The Healthcare Breakdown No. 051 - Peeling back the opportunities in Healthcare: Try DPC!

Brought to you by: Healthcare Huddle

What we’re breaking down: How to save money on healthcare without sacrificing your sanity, and why direct primary care is the unsung hero of affordable healthcare.

Why it matters: Healthcare costs have been on a wild roller coaster ride, leaving patients feeling like they're strapped into a rickety wooden cart. Choosing and navigating traditional insurance plans can feel like trying to untangle a ball of yarn with mittens on while blindfolded. Let’s face it: healthcare shouldn't be a circus act.

Read time: Less time than it takes to reheat last night's leftovers under a hair-dryer (10 minutes for real though).

Before we get into it, just wanted to share something AH-mazing —the Healthcare Huddle newsletter is perfect for healthcare providers like physicians, nurses, APPs, and students to stay updated on the industry.

The weekly newsletter is packed with digital health insights, policy updates, and business trends. Written by Jared Dashevsky, a resident physician in NYC, the content offers a unique physician perspective.

Join 30k+ health professionals already ahead of the curve.

Subscribe now here. Or with this shiny button:

Now, on to the show! And this is a special show, because I, am but the messenger. The episode of actionable and action packed optimism is written by my good friend, Mr. John McCluskey.

John has had a front row seat to health plan building and administration, so it’s safe to say, he knows what he’s talking about when it comes to cost and quality. He’s also just down right cool, incredibly knowledgeable, and pretty savvy with the dad jokes.

Without much more ado, cuz you know I like to type ramble… Here’s John!

Ever felt like your health insurance plan was giving you the runaround? You're not alone. We've all been there. The truth is, healthcare costs can feel like one big, slippery slope. But fear not! We're here to help you navigate this crazy world and find a healthcare strategy that won't break the bank.

Why This Matters:

Studies show preventative care and primary care visits reduce emergency room visits and decrease hospitalizations, but many patients choose to avoid preventative medicine and do not have a primary care provider they see regularly because healthcare costs are leaving many patients feeling like they're on a one-way ticket to Brokeville. Let's break it down:

The Numbers Don't Lie: Healthcare costs are soaring higher than a kite on a windy day. Insurance premiums are through the roof, deductibles are out of control, and patients are left holding the bag for the foreseeable future.

The research group PricewaterhouseCoopers (PwC) is projecting an 8% year-on-year medical cost trend in 2025 for the Group market and 7.5% for the Individual market, driven by inflationary pressure, prescription drug spending and behavioral health utilization and historically averages around 5-7%.

The overall annual average cost per employee increased to $15,290 in 2023, an increase from $14,624 the previous year. The total cost per employee varies depending on several factors that include participation of dependent, spousal coverage and types of health benefits offered.

A survey conducted by the Survey Income and Program Participation (SIPP) estimates that people in the United States owe at least $220 billion in medical debt. Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000.

This System is Broken: The current healthcare system is like a tangled ball of yarn with no end in sight. Insurance companies, providers, and patients are all pulling in different directions, leaving everyone feeling lost.

With a proliferation of benefits structured around High Deductible Health Plans (HDHP), Individual Health Reimbursement Arrangements (ICHRA), Health Reimbursement Arrangements (HSA) and Health Savings Accounts (HSA) can make it difficult to know what the best strategies are to provide meaningful health insurance benefits that create real value and savings.

The Affordable Care Act (ACA) attempted to provide coverage for workers in the United States by mandating that large employers with over 50 employees working at least 30 hours provide some basic levels of coverage or face fines for noncompliance. This brought a new generation of bare bones health plans to the market that typically only cover mandated preventive services and have yet to help provide affordable health coverage.

The Human Cost: The financial burden of healthcare is taking a toll on people's lives. It's like trying to juggle work, family, and medical bills all at once.

Many agree that healthcare costs are out of control and the burden of providing meaningful benefits is getting further out of reach. Look no further than the pending lawsuit from former employees at J&J or Wells Fargo who are suing their former employers for what they believe is mismanagement of their healthcare benefits and not passing along rebates and other discounts they received from their Pharmacy Benefit Managers (PBMs) to their employees, specifically around prescription and rebates. The outcome could have a far reaching impact on the future of how employers and employees provide and obtain health benefits. So what's a constant or true north when thinking about health benefits? The fact that humans need quality, cost effective healthcare. Let’s take a closer look at how healthcare is obtained.

The Rundown: How We Got Here

Imagine healthcare as a complex game of telephone, where information gets lost in translation and everyone ends up speaking a different language.

1. Benefits Gone Wild: Companies offer a dizzying array of health insurance options, leaving employees scratching their heads.

KFF.org reports as of March 2023, 60.4% of the non-elderly, or about 164.7 million people, had employee sponsored insurance (ESI). Of these, 84.2 million had ESI from their own job, 73.8 million were covered as a dependent by someone within their household, and 6.7 million were covered as a dependent by someone outside of their household.

2. The Gatekeepers: These folks decide what treatments are covered and how much you'll pay. It's like trying to get a straight answer out of a politician.

