The Healthcare Breakdown No. 056 - Breaking down the deal with non-profit health systems making like, a lot of profit

Brought to you by Forward Slash / Health, yes, again

What we’re breaking down: Non-profit status of health systems, what it means, and if it should be a thing

Why it matters: Non-profit health systems save billions in tax dollars, but they may not be earning that privilege

Read time: The length of that Sarah McLachlan commercial with the dogs where she makes you cry with her haunting mezzo-soprano (7 minutes for real though)

You want to hear some crazy ish?

The NFL was a non-profit until 2015. In 2023, the NFL generated $20B in revenue.

That’s 1/5 the revenue of Kaiser. Which at $100B in revenue is larger than everyone’s favorite mouse ear ice cream company.

Disney, it’s Disney.

Yet, in 2015, the NFL gave up it’s non-profit status and started paying Uncle Sam.

Today, we’re going to talk about it. Primarily what even does “Non-Profit” mean. What is profit really? Should health systems pay the piper? And how much are we even talking about anyways?

But first, an exciting announcement from my friends at Forward Slash / Health! And before you wonder why they show up here so much, it’s because I sincerely believe in the mission of bringing back, strengthening, and enabling private independent practice. They’re doing the things.

On November 8th, they are launching a comprehensive course to help physicians launch their own direct primary care practice. If you pre-order, it’s at the insanely low price of $599.

That price goes up after November 8th, so act fast.

In additional to all the great course content, which will literally walk you step-by-step through how to setup and get rolling in DPC, you get one-on-one time with the team.

They are also launching a community for clinicians looking to start practices or grow their current practices. If I were a clinician I would be all over it.

Check that out here:

Cool. Check those awesome cats out. Now back to the show.

First, what do we really mean when we say “Non-Profit?”

A Non-Profit or Not-For-Profit if you’re long winded is a type of entity that usually, most of the time, pretty much all the time, doesn’t have to pay any taxes. On more or less anything.

No tax on property. No state tax. No sales tax. No federal tax.

The obvious first question you are going to ask, is how much taxes are health systems not paying?

Great question and a little hard to quantify. Obviously, because they are messy and healthcare entities’ favorite word is obfuscation. A haughty word that means, the action of making something obscure, unclear, or unintelligible.

You know, like most political speeches over the last 8 years.

Here are two takes on how much health systems benefit from non-profit status exemptions:

From the AHA: $13.2B in 2020 and clearly a joke.

From KFF: $28.1B less of a joke.

Even at the high side, it doesn’t seem like all that much. But, if we look at the context of those potential taxes a little differently, the picture becomes clearer.

There are 2,987 non-profit community hospitals in the United States.

That’s $9.4M in taxes not paid by each hospital each year. Imagine what that amount of money could do for the communities these health systems… ahem… serve.

Ok fine in order to get this magical designation, health systems do have to provide services to the community. Here’s another moving target that lives in the grey. And not like the entertaining Liam Neeson type.

If you listen to the AHA, community benefit clocks in over $100B annually. Not too shabby.

KFF on the other hand doesn’t look at total community benefit, but rather only charity care as defined by care provided for free or at a discount for qualifying patients. The estimate clocks in at about $16B.

Comparing apples to apples or kiwis to kiwis if you are feeling exotic, the AHA reports charity care provision at around $57.4B. Now, that is still more broadly defined and includes Medicaid shortfalls.

See, it gets all complicated.

But here is my big contention outside of the fact that we really just need some better definitions around things:

Charity care calculations are like Kris Kross. Wiggity Wiggity Wiggity whack.

Here’s how charity care is calculated:

Cost-to-charge-ratio times the value of the care provided. Sounds simple and great Preston, what’s your issue? Why do you get all bent out of shape over hospitals all the time?

Beeeecause Becka, that value of care provided at a discounted amount is inflated. It’s totally made up. And while the cost to charge ratio should take care of it, it doesn’t.

Here’s an example:

See there, the higher the made up gross charge, the larger the discount and the more charity care is recorded. Fun time.

Let’s keep digging into the madness.

Total community benefit includes shortfalls from Medicare and Medicaid. Medicaid I can get behind, but Medicare, nuh uh. You can make money on Medicare.

Annnnd I am not sure who need to hear this, but running a low margin on Medicare doesn’t mean squat. Non. Profit. Remember? Breaking even should be fine if you are serving the public good.

Sorry. Sorry. I got heated.

Community benefit also includes things like professional education, you know, educating people who work for you to make them better at their jobs and drive more value and quality in your organization. K.

Community activities and services. So, marketing. Word.

And some other things I can get behind.

So maybe there is a middle ground. But I am not entirely sure we’ve seen the entire picture here.

Because while these health systems are enjoying non-existent tax bill, they are still making plenty of money.

Here’s the deal, just because a company isn’t taking all the money it has left over and paying distributions to shareholders or increasing shareholder value, doesn’t mean it can or doesn’t spend all kinds of excess on things like travel, compensation, bonuses, and a whole bunch of other perks that have nothing to do with providing community value.

Let’s just look at some fun things shall we.

How about Atriums $52M in the Cayman Islands:

Or Atrium’s private planes used by it’s executives:

Maybe we should ask about how much of this tax exempt money is being poured into Private Equity. Just look at Cleveland Clinic. There’s almost $7B between PE and Hedge Fund investments. And that’s just one system.

I am not entirely sure that is the best and highest use of the tax payers money, while these profit only driven organizations are destroying healthcare left and right in the name of profit.

