The Healthcare Breakdown No. 054 - Breaking down MSOs, PPMs, other acronyms, and why the 90’s is back in style

Brought to you by Platform shoes apparently

What we’re breaking down: MSOs and the like

Why it matters: Private practice is challenged to say the least, understanding MSOs is critical for physicians

Read time: Much shorter than Apocalypse Now (6 minutes for real though)

I hope you have your espresso martini primed, because we are about to dive into some topics that are changing the landscape of healthcare.

Yes, that’s right, it’s the MSO.

First of all, what is an MSO?

Thank you for asking the most obvious question since asking, if Tay and Travis Kelce breakup, what does that breakup song sound like? And do other teams use it as a hype song against the Chiefs?

P.S. I would sooner quit healthcare than see Tay and Trav breakup. It’s too adorable.

Speaking of adorable, there’s a super adorable guy putting on a webinar this coming Wednesday. You should totally check it out if you’re into this whole private practice thing.

Click on this gorgeous picture for details:

There may even be some extra awesome stuff if you tune in live. See you there!

Here’s a button too in case you forgot to click the picture:

Sorry for the digressions. MSO…

MSO stands for Management Service Organization.

Aside from the obvious that an MSO is an organization that provides management services, what pray tell, does and MSO actually do?

Well, that can depend. At the simplest level, they do in fact provide management services. Think the business junk that is everything except clinical care.

Not like McKinsey consultants that drop a PowerPoint on you after charging you $250K to annoy the people who actually do work in your company.

Management services would be things like billing, accounting, compliance, human resource management, general practice management, etc. That day-to-day grind.

MSOs can do even more depending on the model, which we will get into in a second, like buy buildings and lease them to practices, manage all the bank accounts, invest in additional growth capital, serve as in-house counsel, and negotiate contracts on behalf of a practice.

What you may not know about MSOs, except for all that stuff I just told you, is that they aren’t new.

Shocker, I know.

They used to be called PPMs, or Physician Practice Management organizations. The darling of that original ilk was PhyCor.

