The Healthcare Breakdown No. 039 - Breaking down UCHealth’s insistence on being a huge… not nice person. And a solution.

Brought to you by a sharp stick in the eye

What we’re breaking down: UCHealth’s financials and how they love to sue people

Why it matters: To get a glimpse into the twisted nature of the business of healthcare, how it impacts people, and what can be done about it

Read time: The number of times I have to get up from my seat to get my kids something during dinner (7 minutes for real though)

We’re kicking it a little old school today. We’re going to look at some straight up financials of a health system and ask ourselves, “what in the heck fire nonsense is happening??”

UCHealth, a crown jewel of Colorado, after the Rocky Mountains, Deon Sanders, marijuana dispensaries, yuppy hippy culture, and Coors Light, has been suing its patients for decades. In fact in the last 5 years, it delighted in suing 15,710 people.

That’s 3,142 people per year. Its average collections per year was about $5M. That’s about $1,591 per person.

I’m just going to let that one sink in for a second while I go listen to a quick Taylor Swift song.

Interruption! Healthcare needs a revolution. It needs you. Don’t let numbers and finance be the thing that stops you.

Healthcare Breakdown - The Finance Course! will show you how to:

Read and understand financials like a pro

Build financial models, and

Go toe-to-toe with any CFO

In an afternoon.

There’s templates, jokes, and all kinds of good stuff in there.

Stop avoiding finance. It’s cool.

Cool, sinked?

A health system in Colorado that does $6.9B in revenue is suing people for sixteen hundred bucks. You can read more about it here.

Well, they must really need the money, so let’s get into it.

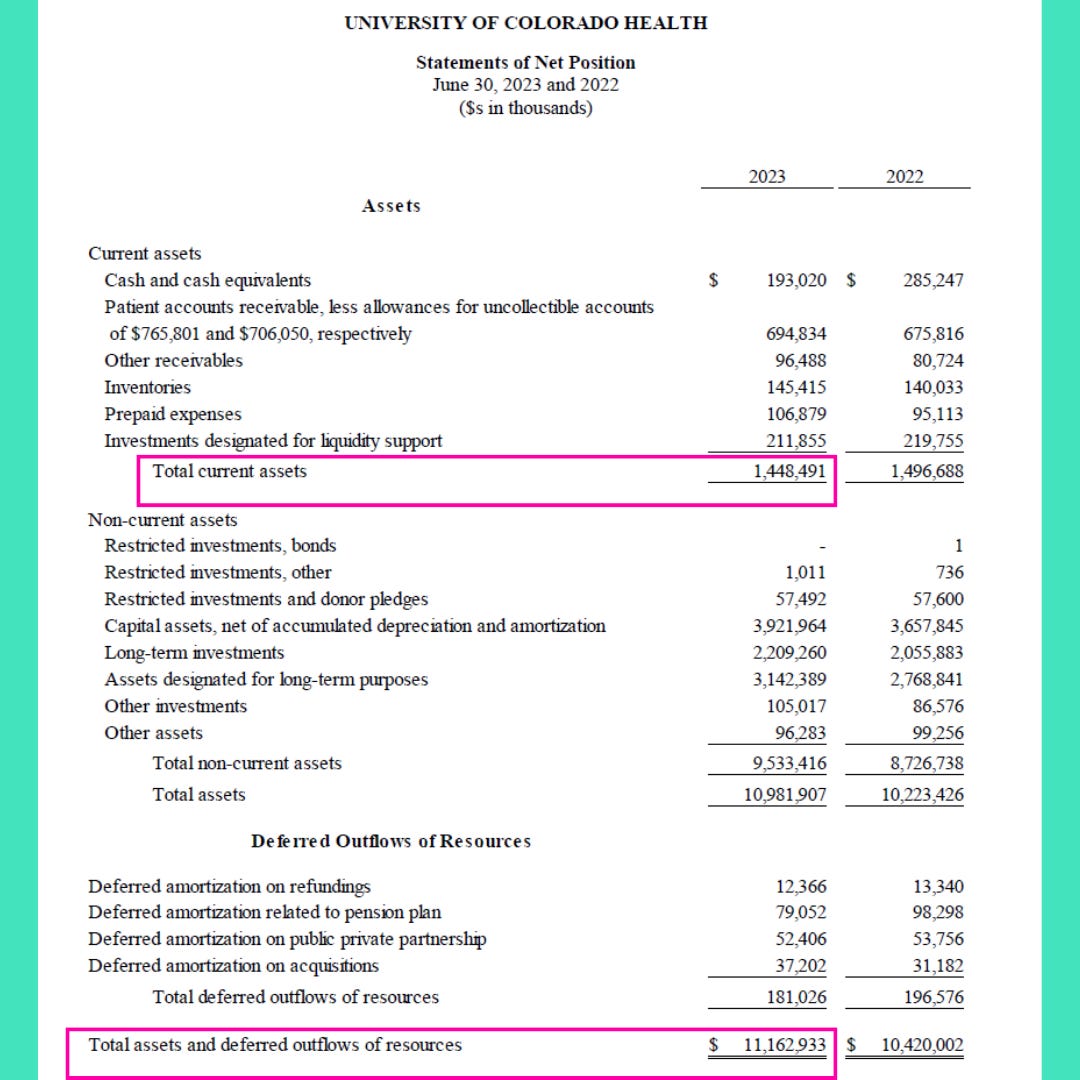

Balance sheet first.

