The Healthcare Breakdown No. 038 - Breaking down Steward Health Care’s REIT fueled, Yacht racing, private equity implosion

Brought to you by Yachtspitals

What we’re breaking down: What got Steward Health Care in this big ‘ole mess while its CEO bought two yachts

Why it matters: Private Equity and financial engineering are destabilizing healthcare and that’s a problem… obvs

Read time: The time it takes to get that popcorn kernel out of your molars (7 minutes for real though)

We’ve all seen the news. If you haven’t then you may have missed the fact that not only is Usher performing at the Super Bowl (ATL represent), but Steward Health Care is a steaming pile of extraction, greed, and all the worst parts of business.

Here’s how it all went down…

Interruption! Healthcare needs a revolution. It needs you. Don’t let numbers and finance be the thing that stops you.

Healthcare Breakdown - The Finance Course! will show you how to:

Read and understand financials like a pro

Build financial models, and

Go toe-to-toe with any CFO

In an afternoon.

There’s templates, jokes, and all kinds of good stuff in there.

Stop avoiding finance. It’s cool.

In 2008, like every would-be Wall Street trader who had to get a different job, Dr. Ralph de la Torre, a heart surgeon at Beth Israel, took over a financially troubled, six-hospital system by the name of Caritas Christi Health Care.

He had quite a lofty goal. As he told the Boston Globe, “My goal is to fix health care.”

First of all, we should have know the dude was up to no good or at least not as quick witted as everyone thought, since he kept spelling healthcare wrong. Red flag number one.

Red flag number two, is that in 2010 he teamed up with the nefariously named, Cerberus Capital Management.

Slight detour… If you are going to name a private equity fund, you probably should not name it after the three headed hell hound from Greek mythology that kept souls from escaping Hades. Like, props for just wearing your real intentions loud and proud, but c’mon.

Anyways, if those two etymological conundrums didn’t give anyone the willies, the structure of the deal should. Cerberus, like all PE firms, live in a world of debt. They invest a little equity and saddle the business with debt to cover the rest of the acquisition price.

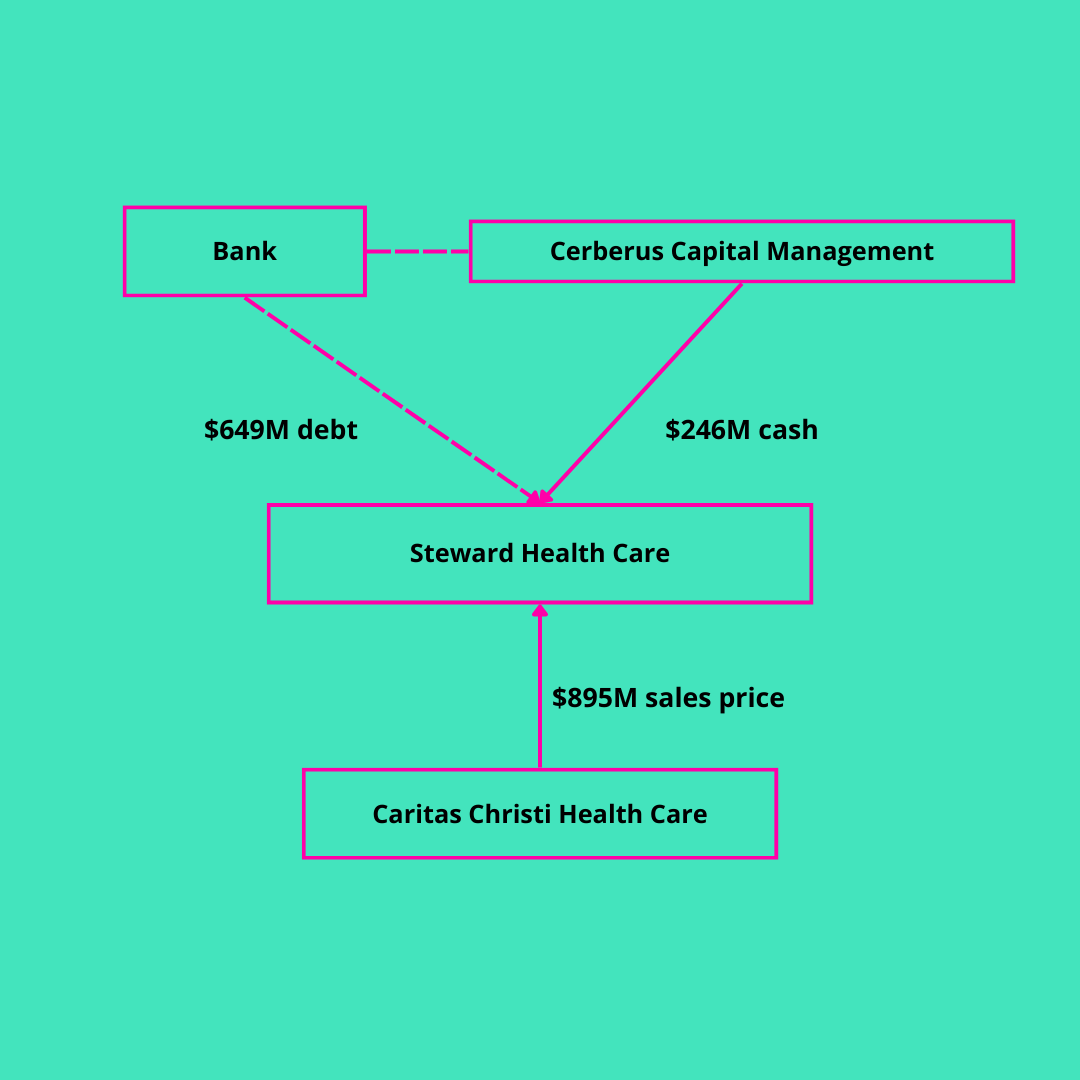

Cerberus paid $246M in cash and borrowed $649M. The horror of these types of transactions is that debt is borrowed against the business. Cerberus isn’t on the hook, Steward is.

