The Healthcare Breakdown No. 009 - Breaking down Balance Sheets Part II: Ratio hell

Breaking down Wellstar's BS

What we’re breaking down: The Balance Sheet Part II: What does it all mean??

What you’ll learn: How to interpret the numbers on the balance sheet and a bunch of exciting boring ratios

Why it matters: The balance sheet it irrelevant without context, looking at the right ratios makes the balance sheet meaningful

Read time: Picture a George R.R. Martin Novel

Before we get started, I just want everyone to know that I almost cried writing this episode. Not only is creating a spreadsheet with 14 financial ratios incredibly tedious, it’s also downright boring.

But now that I’ve done all the boring work for you, you can sit back relax, put on your readers or get your butler to read this to you, and enjoy the wild world of interpreting the balance sheet.

Sorry, sorry, sorry…. one more thing. Sorry.

I lied a little bit.

This isn’t only about the balance sheet. It’s really about Liquidity, Capital structure, and Asset Management. And for that, we need more than just the regular BS. We also need a side of income statement. Sorry.

The goal is to go into a company or build a company with your eyes up. Healthcare is a crazy pot right now and it’s important to see around corners when it comes to financial performance.

This will help.

Onto the boredom… I mean fun!

Crap… I forgot, one more thing. Last thing, I promise.

As you read this or are read to, don’t get caught up in the specific calculations I am going to show you. Don’t feel like you should memorize them or that they are the end-all.

Instead, think about their implications. Think about why we are using them. They’re all really just comparisons.

Debt to equity. Assets to revenue.

Comparing numbers to provide an insight. As you go through and become more familiar, you’ll be able to see relationships and maybe even make up your own calculations that will serve you depending on your sitch.

Ok, for real now. Here.. we… go!

Presenting…. Dun da da da!!!

Wellstar Health System!

Woohooo!!! Yea!

Wellstar, if you don’t know, is an 11… wait, 9 hospital health system here in Georgia. Its most recent claim to fame is shuttering a 100-year-old hospital because it served too many low-income individuals. It also just launched a $100M venture fund.

All right, let’s peek at the Balance Sheet:

Cool, since you read last week’s jam, you know what all this stuff is. But maybe not quite what the point is.

As I mentioned we are going to look at 3 things.

Capital Structure - how the company is capitalized. More debt or more equity?

Liquidity - how much cash there is or could be. Can you pay your bills?

Asset management - How are assets being used. Are assets making the dollars?

See, not so bad.

On to the hell, I mean good stuff!

1. Capital Structure

Don’t get mad if you think things should be in other categories. Start your own newsletter then.

Debt-to-Asset Ratio

Tells you how much of your assets were bought with debt.

None too shabby. Of all Wellstar’s assets, 27% were bought with debt.

Debt-to-Equity Ratio

Tells you how many dollars of liability you have for every dollar of equity. Will show how leveraged the company is, versus owned.

Mmmkay, you’re probably like this doesn’t make sense. The first ratio looked at debt but aren’t liabilities debt? Well… I mean yes. But the first ratio is looking at debt debt, not things like accounts payable.

Back to the main takeaway of all this. It’s about how you look at numbers, not specific calculations. All different people use all different ratios and calculations to determine financial health.

Anywho, Wellstar carries more total liabilities than equity. But when you look at both ratios together, you can see a picture of financial debt vs. operational debt. If that makes any sense at all.

Wellstar is leveraged. That’s not necessarily bad, just information. It’s using debt to make money.

Net Working Capital

How much money is available to invest after meeting obligations.

$129M of money to toss around. This is what the company has available to invest into itself (theoretically).

Hopefully you can start to see the practicality of all this. Again, we’re just trying to see what’s going on by comparing some stuff.

Let’s pop over to liquidity.

2. Liquidity

Liquidity is all about cash. Can you pay the bills? If you had a fire sale, how much dinero would be left?

MC Hammer versus Rihanna.

Cash Ratio

How much cash you have to cover liabilities.

I put an asterisk in the image, but I suppose it bares repeating. Cash isn’t just cash, I know it’s dumb. So you sometimes have to dig to figure out what they really mean by cash. And when I say “they” I mean the people who get paid to much to make our lives more challenging.

Anyways, Wellstar can cover its debts. Twice.

Cash-to-Debt

Cash available to pay just debt.

Wellstar be taking its cash and throwing it all (mostly) into investments. This is a more conservative view than Cash to current liabilities. Same spirit. Wellstar can foot the bill.

Current Ratio

Can you pay your current obligations with your current assets?

Yup, it can. Want to be over 1. The higher the better.

Days Cash on Hand

If all the money stops coming in, how many days until you run out of money?

Wellstar has less runway than a mediocre digital health startup backed by a your favorite venture capitalist.

Actually, this isn’t terrible, though a large non-profit health system needs more than 400 days cash on hand for the perfect bond rating.

Safe to say between this and its cash from operations, Wellstar has it well in hand… get it? Pun for sure intended.

Debt Service Coverage Ratio

How well you can cover your debt payments with operating income.

See, here we go. More information. Wellstar doesn’t carry cash. But it can meet it’s current obligations. Lenders typically look for a DSCR above 1.2. Wellstar is crushing that.

Something is going right. Financially, I mean. It doesn’t treat people, especially poor people very well.

Home stretch! Asset Management!

3. Asset Management

How good is an organization at making money off its assets.