Typically these payers are administrative service organizations (ASO) in fully insured arrangements or Third Party Administrators (TPA’s) for self funded employers who are responsible for things like paying claims, answering phones and other administrative aspects managing a health plan.

According to the research from the Health Affairs Forefront article, administrative spending accounts for between 15 and 30 percent of medical spending.

Healthcare Consumers: Caught in the Middle: Doctors and hospitals are trying to do their best, but they're often handcuffed by insurance red tape.

According to Debt.org the average family of four with health insurance in 2023 paid $31,065 in medical expenses, including insurance premiums, up from $28,310 in 2021. Those without insurance often must make choices between getting healthcare or paying bills.

Debt.org continues to say the cost of a doctor visit is hard to quantify because there are many factors that go into what the final bill is. The average cost of a doctor visit, not including procedures or tests, ranges anywhere from $80-$170 across the U.S.

It's me, hi, I'm the problem, it's me: Misaligned Incentives & Information Overload

The current healthcare system is like a three-legged race where everyone is pulling in different directions. Insurance companies want to maximize profits, providers want to deliver quality care regardless of cost, and patients just want to be healthy but not have to choose between housing and medical bills and food. It's a recipe for disaster.

The MRI Maze Example

Mr. Thompson had a headache and went to see Dr. Evans. Dr. Evans thought it was stress, but to be sure, wanted to order an MRI. But first, Dr. Evans had to get okay from the insurance company. Mr. Thompson didn’t know how much it would cost, but wanted to feel better. The insurance company (plan design) dictates if a prior authorization is needed, how much the plan will pay and how much Mr. Thompson’s financial responsibility will be, which could cost thousands of dollars and puts everyone in a tricky position to evaluate the best path forward.

Building Trust: Doctors vs. Insurance Companies

Let's be honest: you probably trust your doctor more than your insurance company. It’s like choosing between a trusted friend and a used car salesman. What about the payer “insurance company”? Their main focus is managing risk and keeping costs down, not always directly translating into the best care for you as seen in the example with Mr. Thompson. You don’t have to look far for examples of how this impacts each of us. Just ask Dr. Jerome Adams, MD, MPH, the former Surgeon General who ended up with a $5,000 medical bill for an emergency room visit. So how do we move towards cost effective solutions that are making a difference? It is important to note there are times when urgent care and emergency room visits are appropriate however there are other instances where other options are extremely beneficial.

Healthcare Opportunity: Options You Will Enjoy:

Enter Direct Primary Care (DPC). It's like finding a hidden oasis in the desert. DPC offers a refreshing alternative to traditional healthcare, with a focus on prevention, personalized care, and affordable pricing.

Direct Primary Care (DPC): Your Doc on Speed Dial

Imagine having a doctor you know and trust, accessible 24/7 (well, almost!). DPC practices can offer a flat monthly fee for primary care services typically ranging between $70-$80 that include preventive care. This fosters a closer relationship with your doctor and potentially cuts out unnecessary costs.

According to a National Association of Community Health Centers NACHC report it is estimated that more than 100 million people in the United States don't have a primary care provider, and about a quarter of those are children.

The lack of an established primary care can significantly impact the amount consumers spend when needing healthcare along with preventable healthcare issues.

