The Healthcare Breakdown No. 050 - Breaking down the discount card race to the bottom. It’s Part IV of the PBM series! Discount cards

Brought to you by definitely not GoodRx

What we’re breaking down: How GoodRx (and all discount cards) work

Why it matters: You’ll see

Read time: Dominos delivery in the 90’s (7 minutes for real though)

I know. I know. We’ve been talking about PBMs a lot. The news, in fact, has been talking about PBMs a lot.

I told you I was a serious journalist. Take that high school teachers who gave me bad grades on my book reports.

But stick with me. Don’t just mark this as unread in your email and then delete it after not reading it for 3 weeks. It’ll be good, promise.

Today we have no sponsors so we’ll just jump right in.

By the way, you or your friend should totally sponsor this newsletter cuz it’s super cool and you’ll totally get business. Press this button to fill out the form.

Ok, that was a word from our non-sponsor.

Today we are going to address the elephant in the pharmacy room: The discount card. More specifically GoodRx, since it is the dominant discount card on the market.

It’s obviously the yellow branding. It’s also because it saves people all kinds of dollars on prescription drugs. Amazing right?

Wrong!

Well, I mean it is great when someone can actually afford their medication which they otherwise would not have been able to because they are either uninsured or have a poo face plan that makes them pay too much money for their Cialis.

But there are two things I would like to say. First, GoodRx should not HAVE to exist. If our system was designed in such a way that delivered healthcare and supported the healing of people in a way that did not seek to maximize profits through utilization of the system, then it would not need to be a thing. Because PBMs wouldn’t be a thing and mega insurance carriers would also not really be a thing. Nonetheless, we are not here to talk about my Bernie Sanders issued mittens and tin foil hat. We are here to talk about PBMs.

Secondly, GoodRx, not from an individual saving on an individual prescription perspective – that perspective is cool, I like it… No, the other perspective is that of the independent pharmacy that is getting hurt by GoodRx and ultimately the PBMs.

You see GoodRx is great and will totally save you money until your pharmacy closes because it keeps losing money by being forced to work within this broken ecosystem.

Here's how it all works.

