The Healthcare Breakdown No. 053 - Breaking down the Private Equity yacht party in healthcare

Brought to you by unironic popped collars

What we’re breaking down: How the private equity game works in healthcare

Why it matters: Private equity is messin up all kinds of things and making you doctor want to bail

Read time: That time you told your spouse it would only take 5 minutes to fix that shelf (12 minutes for real though. Not the shelf, the reading. The shelf will take an hour).

Today we are re-visiting private equity. That thing you hear about that’s really effing things up for doctors and patients in healthcare.

And as you will see, it’s none too great for the likes of all of us… cough… Steward Health Care… cough

Before we jump in, a quick reminder that if you are in or around Atlanta, GA, the Hotlanta, The ATL, October 6th, and happen to be a doctor looking to bail on this PE mess, and have been thinking about Direct Primary Care as an option, come to the DPC mixer, hosted by my good friend Dr. Michelle Cooke.

Here’s a flyer you think can clicky:

Here’s how this is gonna go. We’re gonna rundown what private equity is, some of the mechanics, and why it’s all up in healthcare’s business. Then I’ll dazzle you with the strategies it uses to maximize returns. Hint: It’s never about better patient care..

So… What is private equity?

I’ll keep this one short. Private equity is a group of people who raise a bunch of money and buy private businesses. It’s a way for investors to invest in private companies, expecting returns they otherwise couldn’t get in the stock market.

Imagine you have like $40M and you want to invest some of it but the old S&P workhorse just doesn’t do it for you anymore. So you meet a slick 30 something who’s dad set him up with his own private equity fund and all the fleece vests he could ever want.

He tells you that he can get 20%+ returns through his new $500M fund that he’s raising. He focuses on healthcare, buying practices and selling them in 3-5 years. And brother, business is a boomin.

So you and 27 of your closest friends plus a number of pension funds throw in and he raises $500M. He starts buying companies, increasing their value, and then selling them in the time frame promised.

Boom. A bunch of besties, pooling money and buying companies. That’s really what it boils down to.

Fine, maybe there’s a little more to it or they wouldn’t be able to afford all the sweater vests. Here’s some more of it.

And how does this magical game work?

Sub-part: the structure of a private equity fund. This part has pictures, yessssssssssss.

Funds are setup like this: A General Partner (GP) goes out in his awesome vest and raises money from Limited Partners (LPs). The GP is the front man, makes the decisions, buys the businesses, and does all the fancy stuff to make lots of money for himself and his investors.

It looks like this:

All the lines are money lines. Not unlike the 80’s in your favorite stock broker’s private room at the club. The main difference is the lines were white then, not hot pink.

When this stately fellow is done raising his fund, he goes out and buys businesses.

Sub-part: how the money flows. More pictures!

The GP makes money on fees and performance. The most common structure is called 2 and 20.

This kindly lad charges 2% on all the money that gets deployed by the fund. So if he has a $500M fund and has bought $372M worth of companies for the portfolio, he’s making a meager $7.4M. Poor guy.

When he sells one of the fund’s businesses or exits it by going public, the LPs get their principle back plus 80% of the returns (the extra money the business was sold for). Young Beckham gets 20%. He’ll also get his principle back if he invested.

Like so:

That’s the fund structure. Now, how are these gracious gallants buying these businesses?

Debt, baby!!

Sub-part: how businesses are bought, the debt jams. Also, pictures.

