The Healthcare Breakdown No. 061 - Breaking down UnitedHealth Group’s 10-K and why they love to hate you so much

Brought to you by the 1964 Buick Skylark

What we’re breaking down: UnitedHealth Group’s 10-K

Why it matters: UHG is the largest healthcare company in the world and they control access and the cost of healthcare for over 100M people… so ya, it matters

Read time: The best scene in My Cousin Vinny, so all of it (9 minutes for real though)

Here’s the crux

UnitedHealth Group is the 8th largest company in the WORLD. It control access to healthcare for over 100 million people, showing no signs of slowing down.

And unfortunately, people with UHG coverage or are in-network physicians often feel like a deer in south Alabama drinking from a little brook. BAM!

It’s financial prowess is underscored by its devious practices that directly impact patient lives. Understanding the financial picture, how the money flows, and where the company is going will help to elucidate issues with the system and possible uncover opportunities.

Here’s the “fun” part

Let’s start this party off with a good laugh. According to UHG’s 10-K, this is the business UnitedHealth Group would have you believe they are in:

“UnitedHealth Group Incorporated is a health care and well-being company with a mission to help people live healthier lives and help make the health system work better for everyone. Our two distinct, yet complementary businesses — Optum and UnitedHealthcare — are working to help build a modern, high-performing health system through improved access, affordability, outcomes and experiences for the individuals and organizations we are privileged to serve.”

No, no. I know. It’s hilarious.

And, since it’s hard to keep up with all the business UHG does do, here’s a little overview:

UnitedHealthcare = individual, employer, Medicare, and Medicaid insurance

Optum Rx = PBM and specialty pharmacy

Optum Insight = Change healthcare and analytics

Optum Health = Care delivery employing over 100,000 physicians and a bank (ya, a bank)

Cool, now that we know generally what UHG is up to, how they doin over there?