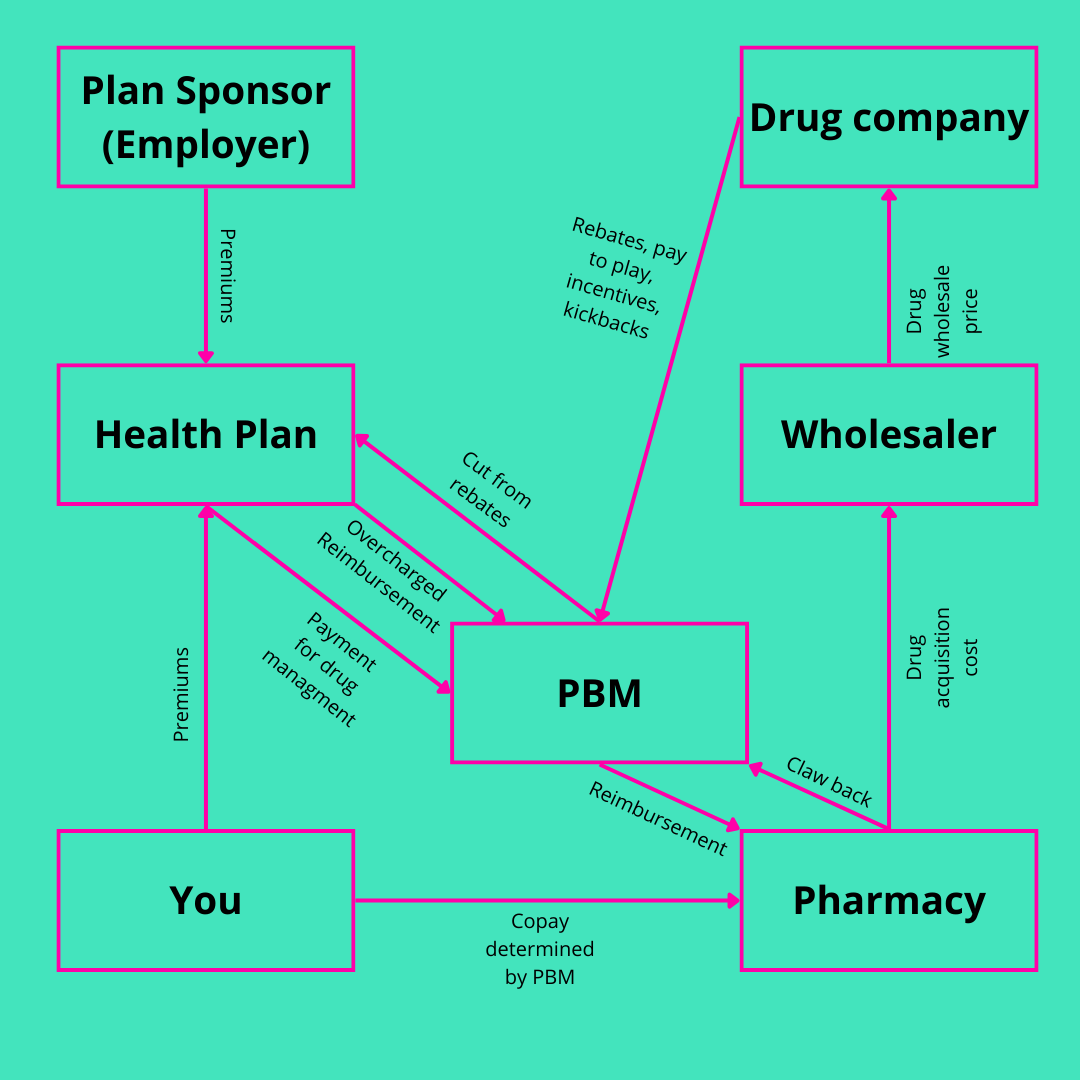

Remember this awesome image:

It’s a little nutty to add another box in there, so we’ll break out the discount card money and data flow seperately.

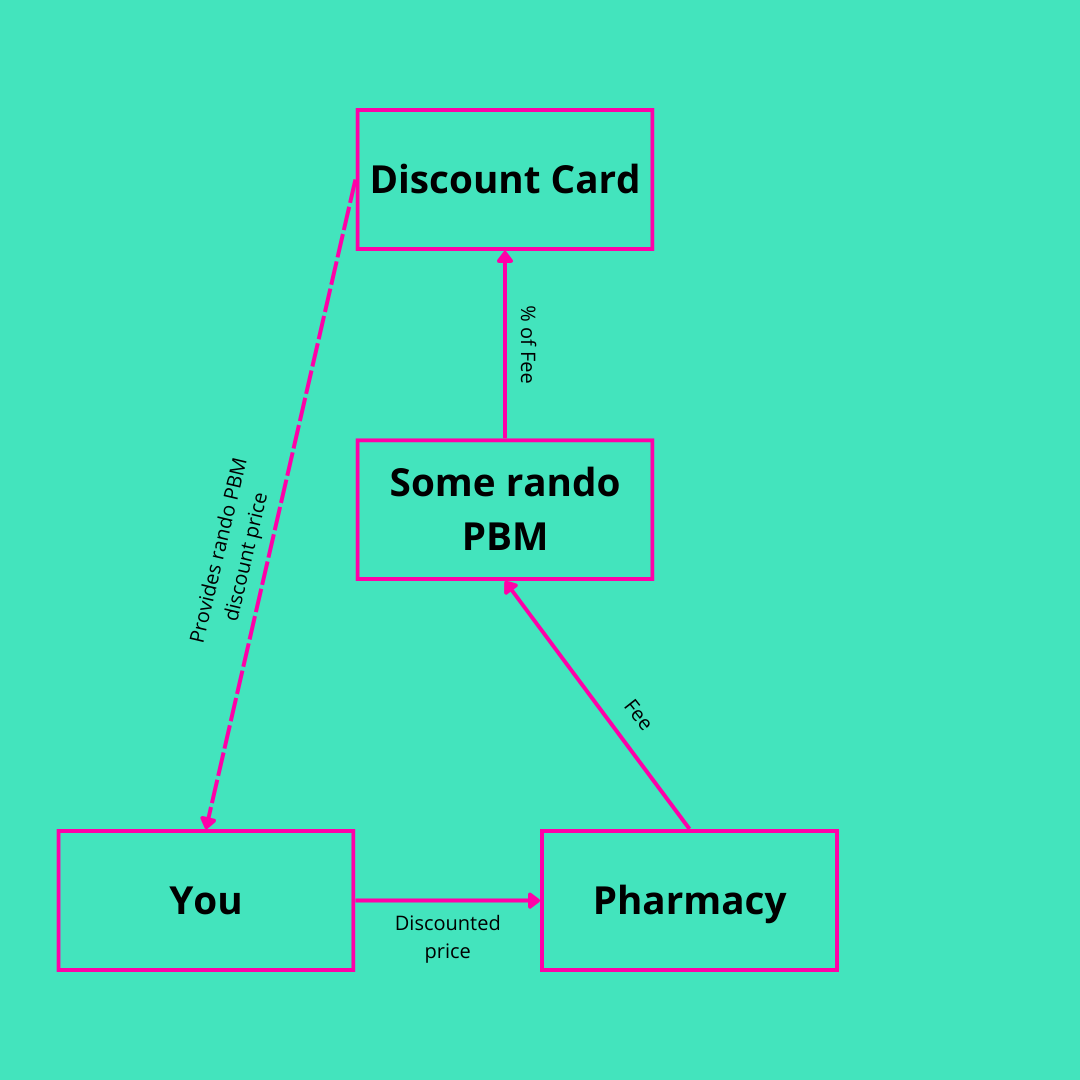

Here we are (Dotted lines represent information flow. Solid lines represent money flow):

Now, let’s see what’s happening here, Maui. Sorry Moana reference just snuck in. I have kids, ok!

