The Healthcare Breakdown No. 043 - Breaking down Hims’ really big CAC

Brought to you by me failing at not being a child and making way too many inappropriate jokes (please don’t unsubscribe)

What we’re breaking down: Hims & Hers flirting with profitability and the importance of understanding marketing metrics

Why it matters: Direct To Consumer (D2C) healthcare came and went, then came back… it’s also maybe the answer to some of our woes

Read time: The amount of time you spent listening to Taylor’s new album (6 minutes for real though)

Hims & Hers took the digital health world by storm when it launched in 2017 and then went public 4 years later. If you want to see what an actual professional has to say about this topic and the inspiration for this issue, check out Yoav Fisher’s article here.

He’s rad. And is doing all kinds of cool stuff with innovation in Israel. Hit him up!

I wanted to take a different spin, and talk about why this matters to clinicians looking for alternatives to going to work for Optum. Or staying at the hospital. Or deciding they should be a passive real estate investor. Whatever the heck that means.

But don’t hang up the phone yet if you’re say a healthtech investor or entrepreneur bullish on the D2C space. This one’s for you too.

First, what is Hims & Hers? Without boring you even a little, Hims helps you get your rocks off, have a hairline like Patrick Dempsey, look dapper any time of year, and get rid of that silly worry brain (also known as anxiety… silly worry brain is a technical term).

Check it out:

Gotta love the simplicity. Especially important considering this is D2C.

Hers takes a similar approach but for the ladies.

Good sex, better skin, weight loss, kick the depression and anxiety to the curb, and have hair fuller than Julia Roberts. What’s not to love?

On to what we’re all here for, the innuendo. I mean the performance. Not that kind. The financial kind. Focus.