As you can see on the asset side, a cool $1.4B in current assets and $11.2B in total assets.

Don’t ask about the deferred outflow of resources thing. It’s confusing. Just know they got the monies.

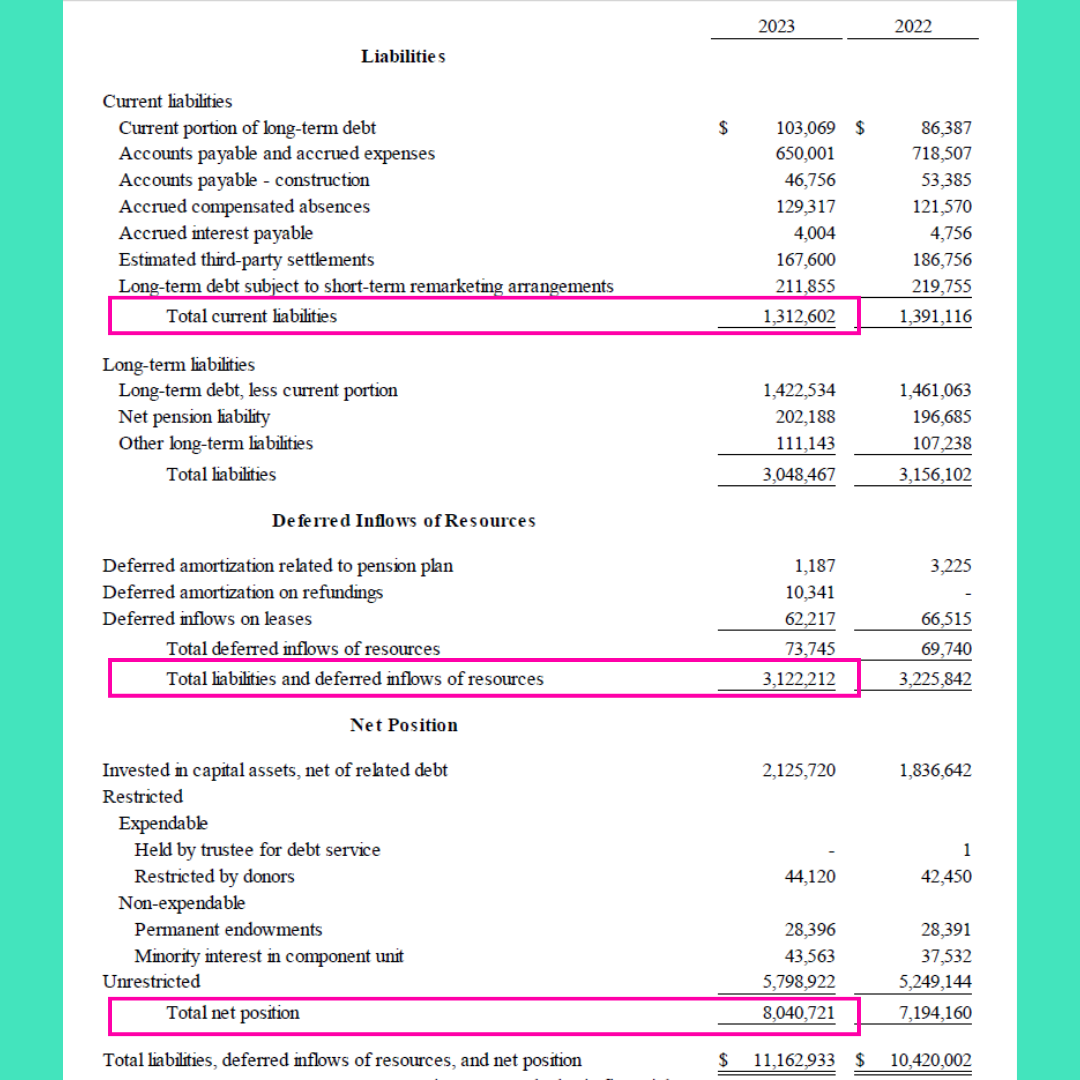

On the liabilities side, nothing crazy, just a sly $1.3B in current liabilities and $3.1B in total. That puts UCHealth’s net position, or equity, at a peachy $8B.

Here it is in hot pink form:

As you can tell, it doesn’t look like UCHealth is drowning in debt like HCA or Steward. Well, I guess Steward has yachts, so maybe drowning isn’t the right word…

Here are some ratios to show how unleveraged it is:

Working capital: $136M

Debt-to-Asset ratio: 0.16

Debt-to-Equity ratio: 0.39

More money than debt. Check.