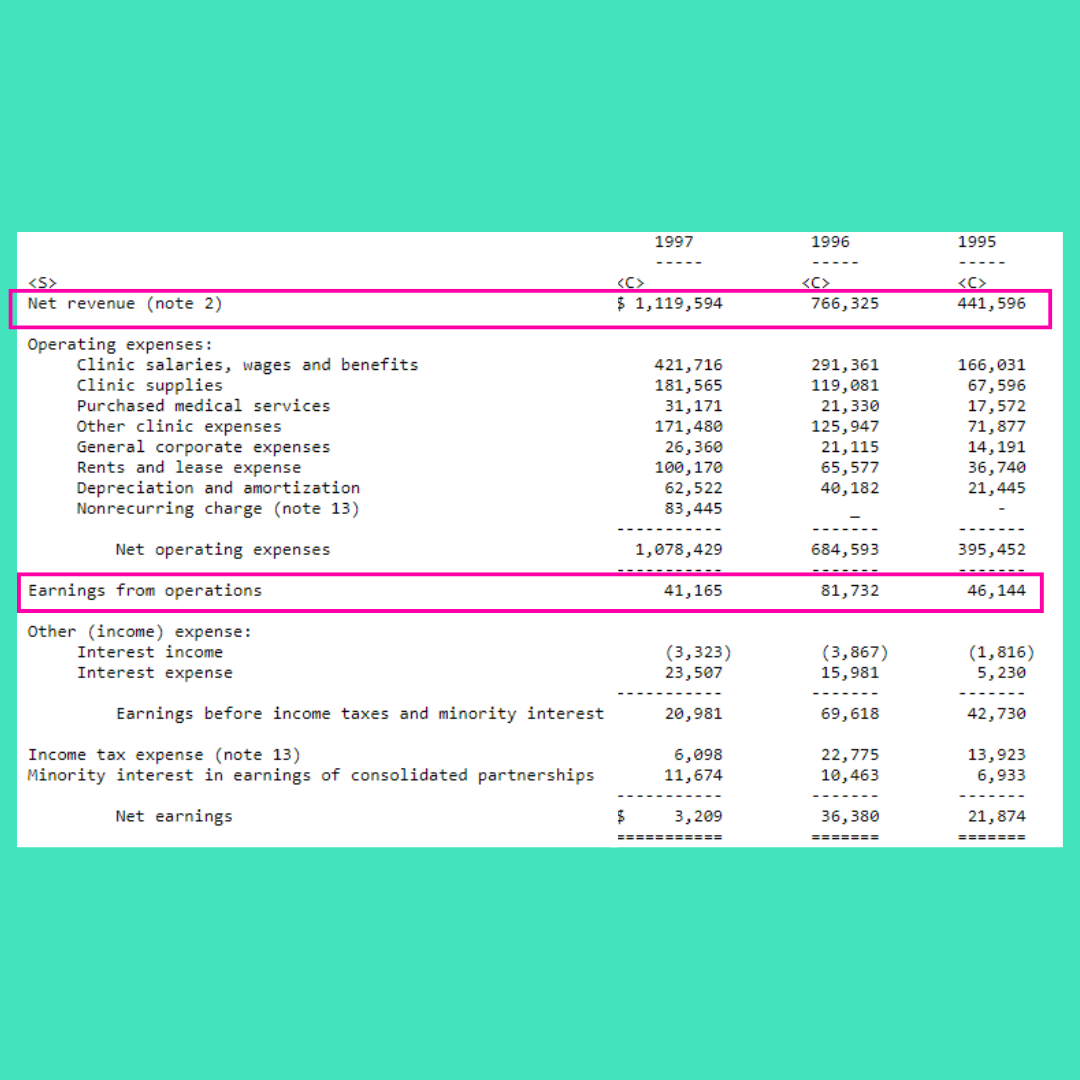

Check out PhyCor at it’s height:

Yup. A billy plus in revenue. Though margins were pretty slime. I guess it’s hard to run a practice after all.

And at it’s demise:

