The Healthcare Breakdown No. 065 - Breaking down the health system's macro system problem

Brought to you by the one ring to rule them all

What we’re breaking down: The systems that govern the healthcare system

Why it matters: Health systems are financial institutions because they have to be, this is why

Read time: The time it takes to decide on a Netflix movie (6 minutes for real though)

Ok, this may be a slightly different episode. A little philosophical perhaps. Mostly because I am not necessarily a systems expert, don’t have the data to completely support what I am going to type-say, and also because if it is long winded and slightly hard to follow, then it must be philosophy.

The health system as it stands today, is a sub-system of something much larger.

You all know it. Some of you love it. It’s our economic system.

There are other systems at play including political and societal. We are going to focus on the economic system, because I could argue that the other two design and influence this system while it has the most salient impact on the healthcare system.

Also the fact that the political system designs the economic system therefore is inherent within it.

See, told you. Philosophy.

Here’s the crux of the matter, we have some version of capitalism in the United States. I can’t really call it pure capitalism, because it’s not truly a free market, considering the regulations in our system.

Our capitalist system sort of sets the tone if you will for any enterprise in America. That includes entities like United Healthcare and CVS, but also Kaiser, Mayo, and Southeast Georgia Medical Center.

Let’s look at “payers” for a moment. These are by and large publicly traded entities who’s sole purpose is to maximize shareholder value. Say what you will, but when shareholders can sue the company they own for poor business decisions that impact the money it makes them, profit maximization becomes the only purpose of the company.