When you, the patient, goes to fill your prescription, your friendly neighborhood pharmacist tells you that it’s going to be $98. You’re like, say huh? That’s crazy expensive. Then you ask what the cash price would be.

They wouldn’t tell you since they aren’t usually allowed to after you flash that fancy insurance card, but the cash rate is even more. See, pharmacies have to play the same dumb games that hospitals play. We all know and hate the chargemaster, which was written in fairy tail land. Pharmacies use the same Narnia math to determine inflated cash prices.

Listen, it makes sense. No one wants uncle insurance carrier to come to the negotiation table and see that you have been charging $15 when they have been reimbursing $25. Say goodbye to ten dollars.

So then you say, what about this yellow discount card thing I have been hearing so much about? Pharmacy Jim rolls his eyes and then tells you that’ll be $13.

Woah! Jackpot! Now you don’t have to die from your cholesterol being too high.

What you don’t know is that now Jim just lost money on that sale. Because he is taking GoodRx, he now only makes $13 in revenue on a drug that he paid $8 for. Factor in all the costs and overhead and he’s probs underwater. Not to mention the fact that he is also going to pay like $3 back to the PBM for the good privilege of taking GoodRx. The PBM then throws some money over to GoodRx for hooking them up with a patient.

And don’t get it twisted. It’s their patient. Despite you paying cash, this is a PBM claim. GoodRx is a data aggregator for existing pharmacy networks. You’re now in the system man. On the grid.

That’s where all this gets squirrely. GoodRx is theoretically doing a great thing. It accesses cash rate, discount pricing from all the PBMs and then gets the pharmacy to give you that price. The problem is everyone wins until the pharmacy is squeezed so much that it goes out of business.

Now, imagine that the you went in, had different insurance and a different PBM and Jim rang you up and told you that your cost was $13. Well look at that. Just so happens that you are a member of the PBM that GoodRx directed you to in the first scenario. In this case, instead of Jim also needing to pay the PBM a fee, the PBM actually pays the reimbursement rate of $13 plus a $2 dispensing fee.

Look at that. Seems like a better deal for ole Jimbo. And you to boot.

The other thing that’s going on here is that the PBMs have seen the writing on the wall and like this GoodRx thing. As a result, they aren’t just hooking up GoodRx with data and then charging pharmacies a fee to pay GoodRx with. They’re partnering to access the GoodRx network.

At the end of the day the PBM is just the pharmacy version of medical benefits. They have a network of treatments and treatment distribution, negotiate rates, and then use your premiums to pay for those treatments while keeping as much as possible. It’s in their benefit then to access lower costs and just collect on the fees.

Here’s how that banana-rama goes.

Picture first (same drill on the dotted versus solid lines):

You go to the pharmacy. You have CVS Caremark. CVS taps into the GoodRx network and finds another PBM with a cheaper price. You get the drug for that cheaper price. That price is a discount rate from the second PBM, which you pay as a copay. The copay is applied to your deductible. But since this is a GoodRx rate, the pharmacy is now on the hook for a fee back to the PBM. The PBM then splits the fee between GoodRx, itself, and that rando that got invited last minute.

Now, in this crazy world, you don’t even need to opt to use GoodRx. It gets used for you. The PBMs are also making money for doing literally nothing at all. The health plan doesn’t even lift a finger in this case. But you can be sure the plan sponsor isn’t enjoying any of those bogus fees.

Again, that can be great for you. Lower costs and all. Yay.

But from the pharmacy perspective it’s a rough deal. Now the pharmacy doesn’t even know when it’s going to get hit with additional fees. Lower payment and more fees. That doesn’t sound like a recipe for strong financial performance.

Here’s the TL;DR

GoodRx and discount cards are cool for patients, but generally screw over pharmacies, especially small independent ones.

PBMs are still in the driver seat, determining the fees and the prices. They have opted to embrace GoodRx since it enables them to make money doing nothing at all.

GoodRx is a front door to aggregated pricing data. It’s value is in its brand and current market position. We’ll see how long it’s defensible.

Thus concludes our romp down PBM lane. The next issue is going to be a super special one. I won’t give away too much detail, but you should totes read it.

In the meantime you can catch me watching the summer Olympics enjoying the French way of life. That’s right in honor of the Olympics I will be watching hard working dedicated athletes while drinking mimosas, wine, and bread and cheese. What’s more French than that?

See you out there!

Are you familiar with the direct care model where physicians are dispensing medication’s directly from the wholesalers right from their office for up to 95% discount?