The Healthcare Breakdown No. 042 - Breaking down Walgreens’ value-based party, because it shopped at the dollar store, not because it’s crushing value-based care

Brought to you by Boots, they go on your feet or are a pharmacy in England

What we’re breaking down: Walgreens, VillageMD, and the thirst for VBC blood

Why it matters: VBC is maybe the most significant buzzword in healthcare and it’s sinking ships left and right

Read time: More than the time it takes to hear someone in healthcare mention value-based care in their investor pitch (8 minutes for real though)

Ground rules… this ain’t no deep dive into value-based care (VBC). Mostly because I’m not the man for the job. Also, it’s just a whole thing.

But to get the full picture we do need a minor context setting session.

Here it is: VBC is everyone’s favorite thing to talk about. It can mean a lot of things, but the most important thing is that it’s a different way of paying than Fee-For-Service (FFS).

In the FFS world you get paid when you do something. We presume that this has been a major culprit leading to the high cost of healthcare. Maybe. Probably. Who knows? The issue isn’t the financial models necessarily, but the philosophical approach of the profit driven entities left to be the puppet masters of healthcare. But that’s a different topic for another Sunday.

In contrast, VBC is about paying for value (whatever the heck fire that means… and don’t come after me with your quality/price equation. Robert Prisig wrote a whole book about going insane trying to define quality. I’m out).

Instead of getting paid to do stuff, you get paid for keeping people healthy. I guess. See, there are a million ways to define it. And really what we are talking about is spending less money. Because we know that healthy people cost less money.

But here’s the rub and why we can’t just brazenly say that FFS is the worst thing since unsliced bread.

I may or may not have had a recent conversation with someone from one of the big dog VBC organizations. And while I am usually one to put orgs on blast, this one seemed pretty sensitive so I am not for the time being. But anyways, this organization controls how often and quickly a patient can return for a follow up visit, irrespective of clinical opinion.

So, even if a patient needs to come back in a week, there are rules against it forcing them to wait even longer. That sounds potentially dangerous to me.

Valuable to the bottom line maybe, but definitely not healthcare.

Alright, so why then does everyone love this VBC schtick?

Well, theoretically, it’s the future. And it sounds great, right? Value is rad. Keeping people healthy is delightful. Spending less money is wonderous. But as always, and I know this is not a popular opinion but I’m a pirate dang it, it’s not going to work so long as the main interest is financial gain. Sorry, not sorry.

Wanna fix this mess? I want you to, too.

Don’t know where to start? Start here:

Healthcare Breakdown - The Finance Course!

Craft value props with numbers to sell more

Read and understand financials like a pro

Make better investment decisions

Manage your company’s finances

Build your own financial models

Go toe-to-toe with any CFO

In an afternoon.

There’s templates, jokes, and all kinds of good stuff in there.

Don’t avoid finance anymore. It’s cool.

Ok, Walgreens! Everyone’s favorite pharmacy chain. Just kidding, it’s CVS. Just kidding, it’s Kroger. Just kidding, no one cares. It’s about what’s close and convenient. Be honest.

What does Walgreens, the retail giant have to do with VBC? Over the last couple of years Walgreens has invested about $6.2B into VillageMD and now owns about 52% of the company.