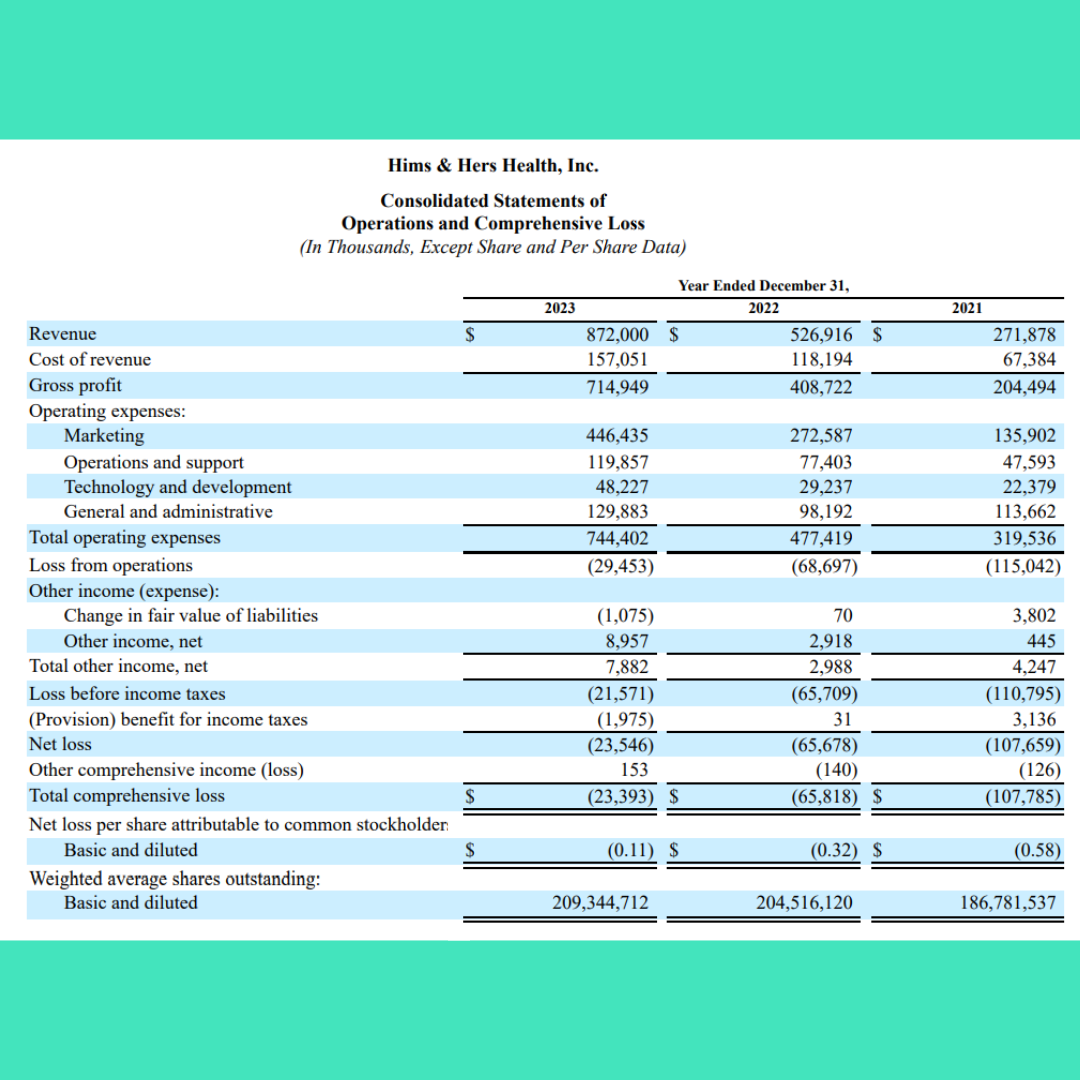

Here’s full year 2023 results:

As you can see, bringing in $872M in revenue and narrowing the net income loss to ($23M). Getting closer. Closer. Closer…

But the big money shot comes from Q4 2023: Can I say that on tv?

Positive net income to the tune of $1.2M!

Some other metrics you will most certainly be interested in are some good old fashioned marketing metrics. These are the foundation of how Hims & Hers has gone from burning cash to actually keeping it.