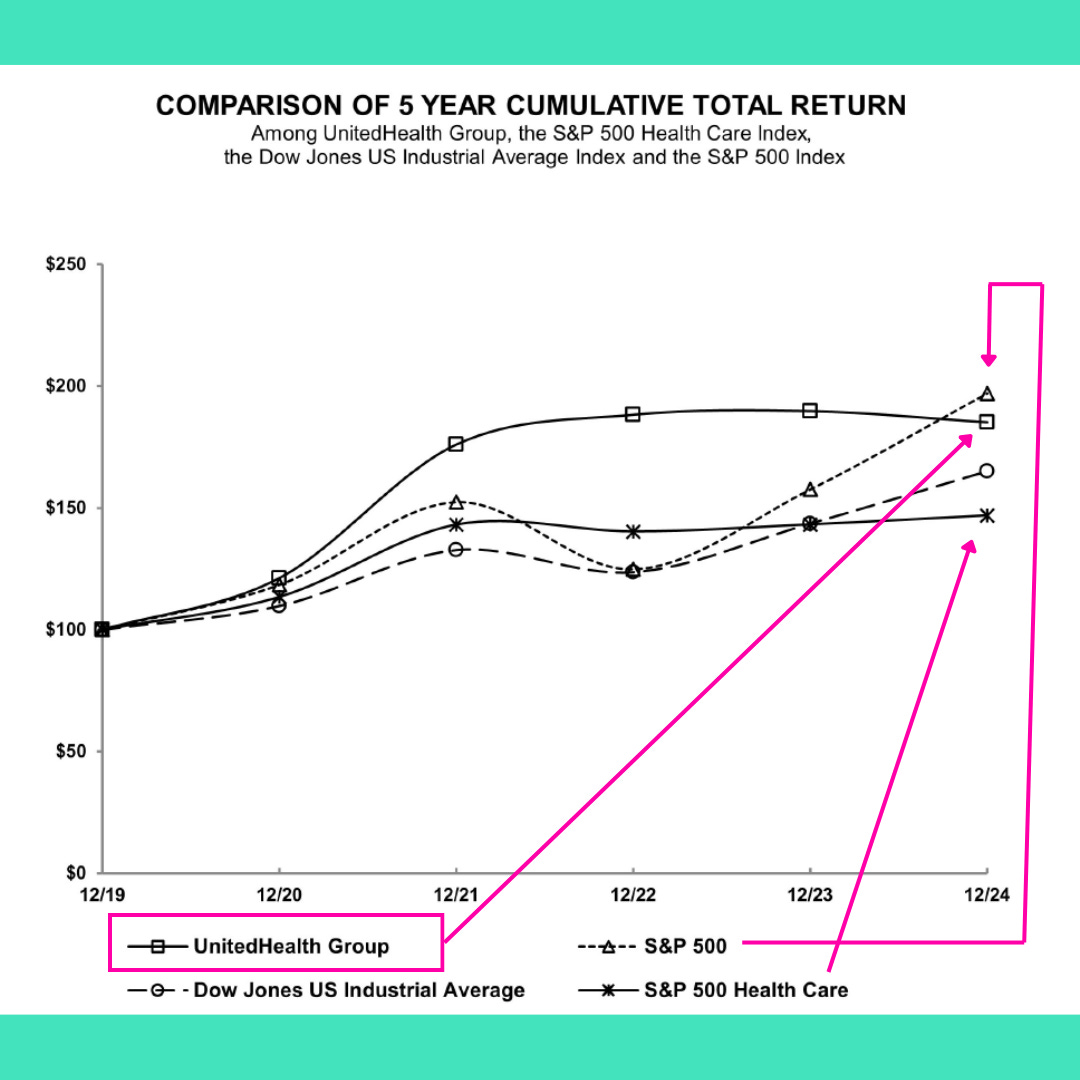

Not too shabby although I am sure Sir Witty would like to see better than flat returns. It has outpaced the so called S&P 500 Health Care index. Basically a more apples to apple situation to make UHG feel better about itself.

That’s more than half of the work that UHG does by the way, making it feel better about itself.

Now that we have an overview of UHG, let’s dig into the numbers to see what these two yutes have been up to, shall we?

Naturally, Balance Sheet first:

Oh, look at that, UHG is rich AF and has all the money. More shocked than Ralph when he got popped on murder one when all he did was cop a can of tuna.

And just because UHG has any Goodwill at all, let alone $107B worth of it, there is more to the balance sheet story.

Liabilities:

After all, UHG does provide, health insurance? Whatever that means. So naturally, we need to scrutinize the liabilities to see 1 of 2 of the biggest heists in the UHG (and all US vertically integrated alleged payors) playbook.

The float.

We see that UHG has $86B in current assets. It also owes $104B in current liabilities.

If you are a graduated master of my Healthcare Breakdown - The Finance Course!, you know this is all kinds of a red flag for the liquidity of the company.

But, this is an insurance company. Meaning, that while they do owe those medical costs payable, that’s other people’s money. In other words, that cash shows up as a liability that is owed, but currently UHG is holding all of that money since you have already paid it in premium dollars.

In other, other words, UHG uses your money to make itself rich AF.

So, I guess we were right to assume the rich AFness in the beginning.

Float, by the way, is what made Warren Buffet so rich. He owns Geico and when people pay their premiums, Warren takes them and invests those dollars. They are recorded as a liability, but all the money made off those liabilities go into his tiny pockets.

But, enough about the float. If you want more, you can read it in past issues here.

Let’s see how UHG makes all it’s cash in the first place. Cuz we know it’s not by hustling J.T. at pool. That guy only has a roll of ones with a twenty wrapped around it anyways.

Here is a detailed income statement:

As you can see, I have pink boxed some interesting items. Namely that premiums have gone up, but so have medical costs. Now, this alone doesn’t tell us a lot. Because with more people served, that means more premiums, and naturally more costs.

The proportion of increase is important though. Premium revenue has increased less than medical costs. This year was “tough” for UHG having to pay for stuff it didn’t want to. There were also Medicaid redeterminations and Medicare Advantage base rate adjustments. That means more cost for UHG.

And we can see that the MCR (medical cost ratio) has increased YoY.

Maybe UHG is incurring higher medical costs. It does deny a lot of care and drives unreasonably high out-of-pocket costs landing people in the ER, which is super expensive. And maybe, juuuuust maybe there is more in that MCR than medical costs which are inflated anyways (foreshadowing).