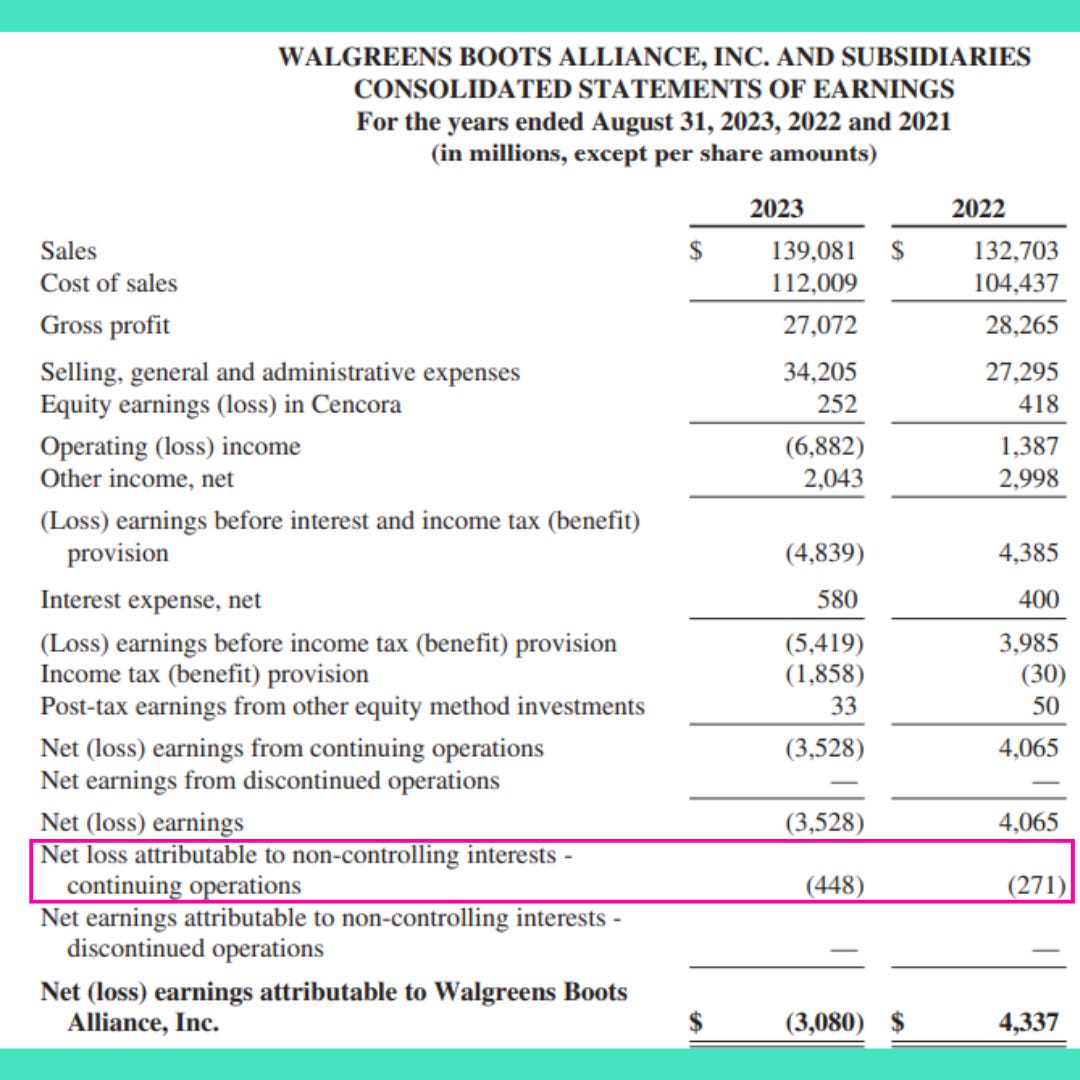

Since Walgreens is the majority owner, it consolidates VillageMD’s financials on its own financial statements. Meaning, if VillageMD makes $100, Walgreens reports that $100 as its income. But if you cruise down the income statement you will also see Walgreens decrease that amount from non-controlling interest.

Here’s an example since we’ve gone too long without a weird green box and pink rectangles.

Also, if the impact of consolidation is that VillageMD generates a loss, Walgreens will increase its final income based on its percentage ownerships.

Cool sauce. So here’s the deal peel. We’ve talked about Goodwill before and we’re going to talk about it again. Because the write downs are coming in hot from all these overvalued acquisitions, or poorly executed plans. Either way, in the case of Walgreens’ last quarter, it took a goodwill impairment to the tune of $12.4B.

Here you are:

Remember, although the impairment had to be expensed on its income statement, Walgreens didn’t expense the full amount because of its non-controlling interest. Essentially, it gets to back out about half of that expense.

Like a so:

Still, not great. Plus the decrease in assets.