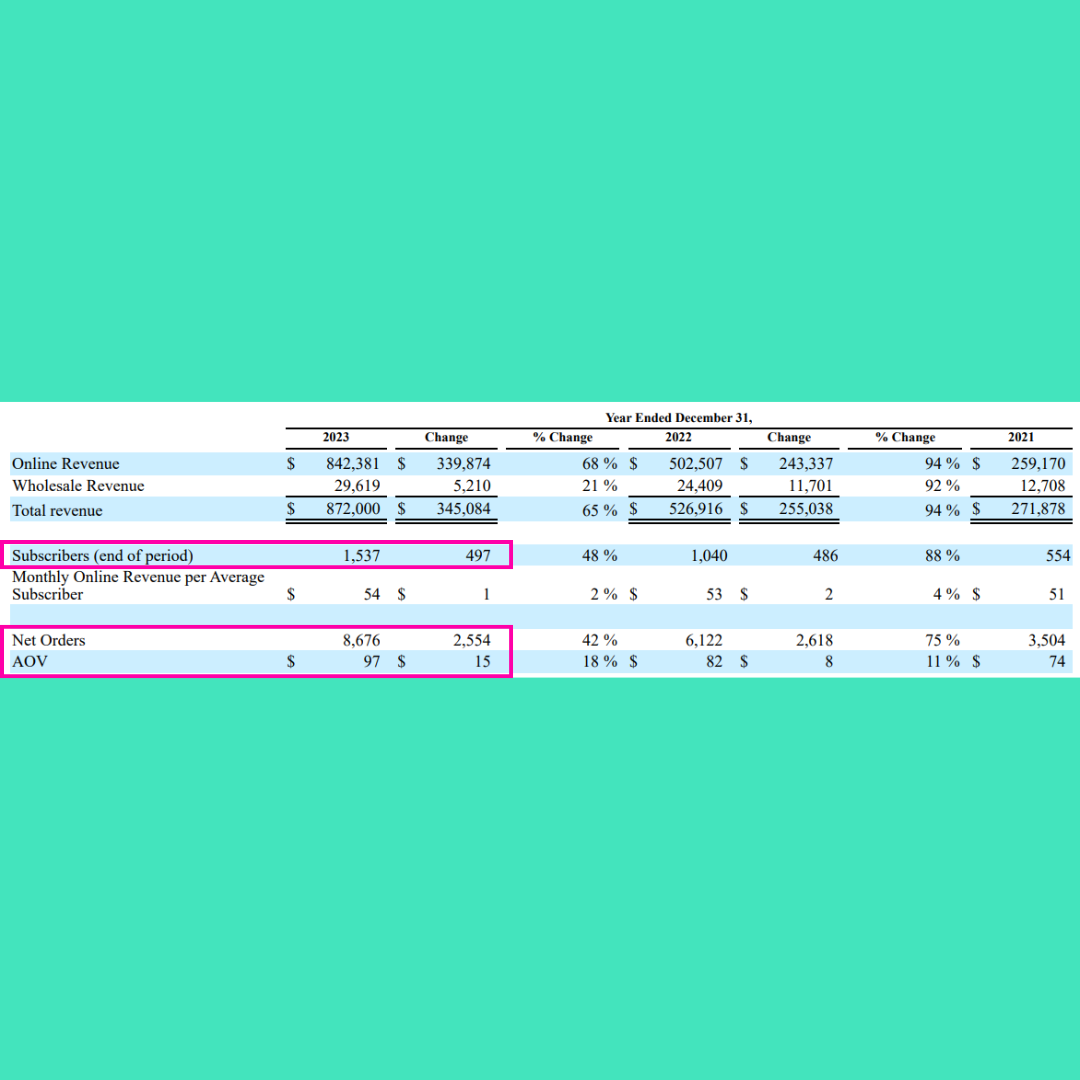

The first levers are here:

We see fairly sizable (even though everyone knows it’s not always about size) growth in total subscribers, clocking in at 1.5M at the end of the year. Up from 554K at the end of 2021.

There’s also been growth in Net Orders and AOV (Average Order Value). Monthly online revenue per average subscriber has stayed relatively flat.

Growth in AOV, growth in Net Orders, and growth in Total Subscribers. Looks like what Hims sells really does work.

See what I did there?

But this isn’t the whole story and we still haven’t even touched on customer acquisition costs. Don’t worry, it’s coming. All about the build up after all.

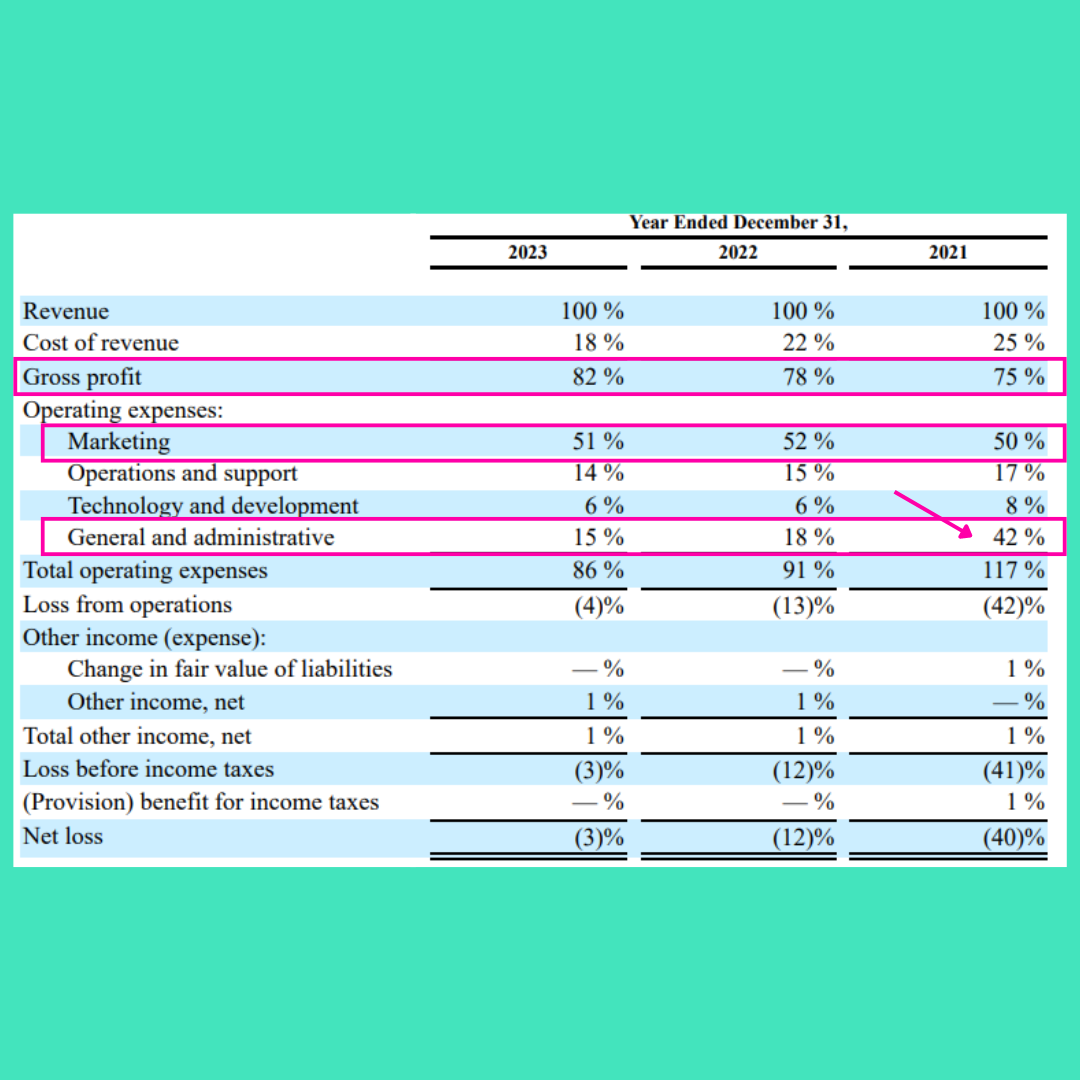

Next, take a look at the percentage of revenue of various costs and profit metrics from the past three years:

