The Healthcare Breakdown No. 049 - Breaking down the 5 PBM Money Games; Part III of our PBM series

Brought to you by me!

What we’re breaking down: How them PBMs be making all that money

Why it matters: I feel like I would like to know if someone is ripping me off

Read time: The time it takes for that first slice of pizza to cool down enough to not melt the roof of your mouth (7 minutes for real though)

Welcome to Part III of this PBM paradise. Perfectly paired with your sippy by the pool.

If you haven’t already, head back in time to Part I; What the heck is a PBM anyways, then over to Part II; The pharmacy ecosystem, to get caught up on all things nefarious in the world of managing pharmacy benefits.

Oh, and since you asked, yes, this episode is brought to you by none other than ME! And this finance course I made, which you should totally take. Because how else are you gonna fix this mess if they’re always hoodwinking you with their financial shenanigans.

Boop.

Back to business.

There are 5 main games that PBMs play to bilk your hard-earned dollars. Kinda like the person who orders water and then puts Sprite in the cup.

We see you bro.

The games:

Spread pricing

Kickbacks, I mean rebates

Mail order

Direct and Indirect Remuneration (DIR)

Overpaying yourself

Bonus – Prior authorization denials, not allowing substitutions, intercompany eliminations

Away we go.

Spread pricing

This one is pretty simple times. Not cool, but simple. The PBM simply charges the health plan way more for the drug than it reimbursed.

For example, the pharmacy is reimbursed by the PBM for $70. The PBM turns around and invoices the health plan for $100 plus the admin fee. In fantasy land, the PBM should be invoicing the health plan for the reimbursement, not some made up number to make extra profit.

Picture!

Kickbacks

I am not calling them rebates. Sorry not sorry. These are dang kickbacks Annie Oakley.

The PBM sets the formulary for the health plan. That means it gets to say what drugs are covered and for how much. To earn that honor one would think it would be based on efficacy, affordability, accessibility, and all the good things that help to treat patients.

Scoff. This is healthcare, not Unicef. We aren’t running a charity here. We’re making hundreds of billions.

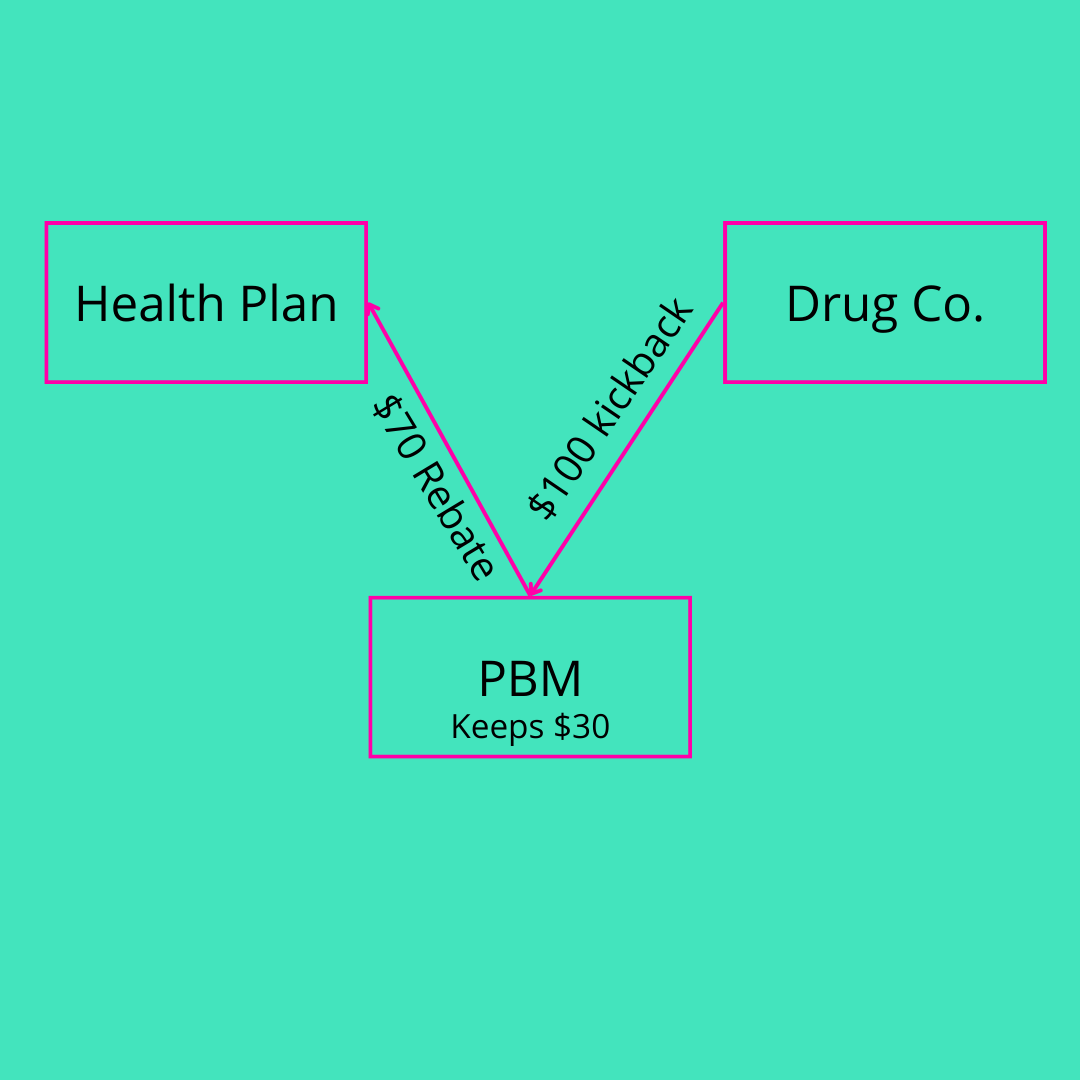

So, the PBM sets the formulary and will happily give a pharmaceutical company preferred access for a kickback. But since kickbacks are illegal, they have rebranded them as rebates.