Check check:

Annnnnd if you are also wondering why in the world Walgreens and everyone else thinks that value-based primary care is the answer to all our problems, here’s one idea:

"Walgreens Boots Alliance is graduating up from being a drug retail store to owning the life-cycle of members' health," [David Larsen] wrote in an analyst's note. "We view this transaction as being a statement by the market that primary care continues to be one of the key drivers of healthcare long-term."

Ok, maybe it’s not really about saving the world. Maybe it’s about owning the “life” of the patient.

If a patient is responsible for about $13,500 in healthcare spend, that spend is SOMEONE ELSE’S REVENUE.

If you own the patient, then that’s your revenue.

Shabang, I solved healthcare.

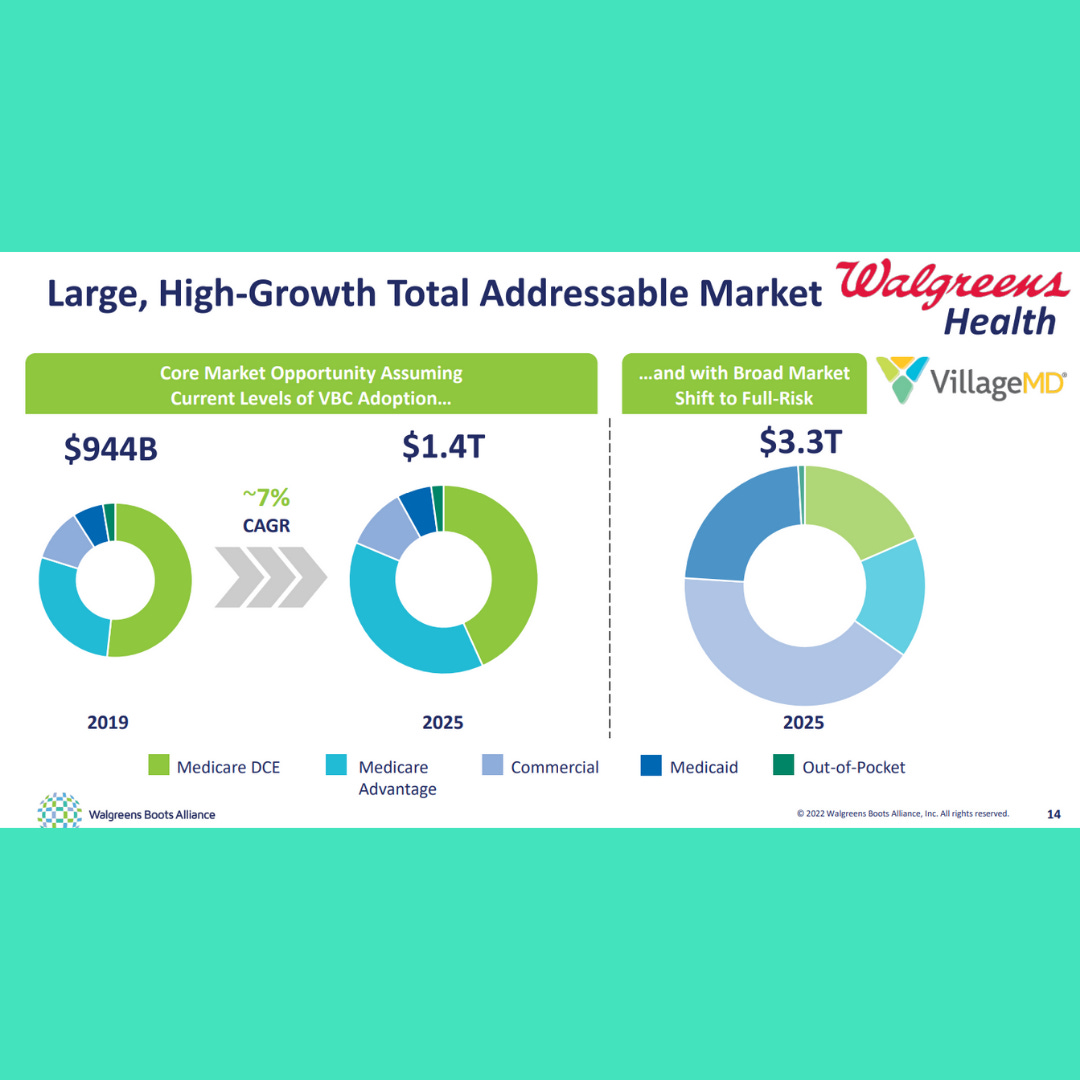

And if you listen to the likes of McKinsey, VBC will someday reach a $1T market. Annnnd if you listened to VillageMD at the JPM Healthcare Conference a couple years ago, its addressable market is $1.4T (projected 2025). It even went on to show in the same slide that if there is a broad shift to VBC, its addressable market is $3.3T.