Fun fact about medical costs. Did you know things like quality improvement initiatives count as medical costs? Whatever that means.

Bottom line, between the inflation of medical costs (more foreshadowing) and the bogus padding games UHG can play, what I see is solid positioning to raise premiums across the board.

But despite this cost increase, UHG has tightened up and fired a bunch of people to keep it’s operating margin right about 8%.

Next! The second best trick in the playbook and one of the reasons our healthcare keeps getting more expensive.

Intercompany Eliminations! He said with a booming voice. We’re that the foreshadowing part by the way.

You can read up on intercompany eliminations here if you are so inclined.

You see there that UHG eliminated $151B last year. That means, in my humble opine, it took too much money out of one pocket and put it in its other pocket.

Because the beauty of intercompany eliminations is that you can pay yourself as much as you want and still make oodles of cash. All while boosting the ole’ MCR.

Here’s a picture of how it works:

We can also see it’s significant growth of 11% YoY. So, while medical costs have increased 9%, eliminations have increased 11%.

I obviously don’t have all the detail to do a super detailed analysis, but when your eliminations are growing like this, to me it seems like a driver of costs. Not the opposite like UHG would have you believe.

Anyways, let’s take a stroll down revenue lane to see the segments and where all the scrilla comes from.

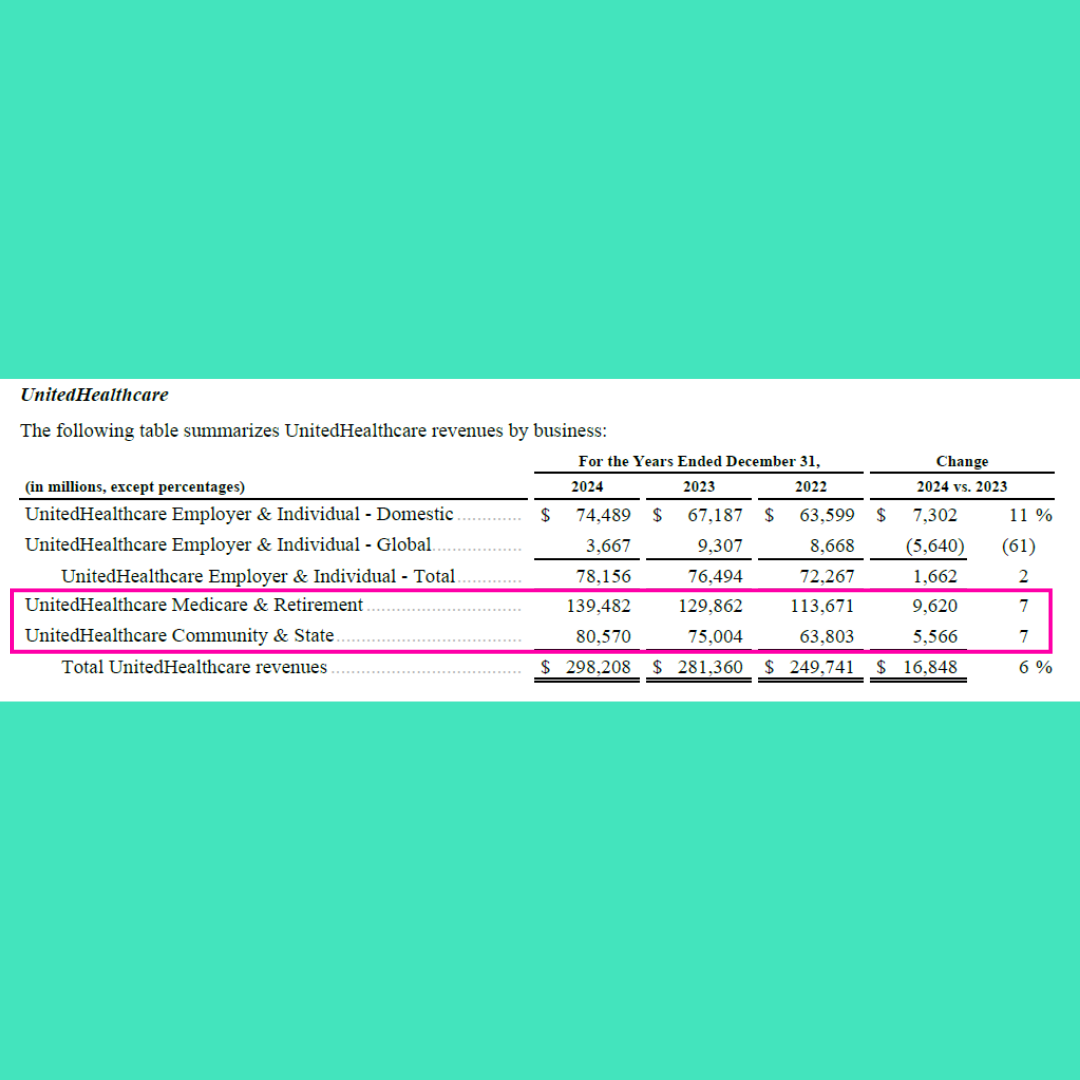

This is UnitedHealthcare revenue by segment:

Holy CMS Batman. If we look at the total portfolio, UHG earns 74% of its revenue from Medicare and Medicaid.

What that means is tax payer dollars are enriching UHG. Because last I checked and as we are about to see and have seen, UHG makes a ton of cash.

P.S. UHG exited Brazil faster than Vinny got out of town before the New York Clerk came back and was about to get busted by Judge Chamberlin. That’s what the big swing in the Global segment is. It also accounts for a significant expense on the income statement, which you may have caught.