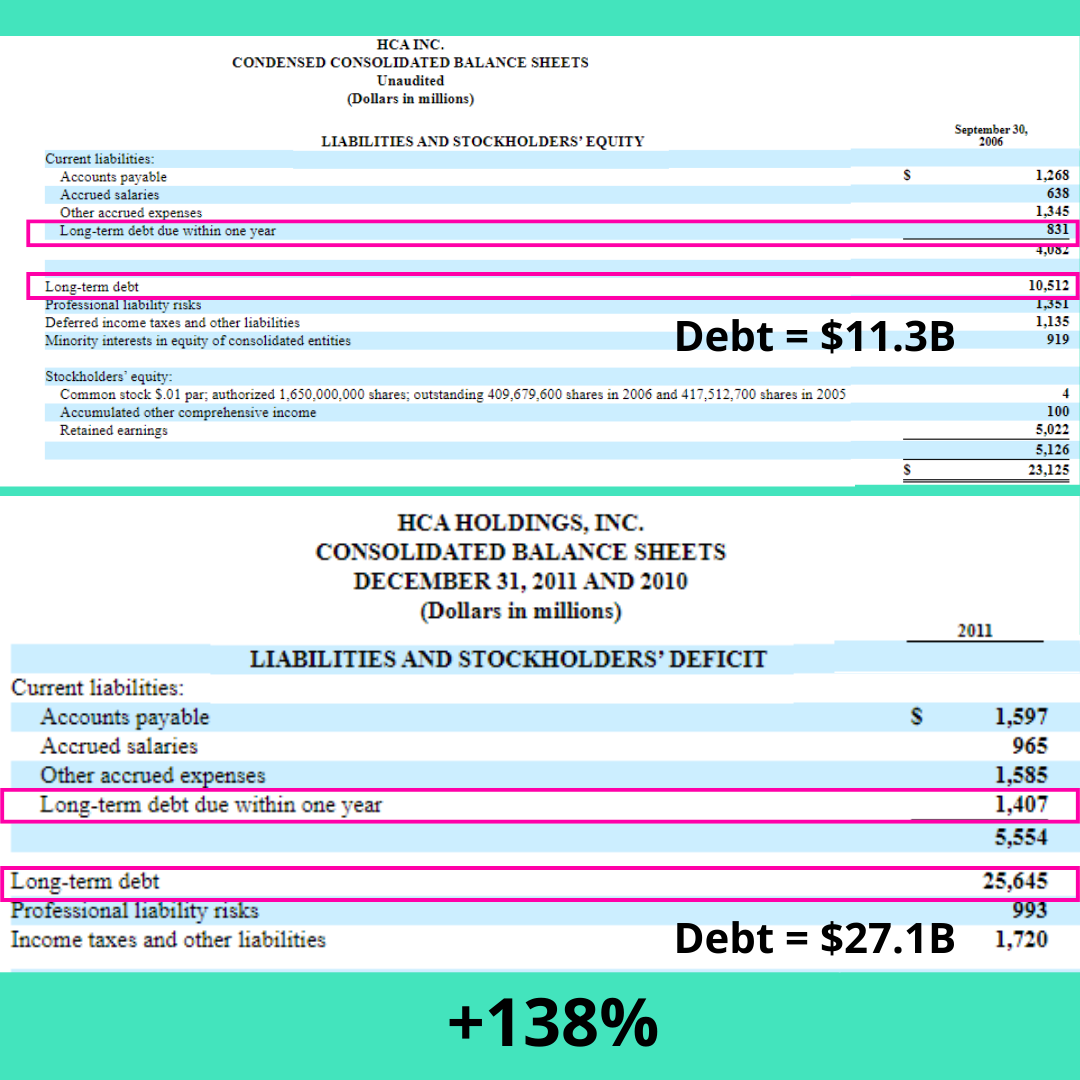

Fun fact: HCA was bought by private equity in 2006 and then taken back public in 2011. It demonstrates on a large scale how this works.

Here are the high level deets:

HCA was bought for $21B.

The private equity gentleman borrowed $16.8B (debt).

They invested $4.2B of their own money from the fund.

They owned it for 5 years.

During that time they distributed $4.3B in dividends.

They decided to exit by going public again in 2011 and raised $3.8B in the IPO.

Investors made $1B through the IPO.

They kept equity stake in the company worth $11B.

So basically they invested $4.2B and earned cumulative returns of $16.3B (dividends + sale profit + current equity).

Not a bad slice of pie.

I made another picture:

Check out the numbers behind this ole leveraged buy-out bonanza. Debt in 2006 before the private equity saddle and after it went back public in 2011:

That’s quite the debt increase.