And if I write and one more time you will probably stop reading this immediately because my grammar doesn’t even exist. I get it, it’s annoying, but also part of my charm. Like we’re just talking over a finely aged White Claw while the Era’s tour is on in the background.

Back to business. If someone is waltzing in saying its TAM is 73% of the entire healthcare market, ahem… no. Bye. So long, been real. That’s the ish that angel investors throw you out the door for.

But there is a different dynamic when dealing with the big players in VC and folks like Walgreens. They need to take big swings. They have tons of cash and need to put it to work. So showing them wild market sizes and opportunities is a pre-requisite. No matter how fanciful the actual capture of something like that may be.

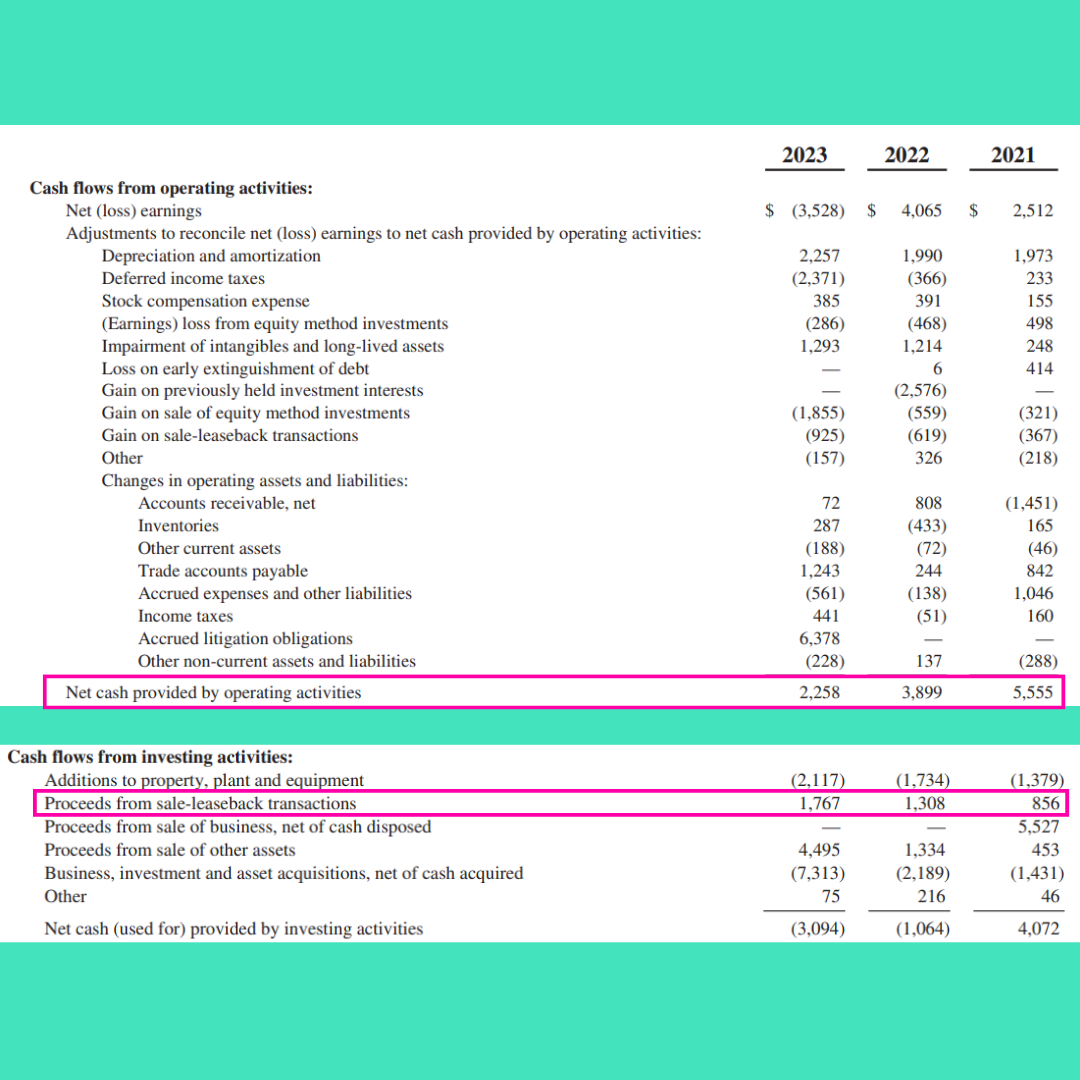

Just look at the cash its generated over the past 3 years. About $11.5B. It also made some scratch from sale leaseback transactions. Private Equity style plays.

With all this cash coming in it’s leadership’s job to allocate those funds to generate outsized returns. I can only imagine that this leadership was sitting around their 18 foot fine Mahogony board room table sourced from the far eastern shores of Java and thinking, “how do we take on the big dawgs out there? How do we catch CVS, get out of the just pharmacy retail, and go head to head in the healthcare battle?”

Oooooh!! I know! Value Based Care!! Everyone is doing it. And even other pharmacies. Just look at CVS which bough Signify for $8B and Oak Street for $10.6B. Not to mention Amazon which has a whole healthcare thing going on and bought One Medical for $3.9B.

And of course UHG, which owns Optum, which employs all the doctors.

But here is the rub. UHG and CVS are insurance companies. Well they exploit arbitrage, but you know what I mean. They control the purse strings. They aren’t just participating in VBC arrangements. They are paying for the VBC arrangements. Walgreens isn’t.