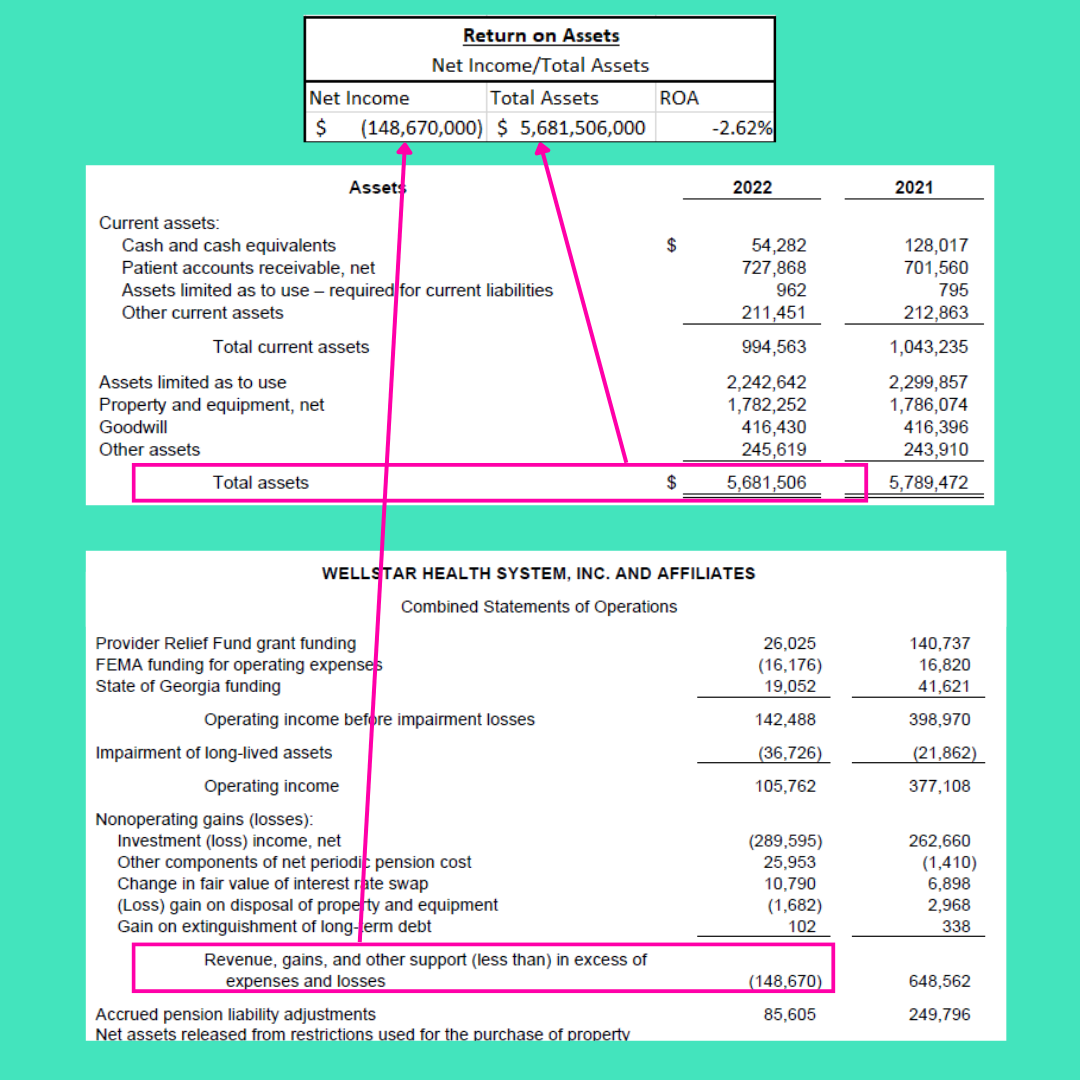

Return on Assets

How much income do your assets generate.

Well, Wellstar didn’t have a great year from a net income perspective. But this includes paper, unrealized losses too. One could argue we can take some of those losses out, but I do things by the book around here!

Current year 2022, Wellstar has a negative return on it’s assets. You can also see it would have has a positive return in 2021.

The case can also be made to look across time for this calculation to see generally what the ROA is.

Return on Equity

How much income your equity generates.

Same deal as ROA. Is my equity generating a return.

You could look at return on debt too. It’s all about what you choose to look at and what is important to you. The specific calculations aren’t the point, thinking about them and other things that are interrelated is.

Fixed Asset Turnover Ratio

Each dollar of fixed assets, like buildings and such, contributes x dollars in revenue.

Each dollar of fixed assets generates $2.60 in revenue. A good measure for a hospital, which is highly dependent on fixed assets like ERs and lobby fountains.

Total Asset Turnover Ratio

Like the other one, but looking at total assets, not just giant buildings, land, and 800 MRI machines.

Similar metric, but looking at the whole. I like the first one better for a fixed asset heavy business.

Days in Accounts Receivable

How long it takes to get that paper.

It takes Wellstar too long. Still doing well overall, but that time should be at least 20 days shorter.

Days in Accounts Payable

How long it takes to pay bills.

It’s mighty nice of Wellstar to pay its bills so fast. Maybe part of the reason its not holding as much cash. I like my receivables collected faster than my payables are going out.

But good for them for paying quickly… or something.

PHEW!!!

What a load of hullabaloo.

If this seemed overwhelming, I get it. Kinda is. The main takeaway is how to look at a company and ask the question, “what does this mean for the business?”

If a company has $100M in cash is that good or bad? Well, it depends.

How much debt does it have? Is it bringing in a steady cash flow?

Now you can start to make sense of the numbers and not just look at them and say, well, that seems like a lot or that doesn’t seem like much. You can see how the numbers are related and how money is working within the company.

Thanks for sticking with me on this one!