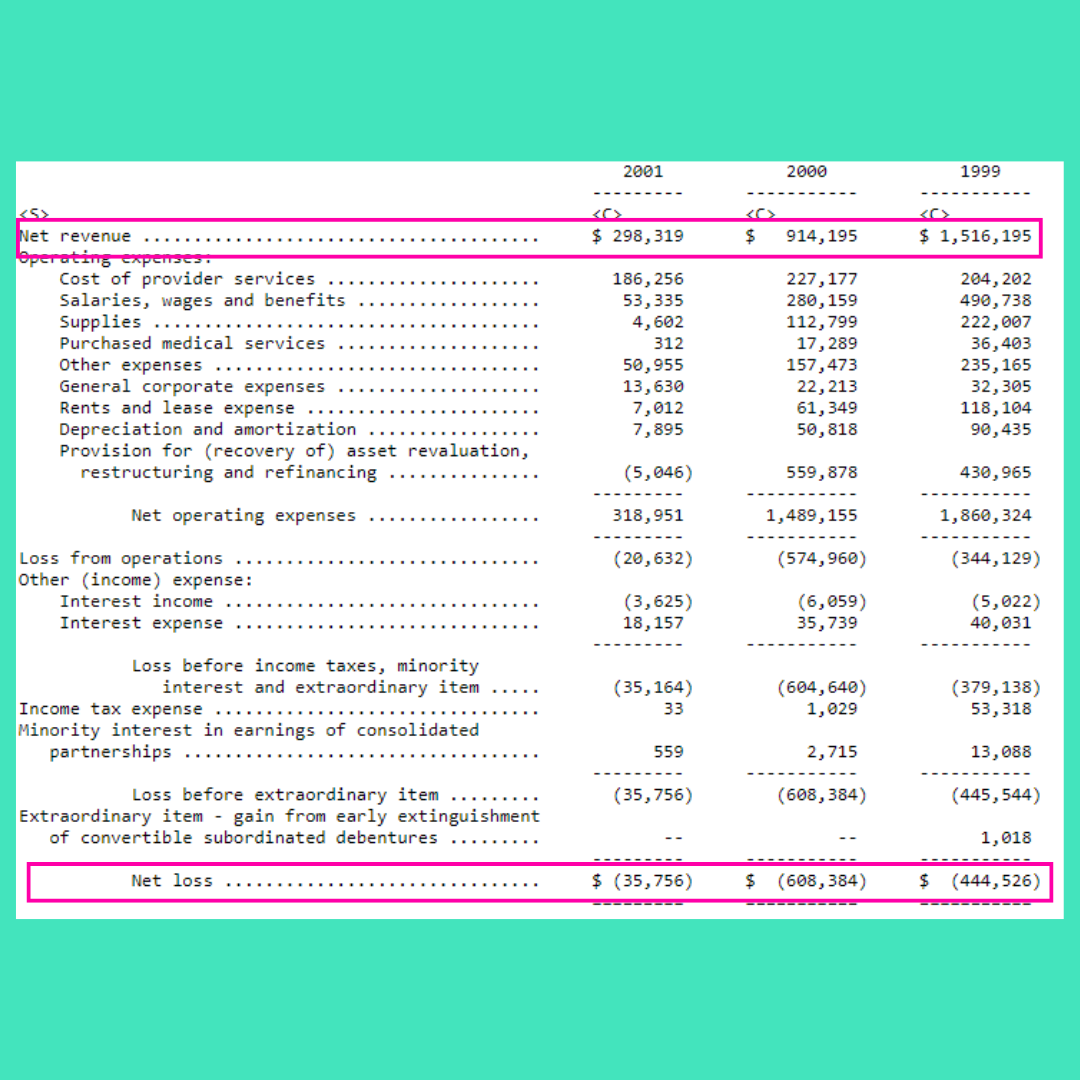

From a cool $1.5B in revenue to $300M, with losses in the hundreds of millions.

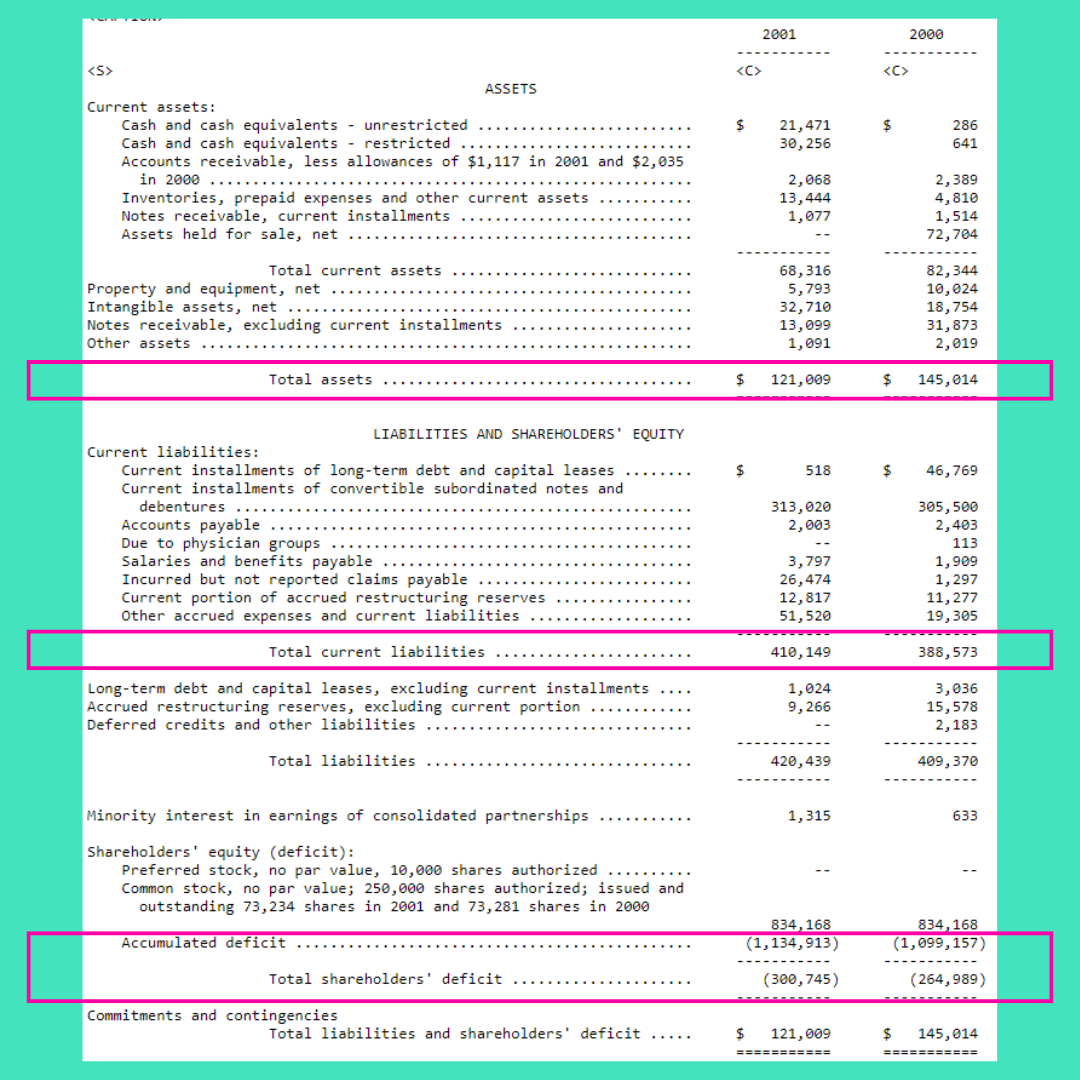

Not to mention its balance sheet…

Yeesh. What happened?