Oh by the way, can we talk about the fact that primary care is not a cash cow. Primary care is meant to facilitate health. To create and build relationships between doctors and patients. Long term, meaningful relationships.

I would hazard a guess that most people see VillageMD as little more than an urgent care. In fact, it bought an Urgent Care provider group for $9B.

While it may claim to have 1.6M patients, 346K of which are on VBC arrangements, I wonder how many are truly engaged, feeling like they have a meaningful relationship with a physician who knows them.

When you play to maximize profit, you aren’t going to build those long term, meaningful relationships. You are going to be a FFS model shrouded in VBC’s clothes. Limiting visits, narrowing networks, gate-keeping, prior-authing the crap out of everything, and not actually helping to improve health.

Because again, not to beat a dead horse, but just call me Jared from Subway from South Park, when you are a publicly traded entity your obligation is to maximize shareholder value. And that value equation sure as heck isn’t quality/cost. It’s Profit. And if your profit is based on a chunk of money that you get to keep what’s left after taking care of someone, then how do you plan to maximize profit? Reduce cost. And what is the cost? Someone’s healthcare.

Anyways, since this is supposed to be a funny periodical about financial things, not just my philosophical gripes with the macro systems that ultimately govern healthcare, let’s go a little deeper into what’s up with Walgreens and VillageMD.

It could be that Walgreens bit off more than it could chew. It could be that this VBC is not made for this profit driven world. Though you have to give the people credit for trying. It could be that Walgreens just doesn’t have the infrastructure yet to really make this thing work.

It should probably just buy Clover Health.