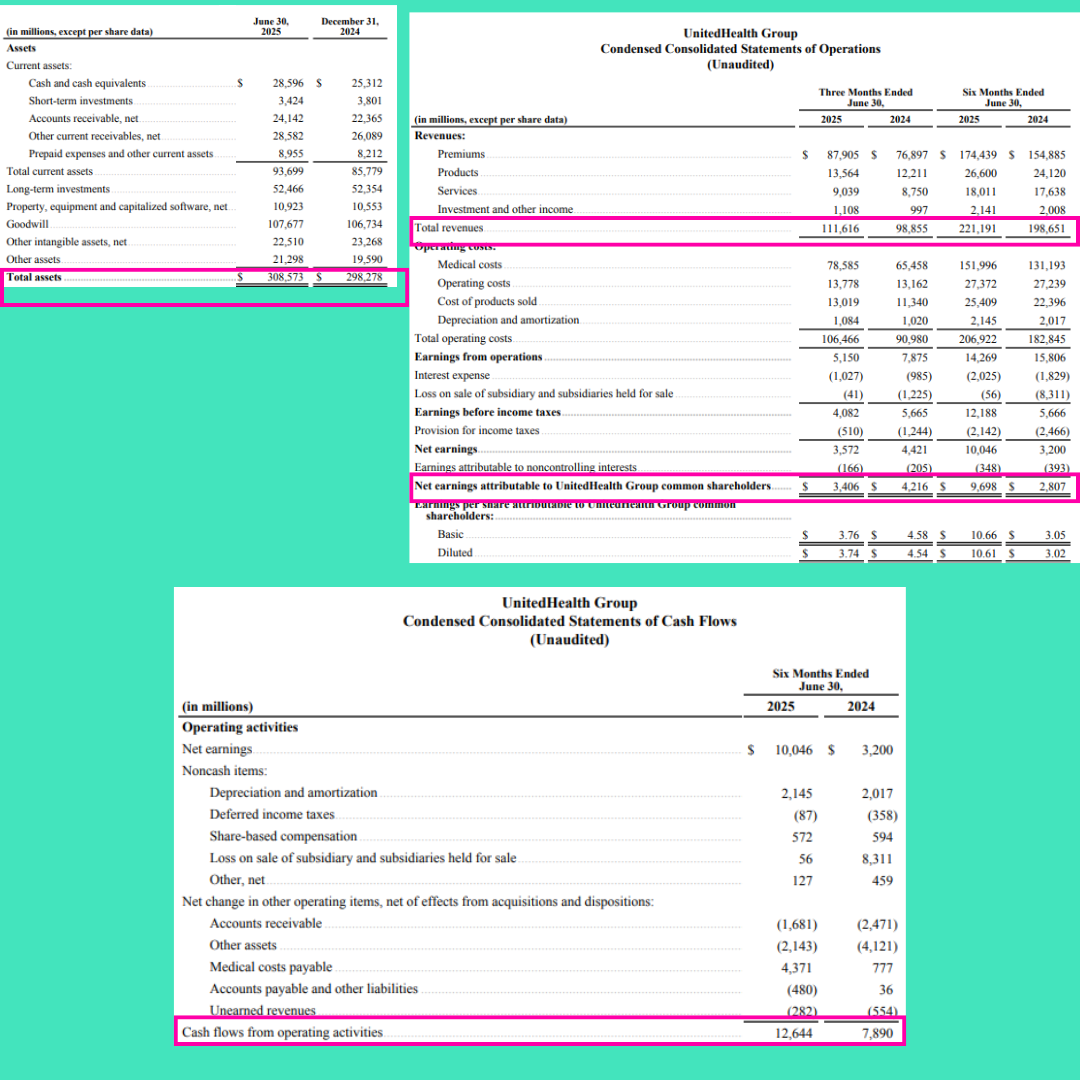

And just look at UHG, they aren’t doing too bad at it.

These companies arguably sit at the top of the pecking order. Deciding how much we all end up paying for healthcare access and how much our wonderful clinicians get paid.

Good for them I guess. But then here’s where it all gets weird and worse. I mean, the insurance thing is bad, but at least it’s obvious. These are for-profit companies that are publicly traded. We shouldn’t expect anything else.

Health systems on the other hand, we do and should hold them to a much higher standard. Most systems and hospitals are non-profit, or more appropriately, tax-exempt.

So, in exchange for not paying taxes, they are to give back to the communities they serve. Part and parcel is the fact that health systems are legally obligated to care for anyone who walks through the door. We all see it and understand it at face value. It’s great.