And in the Private Equity world, the company holds the debt. That’s the best part.

Another way to think about it is sort of like buying a house and flipping it. Basically you can learn everything about private equity by following those guys on Instagram who boast about how much debt they have in their rental portfolios and using OPM (Other People’s Money).

You put down 20% of your cash and then get a loan for the other 80%. The house is collateral.

For a company, you put down 20% of your cash and get a loan for the other 80%. The magic here is that the 80% goes on the company’s books. The business is on the hook for the debt, not you. And in theory, operations covers the debt. Just like your renters cover your mortgage.

Then you increase the value of the company and sell it in a couple of years. While in the house example you would need to pay off the debt from the sales money, in Private Equity world, you don’t. You leave the debt behind for the business to take care of over the next 30 years or so.

Winner, winner, chicken dinner.

See the game? No wonder Beckett just bought that chalet in Big Sky.

But why does Private Equity love it some healthcare?

I think you know. We all know. It’s a $4.8T opportunity for cryin out loud.

As you may know, PE groups have had their eye on specialty practice groups for a couple of decades. There are two main reasons PE targets specialty clinics in their pursuit of happiness.

It’s hard as shoot buckets to delivery care these days in a highly complex regulatory environment, not to mention individual and population dynamics, and trying to figure out how to get paid through value-based contracts

Reimbursement suuuuuuuuucks. Sorry, not sorry. CMS isn’t paying doctors enough. Doctors, not hospitals. Hospitals make enough. And to boot, commercial plans don’t care about your 3 physician practice being out of network so they are going to go ahead and cut your payments 40%. Because.

That’s also why a PE buyout is appealing to docs. Not only do those headaches go away (don’t worry, new ones are right behind them), you also get a nice payout which is better than riding into the sunset with a satchel full of thank you notes.

Don’t get me wrong, satchels of thank you notes are amazing. They warm the soul. But so does a yearly vacation to the Mediterranean on a chartered yacht. The weather is positively soul warming.

The play for private equity in any of their acquisitions is to maximize EBITDA for a sale at a higher multiple in 3-5 years.

Financial returns are the name of the game.

Now, as you can imaging there are some different ways an organization can go about improving EBITDA and multiples.

The first is grow a great business. Treat people right, make good decisions, try really hard, all that good stuff. If you love that kinda thing, you should talk to my people at Forward Slash / Health. It’s all they do.

Orrrrrr, if you’re way more awesome, use financial engineering to pump up the valuation.

What’s financial engineering you ask?

So glad you asked. It’s basically the use of financial strategies to improve the financial position and hence the valuation of a company.

To help think about it, here’s what financial engineering is not:

Operational improvements.

Value creation for the patient or clinician.

To help even more, which is the reason I spent my donut fueled Saturdays writing this, we’ll look at some perennial favorite tools of Blair’s PE fund:

Sale and lease back

This is when you sell an asset and then lease it back from the buyer. You get a lump of cash and then lease payments become an expense. You were depreciating the asset before as an expense on paper, now it’s just become a real expense. Here’s the upside:

Lower tax payments

No maintenance costs

Risk transferred to buyer

Cash available for distributions, I mean investing in the business

Optimize cashflow

Ok, this one is a little more on the up and up. Basically we are just bringing cash in faster and optimizing our outflow. The bring cash in faster makes sense, but optimizing outflow deserves a couple extra lines.

Sometimes waiting as long as possible to pay is well and good. No penalties and more importantly, no incentive to pay early. In some cases you have the option to pay within say 15 days and get a 2% discount. That might be worth it depending on your cash flow cycles.

Them PE boys will look at all that and get the cash machine humming. When you are collecting faster and paying more efficiently, costs go down and cash conversion cycle gets faster. For the distributions, I mean investments.