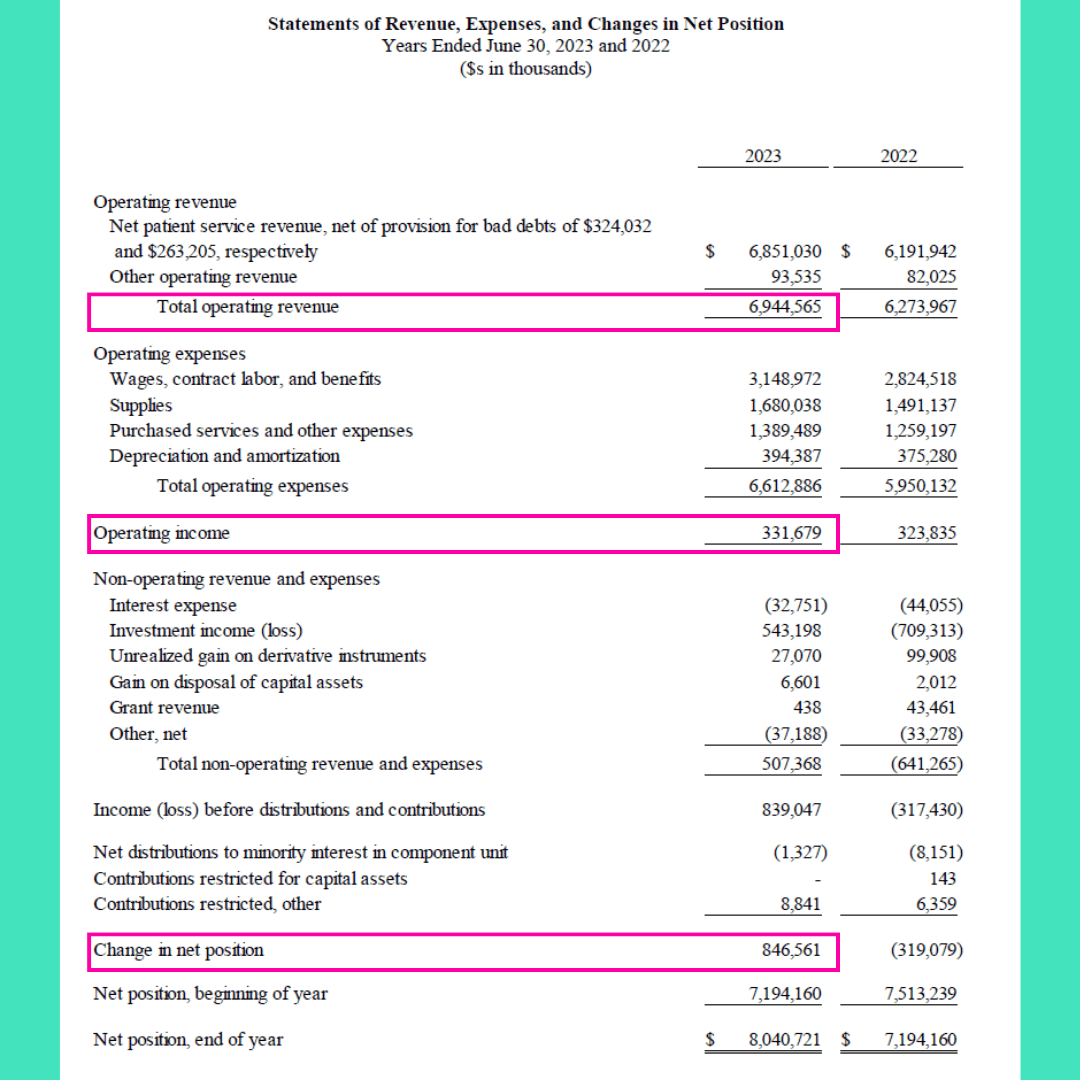

How’s the income statement looking?

Not bad… not bad. In a world where all you see is “red,” (not a Taylor reference, she’s the best), looks like UCHealth is just fine.

Here’s the words recap:

$6.9B in revenue

$332M in operating income

$847M in net income

That five million is really making a dent.

And in case you’re wondering if that five millie propped them up from last year, revenue was up $671M (+11%) and operating income was up $7.8M (+2.4%) year over year.