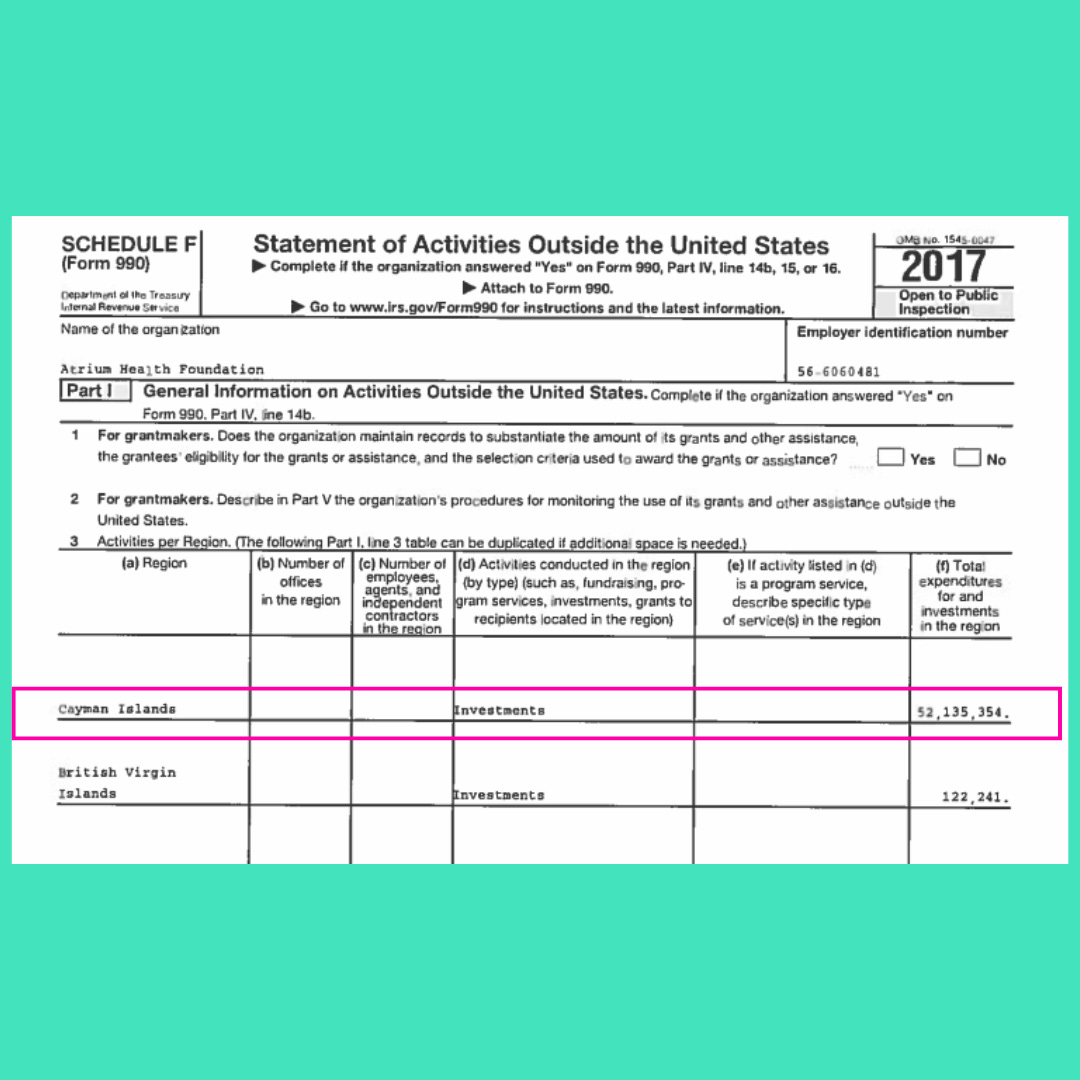

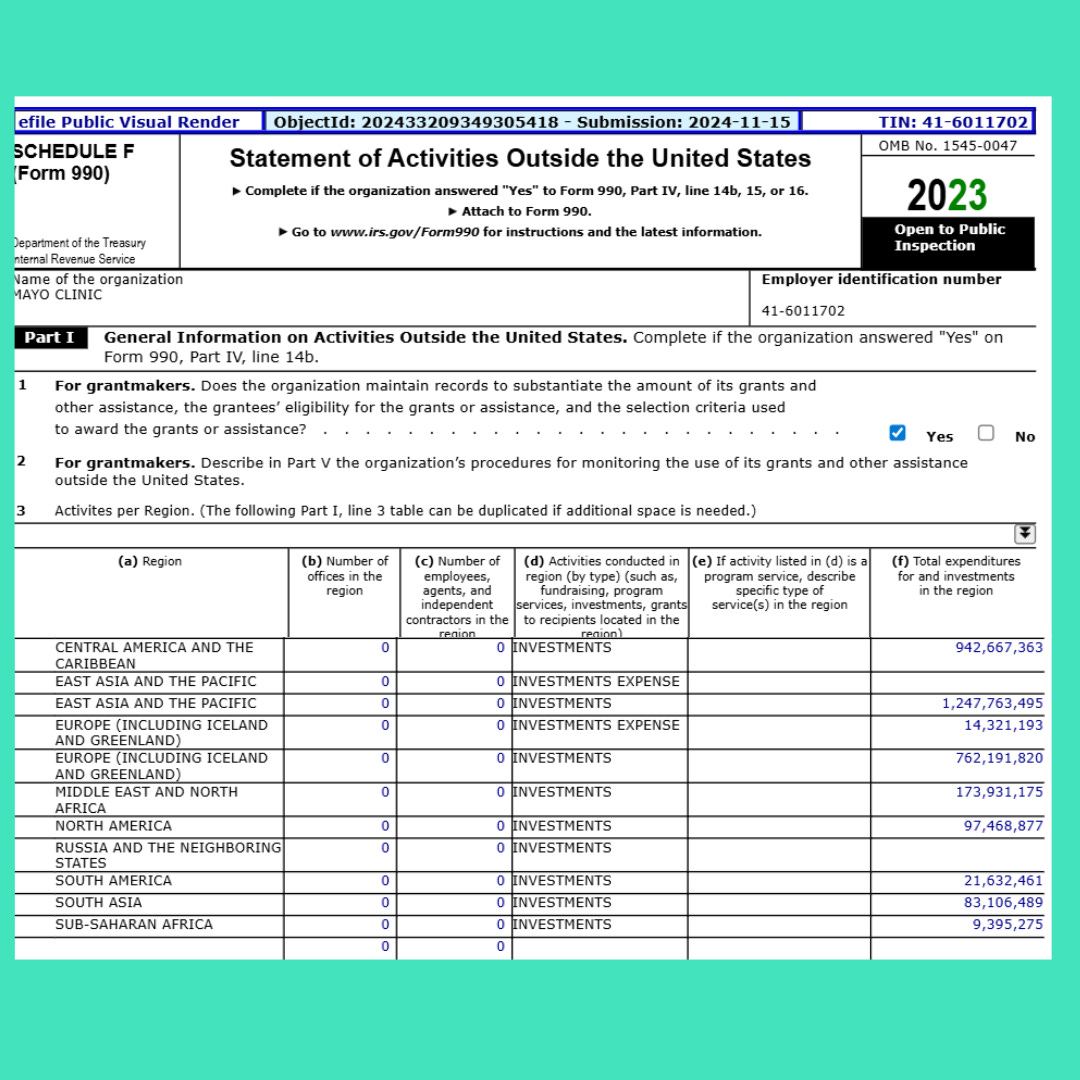

But, if you have read this newsletter you know there is always more to the story. Multi-billion dollar health systems with private planes, investments in the Caymans and Saudi Arabia, pouring billions into Private Equity, earning revenue from tax-exempt land used for non-healthcare related activities, I could go on.