Financial incentive alignment

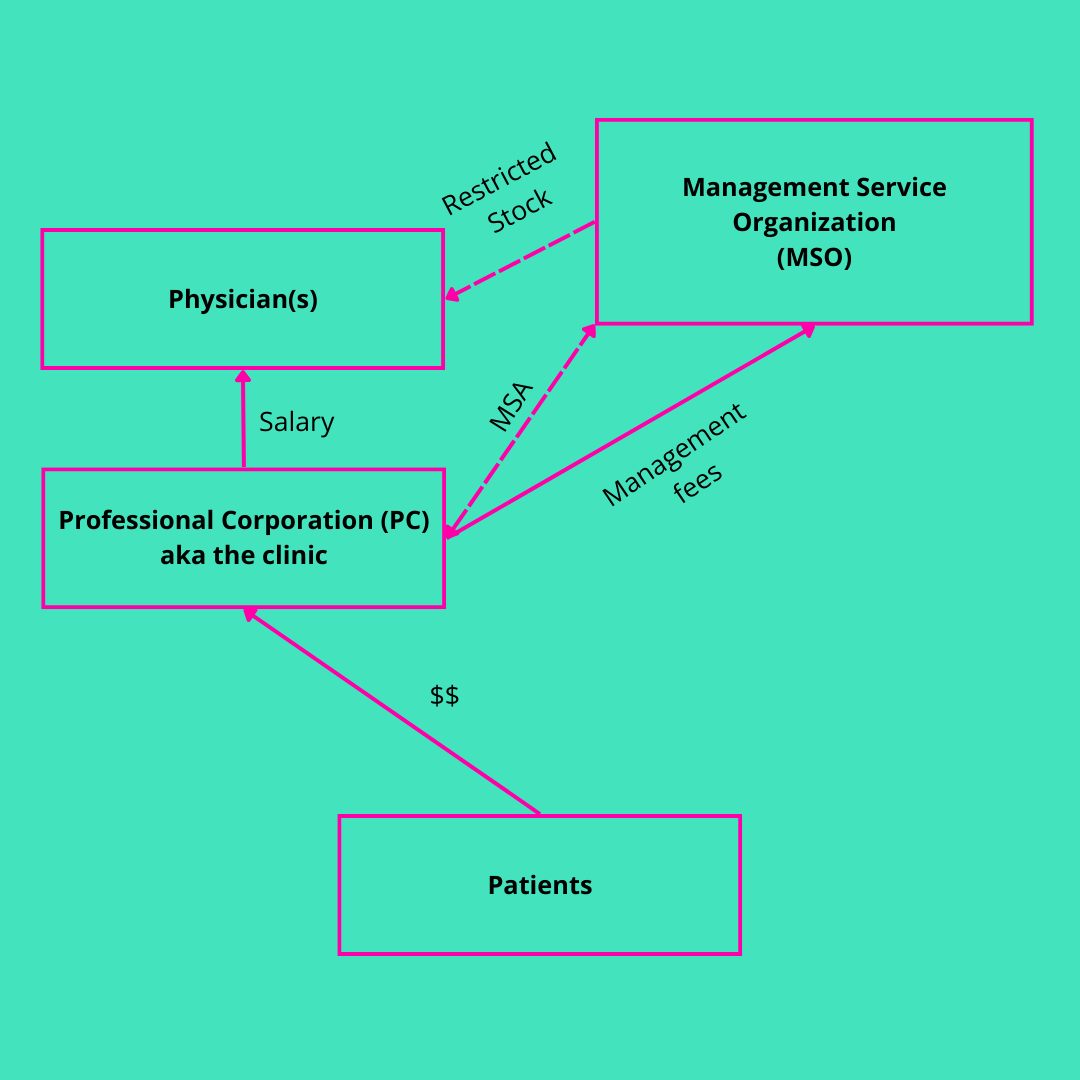

Here’s the real thorn in everyone’s side. When a PE firm buys a physician practice, they can’t employ the doctor directly. That would violate Corporate Practice of Medicine laws. And although hospitals do it all the time, Brighton’s dad’s firm isn’t allowed to.

What you can do is setup a management service organization (MSO) that has a master service agreement (MSA) with the practice you just bought. Then the MSO does everything except tell the doctor how to practice medicine… sort of.