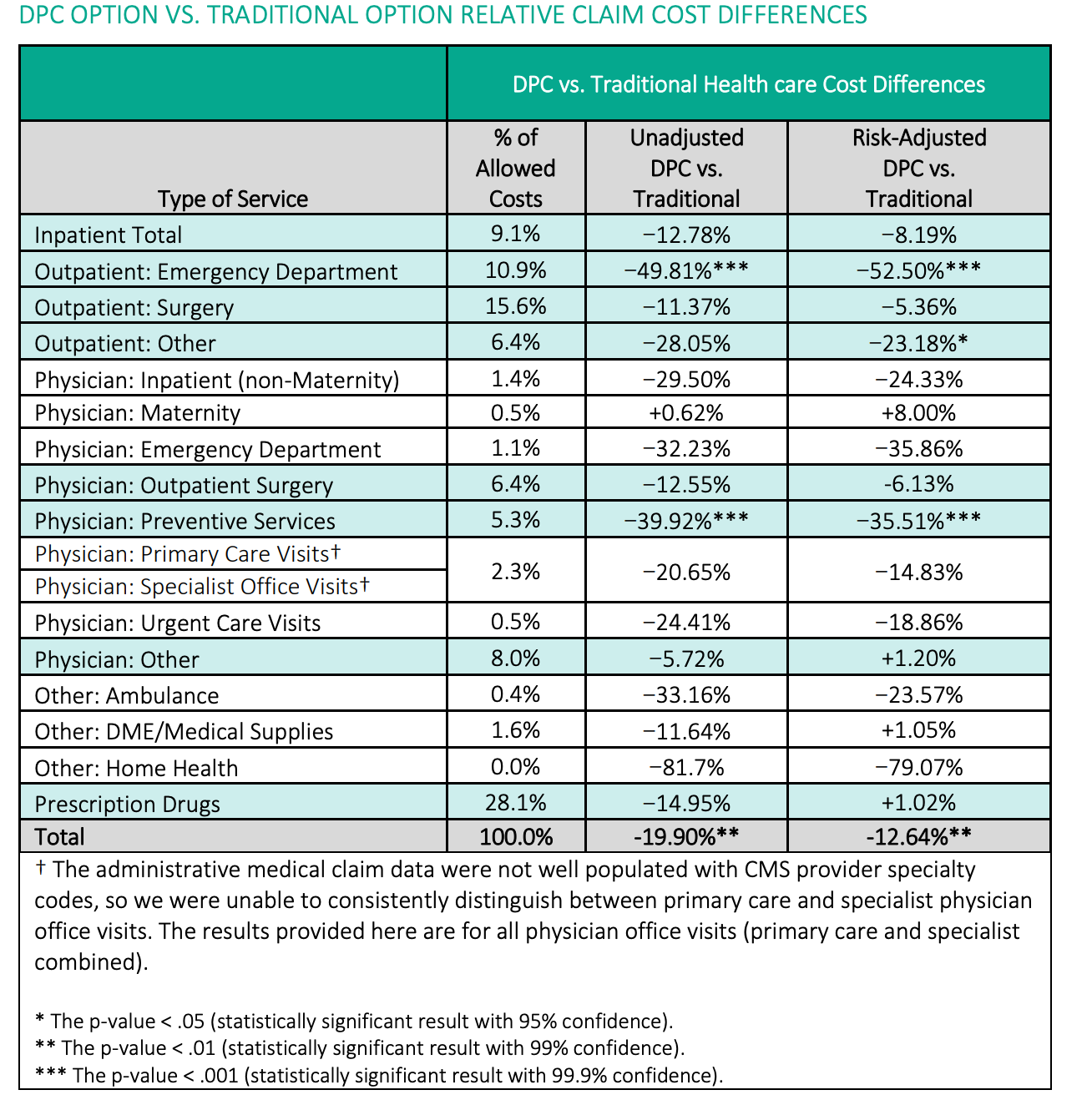

In 2020 the Society of Actuaries (SOA) commissioned Milliman to develop a report on potential savings that can be achieved by making DPC a focus and showed an average decrease in medical claims cost by an average of 12.64% after risk adjustment.

Figure 1: DPC: Evaluating a New Model of Delivery and Financing

Additionally, emergency department usage decreased by 52.50% and urgent care visits by 18.86% respectively further validating the impact that DPC can have on healthcare.

Figure 2: DPC: Evaluating a New Model of Delivery and Financing

The U.S. Centers for Disease Control and Prevention (CDC) says that ninety percent of the nation's $4.5 trillion in annual health care expenditures are for people with chronic and mental health conditions.

Some of the usual suspects are heart disease, stroke, cancer, diabetes, obesity, arthritis and often patients have several conditions going on simultaneously known as comorbidities.

There is a silver lining, according to the CDC proven chronic disease interventions can be cost-effective. "Cost-effectiveness" recognizes that the cost of the intervention is worthwhile in terms of longer life and better quality of life. in that proven chronic disease intervention.

This builds on the value and credibility that DCP can have on healthcare costs and provides the ability to better support disease management through the continuity of care (CoC) model. The State of Rhode Island’s Department of Health defines CoC as an approach to ensure that the patient-centered care team is cooperatively involved in ongoing healthcare management toward a shared goal of high-quality medical care. CoC promotes patient safety and assures quality of care over time.

The DPC strategy can be embedded in plan designs and also has the added benefit of being an additive healthcare benefit that comes alongside existing health insurance offerings. Notably there has been a resurgence on making DPC a focal point of health plans while providing modern virtual solutions for members to engage wherever they are at. One such solution is Vitable Health who’s founder Joseph Kitonga started the company to offer a benefit for those who do not have access to meaningful health insurance. The DPC strategy has proven time and time again to be effective in both terms of providing a meaningful health benefit and also a solid cost management strategy.

The Final Takeaway:

Direct Primary Care (DPC) offers a refreshing alternative. By focusing on preventive care, building strong doctor-patient relationships, and offering transparent pricing, DPC can help you take control of your healthcare. With DPC, you'll enjoy easier access to care, potential cost savings, and improved overall health.

Annnnnd scene!

See you next time, planet earth.

This post is spot on. Also spot is the solution Orriant.com and Concentric Health Systems are bringing, which empowers individuals and companies to reallocate how and where money is spent. Ending the waste solves the problem. For more details: https://drive.google.com/file/d/12aA-zTAfP1_3-xnB6go2xX74yGDFa1aW/view?usp=drivesdk

I have had a DPC model for my integrative medicine clinic now for the last 8 years or so. I would say if we could help people understand that health insurance is not a ticket to "free" healthcare it would help the patient and doctor begin to repair the doctor-patient relationship that insurance has corroded over the decades, imho!