And what can we learn from it.

PhyCor essentially did what the modern MSO does today. They would buy or contract with practices to leverage scale, take on capitated payment structures, provide administrative support, and help navigate the ever evolving regulatory and payment landscape.

It was much easier to take on risk as a group with thousands of physicians as opposed to 7.

Not at all familiar, right?

Before we look at the modern marvel, let’s chunk down the types of MSOs into 3 buckets.

1. The private equity MSO

Private equity can’t own physician practices outright. I have written about the structuring a few times, which you can check out here.

Essentially, a company is created and a series of contracts are written whereby the physicians retain ownership of their practices on paper, but all the value transfers to the MSO and the physician cannot sell the practice without permission.

The PE group uses the MSO to provide admin services, consolidate negotiating power, roll up practices for higher valuations, and then sells the whole thing in about 3 years.

2. The old, but now new model

The modern MSO such as Privia, Astrana, Aledade, Pearl, and agilon to name a few function eerily similar to PhyCor and it’s best friend MedPartners. Although these days, with such diverse payment models, they each focus in slightly different areas.

At the end of the day though, it comes down to three main things.

Enablement, Aggregation, and Management.

While some focus on one area more than others, it’s really about these three levers. The same levers that PhyCor used to pull.

Now, PhyCor was heavy into buying practices, got way over it’s skis in debt, and realized (as PE soon will) that there are two kinds of leverage in this world and they were playing with the risky kind.

Without dissecting each in great detail, the highlight is this:

Aledade - ACO enablement all day. Still private so the jury is out

agilon - MA now into ACO, losing all the money. They also sign like 10 year term contracts… Yeesh. PhyCor used to sign 25 year terms. Even 2 years gives me hives.

Pearl - ACO, still private. Founded by investment bankers and hedge fund managers so who knows.