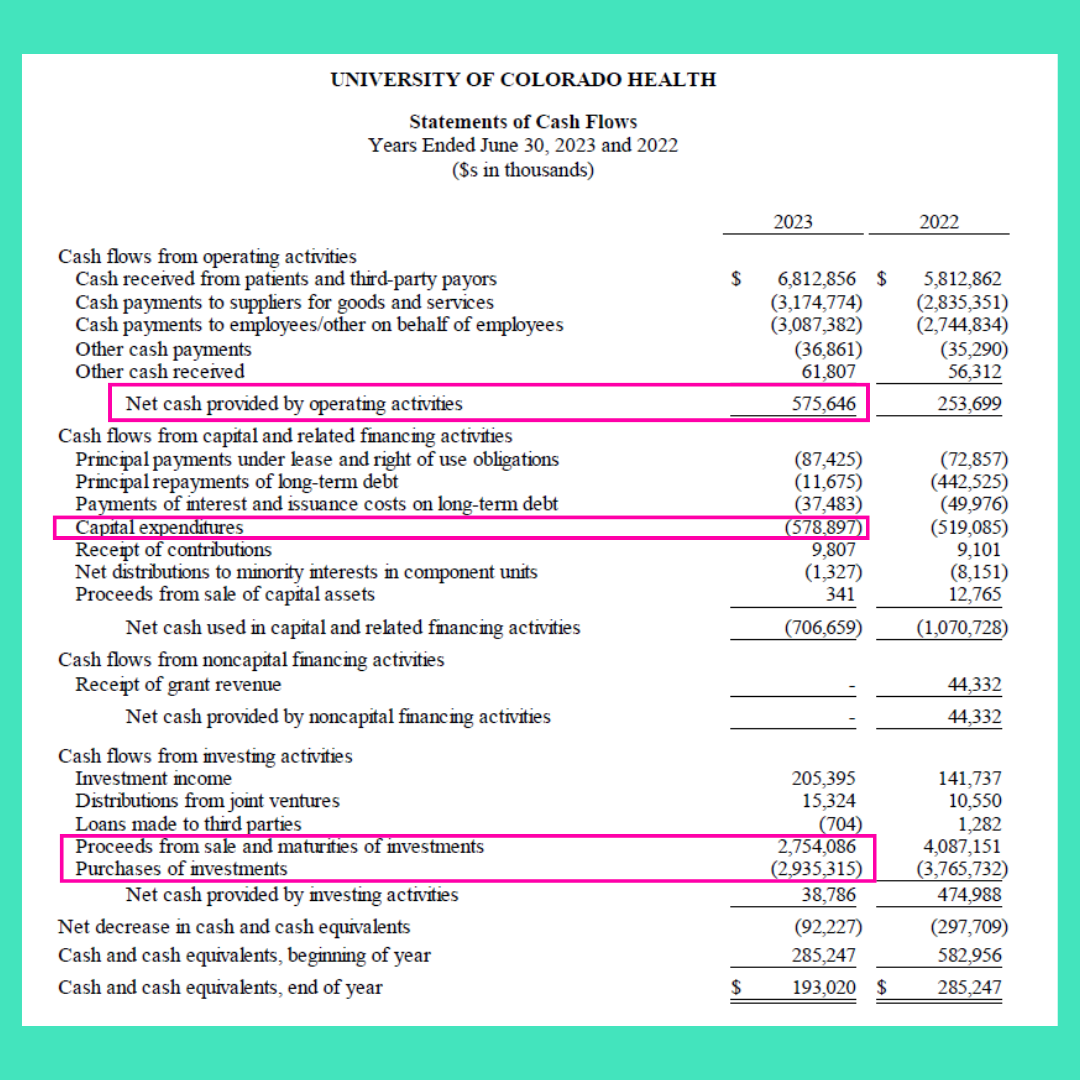

Well maybe cash flow has the answers. Perhaps it was a cash flow issue that made UCHealth want to sue people over less than 2 iPhones.

Let’s see shall we?

Well, criminy.

It made $576M cash from operations, +127% YOY.

It was also able to spend $579M on capital expenditures. Lobbies are way cooler than taking care of sick people.

It was also able to make $2.8B from investment sales and over the course of the same year, buy $2.9B in new investments.

Uhhhh, ya I am running out of defense mechanisms. I feel like I am in therapy.

Anyways, it must be doing some good right. Like charity care. How about some charity care?