Sort of, because the doctor(s) have vested interest in the financial success of their “new” practice. It’s new because the PE firm sets up a separate holding company in which the doctor receives equity on top of the buyout (that’s the MSO). Then the PE maestros will put all kinds of “incentives” in place to increase the valuation.

Like-a-dis:

That’s the gist of the structure and how not to run afoul of CPOM laws.

Not saying that docs are doing nefarious things by any stretch. The usual situation is the doc becomes a minority owner in the new company with little say in how things roll. And yes, on paper the doctor still has full control over clinical decision making, but when someone else has all the operations under their control and controls the money and controls your financial future, it becomes easier to see why a private equity owned OBGYN practice does significantly more C-sections than practices not owned by PE.

Just sayin.

Multiples arbitrage

This one is fun and ties directly into the big strategic play.

A business’s sale price is based on a multiple. Usually it’s a multiple of EBITDA. Private Equity yacht jocks love them some EBITDA.

A practice for example may sell for 2x EBITDA. The “2x” is the multiple. This completely made up, hypothetical practice is smaller and has about $500K in earnings.

Another practice in the same specialty with $4M in earnings may sell for 5x EBITDA. Bigger is better after all. It shows more stability as a larger organization, which would command a higher multiple, not to mention the gross values.

So, now, here’s the trick. Write this down. Wait, I’m writing it. Just don’t delete this email.

Buy 10 small practices at a 2x multiple on $500K EBITDA for a purchase price of $10M. Don’t worry, you only need to front $2M and load the new business with the rest in debt.

Now, you have a business with $5M in EBITDA having done… NOTHING. Well as you know, this bigger business commands higher multiples. So you can turn around and sell it at 5x EBITDA.

$25M. You only put in $2M. Nice return. The goal.

Ok, I did make one more picture:

Listen, this is a simplified version, but you wonder why every finance major wants to go into private equity and why everyone who is super rich at least plays in the arena.

Tax structuring

I’m not an accountant so I can’t give you all the nitty gritty here. And frankly you probably don’t want it. Even I can’t make tax structuring interesting.

My two cents, they do all kinds of stuff with leases (as we saw above), refinancing loans, new debt, etc. to lower the tax bill. Cause damn the man, save the Empire!

It’s very American to avoid taxes. In fact, it’s the exact way and reason this country got it’s start. Huh. I guess tax evasion is about the most American thing there is.

Raise prices

I obviously don’t need to go into this one much. Aggregate that buying power with all the newly owned practices and negotiate better reimbursement. Also raise cash pay prices.

Do what you have to do. But raise prices.

Thus concludes our stroll down Goldman Sachs lane.

Outside of these financial engineering chicanery, PE firms will do some operational things. They’ll get you a bigger, worse EMR. They’ll cut your support staff. They’ll centralize a lot of functions, firing some of your favorite front and back office team. They’ll streamline processes and make things more efficient.

All in the name of cutting costs. The goal again, improve EBITDA. That’s how you get a strong exit.

And here’s The Big Strategy: Buy practices in the same specialty and put them onto a single platform. The PE firm reaches economies of scale in the new business, has a net higher EBITDA to drive a higher multiple, and how more leverage across all it’s contracts.

It’s essentially an economies of scale play. Classic. But the real question… Is economies of scale the way to make healthcare better?

We’re not making sweater vests.

All righty, now you know what in the heck is going on with this financial engineering stuff. And just like is sounds, nothing is really happening in terms of how the business serves people. These are just activities to increase valuations to generate returns on the sale in 3-5 years.

Cool. I am going to call my friend Barron now and see if he’s hiring.

Good day to you.

Powerful analysis of #privateequity, incredibly important insights & graphics. Keep the #thoughtleadership coming! Love the alliance with Direct PrimaryCate too.

Sometimes I wonder what’s in it for the bank. More often than not, in this private equity game, they end up stuck with a hospital that can’t meet its interest payments and is worth far less than what the bank lent.