pills.

I’ll leave it with this… adjusted EBITDA is usually left out of annual filings and mostly talked about on quarterly earnings calls.

Quarterly earnings calls are for companies to tell a bunch of institutional investment analysts how good business is so they should start investing more or why business is bad, but no one should worry about it, it’s not the company’s fault and there’s a plan, so they should invest in it anyways.

It’s a sales pitch.

And when someone is selling hard, you should wonder why…

Go Zags.

Love you.

@preston your audience certainly appreciates the dismantling of the “healthcare pretenders” that disappoint us, before they invariably defraud their investors… it’s depressing to see so many “teams” fall… in the spirit of March Madness, would you consider publishing something slightly more positive? Perhaps your Sweet 16, the Elite 8, or just the Final 4- of companies that are improving outcomes combined with honest accounting? Thanks for all you do!