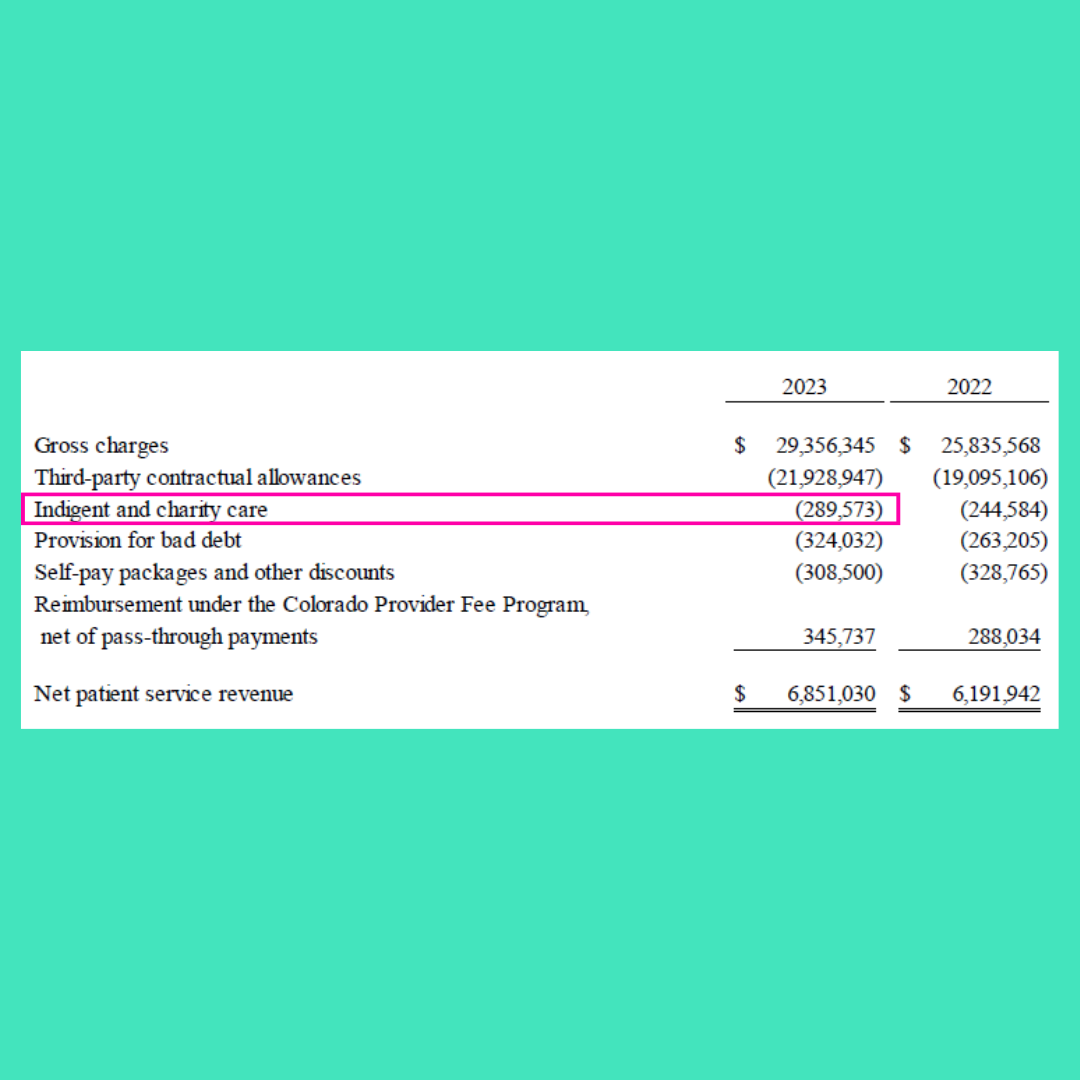

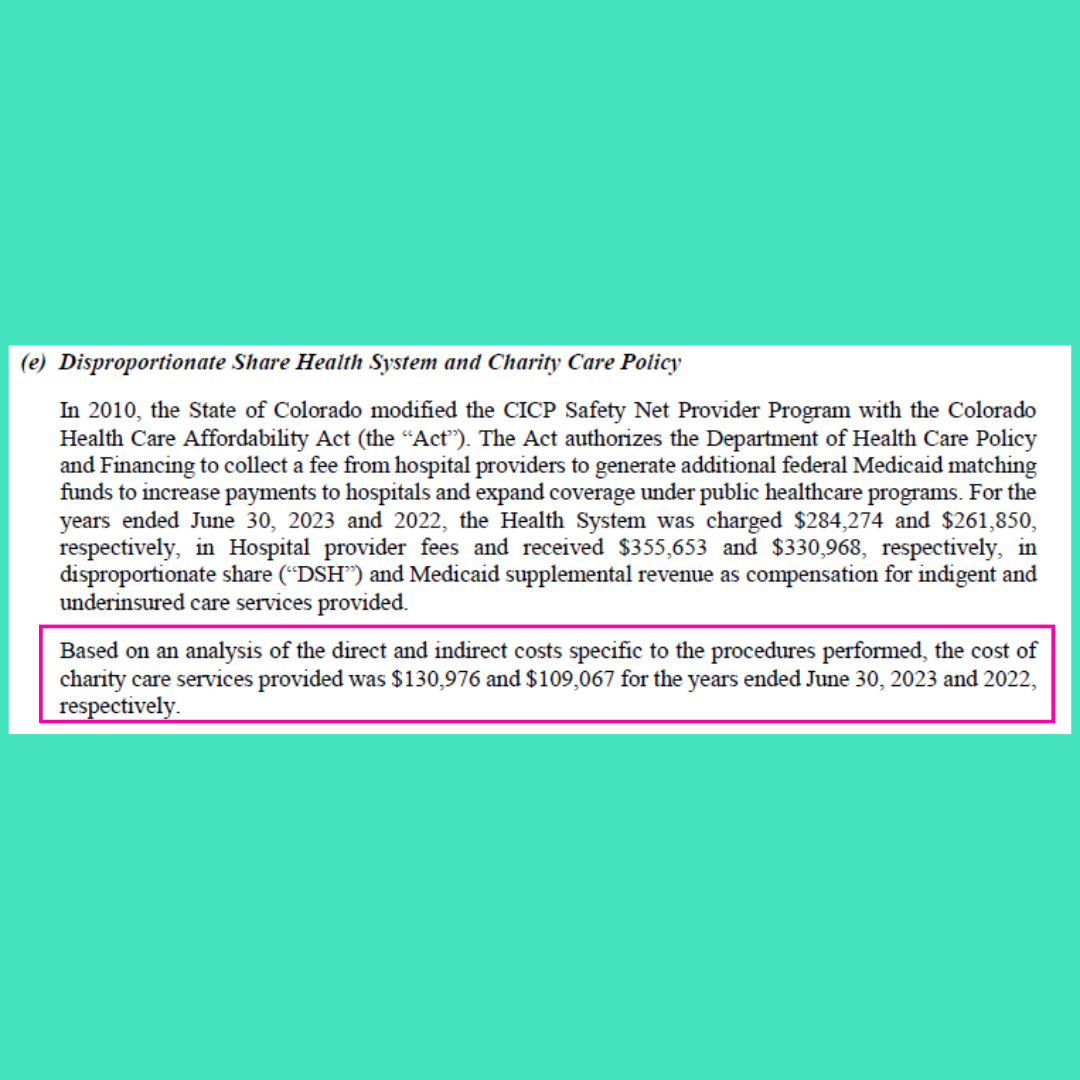

See now, there it is. $290M provided in charity care.