Improvement in gross margins, controlling an out of control G&A from 2021, and essentially flat marketing as a percent of revenue.

My takeaway here is that while marketing spend is high, it’s not increasing as a percent of revenue. That means, Hims and Hers has tapped into its target customer base and is marketing to them effectively. They know how much they need to put in to get a certain amount out.

Curious how well they look at marketing metrics? Here’s what Hims & Hers has to say about it:

“We have built our team and systems to measure consumer behavior, including which types of consumers generate more revenue in their first purchase, generate more revenue over time, generate more gross profit from their purchases, and which types of consumers are most valuable over their lifetime. We also rigorously measure the effectiveness of our marketing budgets and the rate of return we generate from our marketing campaigns.”

The company that is going to win the D2C space is the one who can spend the most, profitably. And Hims & Hers is lazer focused on figuring out how to do that.

Because look, it’s actually simple. You want your cost to acquire a customer to be less than you make from that customer in profit over the customer’s lifetime.

And in 2023, Hims & Hers spent $390.3M on customer acquisition.

To calculate the customer acquisition cost (CAC), we are just going to look at subscribers. You have to subscribe for prescriptions and it’ll be the best proxy for a “customer.” There are for sure more customers since not every customer is a subscriber, but unfortunatley I don’t have that level of detail.

We can look at total subscribers at the end of 2022, which was 1.04M users. At the end of 2023, it had 1.537M.

Taking the difference, Hims acquired at least 497,000 new customers in 2023.

Dividing the acquisition spend of $390M by 497K we get a CAC of $784.70.

Alright, that may seem high to you, but let’s check that margin again. Hims is running an 82% margin. Its AOV is $97. That means on each order it nets $79.54. That’s obviously less than the CAC, but remember the lifetime value (LTV) of a customer includes multiple purchases over time.

I mean listen, you don’t have the best night of your life with a full head of hair and then just cancel your membership. It’s a sticky business. If you know what I mean.

So if these numbers were the whole story (which they are not), Hims & Hers would be aiming to retain customers for at least 10 months to make that acquisition profitable.

Ok, what does this have to do with the independent and/or budding clinician entrepreneurs of the world?

Three things.

First, it’s important to understand all the financial levers available. And it all starts up top with gross margin. Or contribution margin if you’re into that sort of thing. And if you’re not, I know where you can get a pill for that. Mint flavored.

If you don’t know where to start with these levers, calculations, P&Ls, cash flows, and business financial operations, check out Healthcare Breakdown - The Finance Course! We go through it all so you can get the fundementals down and be a business wizard in no time.

Second, there is still hope for D2C in healthcare. In fact, two sub bullets here. (A) my friend Seth just opened my eyes to the fact that D2C isn’t a whack term applied to healthcare. It in fact makes sense as we are all consumers before we become patients and after again. We spend most of our time as consumers and there is a massive opportunity to address consumers before they become patients.

Sub bullet (ii), D2C is in fact what happens all day, every day, in traditional healthcare already. Opening a new primary care clinic? You aren’t selling to employers, you are reaching out to patients directly. Ortho practice? Same. Patient advocacy? Home Health? A good old fashioned hospital? All direct to the consumer/patient.

I mean, I see like 70 Insta ads a day, that start with, “Hey chiropractors, do you need more patients…” Yeesh, get a new hook bro.

D2C isn’t necessarily a paradigm shift in healthcare. It’s just that it is challenging to interrupt the traditional flow of the healthcare continuum and the paths we have worn when illness or issues inevitably find us.

Third and final, once you understand the relationship between CAC and LTV, it’s game, set, match made in 7-minutes of heaven. You can even go beyond and really geek out to understand which customers are most profitable, how to increase share of wallet, when to best target for buying decisions, if first purchases will lead to more profitable lifetime customers, and more.

You’ll need stamina to get through it all, but I know a company that can help.

Tortured poet out!

This was very well written and researched. Thank you!