Here’s a picture though in case you think I am wearing a tinfoil hat right now.

Here are some investments:

Here’s Atrium:

Here’s Mayo:

But, honestly, look at the system they are in. The capitalist system.

The financial design of the system has turned what should be a largely altruistic service, one designed for public good and societal benefit and forced it to act like a financial institution.

Along side the requirement to generate returns for the system, at the heart of that paradigm is the hospital revenue bond.

For a hospital to grow, to compete, to negotiate meaningfully with private, profit driven “payers” they have to have access to capital. Because there can be no investors and not public offering, they issue debt in the form of bonds.

But debt isn’t just a loan out of the goodness of someone’s heart. It is an investment.

Most larger health systems carry billions (that was a “b” back there) in bond liabilities.

Here are some:

That’s like $26B from 5 health systems.

And real quick…

Bonds – a super brief primer

Bonds are debt that a company issues. Non-profits use bonds because they can’t issue stock. It’s how they raise money from investors.

Health systems issue Hospital Revenue Bonds, which are a type of municipal bond. Municipal bonds are tax free. That means that bond holders, the people buying the bonds, are not taxed on the income they earn from the bond.

Real quick side bar, just because you read the part too fast. The bonds that health systems issue are more often than not tax free for investors.

Ok, back to it.

The bond issuer (the company), pays interest to the bond holder. Just like any other debt.

That’s the long and the short of it. No time for how bonds work after market… call your local investment banker for that one. Plus, I’m not over here tryna give investment advice. My cousin Rick is still pissed about the tip I gave him in 2008…

And while this may look like an obsessed love affair, it’s more like an arranged marriage.

Why arranged? Well, frankly, what choice is there?

Say a hospital wants to build a stunning 16 story surgical tower so it can attract all those saucy commercially insured patients for some highly profitable cardiac surgeries.

Well, unless Daddy Warbucks was delivered at your hospital, chances are you ain’t got the $600M to build the thing.

With all these bonds flying around, hospitals need to play the game. And the game is a bond rating. The rating indicates how likely they are to pay what is owed on the bond.

You’ve probably heard of Fitch and Moody’s. Those are the rating folk.

Here is Moody’s rating criteria for hospital revenue bonds:

See anything about patient safety? Patient outcomes? Quality of care? Patient satisfaction?

No.

And why would you? We are talking about finances, investments, and money over here people!

Not that one doesn’t drive the other in my opinion, but no one asked me.

So now we have this wonderful cycle we’ve created.

Hospitals want to expand, buy stuff, build stuff. They also need to have leverage and market power to negotiate with terroris, I mean insurance companies. To do that they issue bonds. To issue bonds, they need a high rating. To get a high rating they need to do well on the rating criteria.

Naturally the focus then goes to finances. Often at the expense of what’s really important.

But back to the point of this missive, this as a macro level systems issue. Hospitals and health systems HAVE to operate like this. It’s the way the system is designed.

Individual motivation, compensation, board seats on your buddy’s company aside, what are we asking when a hospital needs to expand service lines and grow?

We talk about public and community need, but then shift all the responsibility to a private entity to serve those needs with little to no oversight. Along with all the responsibility to operate in a highly complex, financially challenging industry to that entity.

There is little to no planning at county, state, or federal levels.

Imagine a world where we had all the healthcare services we needed, which were appropriately matched to the needs of the communities being served.

If that were happening, a hospital wouldn’t need to issue $139M bond to be used for who knows what, fighting for patients in the name of growth, profitability, and pleasing investors.

Oh wait, I know what that money is going to be used for…

Remember, market position is the highest weighted category for a high bond rating.

My point is, when you place to entire onus on private organizations to grow, serve, flourish, whatever, within the capitalist, profit driven system they operate within they are going to use the means they have. Those means are debt, investments, and operating with financial interests first. They are playing the game.

Bonus feature, now that you know a thing or two about bonds you don’t have to avoid that cousin who’s a bond trader at J.P. Morgan. I mean, you probably should for other reasons, but not about the bonds anymore.

Cheers to you both!

This was amazing, thank you! The system is designed to get the outcomes it gets. If we want to change the outcomes, we HAVE to change the incentives.