Oh wait, what’s that?

Ok. Ok. I mean $131M is still good. Like 1.9% of revenue in charity care is legit.

Fine, ya I agree. That’s some bull hooey. Especially since that charity care number is defo inflated. I wrote about how you do that in episode 31.

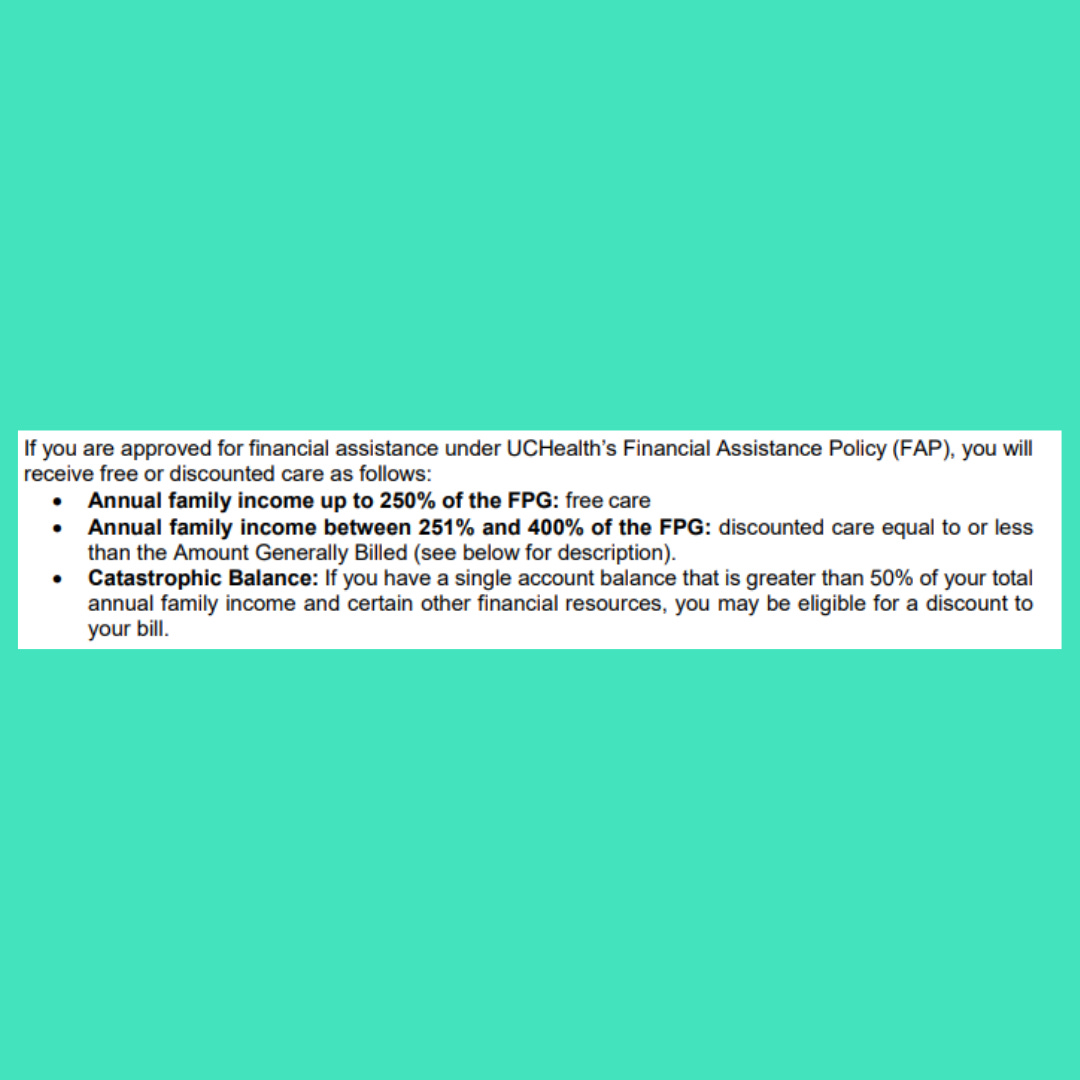

Now, I know what you’re thinking. I thought the same thing. There have got to be some policies around all this. They can’t just sue people all willy nilly. How do people qualify for charity care?

Well, glad I mentioned it.

If you are at or below 250% of the federal poverty level (FPL), then you get free care. Otherwise known as charity care. And if you are a big ole a-hole, indigent care. If you are between 250% and 400% of the federal poverty level, you get a discount.