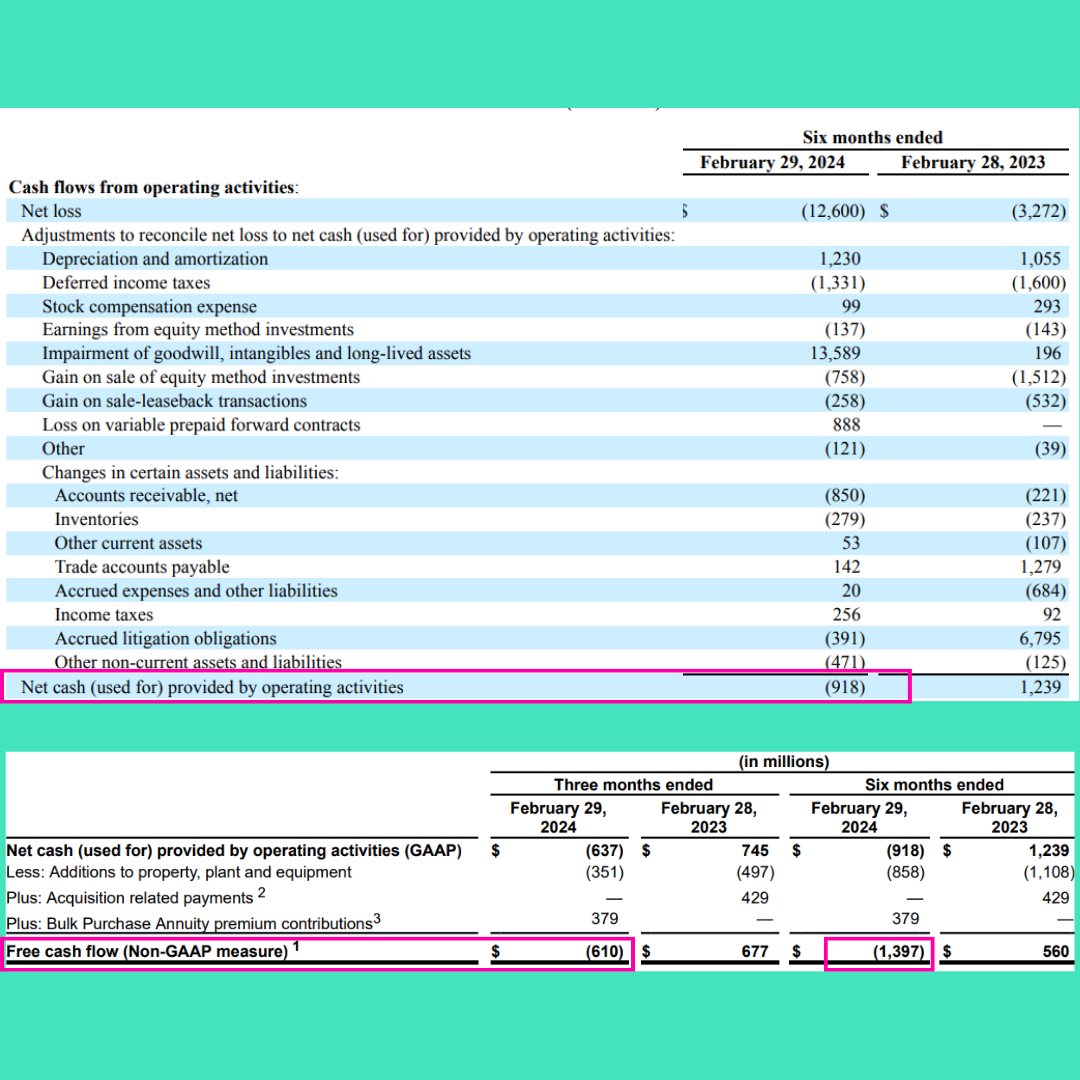

I mean cash flow and free cash flow (since it’s an asset heavy, capital heavy business) ain’t looking so hot recently.

Maybe becoming more fully integrated is a way to buy itself out of this mess. Or into a deeper one. But “owning a patients life” will certainly take more than playing at true primary care. The only other way is to force it like UHG and CVS has done, by literally owning the continuum. It also makes me want to hurl.

All right y’all this is getting long and I need to go catch up on what’s been going down with this whole Kardashian drama. Apparently Kim is a lawyer now? I mean, all right, get after it.

Peace up, A town down. See you next season.

It’s about the cost of specialty care not primary care

It gets even more muddy when you step into the behavioral healthcare lane. Talk about a wrong pocket problem! No innovative intervention in the world that a behavioral health provider can deliver will get them a big enough piece of the VBC pie. They’re saving money for someone else. Until we solve for that at scale we will never see VBC on the behavioral side and sadly fee for service is not sustainable, so here we are 😕