Money is one thing, people are another.

Below is the breakdown of covered lives in the insurance business. Interestingly, the CMS covered folks only account for 39% of covered lives. Meaning a disproportionate contribution of this population in revenue compared to the amount of people covered. Translated, there is a lot of money to be made of Medicare and Medicaid.

Just so long as you aren’t a doctor or a patient.

INTERUPTION!

Whoa whoa whoa, Preston. Hold on second. We at Forward Slash / Health respectfully disagree. There is money to be made with both Medicare AND Medicaid. And we’d be very happy to show you how.

We work with private practices all over the country, helping them grow financially successful practices and stay totally independent. All while taking Medicare and Medicaid.

Just hit this link here to learn more or the button below to set up a call.

Ummmmm, that was a weird interruption. You let someone sponsor your newsletter one time and they just keep popping in unannounced.

Anyways, back to the amount of covered lives for UHG on government programs.

Finally, we come to the statement of cash flows. And a couple of interesting items.

First, Medical costs payable, as you know are premiums paid by customers, held and owed by UHG. This number has gone up year over year and represents a positive cash flow into the business.

Don’t be deceived by every liability.

And of course, over the year, UHG has pulled $24B in cash.

Sweet.

For investing, UHG does it. It has plenty of cash, using that float to buy investments to the tune of $27B last year.

And interestingly, it classified the loans made and repayments received as the results of the Change Healthcare cyber attack as investing activities. I suppose someone smarter than me can give a good explanation, but since UHG constantly has cyber incidents, I would consider this part of operations.

But I am more George Wilbur and less Ms. Vito when it comes to things like this.

Nevertheless! That cash needs to be accounted for somewhere and it is accounted for here.