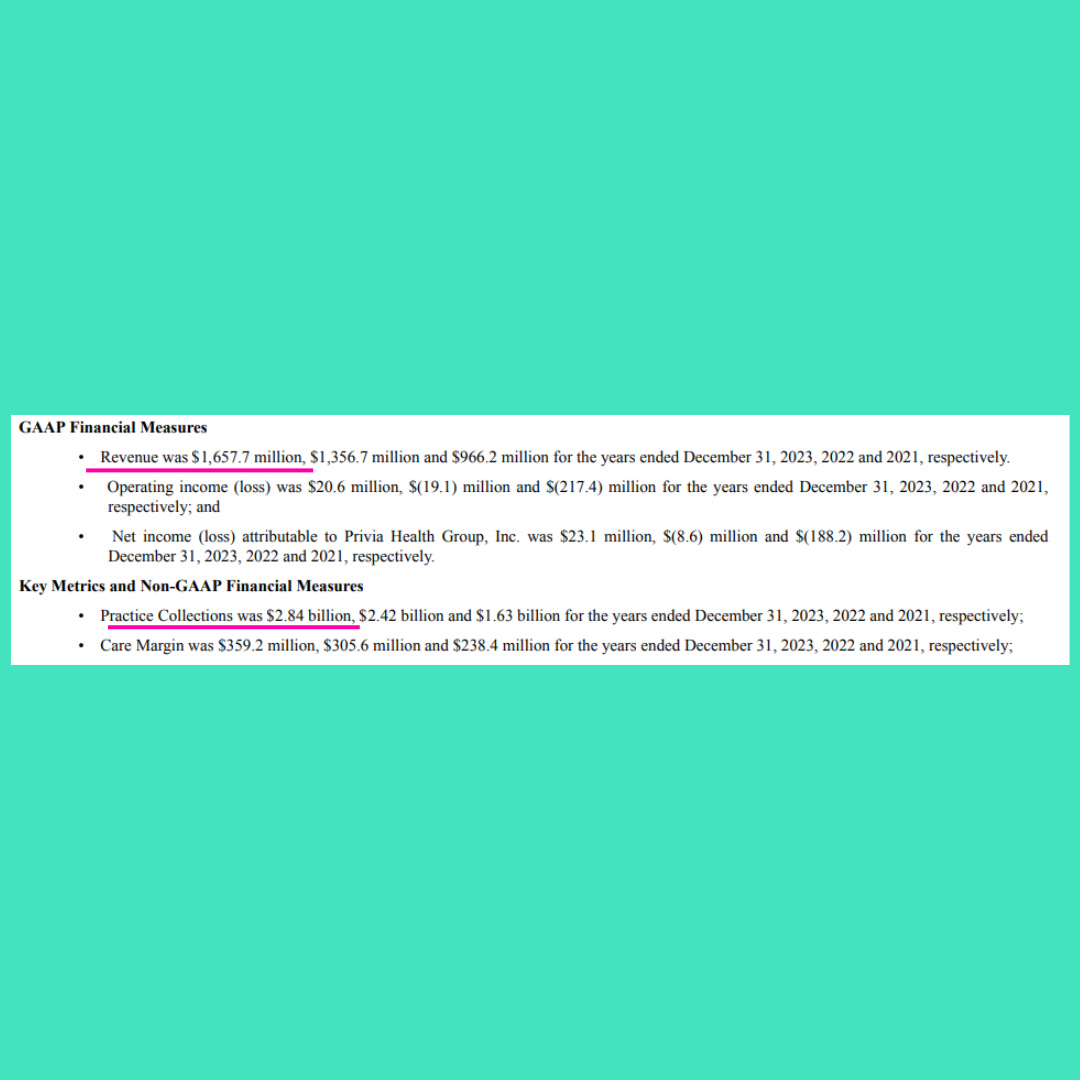

Privia - Public, most diverse revenue, though largely in the FFS game. Meaning, it’s value prop is owning the administrative headache and having you in their medical group. Revenue as a percent of collections is mighty high and I hear it’s hard to get out of a deal.

Astrana - Also public and heavily in on risk based contracts. Most of it’s revenue is capitated payments. It’s profitable too. Imagine that.

They all come in slightly different focus and flavors. At the end of the day, it’s about what makes the most sense for the practice. The major drawbacks I see are that these organizations are another means of shipping out autonomy. Because if you decide to bring things inhouse or change partnerships, you may be looking at an uphill climb.

3. The other guys

This is the fragmented world of MSOs. Smaller boutique style firms that serve as contract organizations to help practices run better. They provide many or if not all the administrative services, but are not as involved in value based arrangements. They can often help work towards VBC readiness, but will not bear risk along side of a practice group.

The folks are pretty straightforward and can be helpful. If they know what they’re doing.

To sum it up, there are three main types of MSOs:

Private equity – we own you

VBC redux – we kinda own you

Outsource – we don’t own you

Now that you know what they offer, here’s what they take.

Private Equity takes it all and leaves some scraps to everyone they didn’t fire so long as you crank your production to unsafe levels.

The big dog enablers can take a lot. For a long time. I am sure some folks out there have more specific numbers that this non-investigatory journalist cold find, but I have seen fees amount to 12% of revenue in some cases for a small practice up to 40% of collections.

Here’s what that looks like for Privia:

Now, there is a lot more to this, but it states that of its representative physician groups, owned and affiliated, those groups bill $2.84B. Privia earns $1.66B in revenue.

That’s 58%.

It does pay out $1.3B in provider expenses. But the devil is in the detail of these contracts where someone else isn’t pulling the purse stings, but controls the entire purse.

Here’s it’s P&L:

It’s taken some time, scale, and lots of aggregation to get to where it is today. The question remains, will history repeat itself?

It comes down to this, which I have said before and I’ll say it again, man I love being a turtle. Wait, sorry, 90’s movie reference.

There is no one way. Only your way.

Speaking of your way, if you are an independent physician making your way, you should talk to my friends at Forward Slash / Health. Their mission is to help independent private practice physicians escape the crush of administrative burden, build a financially successful practice, and remain totally independent.

They’re one of those boutique ones I mentioned.

Here’s an large logo you can click and check out their newly gussied up website:

Tell them I sent you.

While MSOs have been around for a hot minute, they aren’t going anywhere. And with private practice becoming increasingly difficult in the face of reimbursement challenges, the rise of private equity and health system predominance, and the tricky regulatory landscape, MSOs can be a boon to stay in the game. And even, dare I say, thrive in the game.

But then again, that’s what PhyCor said.

Go in with eyes wide open.

Unlike Nicole Kidman that one time.

See you out there!

Every time PhyCor is referenced I hear the bugle sound of Taps in the background. Incredibly insightful analysis & guidance. Can’t wait for the seminar.

Another great summary of a key topic unfamiliar to many of us on the front lines of care, delivered w wit and brevity. Appreciate the finance statements for reference. And speaking of refs, love the contemporary cultural allusions to KC, though am biased! You’ve got a gift, Preston. Keep em coming. Thanks!