It’s all in black and white:

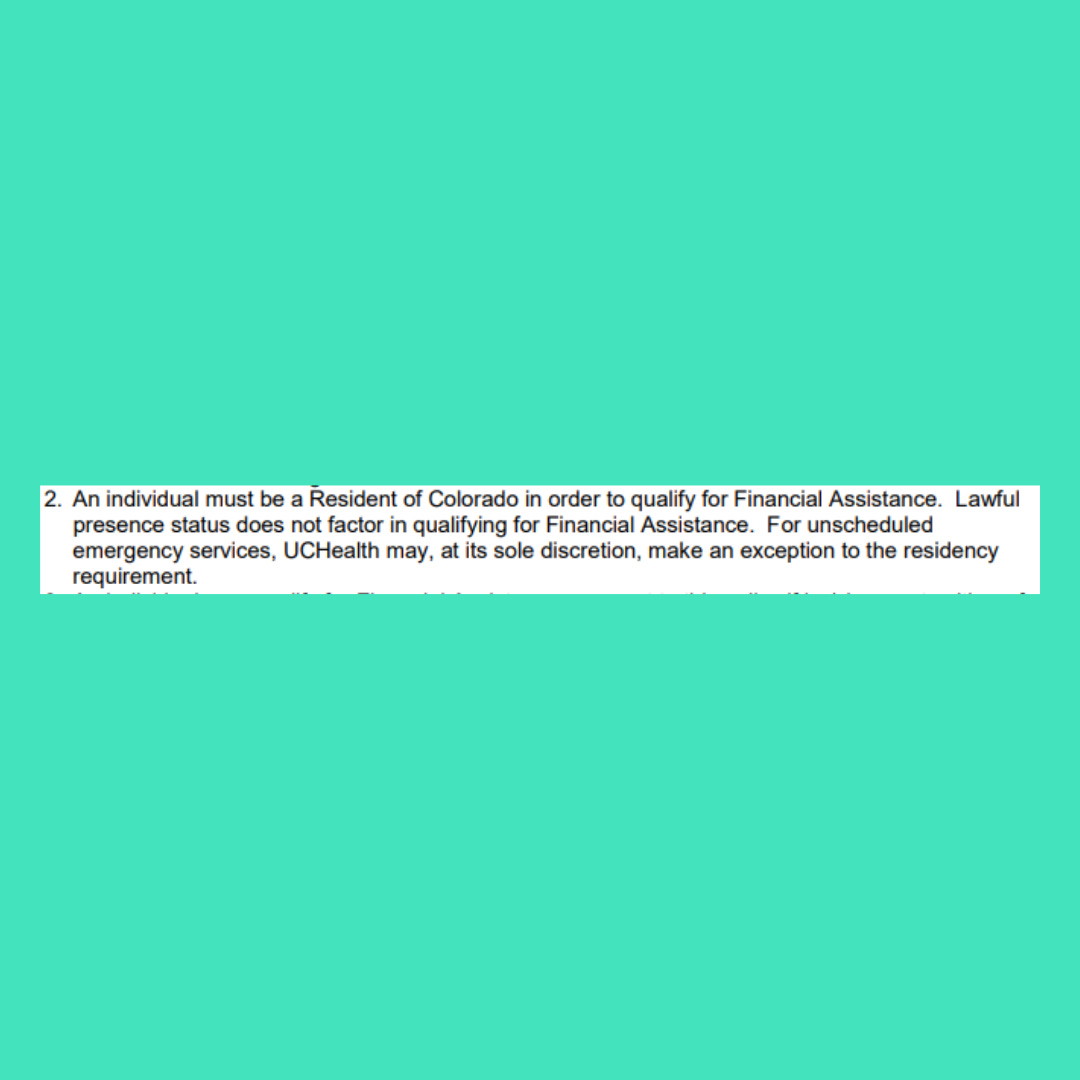

But so is this:

Ok, so you have to be a resident. Check. That leaves out a lot of people. Doesn’t matter, there has to be something good coming.

Ya, not what I had in mind. There is a whole list of doctors who don’t qualify for financial assistance. What the H? How is anyone supposed to know?? You don’t pick your freaking doctors when you roll up for a heart attack.

And in case you were wondering there are 351 providers (whatever “provider” means) who are not covered by the financial assistance policy… at one hospital. Out of 15.

Sweet.