For my visual homies:

For the next few years, Steward Health Care plodded along, loaded with new debt, doing what apparently no one expected, performed poorly.

Shocked.

And if you know anything about private equity, they don’t take kindly to cash drains. Their goal, unlike de la Torre’s healthcare (I spelled it right for him) fixing goal, is to leverage debt, invest little equity, payout large dividends over a 7-year period, then exit the company leaving the debt behind and making a big ole pot of cash.

And that ladies and gentleman is exactly what Hades’ pup did.

One tool they used, which plays a huge role here, is the sale-leaseback strategy. I talked about it in the Private Equity breakdown a few episodes ago. You can get the PE primer here.

Short on cash, good management, and a wherewithal to do the right thing, Steward sold $1.2B worth of the health system’s assets to Medical Properties Trust. Medical Properties Trust is a REIT or Real Estate Investment Trust.

A REIT owns property and then leases it. They were created as a way for the average Joe to invest in real estate. The wonderous thing about a REIT is the tax game.

Obviously.

A REIT pays no taxes so long as it pays 90% of its taxable income to investors as dividends. What a marvelous world.

The other upside here for the PE bros is the liquidity event. And it’s a classic PE move. They sell all the property and get a huge chunk of change. The company is then on the hook for the future lease payments to keep using the buildings. But PE bro dog Barron doesn’t care about that, it’s the company’s problem.

Here’s the deal:

Oh, ya. Did I forget to mention that the PE lords will always pull a giant dividend from a deal like this. That’s really the point.

The other point is that it totally boned Steward. Look at this lease payment obligation after this first of many sale-leaseback setups:

Yup, $4.4B to use property it once owned.

Rad.

Let’s back up and set the stage a bit. Here’s what we have covered so far…

Cerberus leaves its underworld outpost, takes on $649M in debt, invests $240M in cash to buy Caritas and then forms Steward. Steward then has the privilege of owning the debt.

Steward is still sucking wind and now, as it’s loaded with more bills, probably sucks a little more.

Cerberus wants its dividends so it goes to MPT and gets $1.2B in cash money for all of Steward’s property.

Oh, and I forgot this part, when MPT leases back all the property to Steward it’s a triple net lease. That means Steward pays rent, taxes, and maintenance on the property it owned like 4 months ago. It also doesn’t charge fair market value and has a healthy amount of rate hikes in the contract.

K. Looking good for Steward and all the patients it serves. Well on our way to fixing healthcare.

Oh, what’s that you ask? Didn’t Steward just reinvest the $1.2B into the hospital?

That’s hilarious.

In fact, no. It did pay the LPs of Cerberus about $400M in dividends as you saw. And then ignited a hospital buying spree across the country.

The spree was all the same playbook too. Buy hospitals using mostly debt. Immediately sell the property to MPT. Cash out. The hospitals acquired essentially cost nothing from the immediate asset sale offset.

Like this:

All the while, the total health system continued to be loaded with debt.

Like this:

Yessirie doodle. You are reading that right.

($267M) in working capital.

($1.5B) in members’ equity.

All the debt, none of the fun.

It also looks like Steward doesn’t much like to pay the bills. $988M in accrued expenses and A/P. A minor $192M increase year-over-year.

In a Baraka style finishing move, Cerberus sold Steward back to Physician investors in 2021.

How in the world, I know you are wondering, could a crew of doctors buy this humongous, multi-state, 35-hospital health system?

Oh, well, like this:

First, this humongous health system didn’t have the peachiest finances.

You just saw the balance sheet. So, I mean, worthless.

Here’s the income statement 2020 and 2019.

Declining revenue.

Losses.

Party.

Cash flow?

Oooooh positive cash flow in 2020.

Oh, wait, dang. That’s driven by Medicare accelerated payments. That’s debt.

Looks like the sale of assets is still afoot to the tune of $470M over the two years.

And some fishy financing. I am always suspect of round numbers like this. Paying off credit, taking on more debt, and some capital thrown in from MPT for a future failed international push. I know, can’t make this stuff up.

Now that the financial dog house has been established, just get a low-ball sale price. In this case Cerberus offered a note (debt) with interest due in 5 years for $335M.

There was some equity and this and that in the deal, but ya. Way less than you would expect. It’s partially because the system doesn’t own any of its own property. MPT owns it all.

Annnnnnd speaking of MPT, it loaned the physician group the $335M to buyout Cerberus by paying off the note.

Debt to payoff debt, is never a good look.

Meanwhile, de la Torre is hanging out somewhere in the Galapagos islands on his larger of two yachts. This one clocking in at about $40M.

And Cerberus? It made off with about $800M all said and done. On a 10 year, $246M cash investment.

Not too shabby.

So much for saving healthcare though.

Or health care… whatever the heck that is.

Go Taylor’s team!

By the way, the APA style guide settled on "health care" over "healthcare". Though I agree we should refer to the US health care system as "healthcare" in contrast to what people want which is "health care". Unfortunately the APA (and everyone who follows their guide including most newspapers) didn't ask me.

Hi Preston, I am curious if the bank got paid back? Not that I worry about the lending bank's situation but rather they seem the necessary enabler in these schemes. Most of these stories seem to end with the leveraged entity forced into bankruptcy. But then that would seem to wipe out the bank's interest. But knowing how these stories end, why are banking still lending money to fund these schemes? They must also be profiting but how? If they know their holdings will get written down, what's in it for them?