The two companies agree to a certain amount of rebates, often based on pay-for-performance, to buy a spot on the formulary. The PBM looks like a hero to the health plan because they trot back on their white horse, which they overpaid for from the stud farm of a politician, and hand over a “rebate” check.

What they fail to mention is the cut of the rebate check they keep. So the rebate may be $100 but the PBM goes ahead and holds on to $30.

Easy money picture.

Mail order

You can also think of this one as repacking. I don’t know about you but Express Scripts keeps hitting me up asking if I want to get my prescriptions through its mail order service, which naturally will cost me less. No copay!

Jokes on me and them, since I already hit my max out of pocket this year.

Here’s how this seemingly awesome thing actually sucks. They waive the copay, they eliminate the admin fee to the plan, they even offer a deeper discount to the plan. All sounds good right?

Not so fast Halle Barry. Since they are now the wholesaler of the drug, they set the price. So great, no admin fee and a deeper discount on a drug that may cost 50% more.

And PBMs ain’t no scrubs. Why do you think they waive the $40 copay. When a drug costs $873 and then gets marked up 50%, that $40 isn’t making a dent.

Don’t worry, I made another picture.

DIR party

Y’all remember “No Child Left Behind” right? Basically some PBM exec was sitting around reminiscing about the good ole days while sipping a mint julep, peering over his monocle, twirling his Dick Dastardly mustache, and lauding the efforts of politicians penalizing underperforming schools.

Eureka.

See, no child left behind may have been well intentioned, though I have no idea how they missed something so obvious. It’s almost like the same people are responsible for Medicaid.

Anyways, if a school underperformed, it would have it’s funding cut.

Stick, not carrot.

The issue here is that the underperforming schools were also the most already under-resourced. Cutting funding only hurt the school more and sent it into a death spiral, earning cuts year after year.

Think of DIR fees in the same ways. PBMs set some Narnia conditions that a pharmacy must meet and when they don’t they claw back reimbursement.

Guess who gets hit the most? Ya, pharmacies that aren’t CVS. What’s up Caremark.

PBMs make significant amounts of revenue, or rather avoid significant amounts of costs by stealing, I mean, taking the money back from a pharmacy against its will after it preformed a service.

Simple picture.

Overpaying yourself

But how? But why?

Remember, the PBM game is one of vertical integration. Especially where specialty pharmacy is concerned. Specialty pharmacy is just the complex stuff. Think infusions and cancer drugs. Fun fact though, PBMs also deceide what qualifies as “specialty.”

So, Caremark is obviously CVS, which has specialty pharmacy. Cigna owns Express Scripts, which owns Accredo. And United Health owns Optum RX, which owns Optum Specialty.

In the vertically integrated game, when someone else foots the bill (the health plan) it makes all the sense in the world to overcharge yourself.

Say a drug is reimbursed normally at $50. The Plan should bay $50 to the PBM, which then pays the pharmacy $50. I mean, makes sense right?

But this isn’t about sense, or cents, it’s about yachts. Lots and lots of yachts.

Caremark happily “negotiates” a reimbursement rate of $100 to CVS pharmacies and gladly pays. Because guess what? It turns around and charges that $100 to the health plan.

At the end of the day, CVS owns all of it, so it just whips up a few intercompany eliminations and makes itself a cool $100 for negotiating with itself, when it should have only made an admin fee and reimbursed $40.

Good negotiators.

It’s fine cuz, more pictures.

Bonus – Prior authorization denials, not allowing substitutions, intercompany eliminations

I figured you weren’t tired of my overly wordy, not to the point, occasionally often non-sensical writing and stayed for a bonus.

Naturally, PBMs require prior authorization for drugs. The longer the authorization is delayed, the more money they hold and can invest. When your premium dollars aren’t being paid out, they don’t sit on a mattress in a vault. They make millions for the PBM when they buy-back stock and invest in their buddy’s hedge funds.

No substitutions is part of the formulary games. PBMs want the high priced drugs and they want the kickbacks. It can’t be said enough that the higher healthcare costs, the better for insurers and therefore PBMs. So, they have crazy rules and don’t allow for substitutions of certain drugs so that you and the plan are on the hook for the expensive brand name drug.

Finally, intercompany eliminations. I have touched on this in the past. It’s how insurers make the government look like a joke (although it doesn’t need any help), by getting around Medical Loss Ratios. It’s also the mechanism that enables charging yourself really high prices.

All you do is charge your subsidiary or other division a lot of money, but since your cost on the front end is low, you can show greater costs (MLR) but you aren’t really incurring it. It’s a cradle to grave situation. Then you just do an interco elimination to keep the difference.

So if you buy something for $3 then sell it to your subsidiary for $9 and they sell it for $18, your profit isn’t $6 (9 minus 3). You eliminate the $9 and it’s ultimately $15 (18 minus 3).

Last picture.

Party on.

Incredibly elegant analyses of PBM’s. No holiday cards for you this year! Keep up the great #research!

Easy-peasy lemon squeezy and clear as mud at the same time. How do you do it?