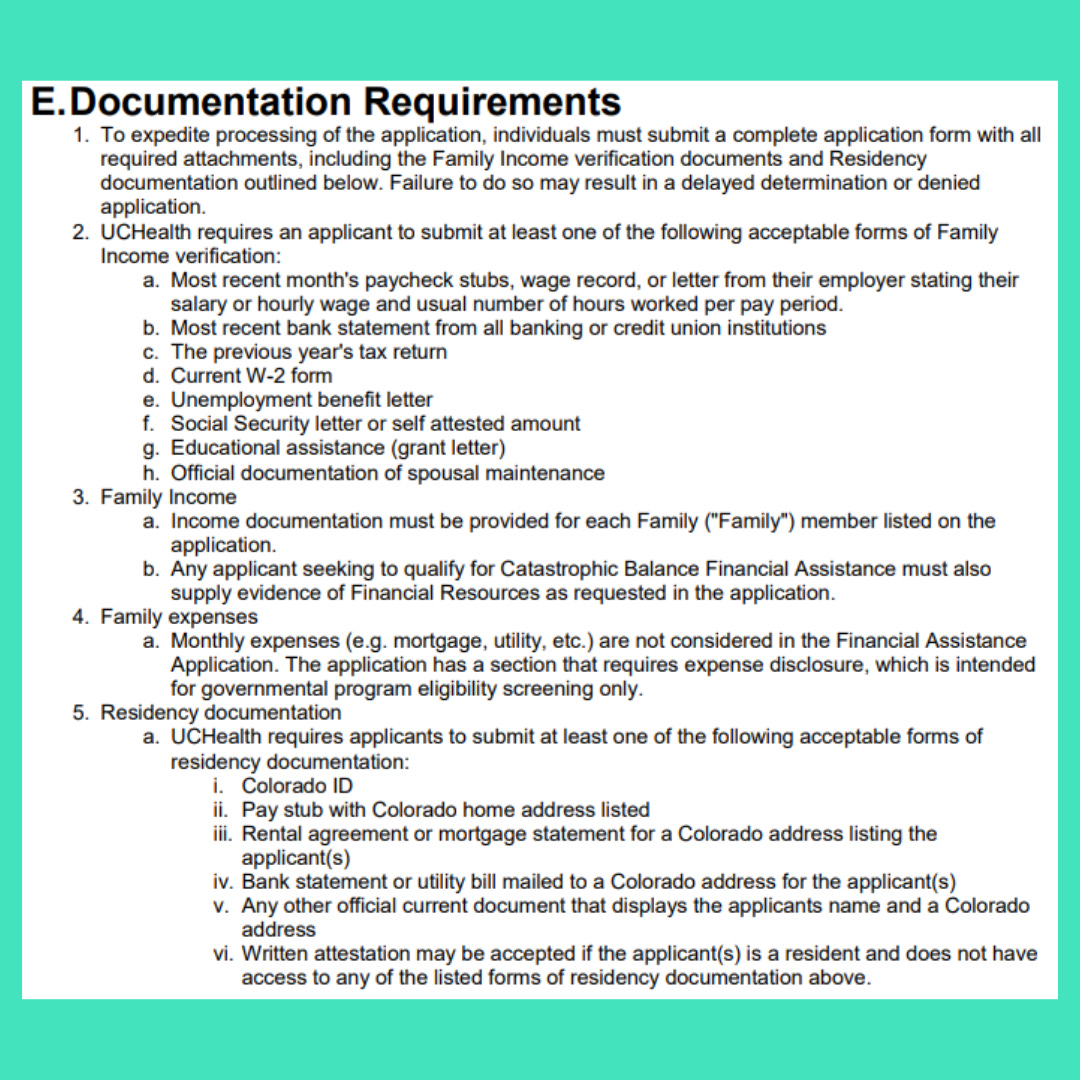

At least it’s easy to submit the documentation to qualify?

Riiiiight….

To recap, like super quick. UCHealth has a bunch of money, spends money on lots of buildings and stuff, has a very challenging financial assistance policy, and sues people for 3 months worth of your car payment.

The worst part is… well, I mean, the whole thing is the worst part, but the other worst part is they don’t even need to do this. Morally it’s obvious. But even financially, its stupid.

First of all the time and resources to gain 0.07% of revenue could be spent better somewhere else.

Second, and if you work in a health system, just lean in a little closer to your computer for this, you can cover subsidized exchange premiums and make more from insurance reimbursement than the premium dollars you’re paying. Then, and this may be the best part, you can even bump the qualifying FPL percentage up so more people can use their insurance and you can keep your pretty tax breaks.

Anyways, there is more to it, but it works. Also, in this very real and very successful pilot, there was a reduction in ED utilization and increase in primary care utilization. It will never cease to amaze me that this is all so fixable, arguably, fixed, but people just ignore it.

I found a cool rate estimator here if you want to see how much insurance may cost on the exchange depending on FPL qualification. You can do some math based on the rates to see how many premium dollars would be going out and how much insurance dollars would come in.

And yes, there are also implications to bad debt, charity care, and more. But the point is, there are mechanisms to provide people with healthcare and not be a total troll about it.

First blush, UCHealth can eat these costs, no problem. 15,710 sued in 5 years for a grand total of a rounding error. That’s shameful.

Too bad its chief legal officer cannot feel shame. As she said, presumably with a straight face, “I can tell you it is a common practice. I don’t think UCHealth is an outlier here. We’re not an outlier in the number, and we’re not an outlier in the way to go about this.”

Translation: “But mom, everybody is doing it!”

Second, with the right approach and strategies, there are ways to successfully run a business and give people the healthcare they need and deserve.

Crazy, right?

K, Love you.

So Patient Receivables are 50% of total current assets?? And 7x other receivables?? Round numbers…$770M at a $500 OOP, which we know most Americans don’t have on hand…would be 1.4M accounts. Who can think those receivables are appropriately discounted?

Thanks for all you do exposing #facts, Preston… keep shining the light 💡 on the #Cartel and eventually care and costs will improve… now, back to work!