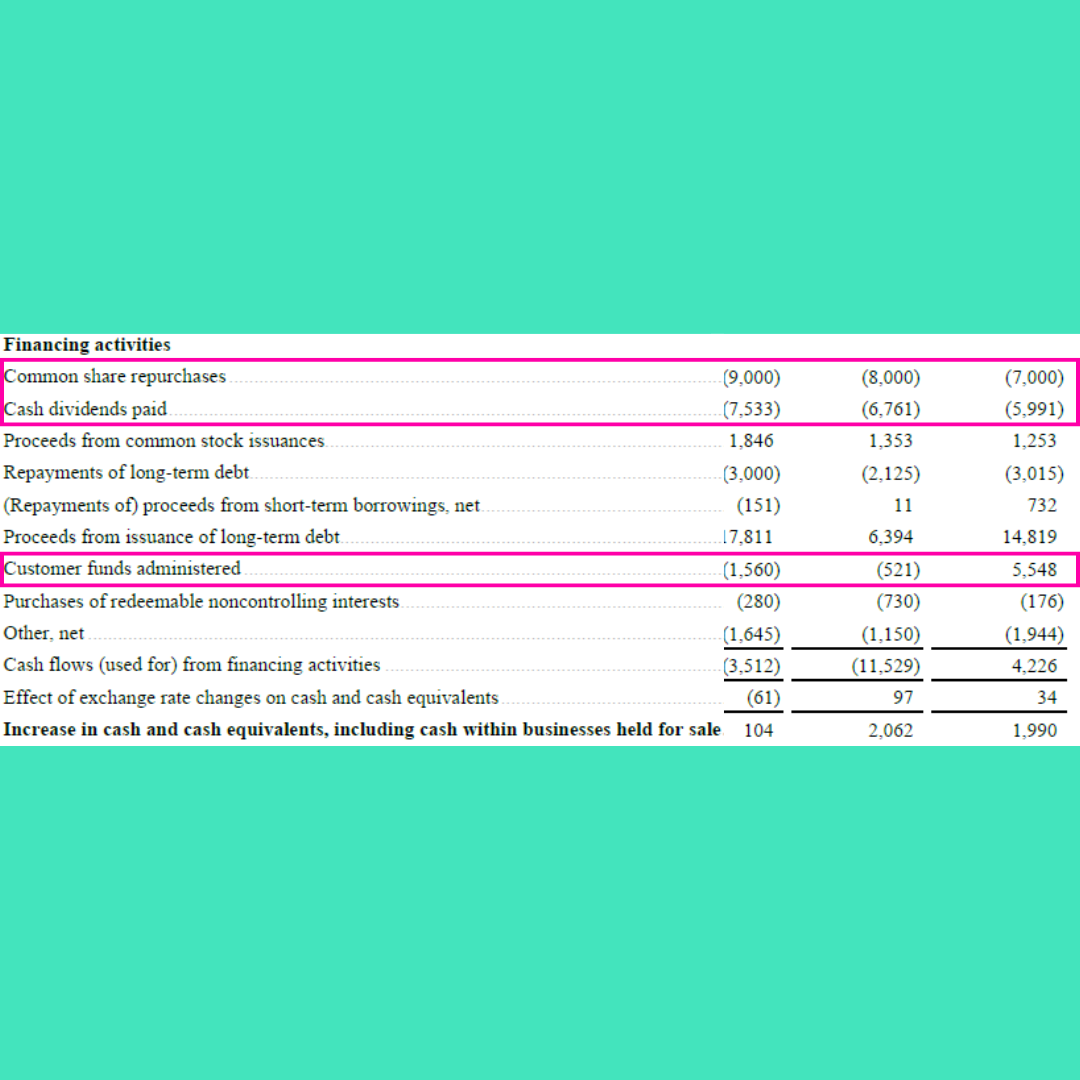

Lastly, as we should all be way too aware, UHG takes your money and buys back its own stock and also pays its shareholders dividends every year.

To the tune last year of $16.5B.

Now, to be frank, it’s good business. If you feel the stock is undervalued and/or a good investment you should buy it back. And you should incentivize and reward shareholders with dividends.

So, this may be more of a commentary on the healthcare system at large (shocker, I know), but it does seem contrary to the spirit and necessity of society creating mechanisms to help ensure and supply healthcare in this country. Surely we are better and stronger the healthier our population is.

As such, while it may be financially prudent from a publicly traded, for profit company perspective, it is antithetical to a healthcare system designed to provide benefit to those which it serves.

Oh, UHG is also a bank. I said that at the beginning but you may have missed it. So wild right?

That’s part of the numbers below. Customer funds administered from HSAs and the like.

And here is how much UHG paid to buy back its stock:

Creating a ton of value for patients right?

Welp, that’s all folks!

I have a new wrap up section below. But if you are exhausted from trying to figure out my movie references and can’t fathom reading any further, just know, I heart your face.

Here’s what I just said in one sentence

UHG controls access to healthcare for over 100 million people and will continue to operate as it has for the past 60 years creating very little patient value and extracting as much as it can from the system it purports to serve.

Heart hands.

Thanks for the last sentence recap- that, as a ‘no smarter than a fifth grader’, I understand!

Heads up. Warren Buffett doesn't own Aflac. He does own GEICO.