Or, Ascension’s private equity fund:

A cool $1B under management with companies generating around $60B annually in revenue. Cool story Hansel.

Or Wellstar’s venture capital fund:

You get the point.

Health systems forgo paying billions in taxes every year, trump up what they are allegedly providing to their communities, all while they are focused on generating as much cash and building as much wealth as possible.

One more, because I have been talking a lot.

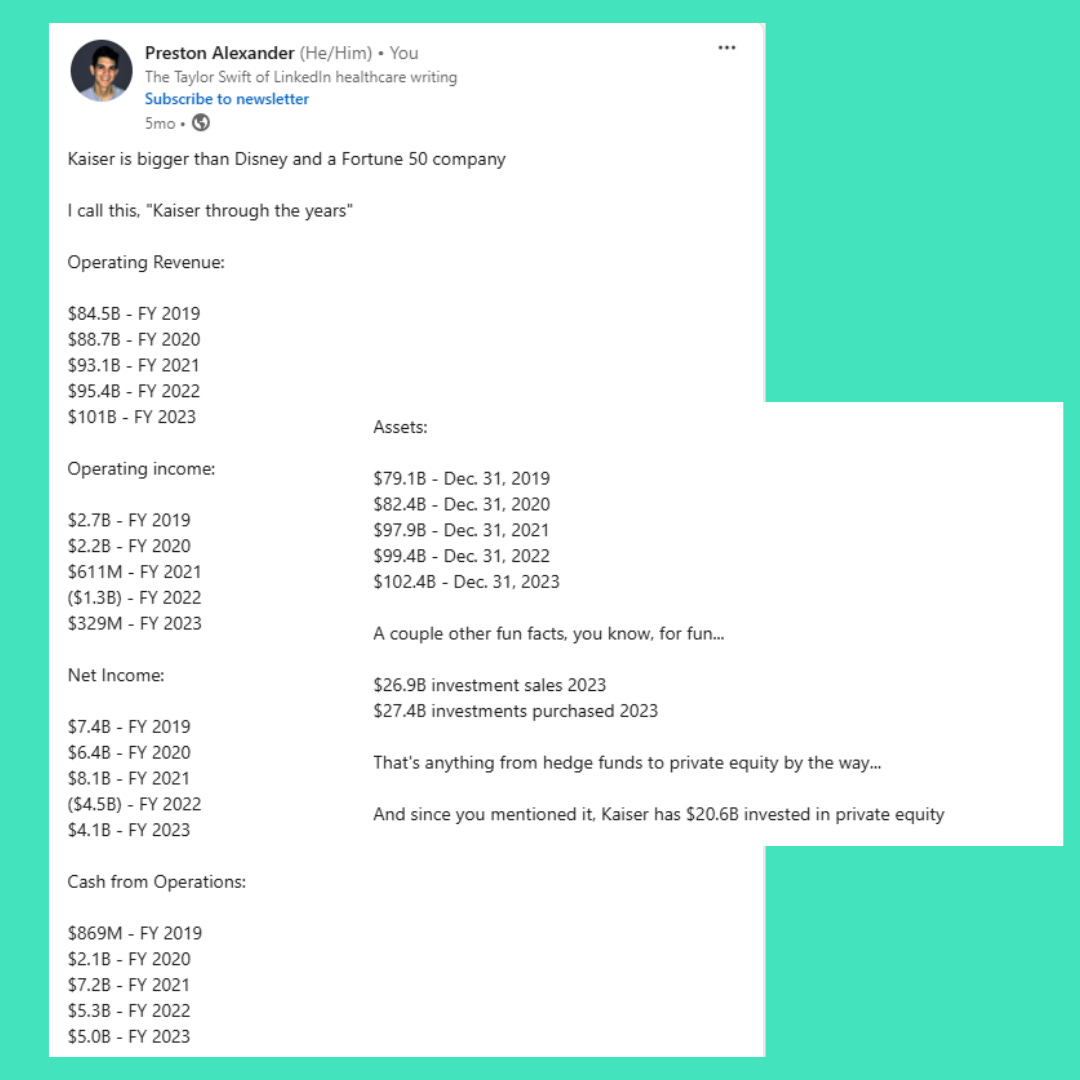

Let’s just look at Kaiser over the years:

Yes, that’s my own LinkedIn post. No, don’t make it weird.

On the flip side, what’s up with the for profit health systems. You know em, you love em, HCA, Tenet? Those guys.

Surely they must be way worse….

Well, Rebecca, yes and no.

If we look at the dollars, which is what we’re about here at the Breakdown, HCA made $5.2B in 2023. It paid $1.6B in taxes. ANNNND provided $3.7B in uncompensated care.

Inflated? Yes, but that’s grapes to grapes.

Lookie:

To be fair and I am sure I can find a nurse in about two seconds that would vouch for this, HCA ain’t a beacon of quality, but from a financial perspective, all the money. While paying taxes. While providing all kinds of uncompensated care.

So, let’s get back to the original question, should non-profits be tax exempt?

Yes, if they were run properly. But no, probably not, because they aren’t nor are they living up to their end of the bargain.

Now, ending caveat. There are plenty of smaller, rural hospitals on the struggle bus right now. Hitting them with taxes and the burden of uncompensated care would be a death blow. So it’s not a one size fits all situation like that oversized sport coat every 12-year-old boy in the 90s owned. Yo.

But those are two different stories with much broader implications of the system’s financial designs that we will tackle another time.

Until then, love you, mean it.

I can't believe you threw in a Kriss Kross reference. That was strong.